Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer this! PARTNERSHIP FORMATION On January 1, 2020, ALMA and BLESS, cousins, have agreed to combine their personal businesses into a partnership. After the

please answer this!

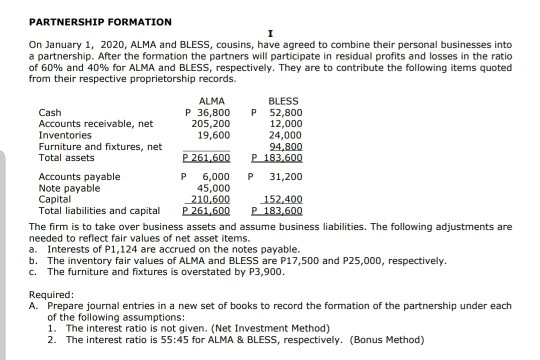

PARTNERSHIP FORMATION On January 1, 2020, ALMA and BLESS, cousins, have agreed to combine their personal businesses into a partnership. After the formation the partners will participate in residual profits and losses in the ratio of 60% and 40% for ALMA and BLESS, respectively. They are to contribute the following items quoted from their respective proprietorship records. ALMA BLESS Cash P 36,800 P 52,800 Accounts receivable, net 205,200 12,000 Inventories 19,600 24,000 Furniture and fixtures, net 94,800 Total assets P. 261,600 P 183.600 Accounts payable P 6,000 P 31,200 Note payable 45,000 Capital 210,600 152,400 Total liabilities and capital P 261,600 183,600 The firm is to take over business assets and assume business liabilities. The following adjustments are needed to reflect fair values of net asset items. a. Interests of P1,124 are accrued on the notes payable. b. The inventory fair values of ALMA and BLESS are P17,500 and P25,000, respectively. c. The furniture and fixtures is overstated by P3,900. Required: A. Prepare journal entries in a new set of books to record the formation of the partnership under each of the following assumptions: 1. The interest ratio is not given. (Net Investment Method) 2. The interest ratio is 55:45 for ALMA & BLESS, respectively. (Bonus Method)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started