please answer these for thumbs up

please answer these for thumbs up

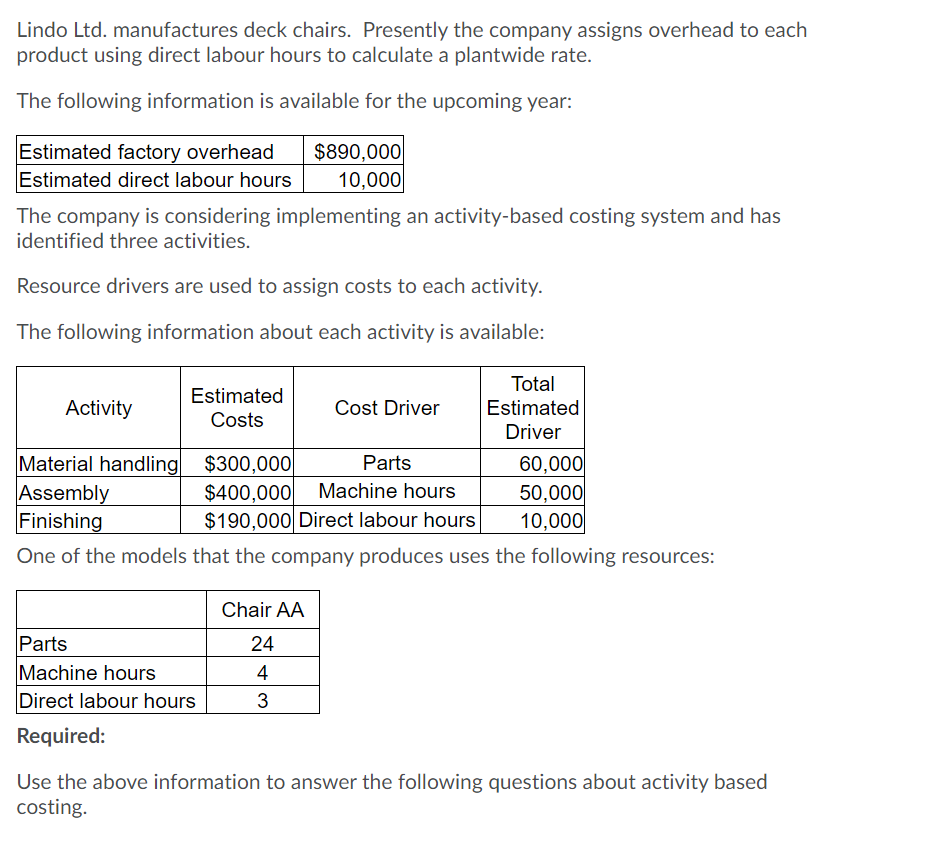

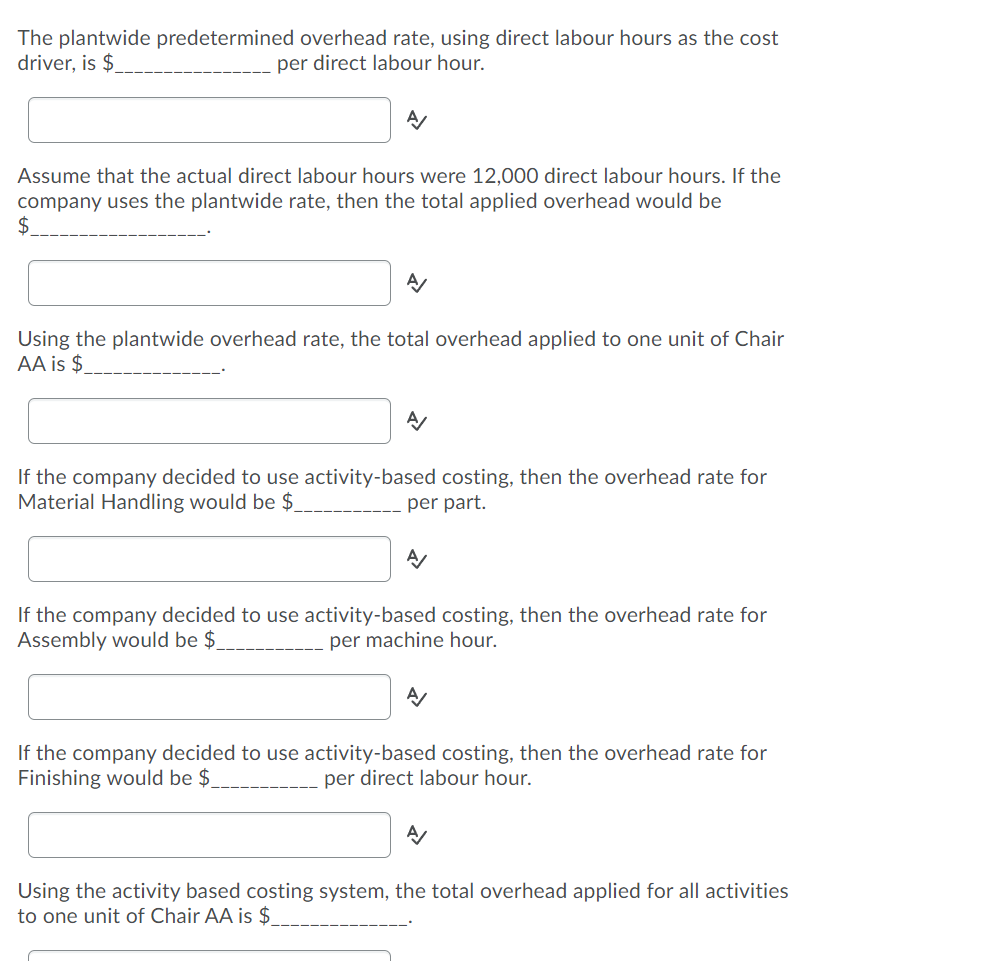

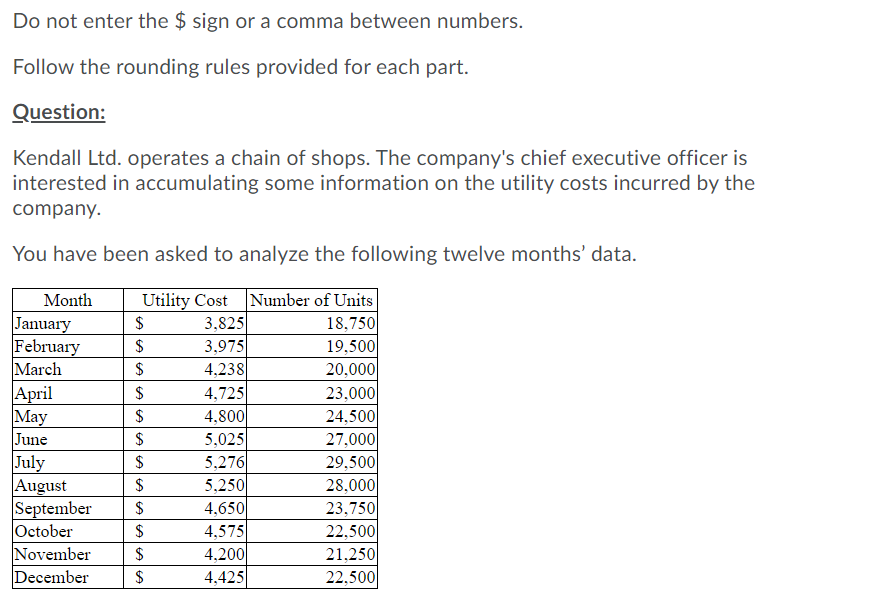

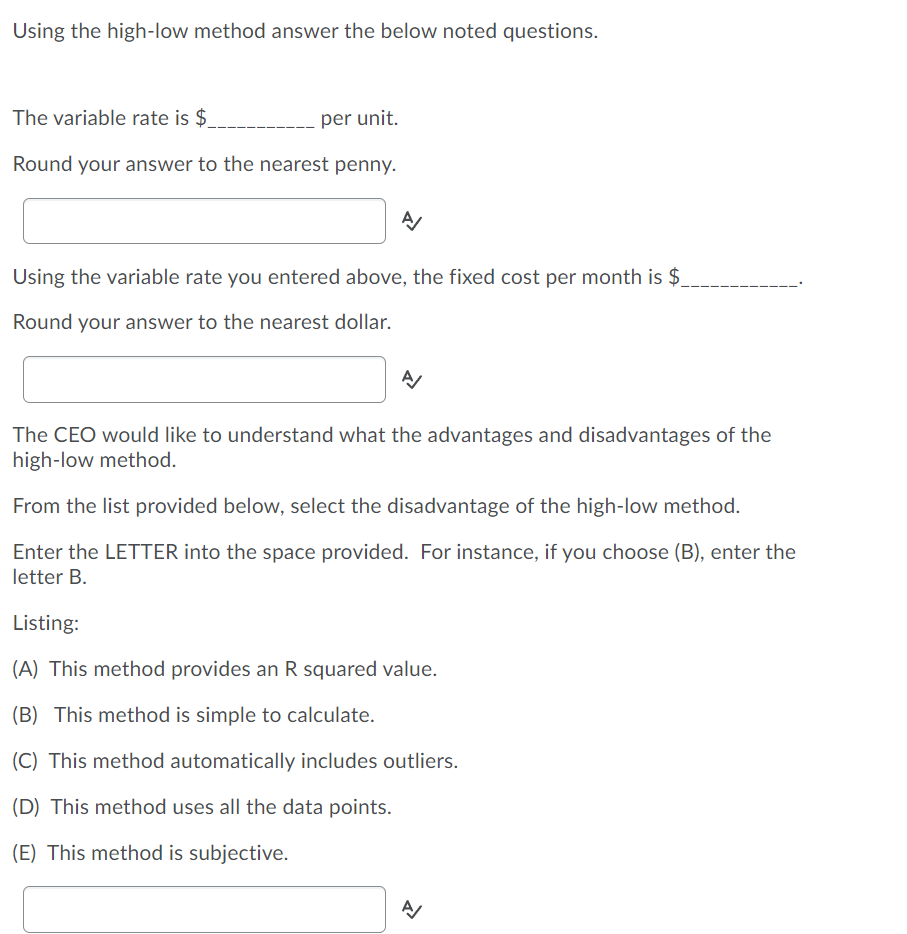

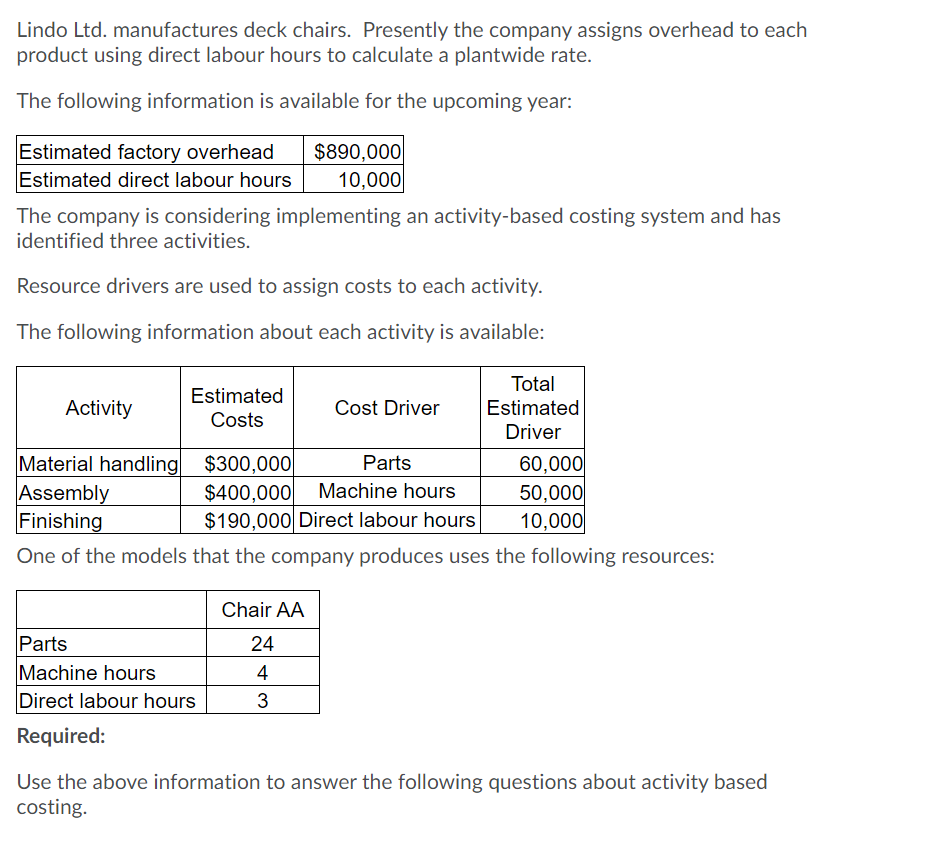

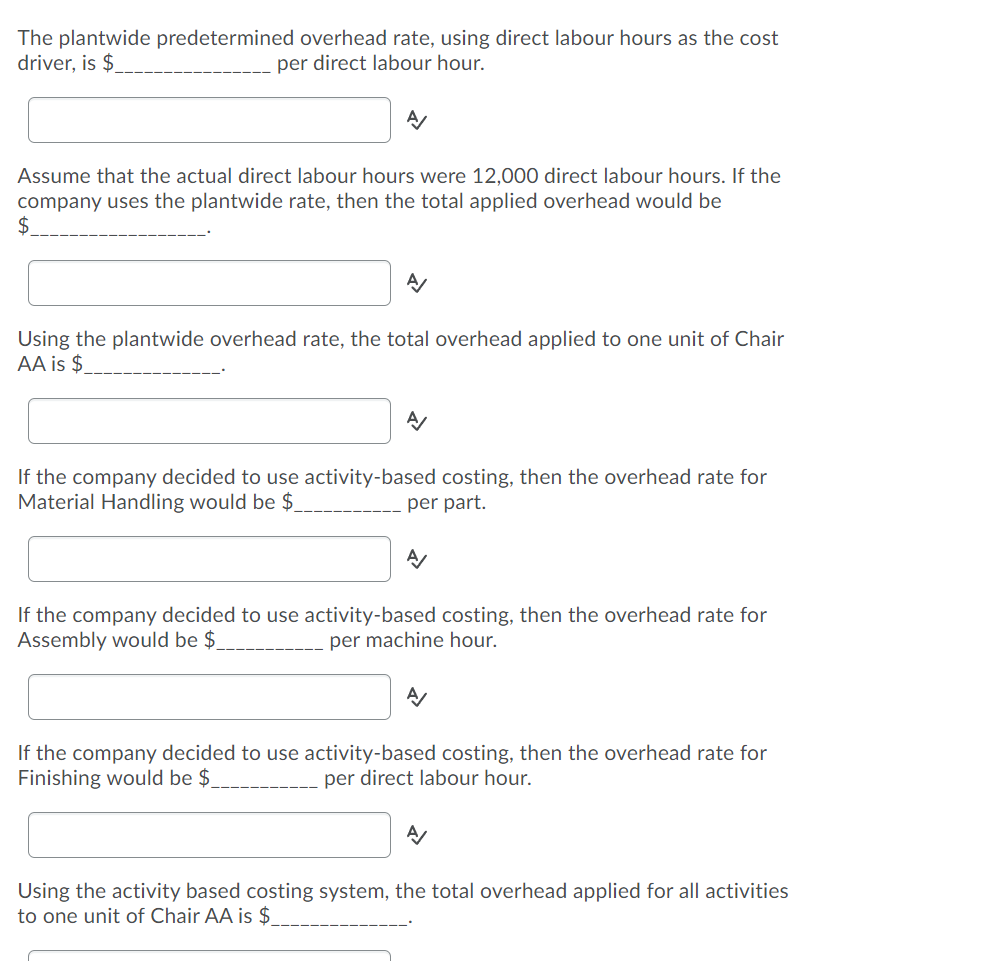

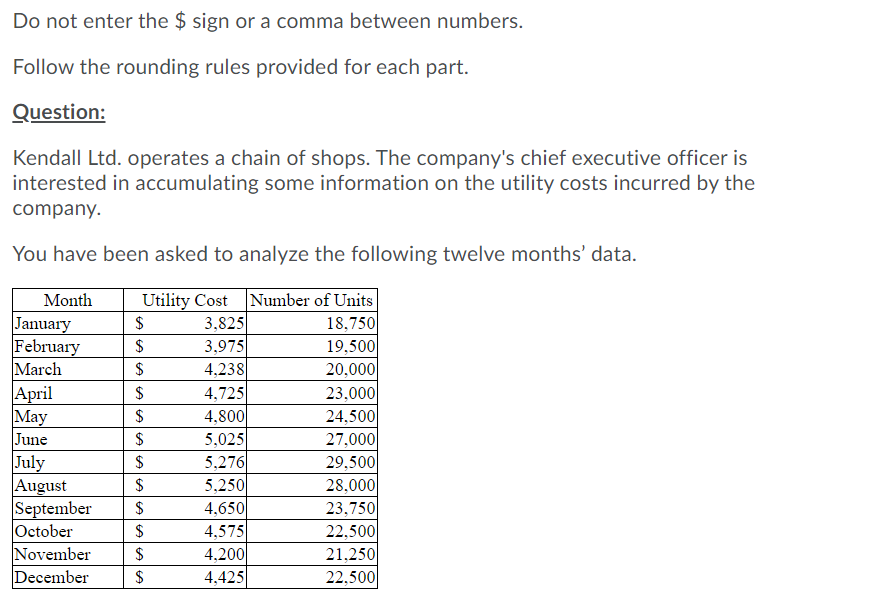

Lindo Ltd. manufactures deck chairs. Presently the company assigns overhead to each product using direct labour hours to calculate a plantwide rate. The following information is available for the upcoming year: Estimated factory overhead $890,000 Estimated direct labour hours 10,000 The company is considering implementing an activity-based costing system and