Please Answer this Question:

Review the topic material, "Analyzing the Financial Statement Using Horizontal-Vertical Analysis to Evaluate the Companys Financial Performance Period 2012-2016." The authors provide four charts to visually summarize their findings. Using Figure 2, 3, 4, or 5, add at least two points the authors did not address regarding the performance of the company based on the data presented in the chart.

The Article is Below:

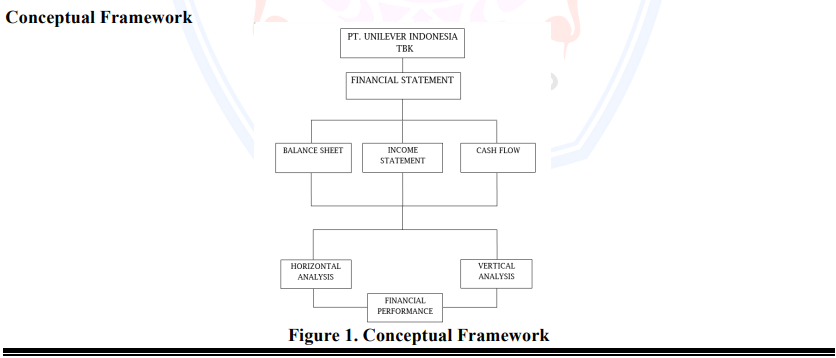

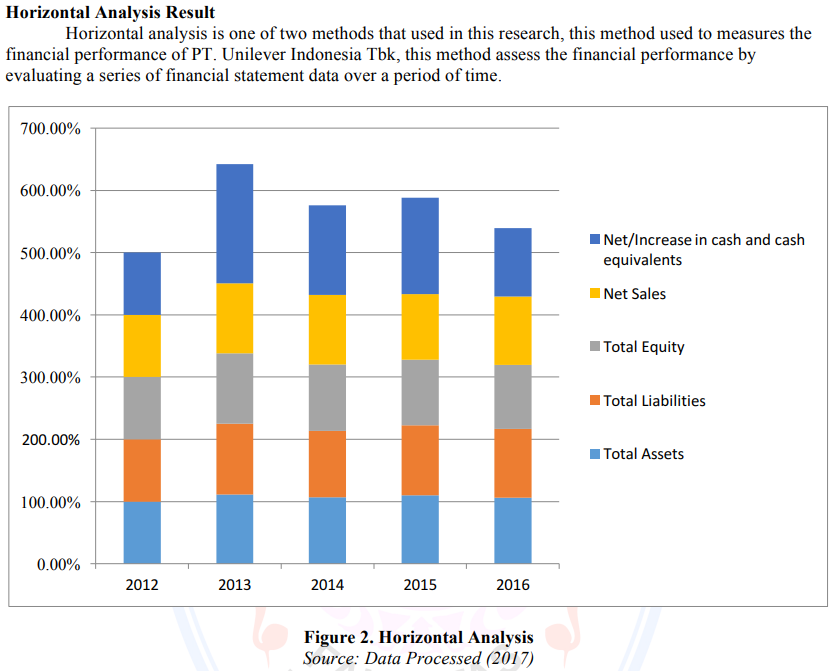

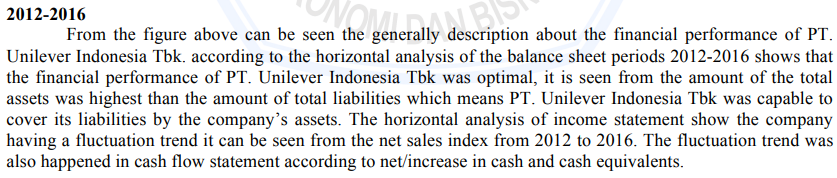

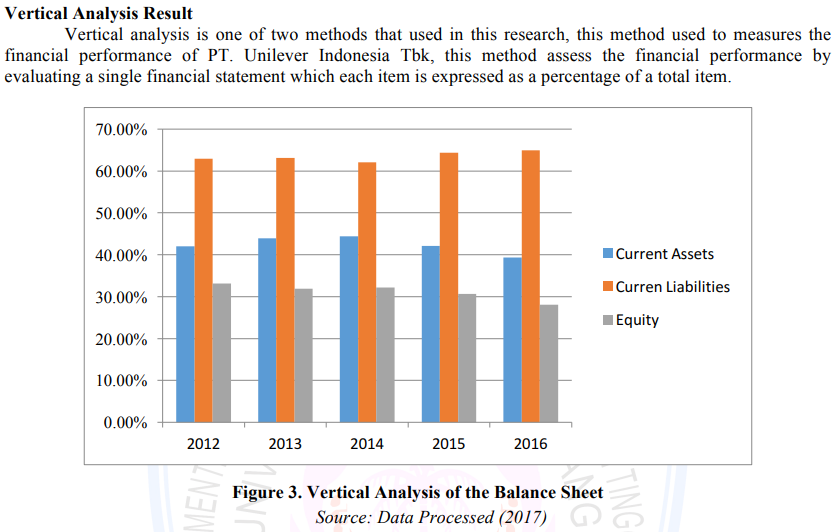

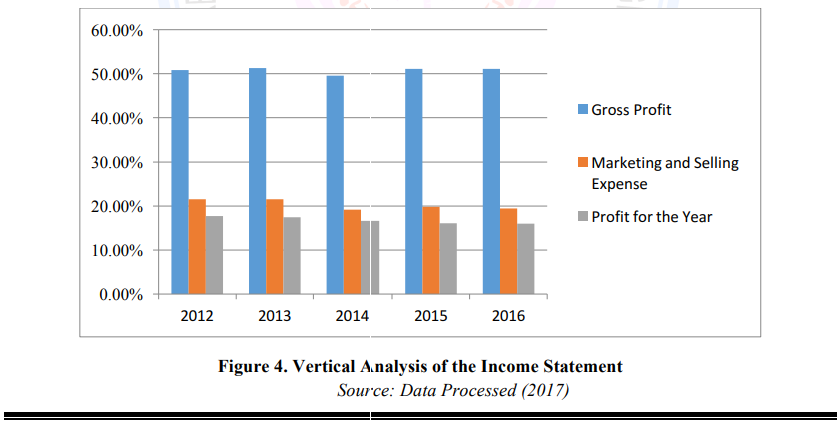

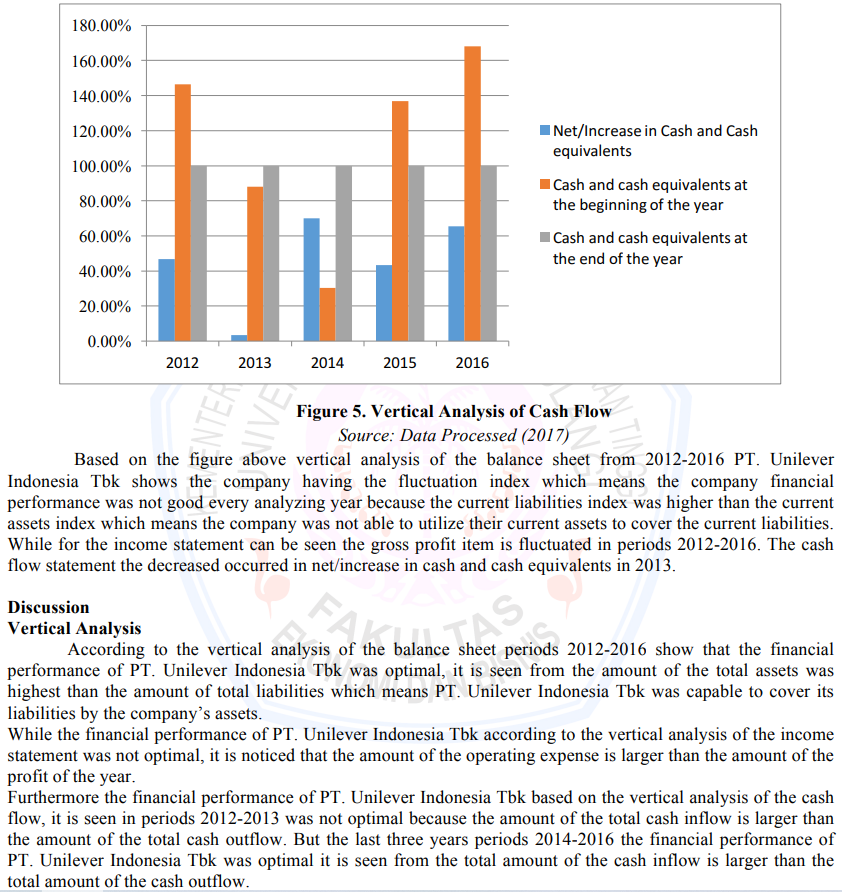

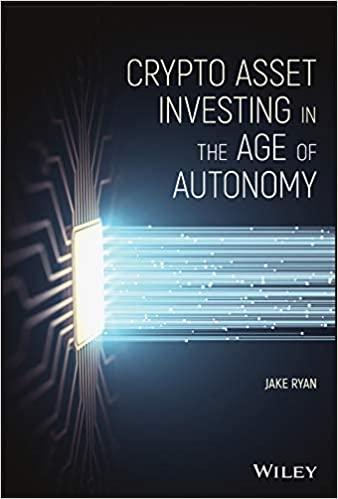

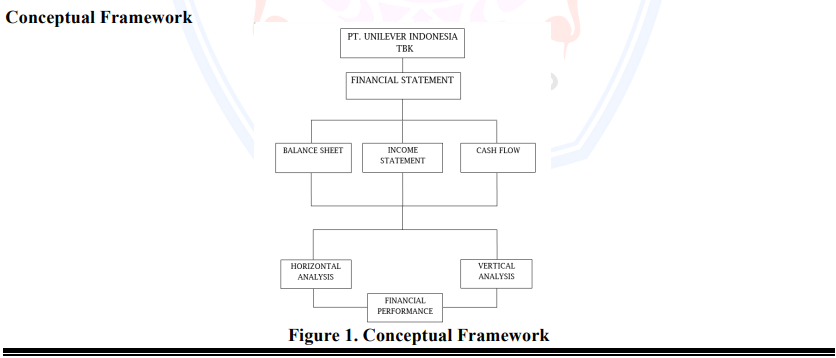

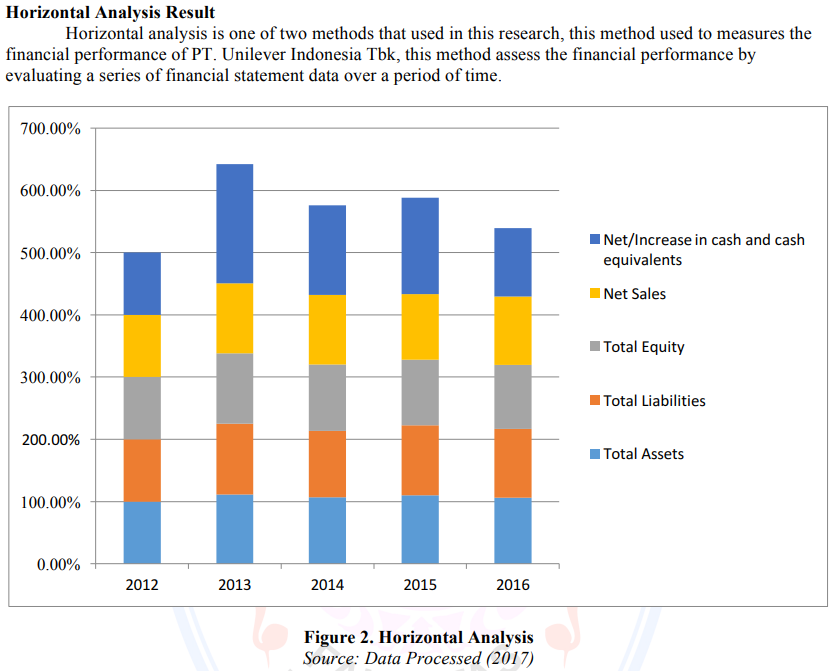

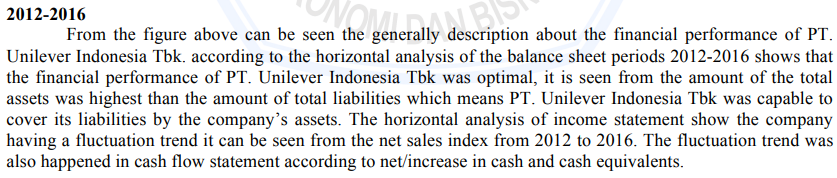

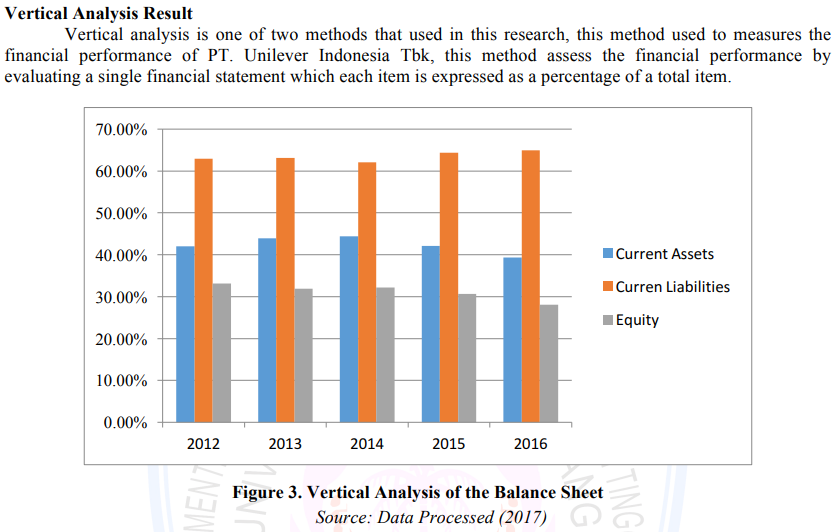

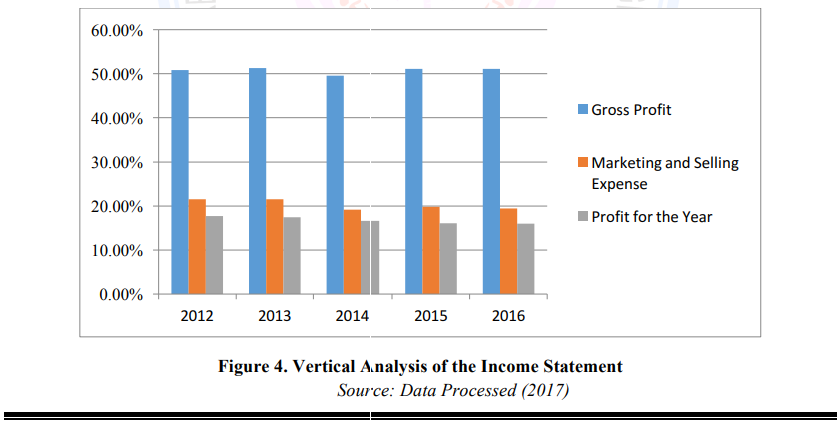

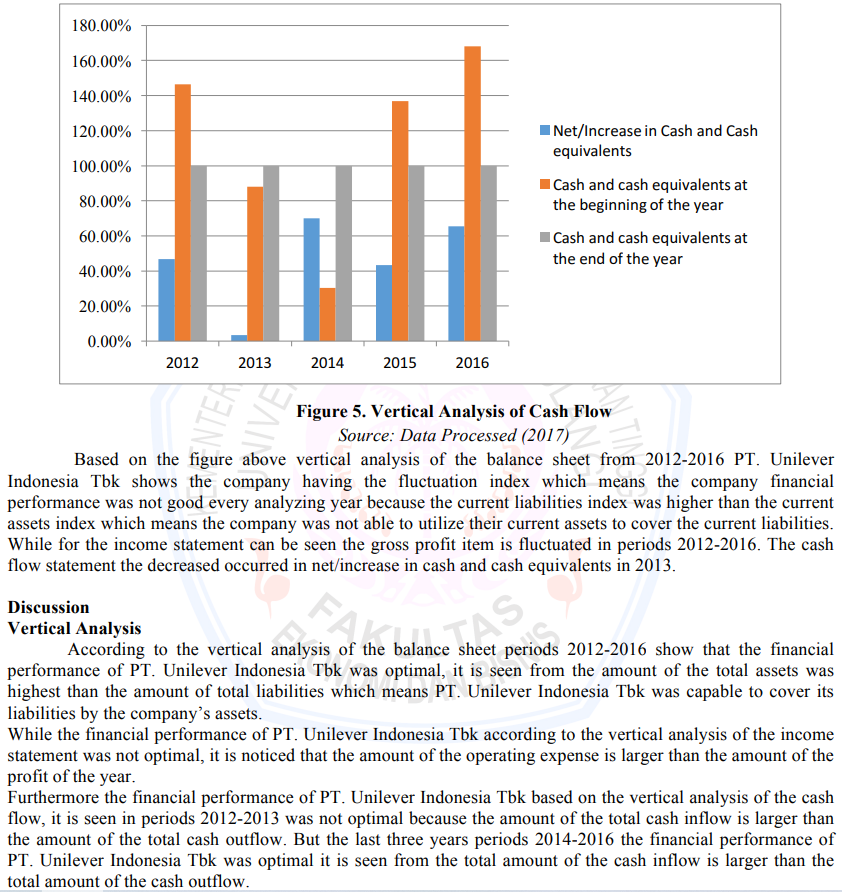

Research Background As markets globalize and an increasing proportion of business activity transcends national borders that have made it easier to sell internationally. For business, this process has given many opportunities. The company can expand their business but this will also put the company into the competition in the global market. As the time goes by the global market has become more competitive, a tight business competition in the era of globalization forces every company to adapt in the global market and competition that would arise in order to survive from the competitor. The globalization of markets makes every business activity transcends the national border that has made many foreign companies setting up companies in other countries that commonly known as the MNC (Multinational Corporation).One of the multinational corporations that operated in Indonesia is PT. Unilever Indonesia Tbk. to survive and compete in the market the company not only focused on the strategy but also expected to be able to pay attention to the importance of financial statement for the continuity of the company in the market. The financial statement is very useful for the company to evaluate the policies that will be applied as well as the policies that has been applied in a company. The term financial statement refers to an organized collection of data on the basis of accounting principles and conventions to disclose its financial information Periasamy (2010). According to Weygandt, Kimmel and Kieso (2013) there are two methods to analyze the financial statements of a company. First is horizontal analysis is a technique for evaluating a series of financial statements data over a period of time. Furthermore, there is a vertical analysis is a technique that expresses each financial statement item as a percentage of a base amount. Therefore, researcher is interested to conduct research titled "Analyzing Financial Statement Using Horizontal - Vertical Analysis to Evaluating the Company Financial Performance for Period 2012-2016 (Case Study at PT. Unilever Indonesia Tbk)". Research Objective Based on the research background the objective of this research isto evaluate the financial performance of PT. Unilever Indonesia Tbk from 2012-2016 measured by horizontal - vertical analysis. Financial Management According to Baker and Powell (2005) financial management is an integrated decision-making process concerned with acquiring, financing, and managing assets to accomplish some overall goal within a business entity. Thus, apart from the issues involved in acquiring external funds, the main concern of financial management is the efficient and wise allocation of funds to various uses. The financial management framework is an analytical way of viewing the financial problems of a firm. Financial Statement The financial statement is the basic document which provides information and recommendation about the financial position, performance and changes in financial position in an organization Atrill and McLaney (2002). Based on the notion above the researcher the term of financial statement can be defined as a company written report which explaining or describing the financial position, performance and changes of an organization. Financial Statement Analysis According to Periasamy (2010) financial statement analysis refers to the process of establishing the meaningful relationship between the items of the two financial statements with the objective of identifying the financial and operational strengths and weaknesses. Based on the notion above, the term of financial statement analysis can be defined as a process to evaluate company performance