PLEASE ANWSER ASAP ITS TIMED AND I WILL GIVE A THUMBS UP!!!

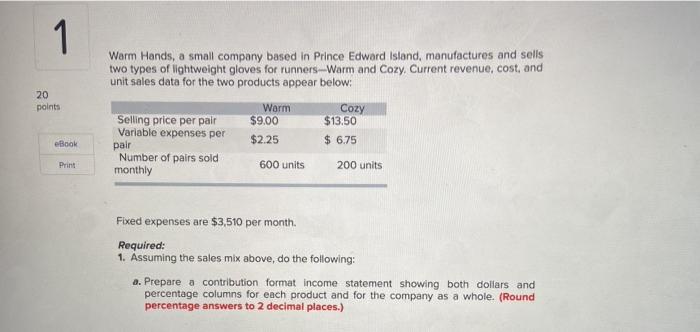

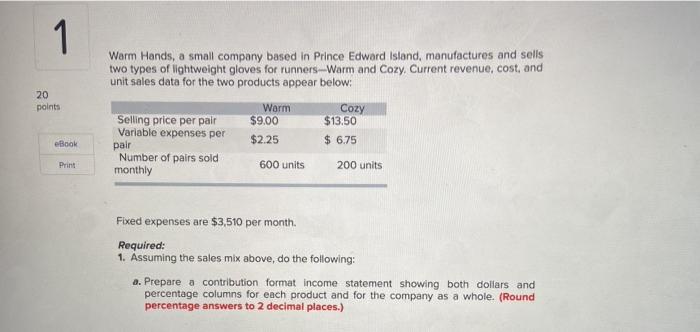

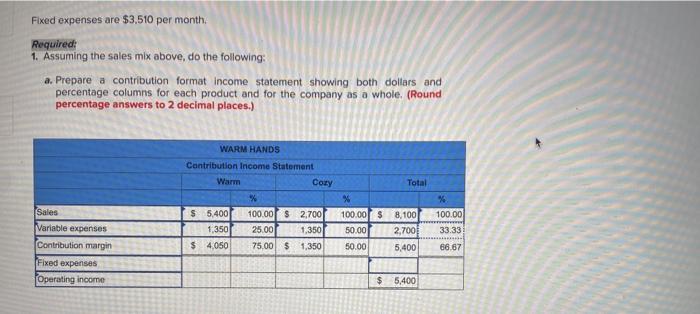

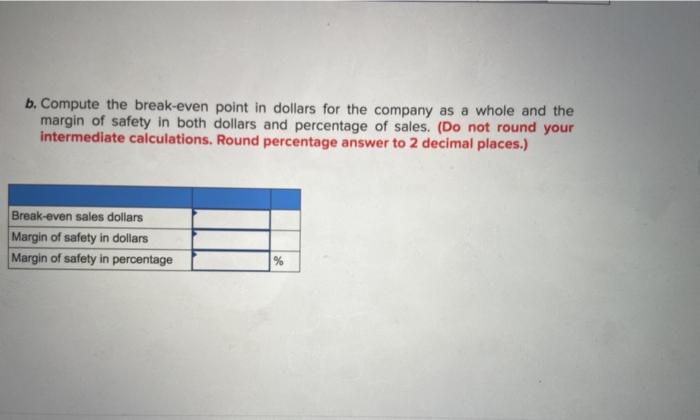

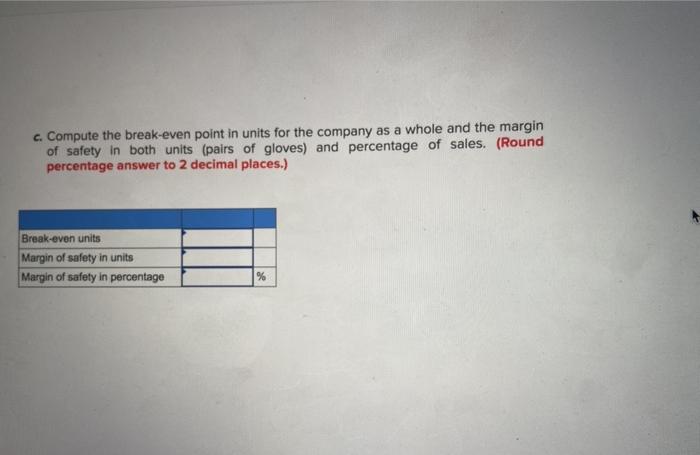

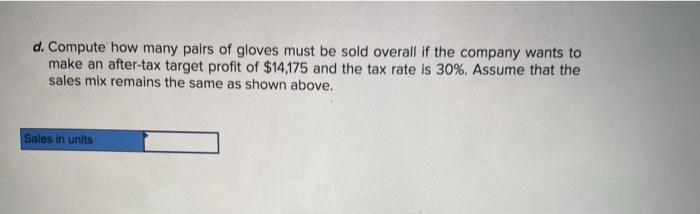

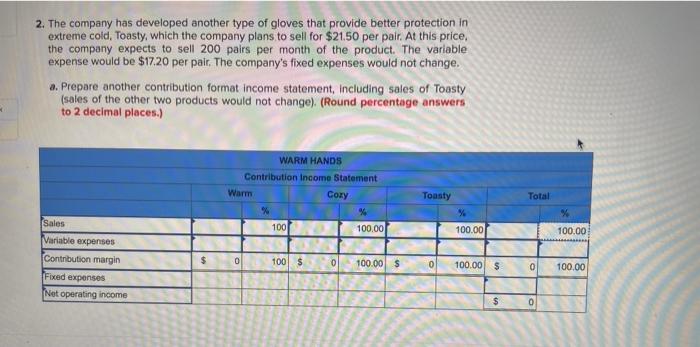

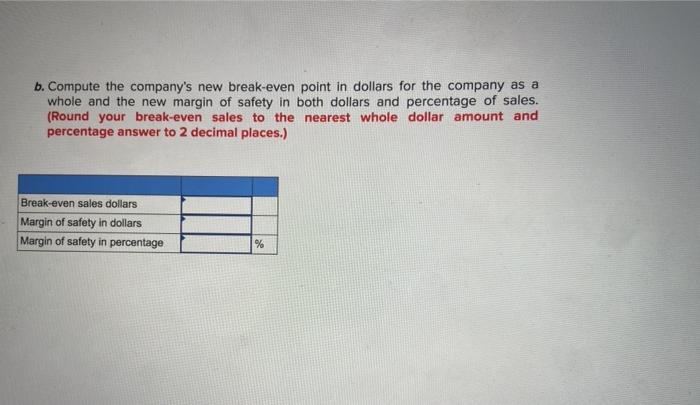

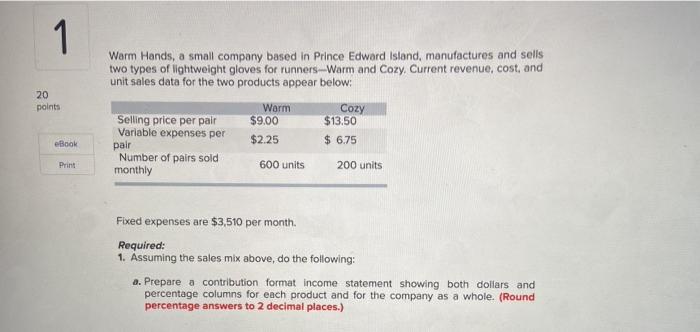

1 20 points Warm Hands, a small company based in Prince Edward Island, manufactures and sells two types of lightweight gloves for runners-Warm and Cozy. Current revenue, cost, and unit sales data for the two products appear below: Worm Cozy Selling price per pair $9.00 $13.50 Variable expenses per $2.25 $ 6.75 pair Number of pairs sold 600 units 200 units monthly eBook Print Fixed expenses are $3,510 per month Required: 1. Assuming the sales mix above, do the following: a. Prepare a contribution format income statement showing both dollars and percentage columns for each product and for the company as a whole. (Round percentage answers to 2 decimal places.) Fixed expenses are $3.510 per month. Required: 1. Assuming the sales mix above, do the following: a. Prepare a contribution format Income statement showing both dollars and percentage columns for each product and for the company as a whole. (Round percentage answers to 2 decimal places.) Total WARM HANDS Contribution Income Statement Warm Coty % $ 5.400 100.00 $ 2,7001 1,350 25.00 1,350 $ 4,050 75.00 $1,350 % Sales Variable expenses Contribution margin Fixed expenses Operating income 100.00 $ 8,100 50.00 2,700 50.00 5,400 100.00 www 33.33 66.67 $ 5,400 b. Compute the break-even point in dollars for the company as a whole and the margin of safety in both dollars and