PLEASE ANSWER THESE QUESTIONS BASED ON THE COMPANY: Guess (the luxury clothing/ accessory and retail brand)

I will provide an example based on the clmpany AT&T, please dont answer for the company at&t please answer for the company GUESS.

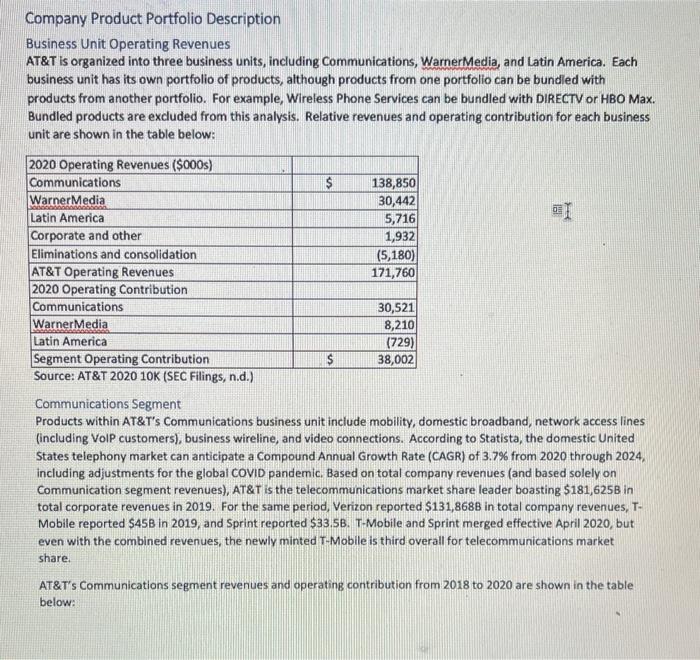

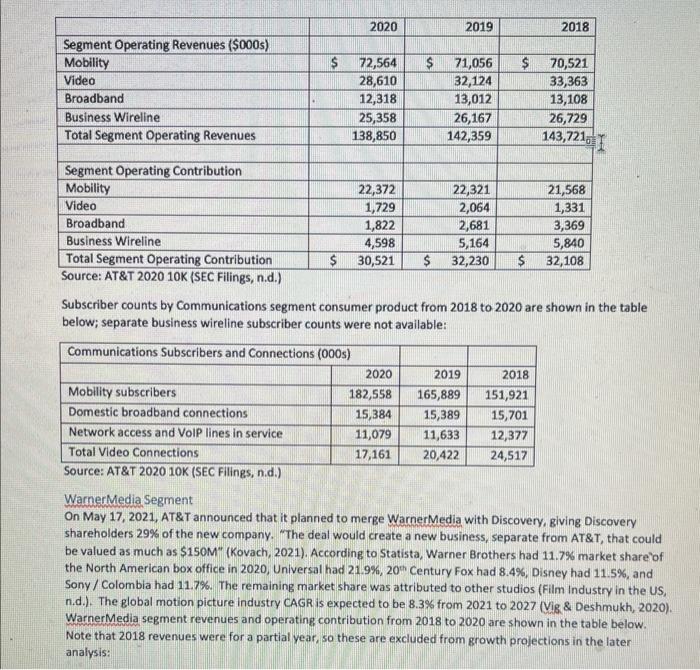

Please fill out this portfolio based on the luxury company GUESS. The clothing, accessory, and bag company. I will provide an example below based on the company AT\&T to better understand the directions. This section should provide product portfolio dato, business unit, or product division dato, depending on how the company provides its detoiled financial informotion and on whot is available from market studies. The product or division dota is used as a foundation to show the company's position on the Boston Consulting Group (BCG) Motrix. The BCG Matrix evaluates morket share ond market growth. Business Unit Operating Revenues: Please fill out this section based on the luxury company GUESS. The clothing, accessory, and bag company Product Portfolio Revenues, Market Growth Rate, and Market Share: Please fill out this section based on the luxury company GUESS. The clothing, accessory, and bag company. (To determine market share and market growth, you may find these doto in a report from Statista or another credible source. Individual company growth in each product portfolio or division should be shown in the company's financial statements.) Communications Segment: Please fill out this section based on the luxury company GUESS. The clothing. accessory, and bag company. WarnerMedia Segment: Please fill out this section based on the luxury company GUESS. The clothing. accessory, and bag company. Latin American Segment: Please fill out this section based on the luxury company GUESS. The clothing. accessory, and bag compary. Company BCG Matrix: Please fill out this section based on the luxury company GUESS. The clothing. accessory, and bag company. (You may use product groupings or organizational definitions to define these segments, as is appropriate for your industry and compony financials. If a company breaks down revenues by division (e.g. Americas region, Europe, Asia) then use those breakouts. If they report by product portfolio (e.g. milk, bread, and chocolate) then use those breakouts. The number of portfolios or divisions will decide the number of circles on the 8cG and the number of segments you define. You may group smaller divisions or portfolios together is they would othenwise be insignificant on the BCG.) You may use product groupings or organizationol definitions to define these segments, as is appropriate for your industry and company financials. If a company breaks down revenues by division (e. 9. Americas region, Europe, Asia) then use those breakouts. Uf they report by product portfolio (e.g, milk, bread, and chocolate) then use those breakouts. The number of portfolios or divisions will decide the number of circles on the BCG and the number of segments you define. You may group smalier divisions or partfolios together is they would otherwise be insignificant on the BCG. If you cannot find information about market share and market growth in on industry report, go to Mergent and: ndustry report, go to Mergent and: - Sum the gross revenues for your company and at least five competitors for the most recent fiscal year. Consider this os market size. Use this number as the denominator. Then use your company's gross revenues as the numerotor. This will give you o percentage number of you company's market share for the most recent