Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer with work thank you 8.Shaker Investments, a private investment holding company, is searching for a new investment opportunity.Shaker Investments has identified two potential

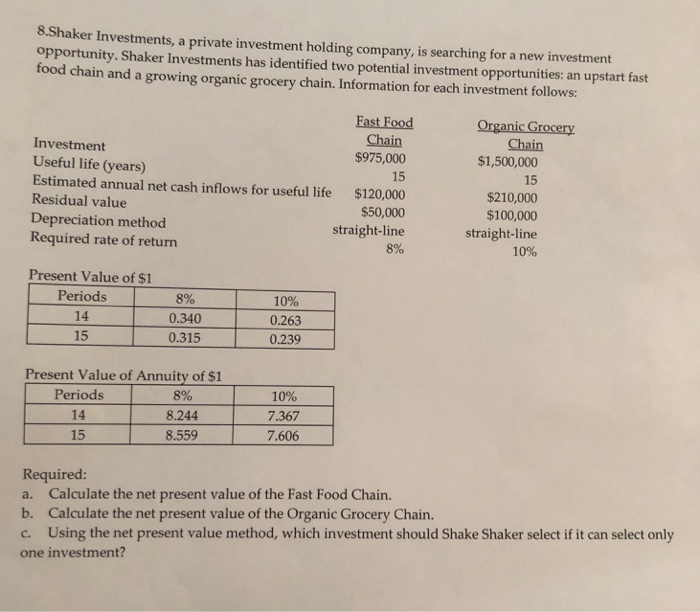

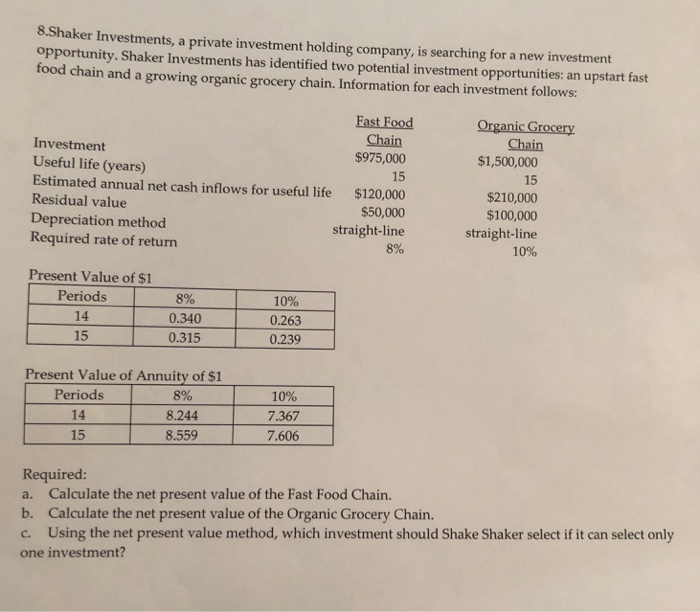

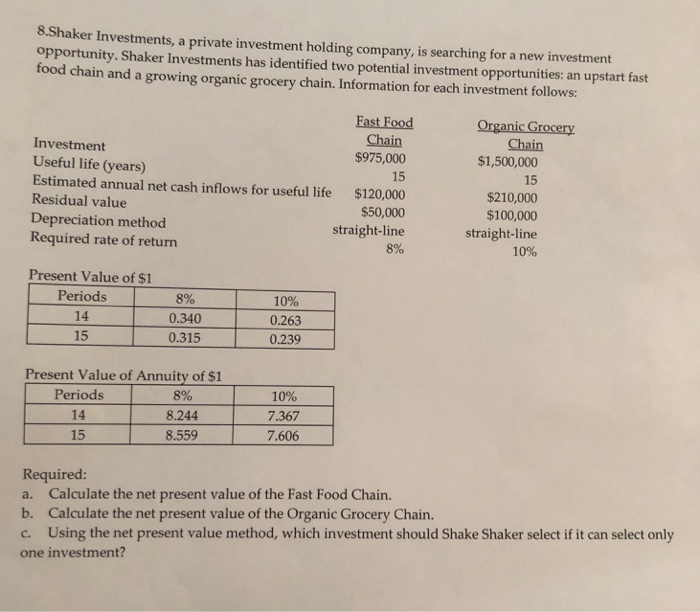

please answer with work thank you  8.Shaker Investments, a private investment holding company, is searching for a new investment opportunity.Shaker Investments has identified two potential investment opportunities: an upstart fast food chain and a growing organic grocery chain. Information for each investment follows: Fast Food Organic Grocery Chain $975,000 15 Estimated annual net cash inflows for useful life $120,000 $50,000 straight-line 8% Chain $1,500,000 15 $210,000 $100,000 straight-line 10% Investment Useful life (years) Residual value Depreciation method Required rate of return Present Value of $1 Periods 14 15 8% 0.340 0.315 10% 0.263 0.239 Present Value of Annuity of $1 Periods 14 15 8% 8.244 8.559 10% 7.367 7.606 Required: a. Calculate the net present value of the Fast Food Chain b. Calculate the net present value of the Organic Grocery Chain. c. Using the net present value method, which investment should Shake Shaker select if it can select only one investment

8.Shaker Investments, a private investment holding company, is searching for a new investment opportunity.Shaker Investments has identified two potential investment opportunities: an upstart fast food chain and a growing organic grocery chain. Information for each investment follows: Fast Food Organic Grocery Chain $975,000 15 Estimated annual net cash inflows for useful life $120,000 $50,000 straight-line 8% Chain $1,500,000 15 $210,000 $100,000 straight-line 10% Investment Useful life (years) Residual value Depreciation method Required rate of return Present Value of $1 Periods 14 15 8% 0.340 0.315 10% 0.263 0.239 Present Value of Annuity of $1 Periods 14 15 8% 8.244 8.559 10% 7.367 7.606 Required: a. Calculate the net present value of the Fast Food Chain b. Calculate the net present value of the Organic Grocery Chain. c. Using the net present value method, which investment should Shake Shaker select if it can select only one investment

please answer with work thank you

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started