Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please anwer my all 3 questions Swifty Corporation has just received its August 31,2023 bank statement, which is summarized as follows: The general ledger Cash

please anwer my all 3 questions

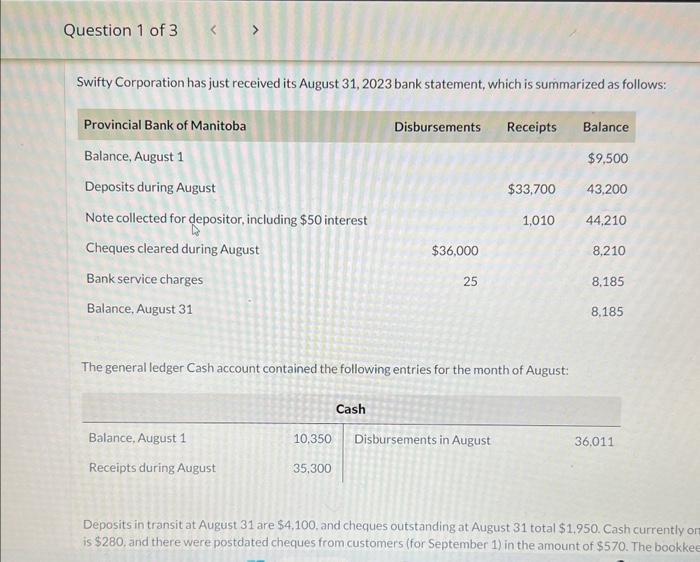

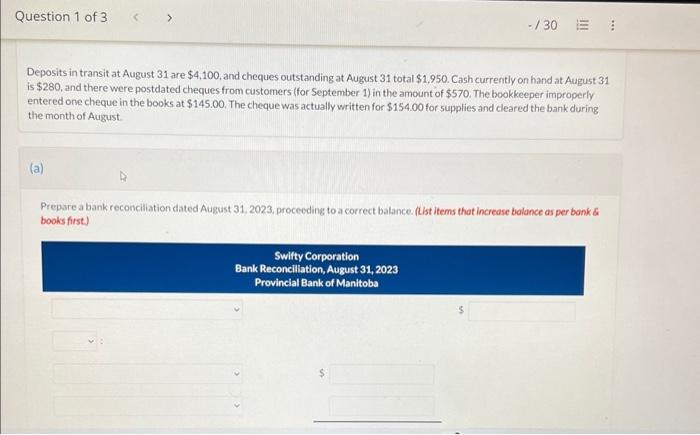

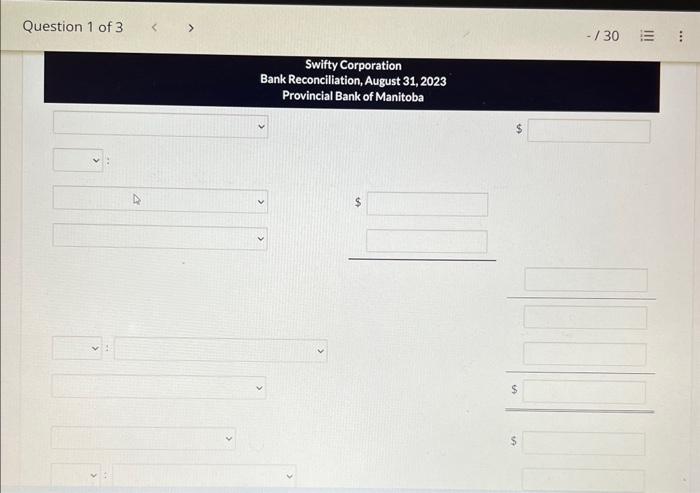

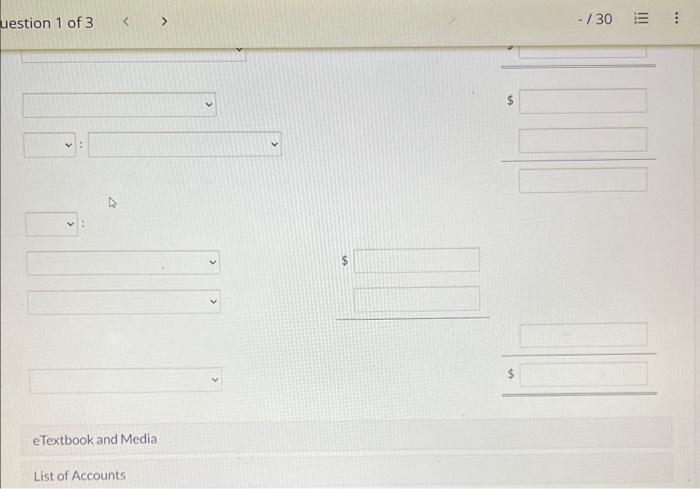

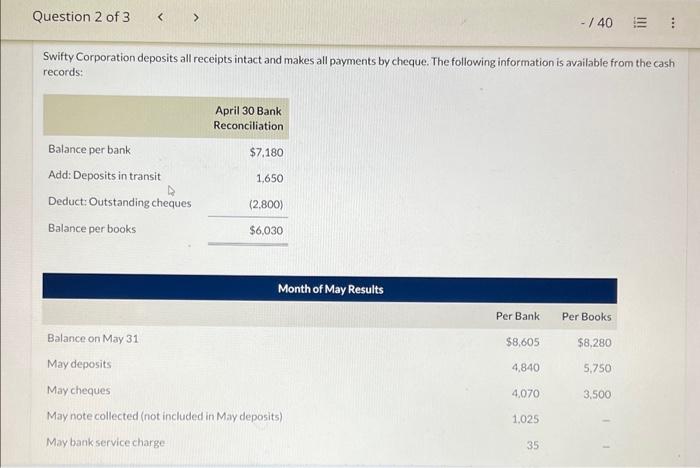

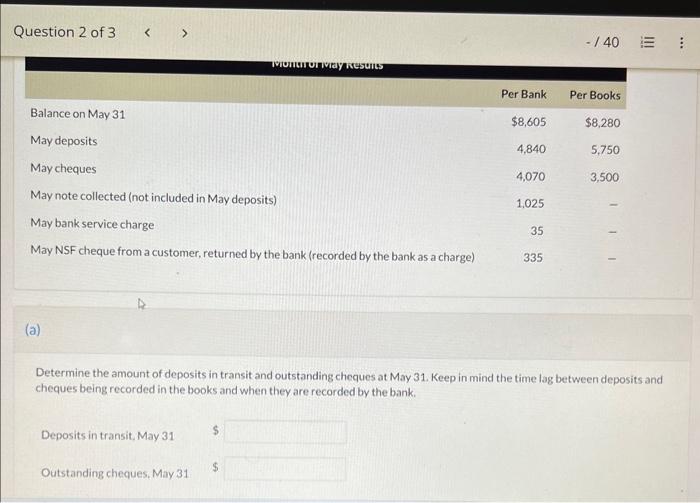

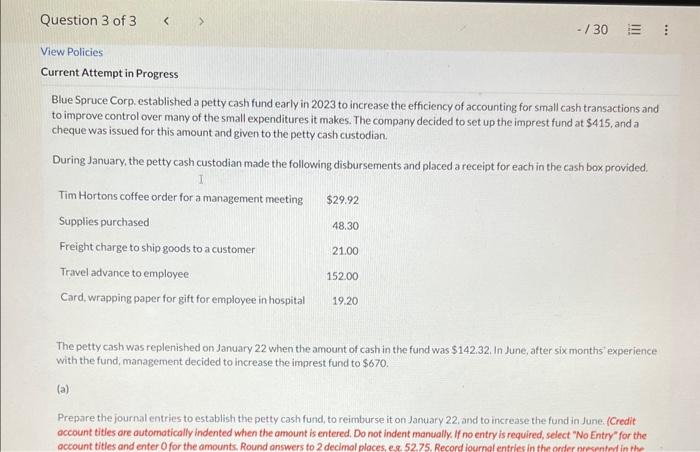

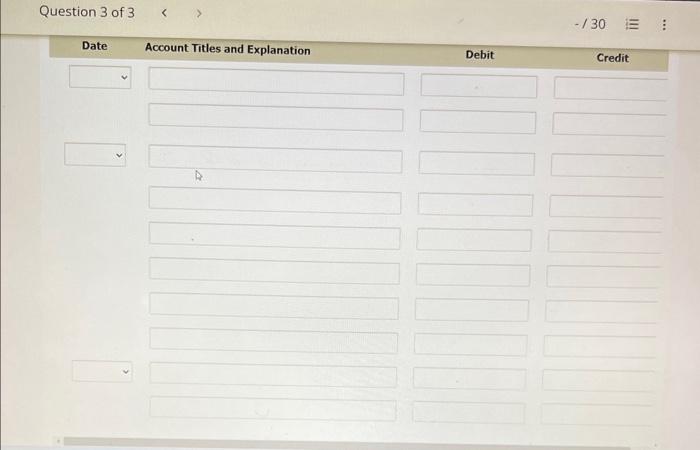

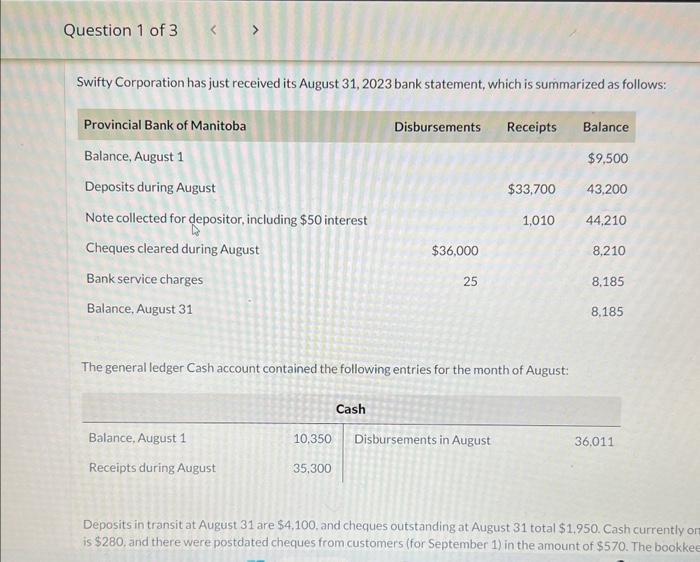

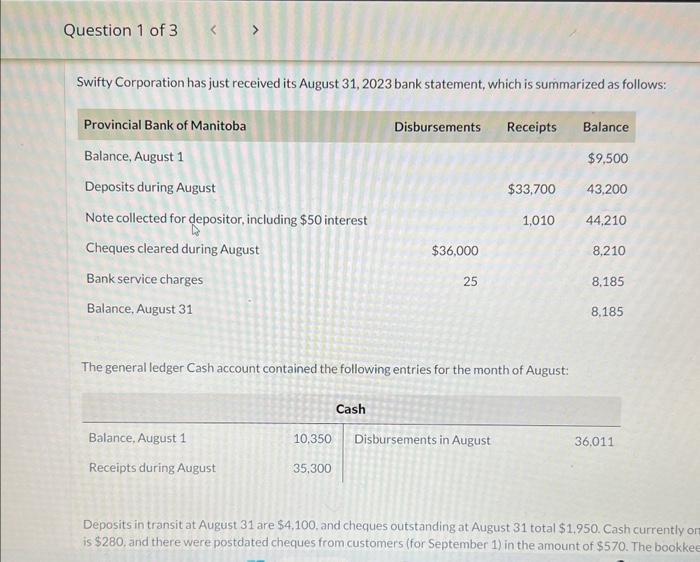

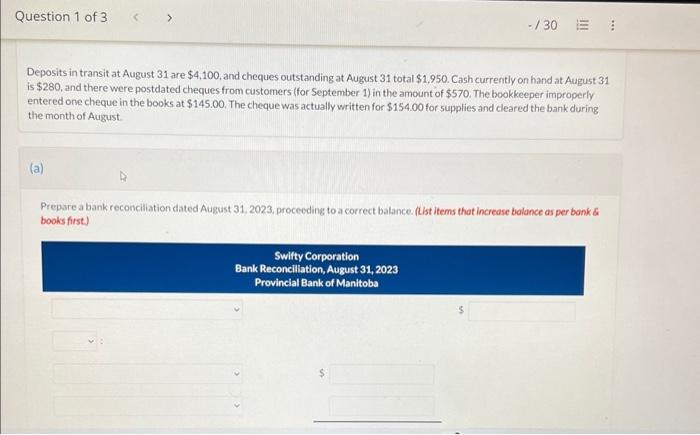

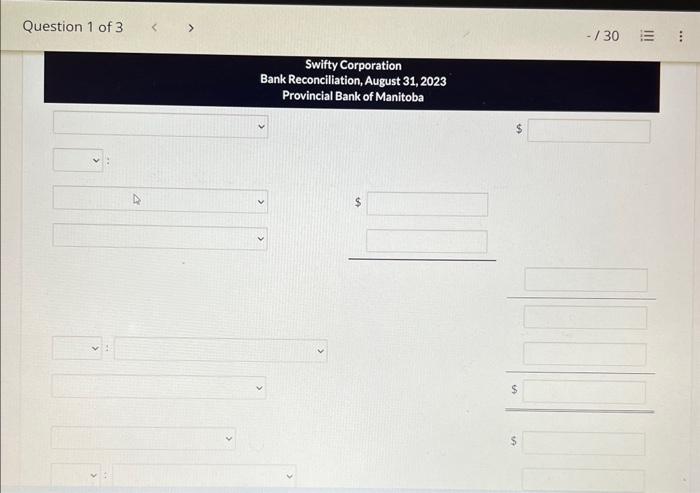

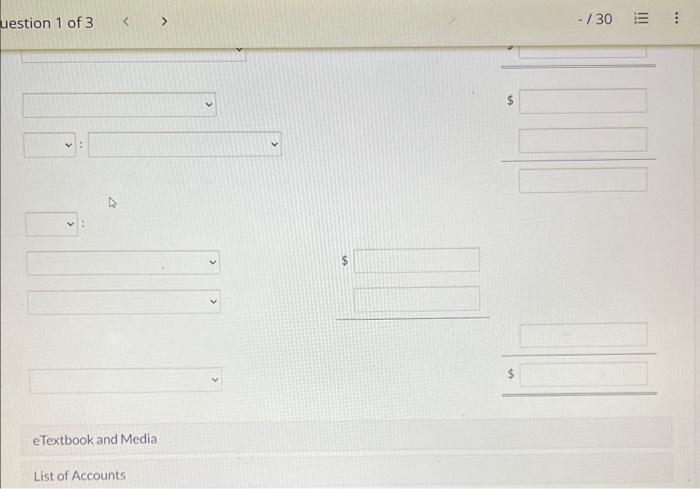

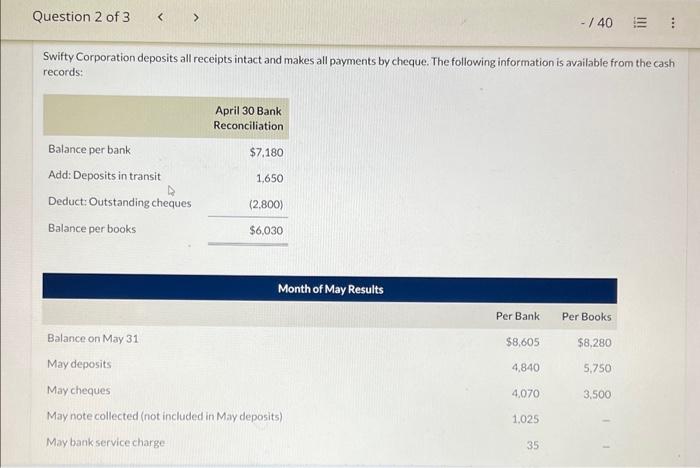

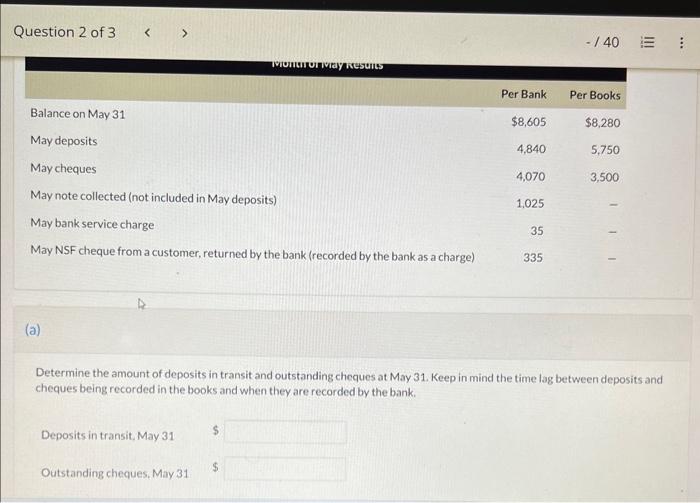

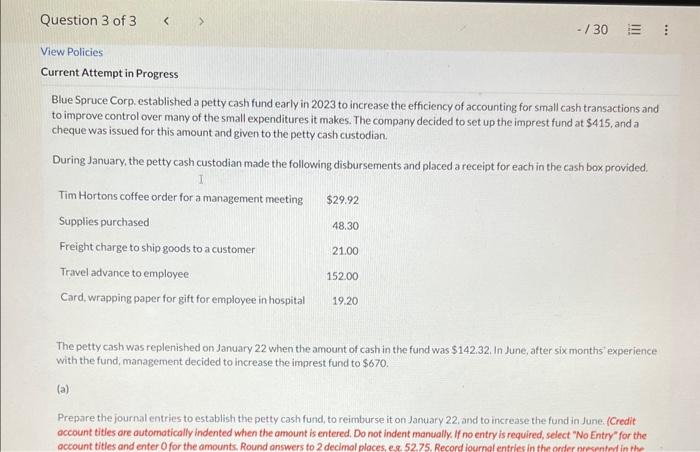

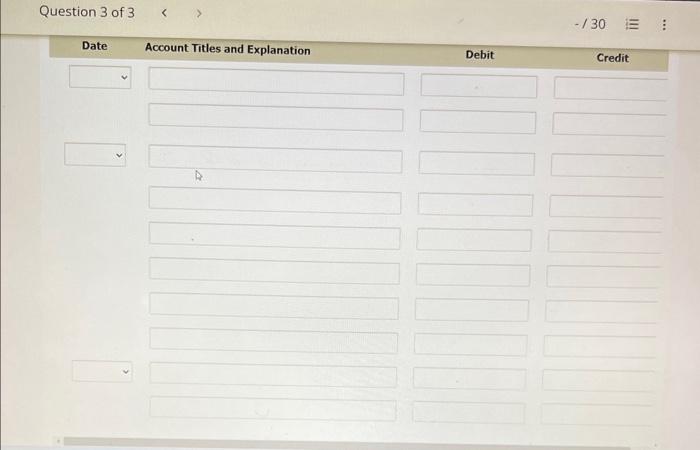