based on the information contained in the elements of the financial balance sheet, income statement and statement of cash flows so that they can make the right decision to run the business in the future. According to Periasamy (2010), based on the methods of operation; financial statement analysis may be classified into two major types such as horizontal analysis and vertical analysis: 1. Horizontal Analysis Under the horizontal analysis, financial statements are compared with several years and based on that, a firm may take decisions. Normally, the current year's figures are compared with the base year (base year is consider as 100) and how the financial information are changed from one year to another. According to Weygandt, Kimmel, and Kieso (2013) Horizontal analysis, is a technique for evaluating a series of financial statement data over a period of time. Its purpose is to determine the increase or decrease that has taken place. 2. Vertical Analysis Under the vertical analysis, financial statements measure the quantities relationship of the various items in the financial statement on a particular period. It is also called as static analysis, because, this analysis helps to determine the relationship with various items appeared in the financial statement. According to Weygandt, kimmel, kieso (2013) Vertical analysis is a technique that expresses each financial statement item as a percentage of a base amount. Previous Research Anupa Jayawardhana, (2016) conducted the research about the Financial performance of Adidas AG. This research using horizontal analysis, vertical analysis, trend analysis, and ratio analysis as the tools to measure the company performance, the latest performance being compared with company's statements over the last five years starting from 2010. After applying all analysis the result shows that the company is performing well and it will continue to make profit and revenues for next financial years. The current research proved that the horizontal and vertical are effective to evaluating PT. Unilever Indonesia Tbk financial performance, the result shows the company has a good performance in every analyzing year. PT. Unilever Indonesia Tbk has utilized well their current assets to cover their current liabilities, it means that PT. Unilever Indonesia Tbk is performing well. Tulung and Ramdani (2016) state a solvable company means that the company has an Conceptual Framen Type of Research The types of this research are descriptive quantitative research. Descriptive is often used to describe variable, descriptive is performed by analyzing one variable at a time all researchers perform this descriptive before beginning any type of data analysis Patel (2009). The quantitative research involves a numeric or statistical approach to research design Patel (2009). Place and Time of Research This research was conducted in Manado city, North Sulawesi, Indonesia for approximately two months from September to October 2017. Population and Sample The population of this research is all the financial statements of PT. Unilever Indonesia Tbk, the sample of this research is the last five years financial statement of PT. Unilever Indonesia Tbk which are the financial statements from 2012 to 2016 . Data Collection Method This research used secondary data approached to gathered the data, The secondary data of this research are the data that obtained from the published financial statement which is the balance sheet, income statement, and cash flow statement as well as another data that are related to the object that will be discussed. Horizontal Analysis Horizontal analysis helps to identify the trend in various indicators of performance. Formula : Rupiah Change; Amount of the item in comparison year - Amount of the item in base year Percentage Change: Rupiah Change x 100 In one horizontal analysis approach, the first thing to do is calculate the first formula which is select the base and comparison year and then amount of the item in comparison year subtracted by the amount of the item in base year the result of the first formula is divided to amount of the item in base year and the result of the calculation multiplied by 100 . Vertical analysis Vertical analysis depicts each amount of the financial statement as a percentage of another item. Formula : Percentage of base: AmountofbaseAmountofindividualitemx100 In vertical analysis approach the base amount is usually taken from an aggregated from the same year's financial statements. Then the vertical analysis percentage formula can be applied to the financial item. The vertical analysis percentage formula is calculated by dividing the analyzed