Answered step by step

Verified Expert Solution

Question

1 Approved Answer

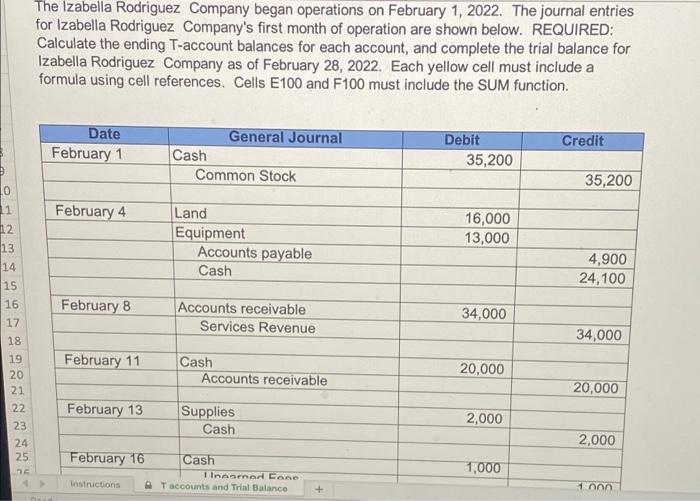

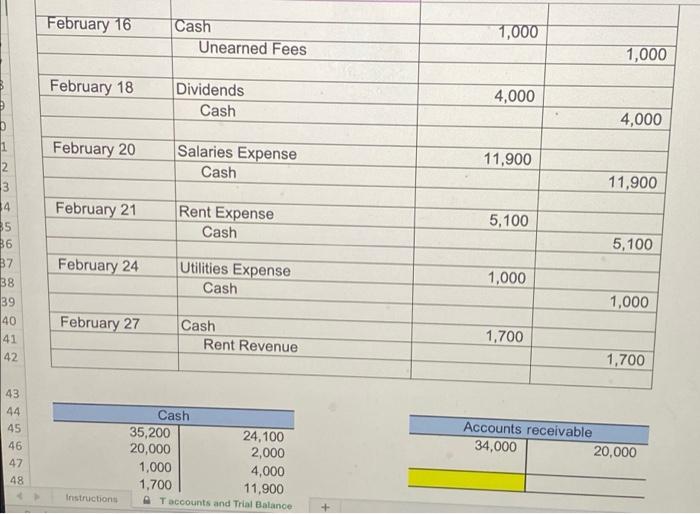

please anwser in formulas only for excel! thank you :) The Izabella Rodriguez Company began operations on February 1, 2022. The journal entries for Izabella

please anwser in formulas only for excel! thank you :)