Swifty Corporation has just received its August 31,2023 bank statement, which is summarized as follows: The general ledger Cash account contained the following entries for the month of August: Deposits in transit at August 31 are $4,100, and cheques outstanding at August 31 total $1.950. Cash currently o is $280, and there were postdated cheques from customers (for September 1) in the amount of $570. The bookke Deposits in transit at August 31 are $4,100, and cheques outstanding at August 31 total $1,950. Cash currently on hand at August 31 is $280, and there were postdated cheques from customers (for September 1) in the amount of $570. The bookkeeper improperly entered one cheque in the books at $145.00. The cheque was actually written for $154.00 for supplies and cleared the bank during the month of August. (a) Prepare a bank reconciliation dated August 31, 2023, proceeding to a correct balance. (List items that increase balance as per bonk \& books first.) Question 1 of 3 Swifty Corporation Bank Reconciliation, August 31, 2023 Provincial Bank of Manitoba $ uestion 1 of 3 $ : eTextbook and Media List of Accounts Swifty Corporation deposits all receipts intact and makes all payments by cheque. The following information is available from the cash records: Determine the amount of deposits in transit and outstanding cheques at May 31 . Keep in mind the time lag between deposits and cheques being recorded in the books and when they are recorded by the bank. Deposits in transit, May 31 5 Outstanding cheques, May 31 Blue Spruce Corp. established a petty cash fund early in 2023 to increase the efficiency of accounting for small cash transactions and to improve control over many of the small expenditures it makes. The company decided to set up the imprest fund at $415, and a cheque was issued for this amount and given to the petty cash custodian. During January, the petty cash custodian made the following disbursements and placed a receipt for each in the cash box provided. The petty cash was replenished on January 22 when the amount of cash