fiscal year. Where possible, put multiple circles in the BCG for each of the company's product portfolios or arganizationol divisions. - Colculate the change in industry revenues for your company and at least five competitors across five years to determine the compound annual growth rate. For determining your company's growth rate as high, medium, or low consider 5% CAGR as the midpoint for medium growth. Product Portfollo Analytical Summary: Please fill out this section based on the luxury company GUESS. The clothing, accessory, and bag company. (Describe the market segments where each product portfolio of division competes.) This section should be between 300 and 500 words, and it should include insights on the competitive positioning of each portfolio or division. Your analysis here con provide insights for the company's swot anglysis in section four of your case study. The marketing segments include Communications Segment WarnerMedia segment Watin America Segment Company Product Portfolio Description Business Unit Operating Revenues AT\&T is organized into three business units, including Communications, WarnerMedia, and Latin America. Each business unit has its own portfolio of products, although products from one portfolio can be bundled with products from another portfolio. For example, Wireless Phone Services can be bundled with DIRECTV or HBO Max. Bundled products are excluded from this analysis. Relative revenues and operating contribution for each business unit are shown in the table below: Communications Segment Products within AT\&T's Communications business unit include mobility, domestic broadband, network access lines (including VolP customers), business wireline, and video connections. According to Statista, the domestic United States telephony market can anticipate a Compound Annual Growth Rate (CAGR) of 3.7% from 2020 through 2024, including adjustments for the global COVID pandemic, Based on total company revenues (and based solely on Communication segment revenues), AT\&T is the telecommunications market share leader boasting $181,625B in total corporate revenues in 2019. For the same period, Verizon reported $131,8688 in total company revenues, TMobile reported \$45B in 2019, and Sprint reported \$33.5B. T-Mobile and Sprint merged effective April 2020, but even with the combined revenues, the newly minted T-Mobile is third overall for telecommunications market share. AT\&T's Communications segment revenues and operating contribution from 2018 to 2020 are shown in the table below: Subscriber counts by Communications segment consumer product from 2018 to 2020 are shown in the table below; separate business wireline subscriber counts were not available: WarnerMedia Segment On May 17, 2021, AT\&T announced that it planned to merge WarnerMedia with Discovery, giving Discovery shareholders 29\% of the new company. "The deal would create a new business, separate from AT\&T, that could be valued as much as \$150M" (Kovach, 2021). According to Statista, Warner Brothers had 11.7% market share of the North American box office in 2020, Universal had 21.9\%, 20 entury Fox had 8.4%, Disney had 11.5\%, and Sony / Colombia had 11.7%. The remaining market share was attributed to other studios (Film Industry in the US, n.d.). The global motion picture industry CAGR is expected to be 8.3% from 2021 to 2027 (Vig \& Deshmukh, 2020). WarnerMedia segment revenues and operating contribution from 2018 to 2020 are shown in the table below. Note that 2018 revenues were for a partial year, so these are excluded from growth projections in the later analysis