Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer to questions 4,5 & 6 470 Group Project #1 Pike's Case - Client name: Angie Pike - Gender: Female - DOB: 06/01/1963 -

Please answer to questions 4,5 & 6

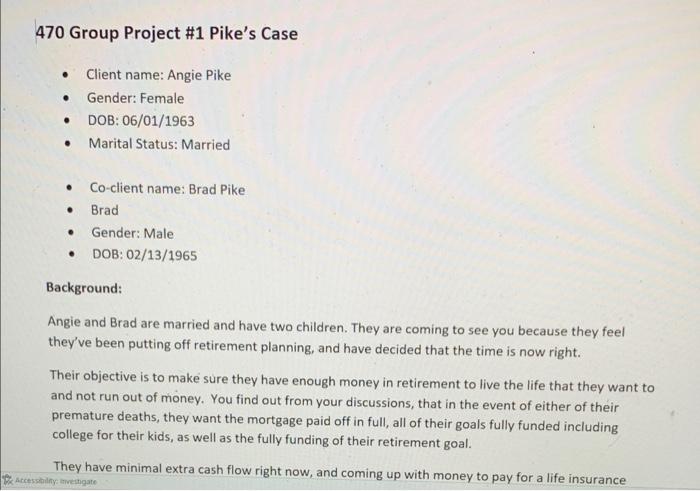

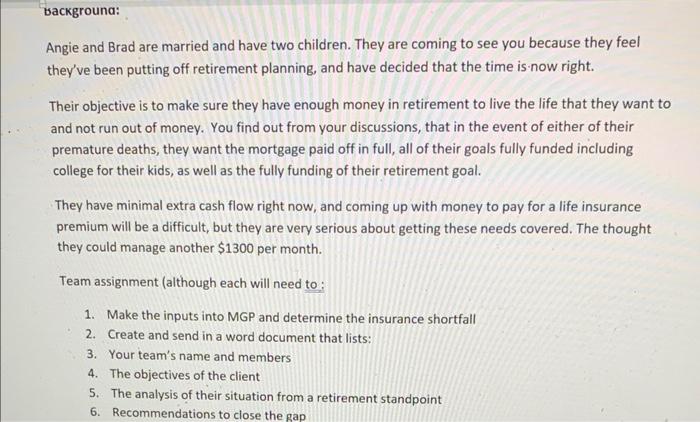

470 Group Project #1 Pike's Case - Client name: Angie Pike - Gender: Female - DOB: 06/01/1963 - Marital Status: Married - Co-client name: Brad Pike - Brad - Gender: Male - DOB: 02/13/1965 Background: Angie and Brad are married and have two children. They are coming to see you because they feel they've been putting off retirement planning, and have decided that the time is now right. Their objective is to make sure they have enough money in retirement to live the life that they want to and not run out of money. You find out from your discussions, that in the event of either of their premature deaths, they want the mortgage paid off in full, all of their goals fully funded including college for their kids, as well as the fully funding of their retirement goal. They have minimal extra cash flow right now, and coming up with money to pay for a life insurance Angie and Brad are married and have two children. They are coming to see you because they feel they've been putting off retirement planning, and have decided that the time is now right. Their objective is to make sure they have enough money in retirement to live the life that they want to and not run out of money. You find out from your discussions, that in the event of either of their premature deaths, they want the mortgage paid off in full, all of their goals fully funded including college for their kids, as well as the fully funding of their retirement goal. They have minimal extra cash flow right now, and coming up with money to pay for a life insurance premium will be a difficult, but they are very serious about getting these needs covered. The thought they could manage another $1300 per month. Team assignment (although each will need to: 1. Make the inputs into MGP and determine the insurance shortfall 2. Create and send in a word document that lists: 3. Your team's name and members 4. The objectives of the client 5. The analysis of their situation from a retirement standpoint 6. Recommendations to close the gap

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started