Please, answer this question. I know its quite lengthy. Thanks.

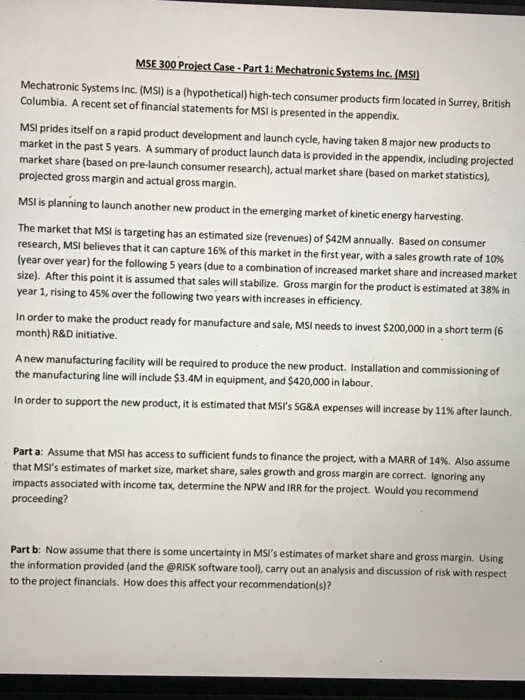

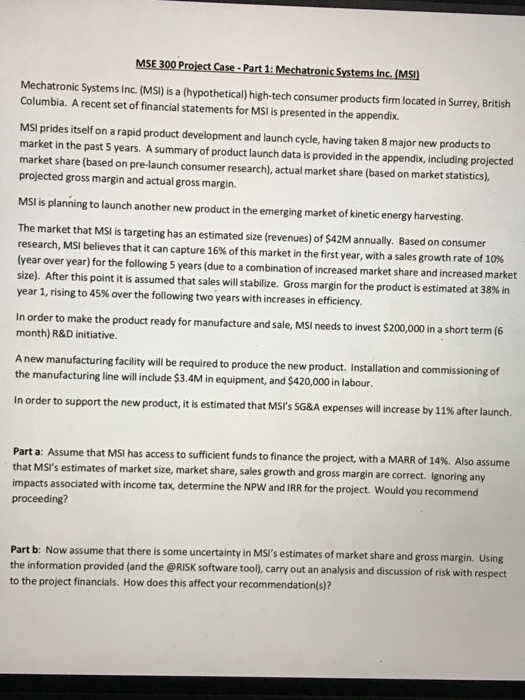

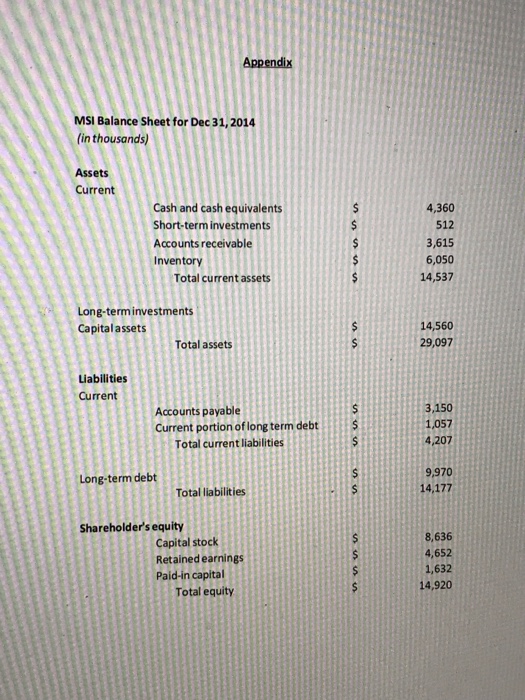

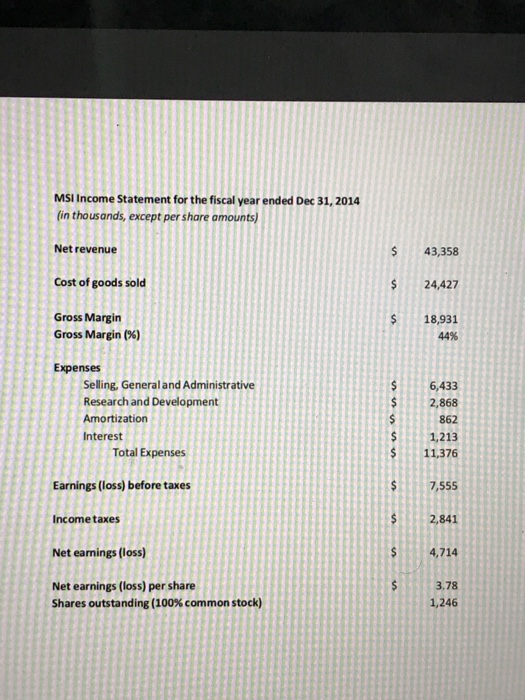

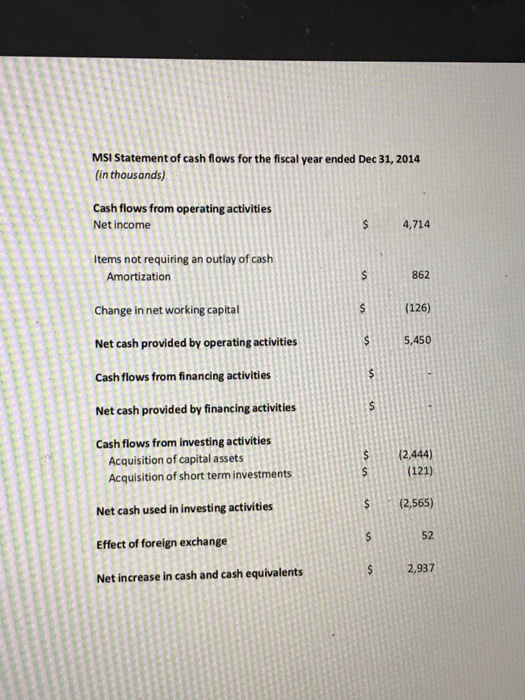

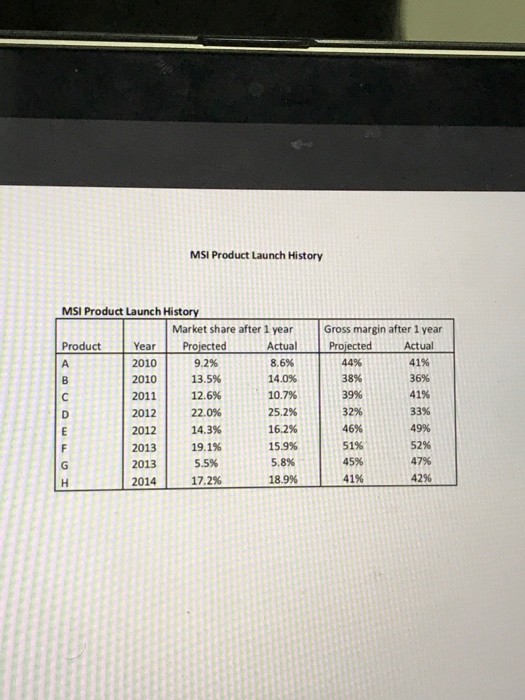

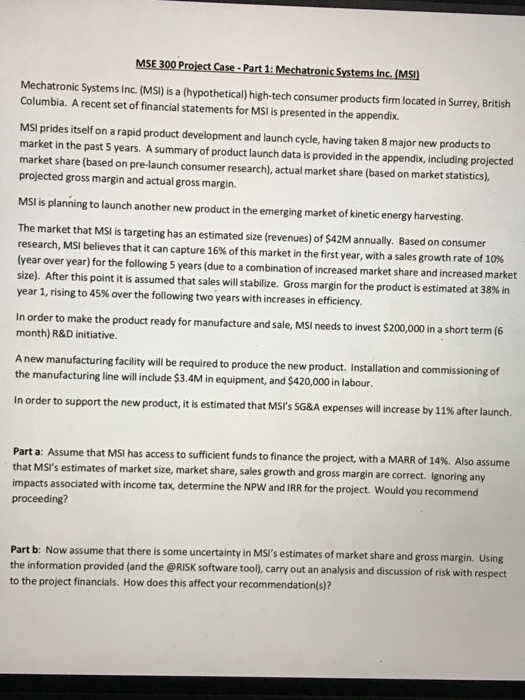

Mechatronic Systems Inc. (MSI) is a (hypothetical) high-tech consumer products firm located in Surrey, British Columbia. A recent set of financial statements for MSI is presented in the appendix. MSI prides itself on a rapid product development and launch cycle, having taken 8 major new products to market in the past 5 years. A summary of product launch data is provided in the appendix, including projected market share (based on pre-launch consumer research), actual market share (based on market statistics), projected gross margin and actual gross margin. MSI is planning to launch another new product in the emerging market of kinetic energy harvesting. The market that MSI is targeting has an estimated size (revenues) of $42M annually. Based on consumer research, MSI believes that it can capture 16% of this market in the first year, with a sales growth rate of 10% (year over year) for the following 5 years (due to a combination of increased market share and increased market size). After this point it is assumed that sales will stabilize. Gross margin for the product is estimated at 38% in year 1, rising to 45% over the following two years with increases in efficiency In order to make the product ready for manufacture and sale, MSI needs to invest $200,000 in a short term (6 month) R&D initiative. A new manufacturing facility will be required to produce the new product. Installation and commissioning of the manufacturing line will include $3.4M in equipment, and $420,000 in labour In order to support the new product, it is estimated that MS's SG&A expenses will increase by 11% after launch. Part a: Assume that MSI has access to sufficient funds to finance the project, with a MARR of 14%. Also assume that MSI's estimates of market size, market share, sales growth and gross margin are correct. Ignoring any impacts associated with income tax, determine the NPW and IRR for the project. Would you recommend proceeding? Part b: Now assume that there is some uncertainty in MSi's estimates of market share and gross margin. Using he information provided (and the eRISK software tool), carry out an analysis and discussion of risk with respect to the project financials. How does this affect your recommendation(s)