Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 (9 Points): Suppose Apple has $10 million dollars of cash to invest. The cash management team of the firm tries to grow the

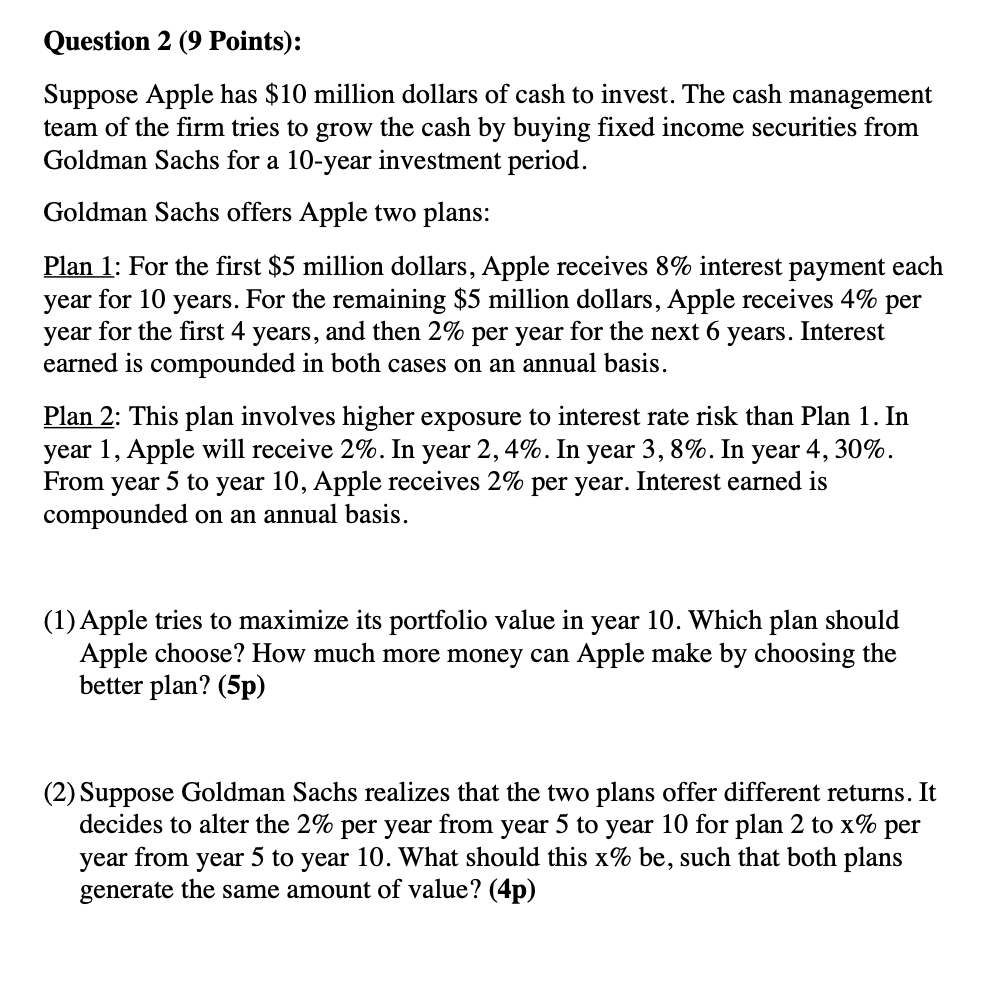

Question 2 (9 Points): Suppose Apple has $10 million dollars of cash to invest. The cash management team of the firm tries to grow the cash by buying fixed income securities from Goldman Sachs for a 10-year investment period. Goldman Sachs offers Apple two plans: Plan 1: For the first $5 million dollars, Apple receives 8% interest payment each year for 10 years. For the remaining $5 million dollars, Apple receives 4% per year for the first 4 years, and then 2% per year for the next 6 years. Interest earned is compounded in both cases on an annual basis. Plan 2: This plan involves higher exposure to interest rate risk than Plan 1. In year 1 , Apple will receive 2%. In year 2,4%. In year 3,8%. In year 4,30%. From year 5 to year 10 , Apple receives 2% per year. Interest earned is compounded on an annual basis. (1) Apple tries to maximize its portfolio value in year 10. Which plan should Apple choose? How much more money can Apple make by choosing the better plan? (5p) (2) Suppose Goldman Sachs realizes that the two plans offer different returns. It decides to alter the 2% per year from year 5 to year 10 for plan 2 to x% per year from year 5 to year 10 . What should this x% be, such that both plans generate the same amount of value? (4p)

Question 2 (9 Points): Suppose Apple has $10 million dollars of cash to invest. The cash management team of the firm tries to grow the cash by buying fixed income securities from Goldman Sachs for a 10-year investment period. Goldman Sachs offers Apple two plans: Plan 1: For the first $5 million dollars, Apple receives 8% interest payment each year for 10 years. For the remaining $5 million dollars, Apple receives 4% per year for the first 4 years, and then 2% per year for the next 6 years. Interest earned is compounded in both cases on an annual basis. Plan 2: This plan involves higher exposure to interest rate risk than Plan 1. In year 1 , Apple will receive 2%. In year 2,4%. In year 3,8%. In year 4,30%. From year 5 to year 10 , Apple receives 2% per year. Interest earned is compounded on an annual basis. (1) Apple tries to maximize its portfolio value in year 10. Which plan should Apple choose? How much more money can Apple make by choosing the better plan? (5p) (2) Suppose Goldman Sachs realizes that the two plans offer different returns. It decides to alter the 2% per year from year 5 to year 10 for plan 2 to x% per year from year 5 to year 10 . What should this x% be, such that both plans generate the same amount of value? (4p) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started