percentage of sales. (Do not round your intermediate calculations. Round percentage answer to 2 decimal places.) Break-even sales dollars Margin of safety in dollars Margin of safety in percentage % c. Compute the break-even point in units for the company as a whole and the margin of safety in both units (pairs of gloves) and percentage of sales. (Round percentage answer to 2 decimal places.) Break-even units Margin of safety in units Margin of safety in percentage % d. Compute how many pairs of gloves must be sold overall if the company wants to make an after-tax target profit of $14,175 and the tax rate is 30%. Assume that the sales mix remains the same as shown above. Sales in units 2. The company has developed another type of gloves that provide better protection in extreme cold, Toasty, which the company plans to sell for $21.50 per pair. At this price, the company expects to sell 200 pairs per month of the product. The variable expense would be $17.20 per pair. The company's fixed expenses would not change. a. Prepare another contribution format income statement, including sales of Toasty (sales of the other two products would not change). (Round percentage answers to 2 decimal places.) WARM HANDS Contribution Income Statement Warm Cozy % 100 100.00 Toasty Total % % 100.00 100.00 Sales Variable expenses Contribution margin $ 0 100 $ 0 100.00 $ 0 100.00 $ 0 100.00 Faced expenses Not operating income $ 0 b. Compute the company's new break-even point in dollars for the company as a whole and the new margin of safety in both dollars and percentage of sales. (Round your break-even sales to the nearest whole dollar amount and percentage answer to 2 decimal places.) Break-even sales dollars Margin of safety in dollars Margin of safety in percentage %