Answered step by step

Verified Expert Solution

Question

1 Approved Answer

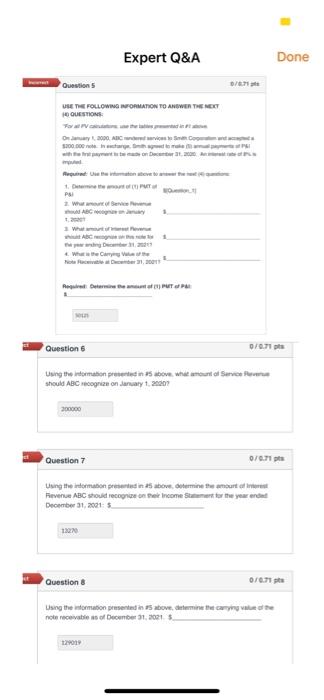

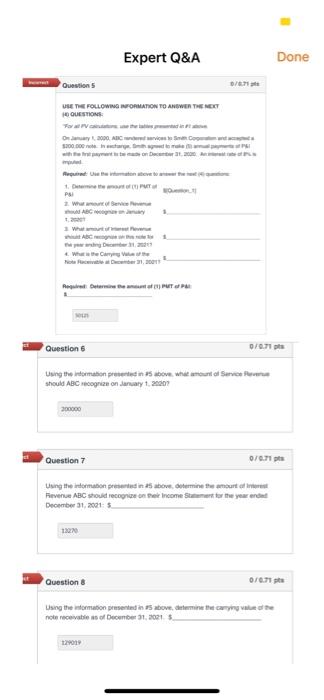

Please answer them correctly The quastion is clear in last image Expert Q&A Done Question 5 / USE THE FOLLOWING INFORMATION TO ANSWER THE NEXT

