please answer this for me

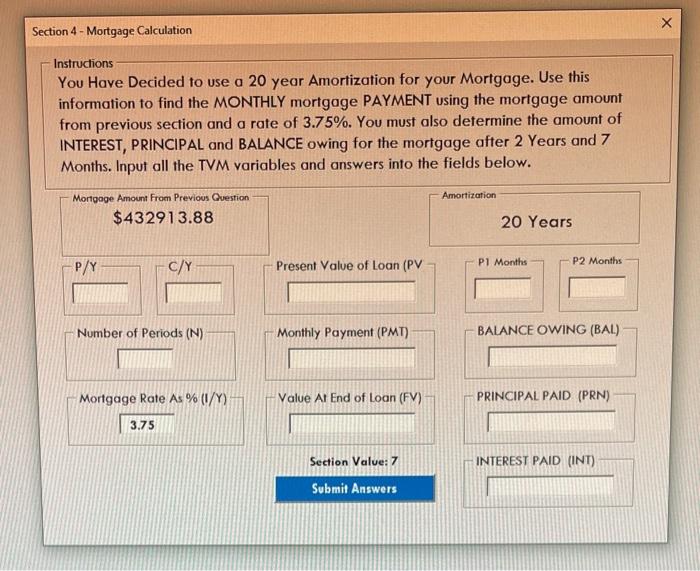

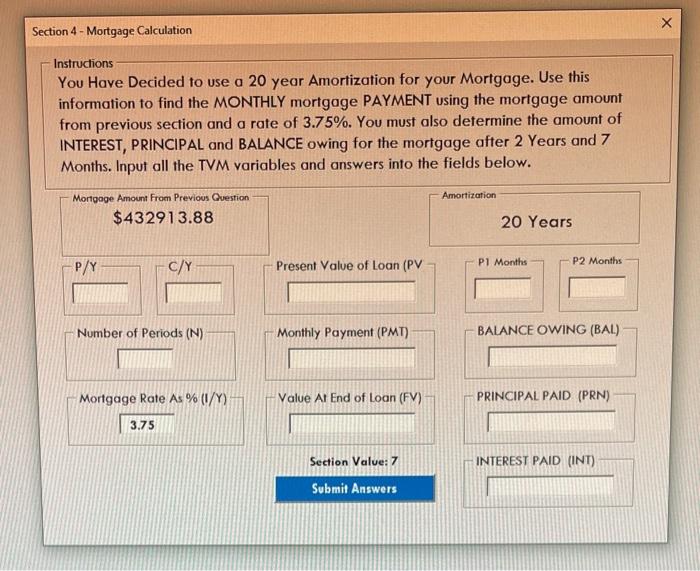

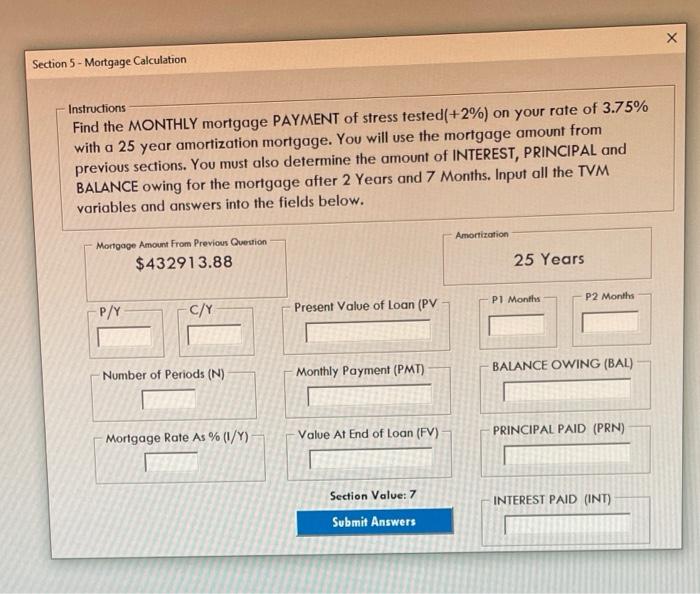

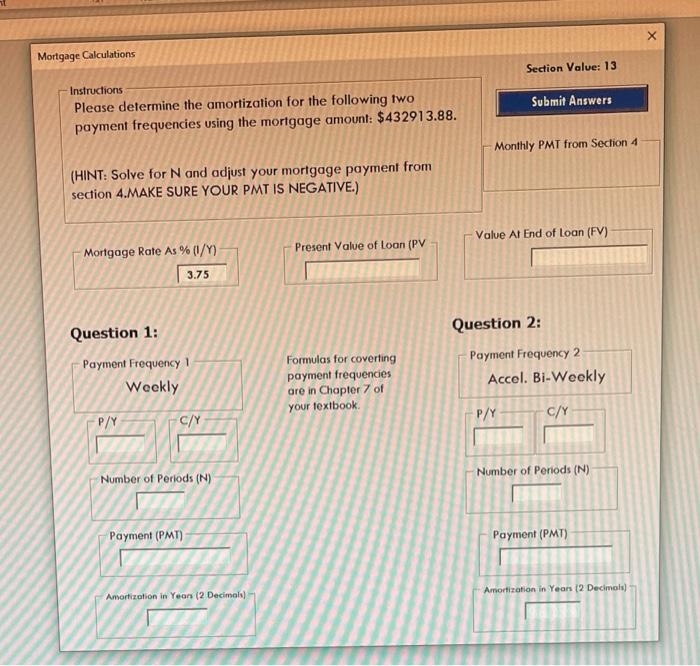

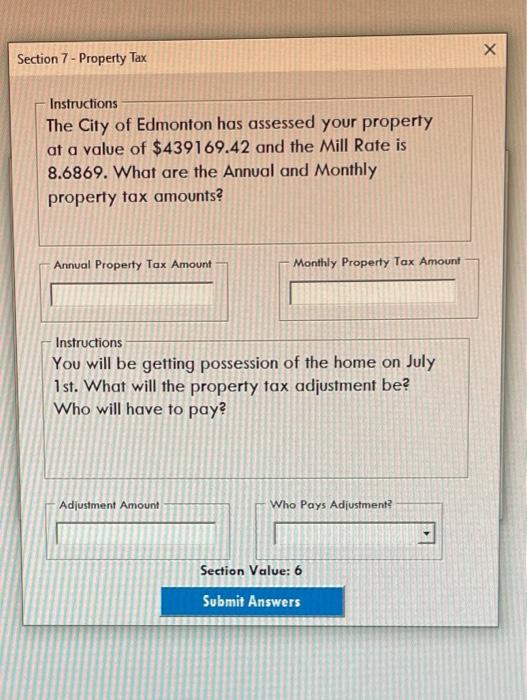

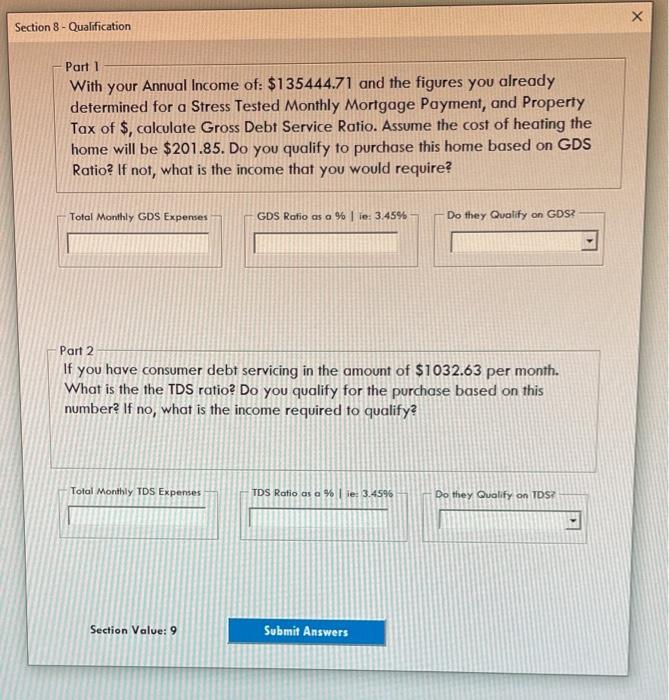

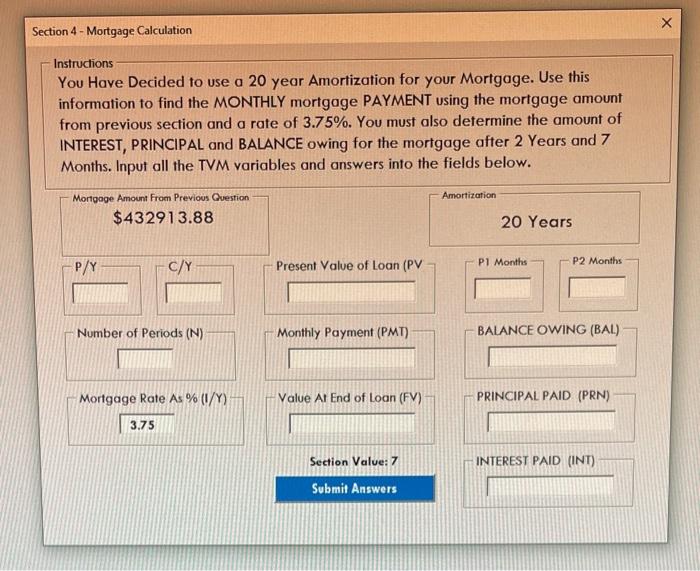

Section 4 - Mortgage Calculation Instructions You Have Decided to use a 20 year Amortization for your Mortgage. Use this information to find the MONTHLY mortgage PAYMENT using the mortgage amount from previous section and a rate of 3.75%. You must also determine the amount of INTEREST, PRINCIPAL and BALANCE owing for the mortgage after 2 years and 7 Months. Input all the TVM variables and answers into the fields below. Amortization Mortgage Amount From Previous Question $432913.88 20 Years P2 Months P/Y C/Y P1 Months Present Value of Loan (PV Number of Periods (N) Monthly Payment (PMT) BALANCE OWING (BAL) Mortgage Rate As % (/) Value At End of Loan (FV) PRINCIPAL PAID (PRN) 3.75 Section Value: 7 INTEREST PAID (INT) Submit Answers Section 5 - Mortgage Calculation Instructions Find the MONTHLY mortgage PAYMENT of stress tested(+2%) on your rate of 3.75% with a 25 year amortization mortgage. You will use the