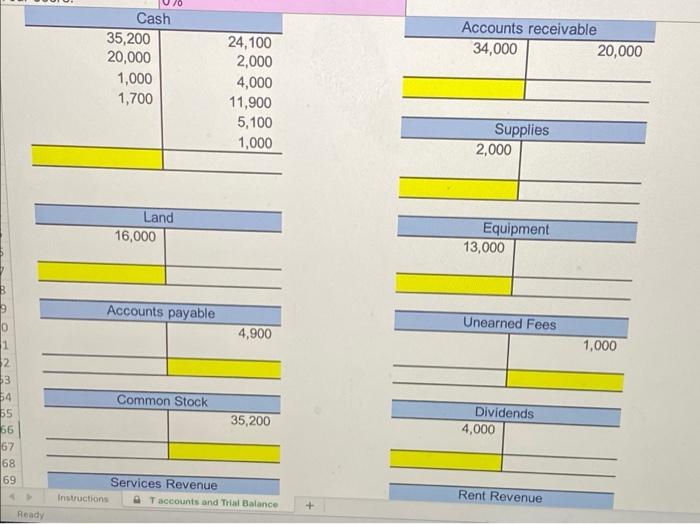

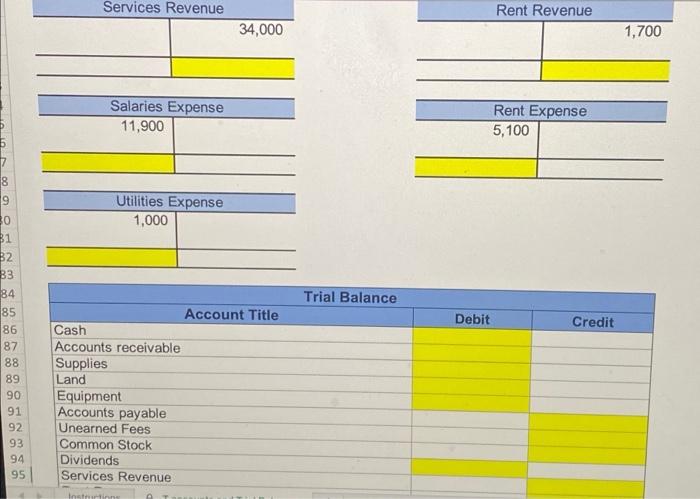

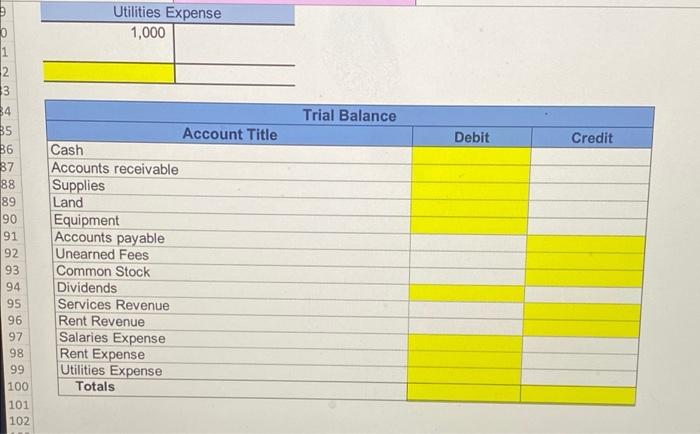

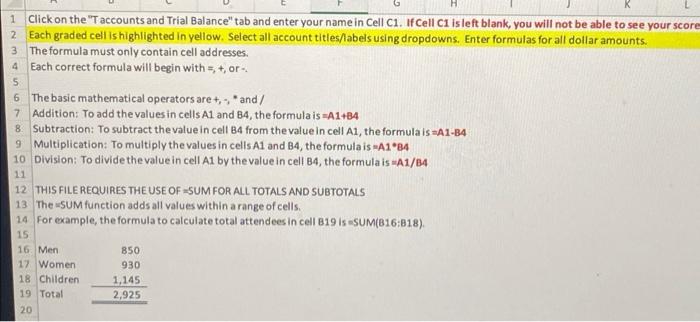

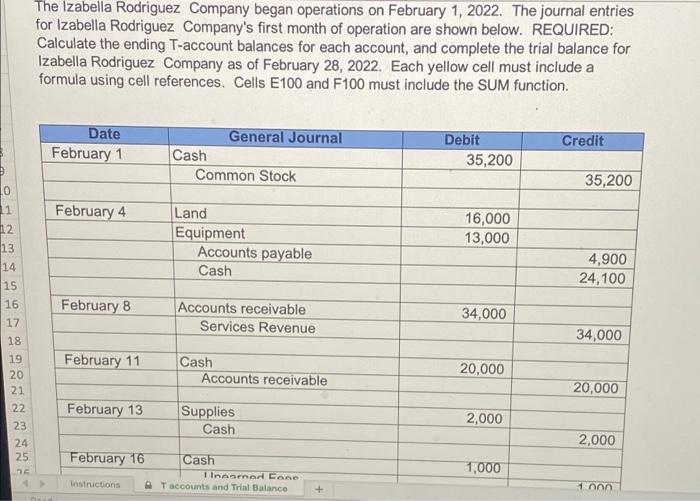

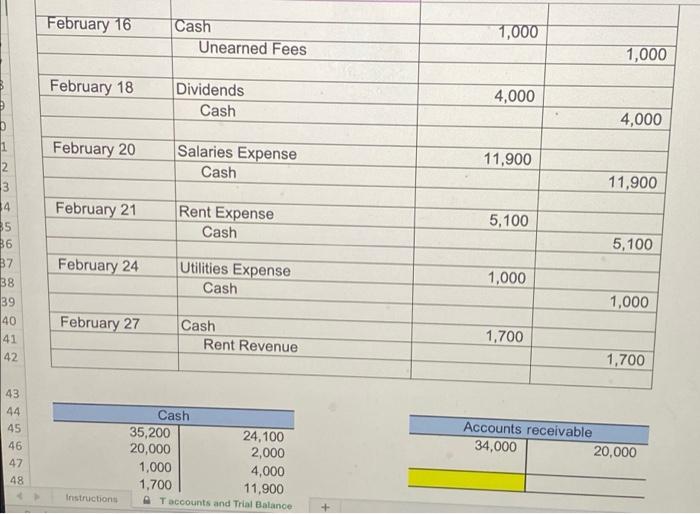

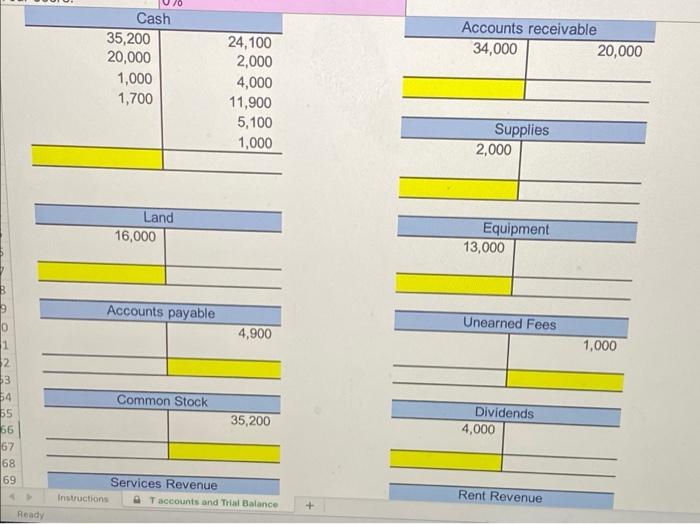

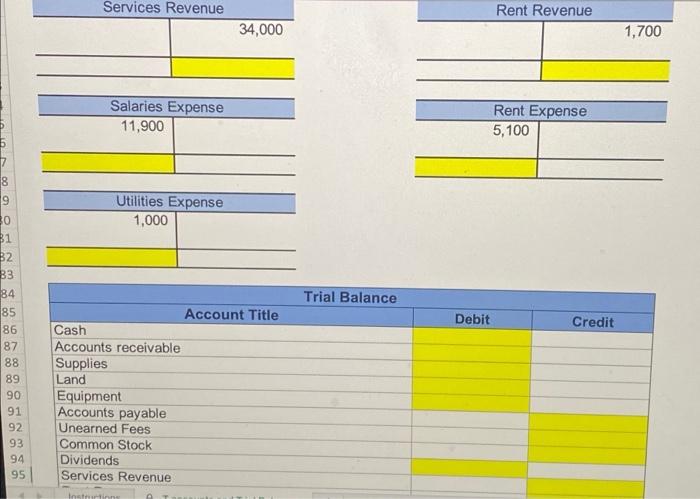

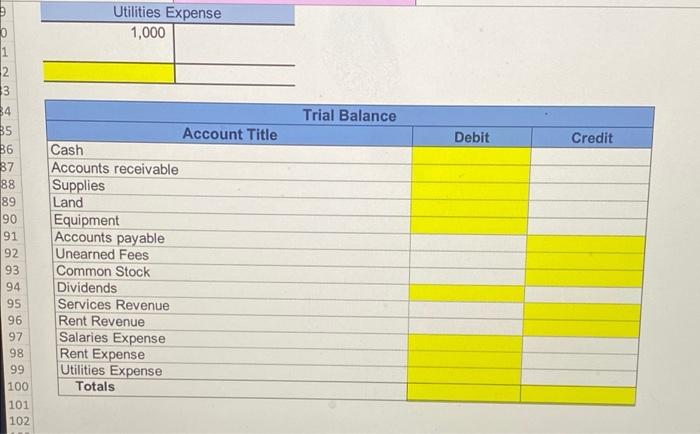

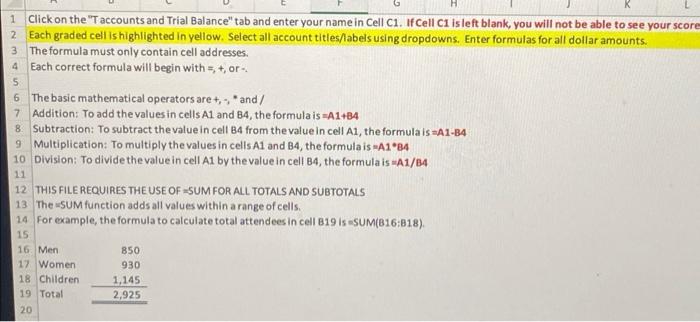

The Izabella Rodriguez Company began operations on February 1, 2022. The journal entries for Izabella Rodriguez Company's first month of operation are shown below. REQUIRED: Calculate the ending T-account balances for each account, and complete the trial balance for Izabella Rodriguez Company as of February 28, 2022. Each yellow cell must include a formula using cell references. Cells E100 and F100 must include the SUM function. Date February 1 Credit General Journal Cash Common Stock Debit 35,200 35,200 10 February 4 1 12 13 14 15 16 Land Equipment Accounts payable Cash 16,000 13,000 4,900 24,100 February 8 Accounts receivable Services Revenue 34,000 17 18 34,000 19 20 February 11 Cash Accounts receivable 20,000 21 20,000 February 13 Supplies Cash 2,000 SNN 22 23 24 25 1 mu 2,000 February 16 Cash Inson Cone Taccounts and Trial Balance 