item by the base amount of benchmark and multiplying it by 100 . Data analysis methods on the financial statements used to measure, know, describe, define and compare the proportions of the items in the balance sheet, income statement, and cash flow statement. The method of this research that is used as tools to analyze is the horizontal and vertical analysis. Horizontal Analysis Horizontal analysis is a financial statement that shows changes in the amounts of corresponding financial statement items over a period of time, which is a helpful tool to assess the trend situations. From this change analysis can be known source of the use of corporate funds, in addition to the development of the company from one period to another period. Vertical Analysis Vertical analysis depicts each amount of the financial statement as a percentage of another item. The vertical evaluation of the balance sheet means every amount belongs to assert is resisted to be a percentage of total assert while vertical analysis of liabilities in balance sheet means every amounts belongs to liability is resisted to be percentage of total liabilities. Vertical analysis of an income statement show that every income statement amount represented as a percentage of sales. In the cash flow statement, total cash inflow is set as a parameter to each post that form the cash inflow, and total cash-out is set as a parameter for each post that form cash out, Then cash and cash equivalents specified as a parameter of each post that form of cash and cash equivalents in the cash flow statement. Company Profile PT Unilever Indonesia Tbk (the company) was established on 5 December 1933 as Lever's Zeepfabrieken N.V. by deed No. 23 of Mr. A.H. van Ophuijsen, notary in Batavia. This deed was approved by the Gouverneur Generaal van Nederlandsch-Indie under letter No. 14 on 16 December 1933, registered at the Raad van Justitie in Batavia under No. 302 on 22 December 1933 and published in the Javasche Courant on 9 January 1934 Supplement No. 3. By deed No. 171 of public notary Mrs. Kartini Muljadi SH dated 22 July 1980 the company's name was changed to PT Unilever Indonesia. By deed No. 92 of public notary Mr. Mudofir Hadi SH dated 30 June 1997 the Company's name was changed to PT Unilever Indonesia Tbk. This deed was approved by the Minister of Justice under decision letter No.C2-1.049HT.01.04 TH.98 dated 23 February 1998 and published in State Gazette No. 2620 of 15 May 1998 Supplement No. 39. The Company went public in 1981 and its shares have been listed on the Indonesia Stock Exchange at Jakarta since 11 January 1982. As of the end of 2016, Unilever Indonesia was the fifth largest company by market capitalization on the Indonesia Stock Exchange. As a responsible company, Unilever Indonesia has a far-reaching Corporate Social Responsibility (CSR) program which is founded on the principles of our Unilever Sustainable Living Plan (USLP). The three pillars of the USLP are Improving Health and Well-being, Reducing Environmental Impact and Enhancing Livelihoods. The Company has nine factories, located in the Jababeka Industrial Zone, Cikarang and Rungkut, Surabaya, and moved toits new head office in Bumi Serpong Damai at the end of 2016. The custom-built premises, on a 3-hectare site, house more than 1,400 employees. The Company's product range, comprising 39 brands and close to 1,000 Stock Keeping Units (SKU), is marketed through a network of more than 800 independent distributors who serve hundreds of thousands of stores across Indonesia. Horizontal Analysis Result Horizontal analysis is one of two methods that used in this research, this method used to measures the financial performance of PT. Unilever Indonesia Tbk, this method assess the financial performance by evaluating a series of financial statement data over a period of time. Net/Increase in cash and cash equivalents Net Sales Total Equity Total Liabilities Total Assets Figure 2. Horizontal Analysis Source: Data Processed (2017) 2012-2016 From the figure above can be seen the generally description about the financial performance of PT. Unilever Indonesia Tbk. according to the horizontal analysis of the balance sheet periods 2012-2016 shows that the financial performance of PT. Unilever Indonesia Tbk was optimal, it is seen from the amount of the total assets was highest than the amount of total liabilities which means PT. Unilever Indonesia Tbk was capable to cover its liabilities by the company's assets. The horizontal analysis of income statement show the company having a fluctuation trend it can be seen from the net sales index from 2012 to 2016. The fluctuation trend was also happened