Please answer them correctly

The quastion is clear in last image

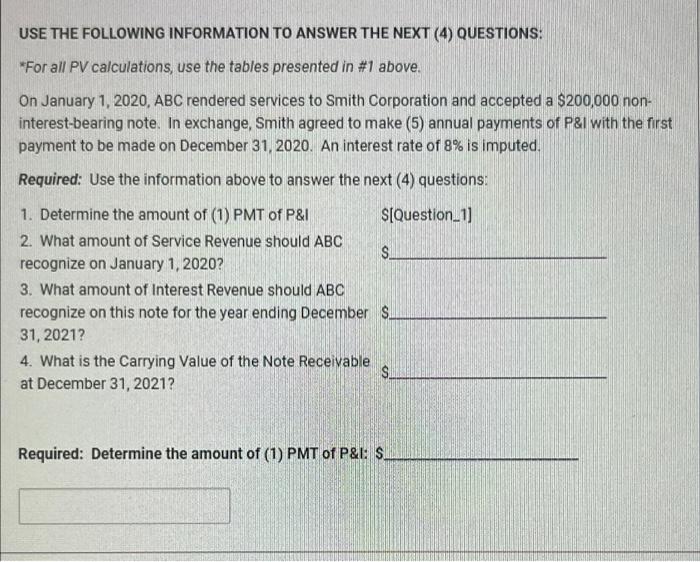

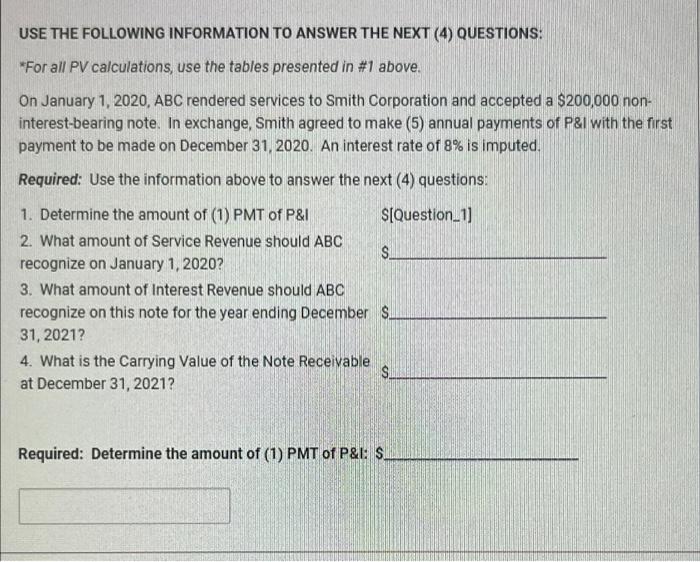

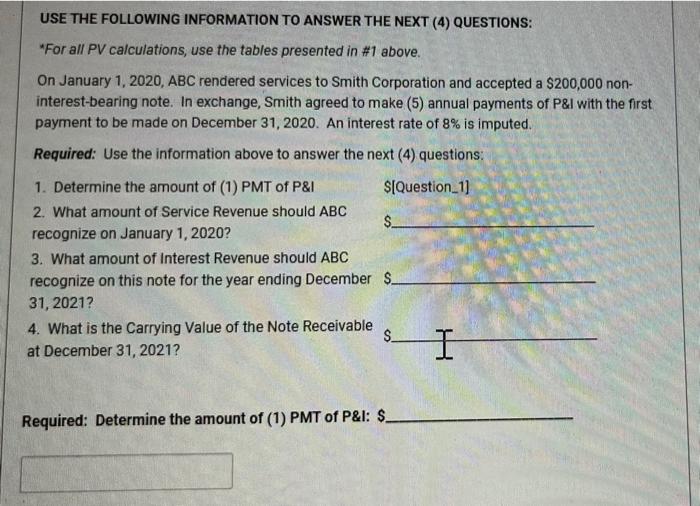

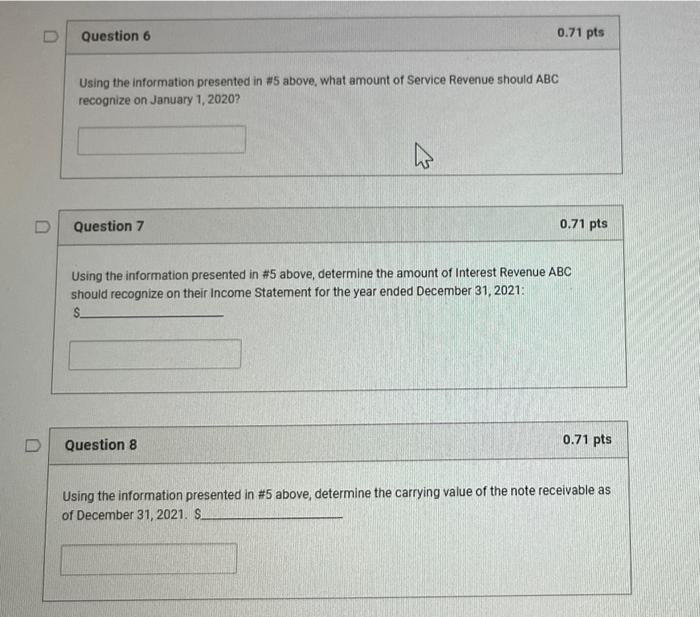

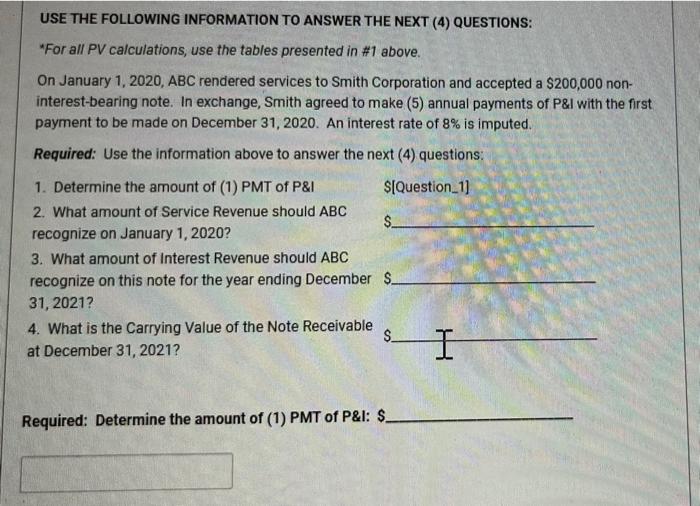

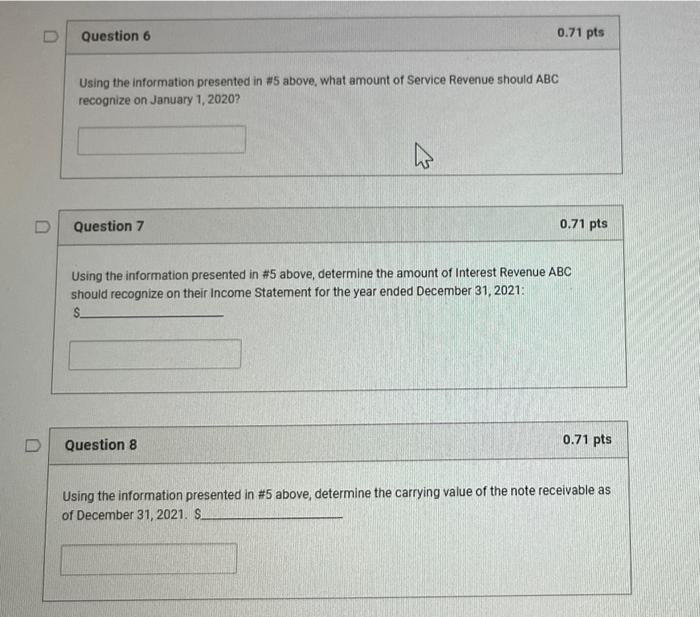

Expert Q&A Done Question 5 / USE THE FOLLOWING INFORMATION TO ANSWER THE NEXT QUESTIONS O2000 Advisor 200.000 1. PUT PS 2. W www. Www What Canye terre et PUT Questions 0/0.71 Using the main preinswount of Service should ABC on January 1, 2000 200000 Question 7 0/0.71 Fevenue ABC should recognize on erinometer for the year andet December 31, 2015 1320 Question 8 0/0.71 Using the formation punted sabo, dumine the carte not receives of December 1, 2021 12003 USE THE FOLLOWING INFORMATION TO ANSWER THE NEXT (4) QUESTIONS: *For all PV calculations, use the tables presented in #1 above. On January 1, 2020, ABC rendered services to Smith Corporation and accepted a $200,000 non- interest-bearing note. In exchange, Smith agreed to make (5) annual payments of P&I with the first payment to be made on December 31, 2020. An interest rate of 8% is imputed. Required: Use the information above to answer the next (4) questions: 1. Determine the amount of (1) PMT of P&/ S[Question 1] 2. What amount of Service Revenue should ABC S. recognize on January 1, 2020? 3. What amount of Interest Revenue should ABC recognize on this note for the year ending December S. 31, 2021? 4. What is the Carrying Value of the Note Receivable S at December 31, 2021? Required: Determine the amount of (1) PMT of P&E SL USE THE FOLLOWING INFORMATION TO ANSWER THE NEXT (4) QUESTIONS: "For all PV calculations, use the tables presented in #1 above. On January 1, 2020, ABC rendered services to Smith Corporation and accepted a $200,000 non- interest-bearing note. In exchange, Smith agreed to make (5) annual payments of P&I with the first payment to be made on December 31, 2020. An interest rate of 8% is imputed. Required: Use the information above to answer the next (4) questions: 1. Determine the amount of (1) PMT of P&I S[Question 1 2. What amount of Service Revenue should ABC $ recognize on January 1, 2020? 3. What amount of Interest Revenue should ABC recognize on this note for the year ending December S. 31, 2021? 4. What is the Carrying Value of the Note Receivable $_ at December 31, 2021? I Required: Determine the amount of (1) PMT of P&I: $. Question 6 0.71 pts Using the information presented in #5 above, what amount of Service Revenue should ABC recognize on January 1, 2020? Question 7 0.71 pts Using the information presented in #5 above, determine the amount of Interest Revenue ABC should recognize on their Income Statement for the year ended December 31, 2021. S. Question 8 0.71 