1,000 Instructions 100 February 16 Cash Unearned Fees 1,000 1,000 February 18 Dividends Cash 4,000 4,000 February 20 Salaries Expense Cash 11,900 11,900 February 21 Rent Expense Cash 5,100 11 2 3 14 95 B6 37 38 39 40 41 42 5,100 February 24 Utilities Expense Cash 1,000 1,000 February 27 Cash Rent Revenue 1,700 1,700 43 44 45 46 47 48 Accounts receivable 34,000 20,000 Cash 35,200 24,100 20,000 2,000 1,000 4,000 1,700 11,900 Taccounts and Trial Balance Instructions Accounts receivable 34,000 20,000 Cash 35,200 20,000 1,000 1,700 24,100 2,000 4,000 11,900 5,100 1,000 Supplies 2,000 Land 16,000 Equipment 13,000 Accounts payable Unearned Fees 4,900 1 1,000 Common Stock 35,200 53 54 55 56 67 68 69 Dividends 4,000 Services Revenue Instructions Taccounts and Trial Balance Rent Revenue Ready Services Revenue Rent Revenue 34,000 1,700 Salaries Expense 11,900 Rent Expense 5,100 Utilities Expense 1,000 Trial Balance Debit 18 19 30 31 B2 B3 84 85 86 87 88 89 90 91 92 93 94 95 Credit Account Title Cash Accounts receivable Supplies Land Equipment Accounts payable Unearned Fees Common Stock Dividends Services Revenue Insthurinn Utilities Expense 1,000 Trial Balance Debit Credit 1 2 3 34 B5 B6 87 88 89 90 91 92 93 Account Title Cash Accounts receivable Supplies Land Equipment Accounts payable Unearned Fees Common Stock Dividends Services Revenue Rent Revenue Salaries Expense Rent Expense Utilities Expense Totals 98 100 101 102 1 5 Click on the "Taccounts and Trial Balance" tab and enter your name in Cell C1. If Cell Ci isleft blank, you will not be able to see your score 2 Each graded cell is highlighted in yellow. Select all account titles/labels using dropdowns. Enter formulas for all dollar amounts. 3 The formula must only contain cell addresses. 4 Each correct formula will begin with = +, or 6. The basic mathematical operators are +, and/ 7 Addition: To add the values in cells A1 and B4, the formula is-A1+B4 8. Subtraction: To subtract the value in cell Ba from the value in cell A1, the formula is -A1-B4 9 Multiplication: To multiply the values in cells A1 and B4, the formula is -A1*84 10 Division: To divide the value in cell A1 by the value in cell B4, the formula is -A1/04 11 12 THIS FILE REQUIRES THE USE OF -SUM FOR ALL TOTALS AND SUBTOTALS 13 The SUM function adds all values within a range of cells. 14 For example, the formula to calculate total attendees in cell B19 is-SUM(B16:018). 15 16 Men 850 17 Women 930 18 Children 1,145 19 Total 2,925 20

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started