in the fund was $142.32. In June, after six months experience with the fund, management decided to increase the imprest fund to $670. (a) Prepare the journal entries to establish the petty cash fund, to reimburse it on January 22, and to increase the fund in June. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Round answers to 2 decimal ploces, e. 52.75. Record lournal entries in the onter nresented in the Question 3 of 3 130

Swifty Corporation has just received its August 31,2023 bank statement, which is summarized as follows: The general ledger Cash account contained the following entries for the month of August: Deposits in transit at August 31 are $4,100, and cheques outstanding at August 31 total $1.950. Cash currently o is $280, and there were postdated cheques from customers (for September 1) in the amount of $570. The bookke Deposits in transit at August 31 are $4,100, and cheques outstanding at August 31 total $1,950. Cash currently on hand at August 31 is $280, and there were postdated cheques from customers (for September 1) in the amount of $570. The bookkeeper improperly entered one cheque in the books at $145.00. The cheque was actually written for $154.00 for supplies and cleared the bank during the month of August. (a) Prepare a bank reconciliation dated August 31, 2023, proceeding to a correct balance. (List items that increase balance as per bonk \& books first.) Question 1 of 3 Swifty Corporation Bank Reconciliation, August 31, 2023 Provincial Bank of Manitoba $ uestion 1 of 3 $ : eTextbook and Media List of Accounts Swifty Corporation deposits all receipts intact and makes all payments by cheque. The following information is available from the cash records: Determine the amount of deposits in transit and outstanding cheques at May 31 . Keep in mind the time lag between deposits and cheques being recorded in the books and when they are recorded by the bank. Deposits in transit, May 31 5 Outstanding cheques, May 31 Blue Spruce Corp. established a petty cash fund early in 2023 to increase the efficiency of accounting for small cash transactions and to improve control over many of the small expenditures it makes. The company decided to set up the imprest fund at $415, and a cheque was issued for this amount and given to the petty cash custodian. During January, the petty cash custodian made the following disbursements and placed a receipt for each in the cash box provided. The petty cash was replenished on January 22 when the amount of cash in the fund was $142.32. In June, after six months experience with the fund, management decided to increase the imprest fund to $670. (a) Prepare the journal entries to establish the petty cash fund, to reimburse it on January 22, and to increase the fund in June. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Round answers to 2 decimal ploces, e. 52.75. Record lournal entries in the onter nresented in the Question 3 of 3 130

please anwer my all 3 questions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started