in cash flow statement according to net/increase in cash and cash equivalents. Vertical Analysis Result Vertical analysis is one of two methods that used in this research, this method used to measures the financial performance of PT. Unilever Indonesia Tbk, this method assess the financial performance by evaluating a single financial statement which each item is expressed as a percentage of a total item. Figure 3. Vertical Analysis of the Balance Sheet Source: Data Processed (2017) Figure 4. Vertical Analysis of the Income Statement Source: Data Processed (2017) Figure 5. Vertical Analysis of Cash Flow Source: Data Processed (2017) Based on the figure above vertical analysis of the balance sheet from 2012-2016 PT. Unilever Indonesia Tbk shows the company having the fluctuation index which means the company financial performance was not good every analyzing year because the current liabilities index was higher than the current assets index which means the company was not able to utilize their current assets to cover the current liabilities. While for the income statement can be seen the gross profit item is fluctuated in periods 2012-2016. The cash flow statement the decreased occurred in net/increase in cash and cash equivalents in 2013. Discussion Vertical Analysis According to the vertical analysis of the balance sheet periods 2012-2016 show that the financial performance of PT. Unilever Indonesia Tbk was optimal, it is seen from the amount of the total assets was highest than the amount of total liabilities which means PT. Unilever Indonesia Tbk was capable to cover its liabilities by the company's assets. While the financial performance of PT. Unilever Indonesia Tbk according to the vertical analysis of the income statement was not optimal, it is noticed that the amount of the operating expense is larger than the amount of the profit of the year. Furthermore the financial performance of PT. Unilever Indonesia Tbk based on the vertical analysis of the cash flow, it is seen in periods 2012-2013 was not optimal because the amount of the total cash inflow is larger than the amount of the total cash outflow. But the last three years periods 2014-2016 the financial performance of PT. Unilever Indonesia Tbk was optimal it is seen from the total amount of the cash inflow is larger than the According to the horizontal analysis of the balance sheet periods 2012-2016 shows that the financial performance of PT. Unilever Indonesia Tbk was optimal, it is seen from the amount of the total assets was highest than the amount of total liabilities which means PT. Unilever Indonesia Tbk was capable to cover its liabilities by the company's assets. While the financial performance of PT. Unilever Indonesia Tbk according to the vertical analysis of the income statement periods 2012-2016 was not optimal, it is noticed that the amount of the operating expense is larger than the amount of the profit of the year. Furthermore the financial performance of PT. Unilever Indonesia Tbk based on the vertical analysis of the cash flow, it is seen in periods 2012-2013 was not optimal because the amount of the total cash inflow is larger than the amount of the total cash outflow. But the last three years periods 2014-2016 the financial performance of PT. Unilever Indonesia Tbk was optimal it is seen from the total amount of the cash inflow is larger than the total amount of the cash outflow. CONCLUSION AND RECOMMENDATION Conclusion This section provides the conclusion of the result Conclusion in this research are: 1. Based on the vertical analysis, the balance sheet of PT. Unilever Indonesia Tbk show that the amount of the total current liabilities is larger than the amount of total current assets. This indicates the balance sheet of PT Unilever Indonesia Tbk is not optimal. Meanwhile for the income statement of PT. Unilever Indonesia Tbk the amount of marketing and selling expenses is larger than the amount of net income that indicates the income statement of PT, Unilever Indonesia Tbk is not optimal even though the net income index was increasing every analyzing year. However the cash flow statement of PT. Unilever Indonesia Tbk is optimal because the total amount of the cash inflow is larger than the total amount of cash outflow. 