mortgage amount from previous sections. You must also determine the amount of INTEREST, PRINCIPAL and BALANCE owing for the mortgage after 2 Years and 7 Months. Input all the TVM variables and answers into the fields below. Amortization Mortgage Amount From Previous Question $432913.88 25 Years PI Months P2 Months -P/Y c/r Present Value of Loan (PV Number of Periods (N) Monthly Payment (PMT) BALANCE OWING (BAL) Mortgage Rate As %(v/Y) Value At End of loan (FV) PRINCIPAL PAID (PRN) Section Value: 7 Submit Answers INTEREST PAID (INT) Mortgage Calculations Section Value: 13 Submit Answers Instructions Please determine the amortization for the following two payment frequencies using the mortgage amount: $432913.88. Monthly PMT from Section 4 (HINT: Solve for N and adjust your mortgage payment from section 4.MAKE SURE YOUR PMT IS NEGATIVE.) Value At End of Loan (FV) Mortgage Rate As %(v/) Present Value of Loan (PV 3.75 Question 1: Payment Frequency 1 Weekly Formulas for coverting payment frequencies ore in Chapter 7 of your textbook Question 2: Payment Frequency 2 Accel. Bi-Weekly PAY c/Y P/Y c/y Number of Periods (N) Number of Periods (N) Payment (PMT) Payment (PMT) Amortization in Yeon (2 Decimals) Amortization in Yeon 12 Decimals) Section 7 - Property Tax Instructions The City of Edmonton has assessed your property at a value of $439169.42 and the Mill Rate is 8.6869. What are the Annual and Monthly property tax amounts? Annual Property Tax Amount Monthly Property Tax Amount Instructions You will be getting possession of the home on July 1st. What will the property tax adjustment be? Who will have to pay? Adjustment Amount Who Pays Adjustment? Section Value: 6 Submit Answers Section 8 - Qualification Part 1 With your Annual Income of: $13544471 and the figures you already determined for a Stress Tested Monthly Mortgage Payment, and Property Tax of $, calculate Gross Debt Service Ratio. Assume the cost of heating the home will be $201.85. Do you qualify to purchase this home based on GDS Ratio? If not, what is the income that you would require? Total Monthly GDS Expenses GDS Ratio as a % lie: 3.45% Do they Qualify on GDS? Part 2 If you have consumer debt servicing in the amount of $1032.63 per month. What is the the TDS ratio? Do you qualify for the purchase based on this number? If no, what is the income required to qualify? Total Monthly TDS Expenses TDS Ratio as a % lje: 3.4596 Do they Qualify on TDS? Section Value: 9 Submit Answers