has identified three activities. Resource drivers are used to assign costs to each activity. The following information about each activity is available: Total Estimated Activity Cost Driver Estimated Costs Driver Material handling $300,000 Parts 60,000 Assembly $400,000 Machine hours 50,000 Finishing $190,000 Direct labour hours 10,000 One of the models that the company produces uses the following resources: Chair AA Parts Machine hours Direct labour hours 24 4 3 Required: Use the above information to answer the following questions about activity based costing. The plantwide predetermined overhead rate, using direct labour hours as the cost driver, is $ per direct labour hour. Assume that the actual direct labour hours were 12,000 direct labour hours. If the company uses the plantwide rate, then the total applied overhead would be $ A Using the plantwide overhead rate, the total overhead applied to one unit of Chair AA is $ A If the company decided to use activity-based costing, then the overhead rate for Material Handling would be $_ per part. A/ If the company decided to use activity-based costing, then the overhead rate for Assembly would be $ per machine hour. A If the company decided to use activity-based costing, then the overhead rate for Finishing would be $ per direct labour hour. A Using the activity based costing system, the total overhead applied for all activities to one unit of Chair AA is $ Do not enter the $ sign or a comma between numbers. Follow the rounding rules provided for each part. Question: Kendall Ltd. operates a chain of shops. The company's chief executive officer is interested in accumulating some information on the utility costs incurred by the company. You have been asked to analyze the following twelve months' data. Month January February March April May June July August September October November December Utility Cost Number of Units $ 3,825 18,750 $ 3,975 19,500 $ 4,238 20.0001 $ 4,725 23,000 $ 4.800 24.500 $ 5,025 27.000 $ 5,276 29.500 $ 5.250 28.000 $ 4,650 23,750 $ 4,575 22.500 $ 4.200 21,250 $ 4,425 22,5001 Al AAA Using the high-low method answer the below noted questions. The variable rate is $ per unit. Round your answer to the nearest penny. A Using the variable rate you entered above, the fixed cost per month is $ Round your answer to the nearest dollar. A The CEO would like to understand what the advantages and disadvantages of the high-low method. From the list provided below, select the disadvantage of the high-low method. Enter the LETTER into the space provided. For instance, if you choose (B), enter the letter B. Listing: (A) This method provides an R squared value. (B) This method is simple to calculate. (C) This method automatically includes outliers. (D) This method uses all the data points. (E) This method is subjective. A/

please answer these for thumbs up

please answer these for thumbs up