2. Based on the horizontal analysis, the balance sheet of PT. Unilever Indonesia Tbk is optimal because the amount of total current assets was good by increasing every analyzing year even though in 2016 the current asset was reduced. The income statement of PT. Unilever Indonesia Tbk is also show a good trend means increasing every analyzing year, and so does the cash flow of PT Unilever Indonesia has a good trend. Recommendation PT. Unilever Indonesia Tbk have to improve their financial performance by improving their profitability, one way can be done by the company to improving their company profitability is decreasing its liabilities. control the marketing and selling expenses is also thee important thing to do by PT. Unilever Indonesia Tbkin order to increase the company's profitability, the company is also expected to utilize the current assets to pay off its current liabilities. Research Background As markets globalize and an increasing proportion of business activity transcends national borders that have made it easier to sell internationally. For business, this process has given many opportunities. The company can expand their business but this will also put the company into the competition in the global market. As the time goes by the global market has become more competitive, a tight business competition in the era of globalization forces every company to adapt in the global market and competition that would arise in order to survive from the competitor. The globalization of markets makes every business activity transcends the national border that has made many foreign companies setting up companies in other countries that commonly known as the MNC (Multinational Corporation).One of the multinational corporations that operated in Indonesia is PT. Unilever Indonesia Tbk. to survive and compete in the market the company not only focused on the strategy but also expected to be able to pay attention to the importance of financial statement for the continuity of the company in the market. The financial statement is very useful for the company to evaluate the policies that will be applied as well as the policies that has been applied in a company. The term financial statement refers to an organized collection of data on the basis of accounting principles and conventions to disclose its financial information Periasamy (2010). According to Weygandt, Kimmel and Kieso (2013) there are two methods to analyze the financial statements of a company. First is horizontal analysis is a technique for evaluating a series of financial statements data over a period of time. Furthermore, there is a vertical analysis is a technique that expresses each financial statement item as a percentage of a base amount. Therefore, researcher is interested to conduct research titled "Analyzing Financial Statement Using Horizontal - Vertical Analysis to Evaluating the Company Financial Performance for Period 2012-2016 (Case Study at PT. Unilever Indonesia Tbk)". Research Objective Based on the research background the objective of this research isto evaluate the financial performance of PT. Unilever Indonesia Tbk from 2012-2016 measured by horizontal - vertical analysis. Financial Management According to Baker and Powell (2005) financial management is an integrated decision-making process concerned with acquiring, financing, and managing assets to accomplish some overall goal within a business entity. Thus, apart from the issues involved in acquiring external funds, the main concern of financial management is the efficient and wise allocation of funds to various uses. The financial management framework is an analytical way of viewing the financial problems of a firm. Financial Statement The financial statement is the basic document which provides information and recommendation about the financial position, performance and changes in financial position in an organization Atrill and McLaney (2002). Based on the notion above the researcher the term of financial statement can be defined as a company written report which explaining or describing the financial position, performance and changes of an organization. Financial Statement Analysis According to Periasamy (2010) financial statement analysis refers to the process of establishing the meaningful relationship between the items of the two financial statements with the objective of identifying the financial and operational strengths and weaknesses. Based on the notion above, the term of financial statement analysis can be defined as a process to evaluate company performance based on the information contained in the elements of the financial balance sheet, income statement and statement of cash flows so that they can make the right decision to run the business in the future. According to Periasamy (2010), based on the methods of operation; financial statement analysis may be classified into two major types such as horizontal analysis and vertical analysis: 1. Horizontal Analysis Under the horizontal analysis, financial statements are compared with several years and based on that, a firm may take decisions. Normally, the current year's figures are compared with the base year (base year is consider as 100) and how the financial information are changed from one year to another. According to Weygandt, Kimmel, and Kieso (2013) Horizontal analysis, is a technique for evaluating a series of financial statement data over a period of time. Its purpose is to determine the increase or decrease that has taken place. 