please answer these two question please.

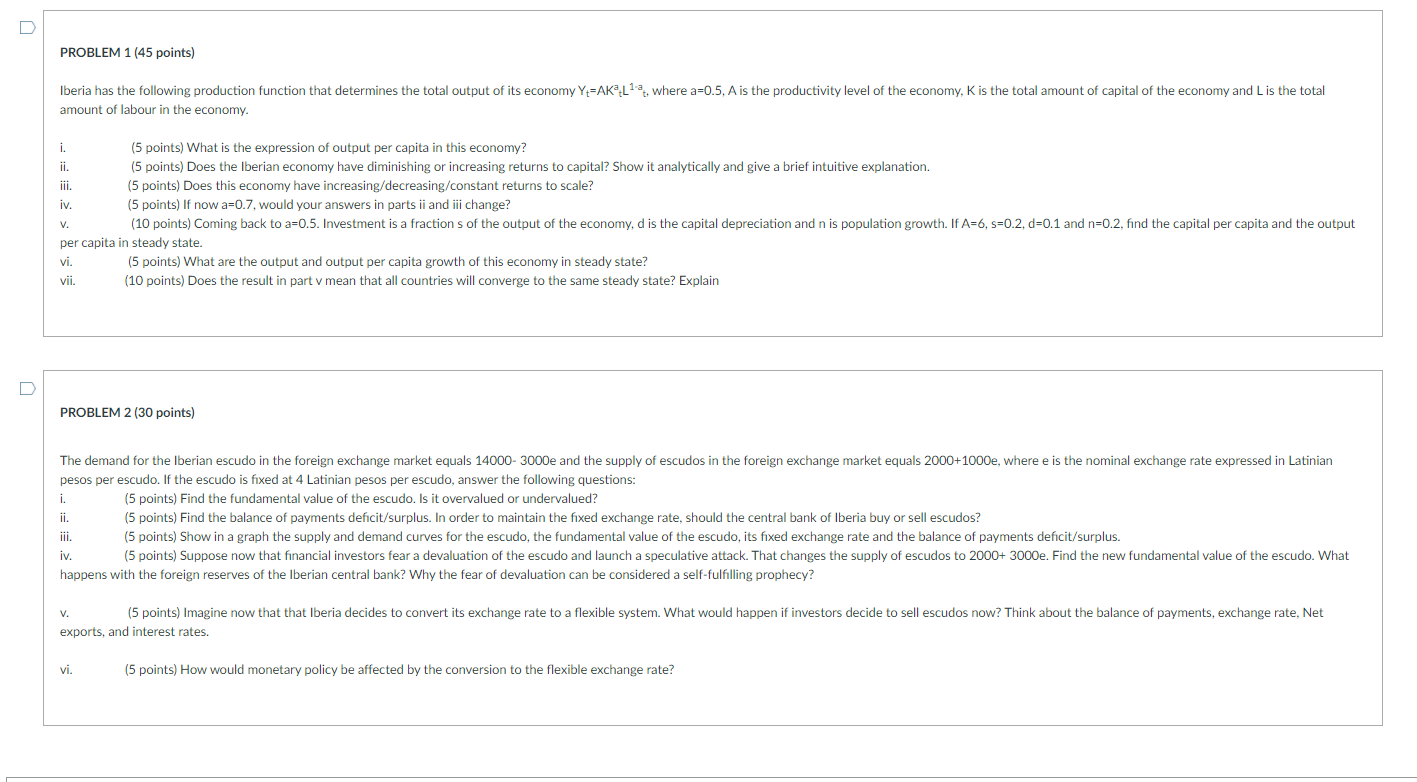

D PROBLEM 1 (45 points) Iberia has the following production function that determines the total output of its economy Y=AK3:Lia, where a=0.5, A is the productivity level of the economy, K is the total amount of capital of the economy and L is the total amount of labour in the economy. i. (5 points) What is the expression of output per capita in this economy? ii. (5 points) Does the Iberian economy have diminishing or increasing returns to capital? Show it analytically and give a brief intuitive explanation. iii. (5 points) Does this economy have increasing/decreasing/constant returns to scale? iv. (5 points) If now a=0.7, would your answers in parts ii and iii change? V. (10 points) Coming back to a=0.5. Investment is a fraction s of the output of the economy, d is the capital depreciation and n is population growth. If A=6, s=0.2, d=0.1 and n=0.2, find the capital per capita and the output per capita in steady state. vi. (5 points) What are the output and output per capita growth of this economy in steady state? vii. (10 points) Does the result in part v mean that all countries will converge to the same steady state? Explain D PROBLEM 2 (30 points) The demand for the Iberian escudo in the foreign exchange market equals 14000- 3000e and the supply of escudos in the foreign exchange market equals 2000+1000e, where e is the nominal exchange rate expressed in Latinian pesos per escudo. If the escudo is fixed at 4 Latinian pesos per escudo, answer the following questions: i. (5 points) Find the fundamental value of the escudo. Is it overvalued or undervalued? in. (5 points) Find the balance of payments deficit/surplus. In order to maintain the fixed exchange rate, should the central bank of Iberia buy or sell escudos? iii. (5 points) Show in a graph the supply and demand curves for the escudo, the fundamental value of the escudo, its fixed exchange rate and the balance of payments deficit/surplus. iv. (5 points) Suppose now that financial investors fear a devaluation of the escudo and launch a speculative attack. That changes the supply of escudos to 2000+ 3000e. Find the new fundamental value of the escudo. What happens with the foreign reserves of the Iberian central bank? Why the fear of devaluation can be considered a self-fulfilling prophecy? V. (5 points) Imagine now that that Iberia decides to convert its exchange rate to a flexible system. What would happen if investors decide to sell escudos now? Think about the balance of payments, exchange rate, Net exports, and interest rates. vi. (5 points) How would monetary policy be affected by the conversion to the flexible exchange rate