pts Using the information presented in #5 above, determine the carrying value of the note receivable as of December 31, 2021. S Expert Q&A Done Question 5 / USE THE FOLLOWING INFORMATION TO ANSWER THE NEXT QUESTIONS O2000 Advisor 200.000 1. PUT PS 2. W www. Www What Canye terre et PUT Questions 0/0.71 Using the main preinswount of Service should ABC on January 1, 2000 200000 Question 7 0/0.71 Fevenue ABC should recognize on erinometer for the year andet December 31, 2015 1320 Question 8 0/0.71 Using the formation punted sabo, dumine the carte not receives of December 1, 2021 12003 USE THE FOLLOWING INFORMATION TO ANSWER THE NEXT (4) QUESTIONS: *For all PV calculations, use the tables presented in #1 above. On January 1, 2020, ABC rendered services to Smith Corporation and accepted a $200,000 non- interest-bearing note. In exchange, Smith agreed to make (5) annual payments of P&I with the first payment to be made on December 31, 2020. An interest rate of 8% is imputed. Required: Use the information above to answer the next (4) questions: 1. Determine the amount of (1) PMT of P&/ S[Question 1] 2. What amount of Service Revenue should ABC S. recognize on January 1, 2020? 3. What amount of Interest Revenue should ABC recognize on this note for the year ending December S. 31, 2021? 4. What is the Carrying Value of the Note Receivable S at December 31, 2021? Required: Determine the amount of (1) PMT of P&E SL USE THE FOLLOWING INFORMATION TO ANSWER THE NEXT (4) QUESTIONS: "For all PV calculations, use the tables presented in #1 above. On January 1, 2020, ABC rendered services to Smith Corporation and accepted a $200,000 non- interest-bearing note. In exchange, Smith agreed to make (5) annual payments of P&I with the first payment to be made on December 31, 2020. An interest rate of 8% is imputed. Required: Use the information above to answer the next (4) questions: 1. Determine the amount of (1) PMT of P&I S[Question 1 2. What amount of Service Revenue should ABC $ recognize on January 1, 2020? 3. What amount of Interest Revenue should ABC recognize on this note for the year ending December S. 31, 2021? 4. What is the Carrying Value of the Note Receivable $_ at December 31, 2021? I Required: Determine the amount of (1) PMT of P&I: $. Question 6 0.71 pts Using the information presented in #5 above, what amount of Service Revenue should ABC recognize on January 1, 2020? Question 7 0.71 pts Using the information presented in #5 above, determine the amount of Interest Revenue ABC should recognize on their Income Statement for the year ended December 31, 2021. S. Question 8 0.71 pts Using the information presented in #5 above, determine the carrying value of the note receivable as of December 31, 2021. S

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started