2. Vertical Analysis Under the vertical analysis, financial statements measure the quantities relationship of the various items in the financial statement on a particular period. It is also called as static analysis, because, this analysis helps to determine the relationship with various items appeared in the financial statement. According to Weygandt, kimmel, kieso (2013) Vertical analysis is a technique that expresses each financial statement item as a percentage of a base amount. Previous Research Anupa Jayawardhana, (2016) conducted the research about the Financial performance of Adidas AG. This research using horizontal analysis, vertical analysis, trend analysis, and ratio analysis as the tools to measure the company performance, the latest performance being compared with company's statements over the last five years starting from 2010. After applying all analysis the result shows that the company is performing well and it will continue to make profit and revenues for next financial years. The current research proved that the horizontal and vertical are effective to evaluating PT. Unilever Indonesia Tbk financial performance, the result shows the company has a good performance in every analyzing year. PT. Unilever Indonesia Tbk has utilized well their current assets to cover their current liabilities, it means that PT. Unilever Indonesia Tbk is performing well. Tulung and Ramdani (2016) state a solvable company means that the company has an Conceptual Framen Type of Research The types of this research are descriptive quantitative research. Descriptive is often used to describe variable, descriptive is performed by analyzing one variable at a time all researchers perform this descriptive before beginning any type of data analysis Patel (2009). The quantitative research involves a numeric or statistical approach to research design Patel (2009). Place and Time of Research This research was conducted in Manado city, North Sulawesi, Indonesia for approximately two months from September to October 2017. Population and Sample The population of this research is all the financial statements of PT. Unilever Indonesia Tbk, the sample of this research is the last five years financial statement of PT. Unilever Indonesia Tbk which are the financial statements from 2012 to 2016 . Data Collection Method This research used secondary data approached to gathered the data, The secondary data of this research are the data that obtained from the published financial statement which is the balance sheet, income statement, and cash flow statement as well as another data that are related to the object that will be discussed. Horizontal Analysis Horizontal analysis helps to identify the trend in various indicators of performance. Formula : Rupiah Change; Amount of the item in comparison year - Amount of the item in base year Percentage Change: Rupiah Change x 100 In one horizontal analysis approach, the first thing to do is calculate the first formula which is select the base and comparison year and then amount of the item in comparison year subtracted by the amount of the item in base year the result of the first formula is divided to amount of the item in base year and the result of the calculation multiplied by 100 . Vertical analysis Vertical analysis depicts each amount of the financial statement as a percentage of another item. Formula : Percentage of base: AmountofbaseAmountofindividualitemx100 In vertical analysis approach the base amount is usually taken from an aggregated from the same year's financial statements. Then the vertical analysis percentage formula can be applied to the financial item. The vertical analysis percentage formula is calculated by dividing the analyzed item by the base amount of benchmark and multiplying it by 100 . Data analysis methods on the financial statements used to measure, know, describe, define and compare the proportions of the items in the balance sheet, income statement, and cash flow statement. The method of this research that is used as tools to analyze is the horizontal and vertical analysis. Horizontal Analysis Horizontal analysis is a financial statement that shows changes in the amounts of corresponding financial statement