Answered step by step

Verified Expert Solution

Question

1 Approved Answer

****please answer within 1 hour*** Exercise 4 (Forward rate agreements) (13 points) Forward rate agreements are used to hedge the effects which result from future

****please answer within 1 hour***

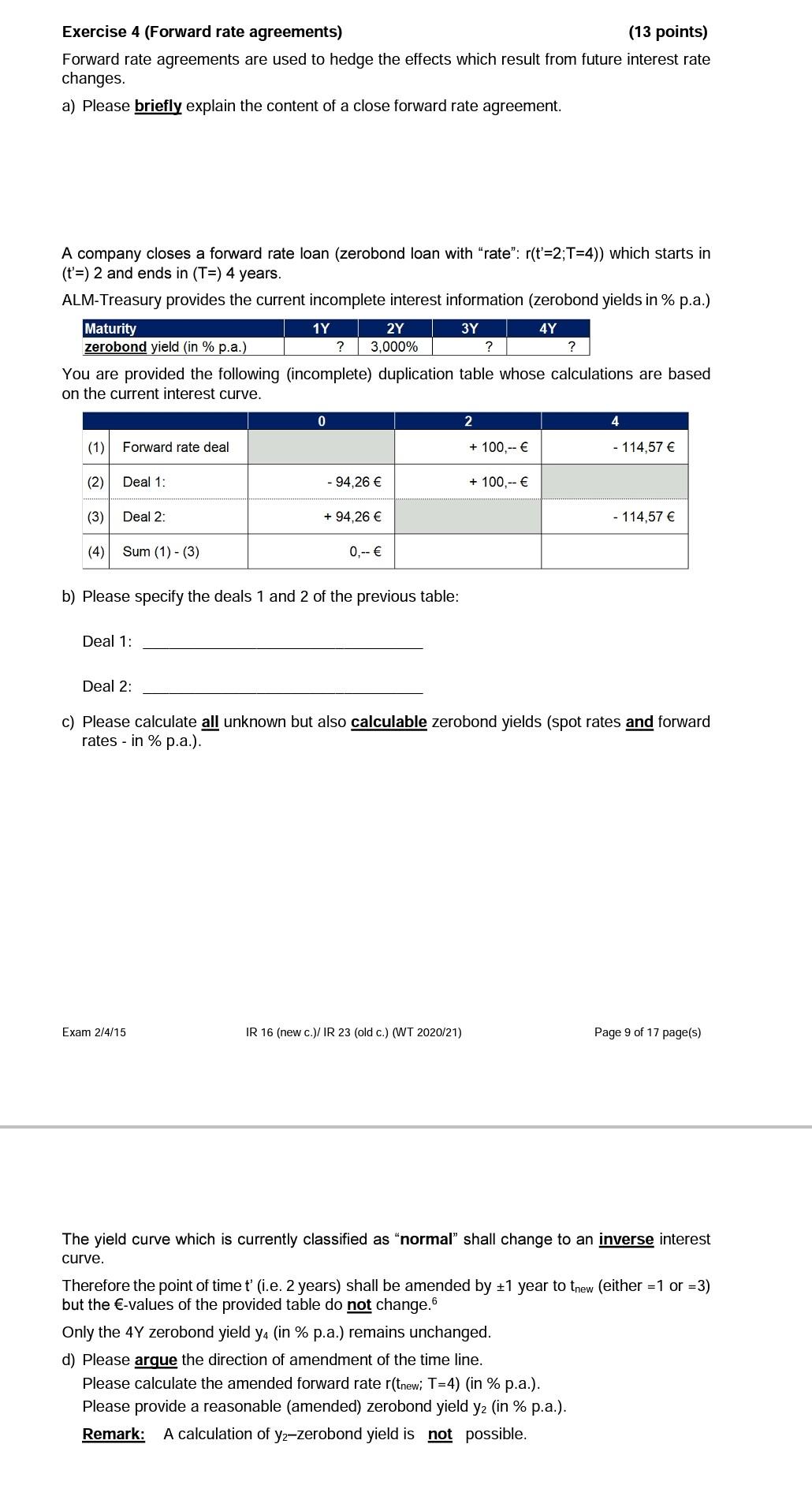

Exercise 4 (Forward rate agreements) (13 points) Forward rate agreements are used to hedge the effects which result from future interest rate changes. a) Please briefly explain the content of a close forward rate agreement. A company closes a forward rate loan (zerobond loan with rate": r(t=2;T=4)) which starts in (t'=) 2 and ends in (T=) 4 years. ALM-Treasury provides the current incomplete interest information (zerobond yields in % p.a.) Maturity 1Y 2Y 3Y 4Y zerobond yield (in % p.a.) ? 3,000% ? ? You are provided the following (incomplete) duplication table whose calculations are based on the current interest curve. 0 2 4 (1) Forward rate deal + 100,-- - 114,57 (2) Deal 1: - 94,26 + 100,-- (3) Deal 2: + 94,26 - 114,57 (4) Sum (1)-(3) 0,-- b) Please specify the deals 1 and 2 of the previous table: Deal 1: Deal 2: c) Please calculate all unknown but also calculable zerobond yields (spot rates and forward rates - in % p.a.). Exam 2/4/15 IR 16 (new c.) IR 23 (old c.) (WT 2020/21) Page 9 of 17 page(s) The yield curve which is currently classified as "normal" shall change to an inverse interest curve. Therefore the point of time t' i.e. 2 years) shall be amended by #1 year to thew (either =1 or =3) but the -values of the provided table do not change.6 Only the 4Y zerobond yield y4 (in % p.a.) remains unchanged. d) Please argue the direction of amendment of the time line. Please calculate the amended forward rate r(tnew; T=4) (in % p.a.). Please provide a reasonable (amended) zerobond yield yz (in % p.a.). Remark: A calculation of yz-zerobond yield is not possible. Exercise 4 (Forward rate agreements) (13 points) Forward rate agreements are used to hedge the effects which result from future interest rate changes. a) Please briefly explain the content of a close forward rate agreement. A company closes a forward rate loan (zerobond loan with rate": r(t=2;T=4)) which starts in (t'=) 2 and ends in (T=) 4 years. ALM-Treasury provides the current incomplete interest information (zerobond yields in % p.a.) Maturity 1Y 2Y 3Y 4Y zerobond yield (in % p.a.) ? 3,000% ? ? You are provided the following (incomplete) duplication table whose calculations are based on the current interest curve. 0 2 4 (1) Forward rate deal + 100,-- - 114,57 (2) Deal 1: - 94,26 + 100,-- (3) Deal 2: + 94,26 - 114,57 (4) Sum (1)-(3) 0,-- b) Please specify the deals 1 and 2 of the previous table: Deal 1: Deal 2: c) Please calculate all unknown but also calculable zerobond yields (spot rates and forward rates - in % p.a.). Exam 2/4/15 IR 16 (new c.) IR 23 (old c.) (WT 2020/21) Page 9 of 17 page(s) The yield curve which is currently classified as "normal" shall change to an inverse interest curve. Therefore the point of time t' i.e. 2 years) shall be amended by #1 year to thew (either =1 or =3) but the -values of the provided table do not change.6 Only the 4Y zerobond yield y4 (in % p.a.) remains unchanged. d) Please argue the direction of amendment of the time line. Please calculate the amended forward rate r(tnew; T=4) (in % p.a.). Please provide a reasonable (amended) zerobond yield yz (in % p.a.). Remark: A calculation of yz-zerobond yield is not possibleStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started