Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer this 3 part problem and double check the dollar amount which is 9,726 at 7 percent not sure if the table is needed

please answer this 3 part problem and double check the dollar amount which is 9,726 at 7 percent

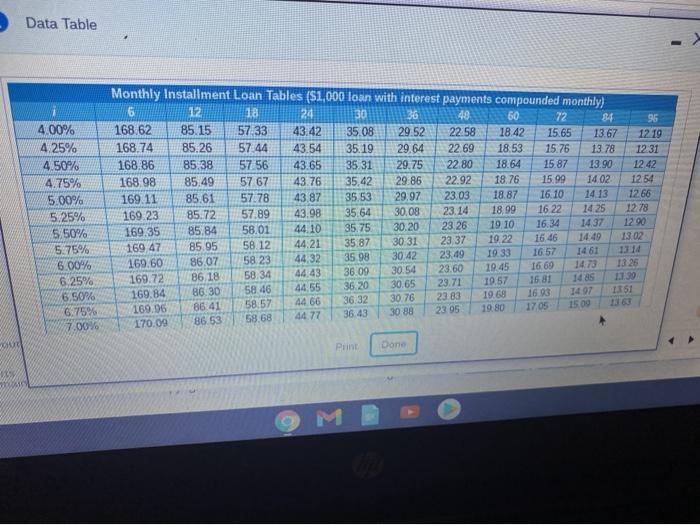

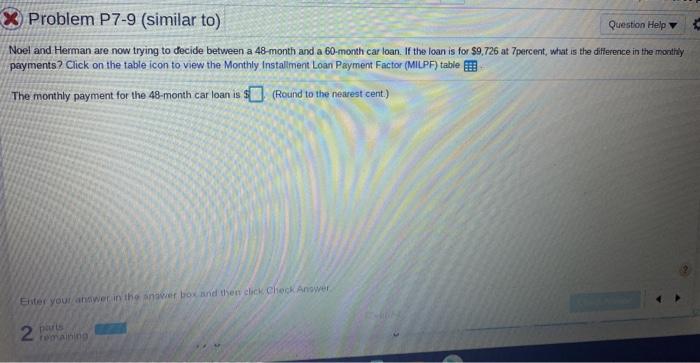

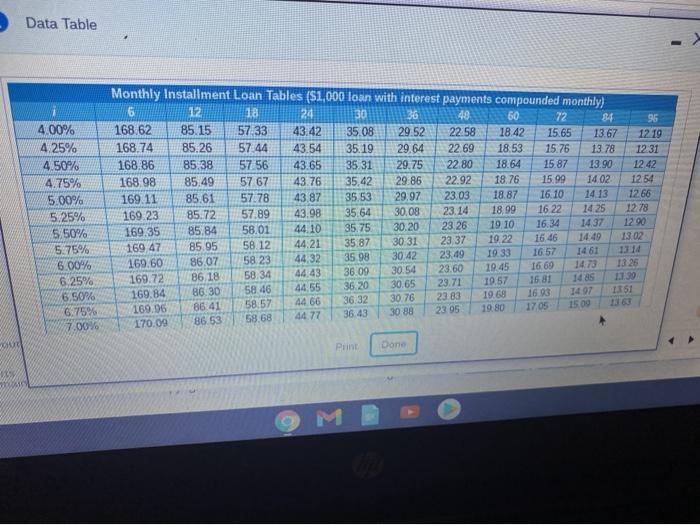

X Problem P7-9 (similar to) Question Help Noel and Herman are now trying to decide between a 48-month and a 60-month car loan. If the loan is for $9,726 at 7percent, what is the difference in the monthly payments ? Click on the table icon to view the Monthly Installment Loan Payment Factor (MILPF) table The monthly payment for the 48-month car loan is $ (Round to the nearest cent.) Enter your answer in the answer box and then clickCheck Answer parts 2 Data Table 400% 4.25% 4.50% 4.75% 5.00% 5.25% 5 50% 5,75% 6.00% 6.25% 6.50% 6,75% 7.00% Monthly Installment Loan Tables ($1,000 loan with interest payments compounded monthly) 6 12 18 24 30 36 48 60 12 844 96 168,62 85.15 57 33 43.42 35.08 29:52 22.58 18.42 15.65 13 67 168.74 12.19 85.26 57:44 43.54 35.19 29.64 22.69 18.53 15.76 13.78 1231 168.86 85 38 57 56 43.65 35 31 29.75 22.80 18.64 15.87 13.90 1242 168.98 85.49 57 67 43.76 35.42 29.86 22.92 18.76 15.99 14.02 1254 169.11 85.61 57.78 43.87 35 53 29.97 23.03 18.87 16.10 14 13 1266 169 23 85.72 57.89 43.98 35.64 30.08 23.14 18.99 16 22 1425 12.78 169.35 85,84 58 01 44.10 35.75 30.20 23. 26 19.10 14.37 16.34 12.90 169 47 85.95 58.12 44.21 35.87 30 31 23 37 19.22 16.46 13.02 14:49 86.07 169.60 35 98 58.23 1461 44.32 30.42 1314 23.49 16.57 19 33 16 69 1473 19.45 13 26 23.60 30.54 169.72 86 18 58.34 44.43 36.09 1139 3620 19.57 30.65 16 81 23.71 58.46 44.55 169.84 86.30 1351 1497 16.93 19.69 36:32 44.66 23 83 58 57 86.41 169.96 15.00 136 19.80 17.05 36.43 30.88 23 05 58.68 44 77 86 53 170.09 30.76 Done ws not sure if the table is needed

48 month loan ?

60 month loan ?

the difference ?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started