items over a period of time, which is a helpful tool to assess the trend situations. From this change analysis can be known source of the use of corporate funds, in addition to the development of the company from one period to another period. Vertical Analysis Vertical analysis depicts each amount of the financial statement as a percentage of another item. The vertical evaluation of the balance sheet means every amount belongs to assert is resisted to be a percentage of total assert while vertical analysis of liabilities in balance sheet means every amounts belongs to liability is resisted to be percentage of total liabilities. Vertical analysis of an income statement show that every income statement amount represented as a percentage of sales. In the cash flow statement, total cash inflow is set as a parameter to each post that form the cash inflow, and total cash-out is set as a parameter for each post that form cash out, Then cash and cash equivalents specified as a parameter of each post that form of cash and cash equivalents in the cash flow statement. Company Profile PT Unilever Indonesia Tbk (the company) was established on 5 December 1933 as Lever's Zeepfabrieken N.V. by deed No. 23 of Mr. A.H. van Ophuijsen, notary in Batavia. This deed was approved by the Gouverneur Generaal van Nederlandsch-Indie under letter No. 14 on 16 December 1933, registered at the Raad van Justitie in Batavia under No. 302 on 22 December 1933 and published in the Javasche Courant on 9 January 1934 Supplement No. 3. By deed No. 171 of public notary Mrs. Kartini Muljadi SH dated 22 July 1980 the company's name was changed to PT Unilever Indonesia. By deed No. 92 of public notary Mr. Mudofir Hadi SH dated 30 June 1997 the Company's name was changed to PT Unilever Indonesia Tbk. This deed was approved by the Minister of Justice under decision letter No.C2-1.049HT.01.04 TH.98 dated 23 February 1998 and published in State Gazette No. 2620 of 15 May 1998 Supplement No. 39. The Company went public in 1981 and its shares have been listed on the Indonesia Stock Exchange at Jakarta since 11 January 1982. As of the end of 2016, Unilever Indonesia was the fifth largest company by market capitalization on the Indonesia Stock Exchange. As a responsible company, Unilever Indonesia has a far-reaching Corporate Social Responsibility (CSR) program which is founded on the principles of our Unilever Sustainable Living Plan (USLP). The three pillars of the USLP are Improving Health and Well-being, Reducing Environmental Impact and Enhancing Livelihoods. The Company has nine factories, located in the Jababeka Industrial Zone, Cikarang and Rungkut, Surabaya, and moved toits new head office in Bumi Serpong Damai at the end of 2016. The custom-built premises, on a 3-hectare site, house more than 1,400 employees. The Company's product range, comprising 39 brands and close to 1,000 Stock Keeping Units (SKU), is marketed through a network of more than 800 independent distributors who serve hundreds of thousands of stores across Indonesia. Horizontal Analysis Result Horizontal analysis is one of two methods that used in this research, this method used to measures the financial performance of PT. Unilever Indonesia Tbk, this method assess the financial performance by evaluating a series of financial statement data over a period of time. Net/Increase in cash and cash equivalents Net Sales Total Equity Total Liabilities Total Assets Figure 2. Horizontal Analysis Source: Data Processed (2017) 2012-2016 From the figure above can be seen the generally description about the financial performance of PT. Unilever Indonesia Tbk. according to the horizontal analysis of the balance sheet periods 2012-2016 shows that the financial performance of PT. Unilever Indonesia Tbk was optimal, it is seen from the amount of the total assets was highest than the amount of total liabilities which means PT. Unilever Indonesia Tbk was capable to cover its liabilities by the company's assets. The horizontal analysis of income statement show the company having a fluctuation trend it can be seen from the net sales index from 2012 to 2016. The fluctuation trend was also happened in cash flow statement according to net/increase in cash and cash equivalents. Vertical Analysis Result Vertical analysis is one of two methods that used in this research, this method used to measures the financial performance of PT. Unilever Indonesia Tbk, this method assess the financial performance by evaluating a single financial statement which each item is expressed as a percentage of a total item. Figure 3. Vertical Analysis of the Balance Sheet Source: Data Processed (2017) Figure 4. Vertical Analysis of the Income Statement Source: Data Processed (2017) Figure 5. Vertical Analysis of Cash Flow Source: Data Processed (2017) Based on the figure above vertical analysis of the balance sheet from 2012-2016 PT. Unilever Indonesia Tbk shows the company having the fluctuation index which means the company financial performance was not good every analyzing year because the current liabilities index was higher than the current assets index which means the company was not able to utilize their current assets to cover the current liabilities. While for the income statement can be seen the gross profit item is fluctuated in periods 2012-2016. The cash flow statement the decreased occurred in net/increase in cash and cash equivalents in 2013. Discussion Vertical Analysis According to the vertical analysis of the balance sheet periods 2012-2016 show that the financial performance of PT. Unilever Indonesia Tbk was optimal, it is seen from the amount of the total assets was highest than the amount of total liabilities which means PT. Unilever Indonesia Tbk was capable to cover its liabilities by the company's assets. While the financial performance of PT. Unilever Indonesia Tbk according to the vertical analysis of the income statement was not optimal, it is noticed that the amount of the operating expense is larger than the amount of the profit of the year. Furthermore the financial performance of PT. Unilever Indonesia Tbk based on the vertical analysis of the cash flow, it is seen in periods 2012-2013 was not optimal because the amount of the total cash inflow is larger than the amount of the total cash outflow. But the last three years periods 2014-2016 the financial performance of PT. Unilever Indonesia Tbk was optimal it is seen from the total amount of the cash inflow is larger than the According to the horizontal analysis of the balance sheet periods 2012-2016 shows that the financial performance of PT. Unilever Indonesia Tbk was optimal, it is seen from the amount of the total assets was highest than the amount of total liabilities which means PT. Unilever Indonesia Tbk was capable to cover its liabilities by the company's assets. While the financial performance of PT. Unilever Indonesia Tbk according to the vertical analysis of the income statement periods 2012-2016 was not optimal, it is noticed that the amount of the operating expense is larger than the amount of the profit of the year. Furthermore the financial performance of PT. Unilever Indonesia Tbk based on the vertical analysis of the cash flow, it is seen in periods 2012-2013 was not optimal because the amount of the total cash inflow is larger than the amount of the total cash outflow. But the last three years periods 2014-2016 the financial performance of PT. Unilever Indonesia Tbk was optimal it is seen from the total amount of the cash inflow is larger than the total amount of the cash outflow. CONCLUSION AND RECOMMENDATION Conclusion This section provides the conclusion of the result Conclusion in this research are: 1. Based on the vertical analysis, the balance sheet of PT. Unilever Indonesia Tbk show that the amount of the total current liabilities is larger than the amount of total current assets. This indicates the balance sheet of PT Unilever Indonesia Tbk is not optimal. Meanwhile for the income statement of PT. Unilever Indonesia Tbk the amount of marketing and selling expenses is larger than the amount of net income that indicates the income statement of PT, Unilever Indonesia Tbk is not optimal even though the net income index was increasing every analyzing year. However the cash flow statement of PT. Unilever Indonesia Tbk is optimal because the total amount of the cash inflow is larger than the total amount of cash outflow. 2. Based on the horizontal analysis, the balance sheet of PT. Unilever Indonesia Tbk is optimal because the amount of total current assets was good by increasing every analyzing year even though in 2016 the current asset was reduced. The income statement of PT. Unilever Indonesia Tbk is also show a good trend means increasing every analyzing year, and so does the cash flow of PT Unilever Indonesia has a good trend. Recommendation PT. Unilever Indonesia Tbk have to improve their financial performance by improving their profitability, one way can be done by the company to improving their company profitability is decreasing its liabilities. control the marketing and selling expenses is also thee important thing to do by PT. Unilever Indonesia Tbkin order to increase the company's profitability, the company is also expected to utilize the current assets to pay off its current liabilities