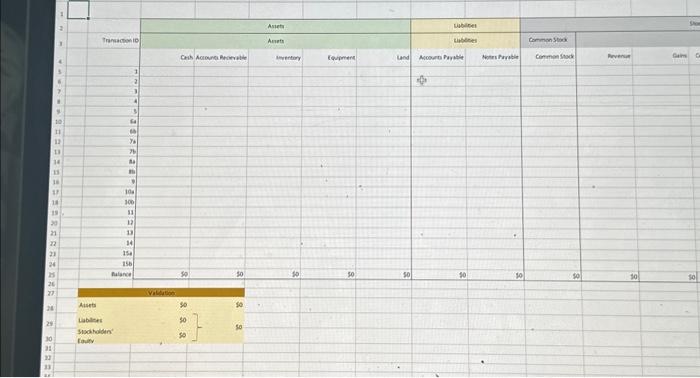

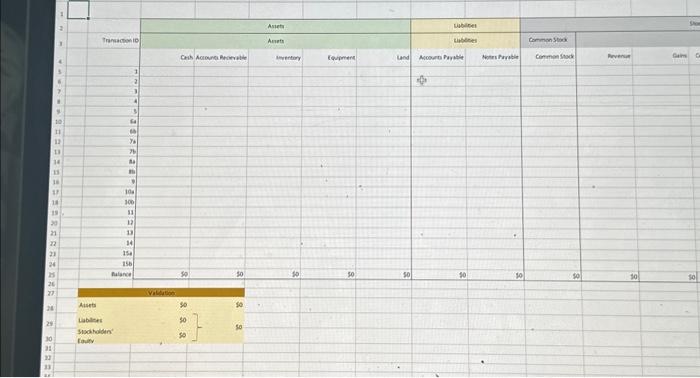

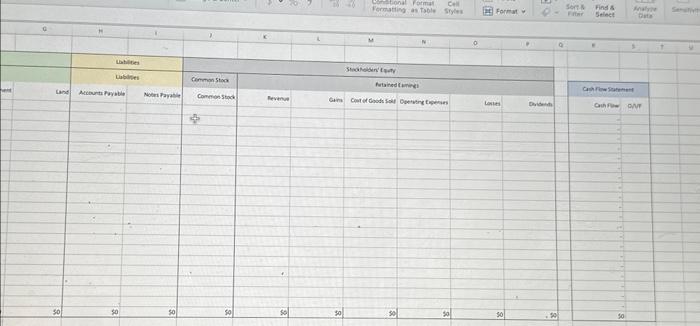

please ASAP ASAP ASAP pls hurry look at last pic for instructions. PLS ANSWER with an excel screenshot. pls answer using excel. need transactions on excel. pls answer with a picture of excel inputs

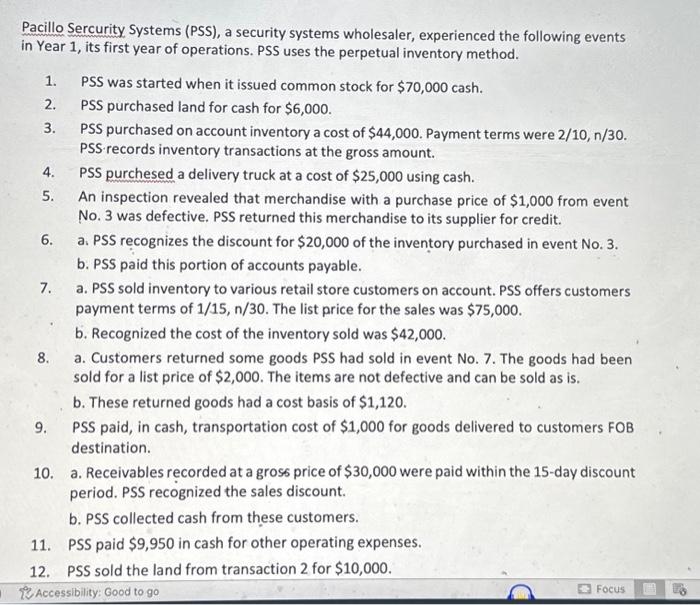

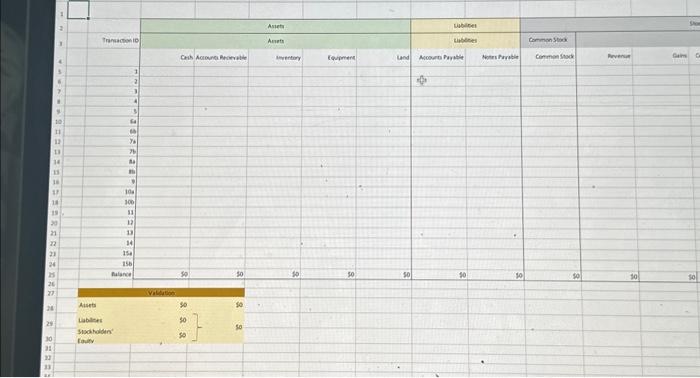

Pacillo Sercurity Systems (PSS), a security systems wholesaler, experienced the following events in Year 1, its first year of operations. PSS uses the perpetual inventory method. 1. PSS was started when it issued common stock for $70,000 cash. 2. PSS purchased land for cash for $6,000. 3. PSS purchased on account inventory a cost of $44,000. Payment terms were 2/10,n/30. PSS records inventory transactions at the gross amount. 4. PSS purchesed a delivery truck at a cost of $25,000 using cash. 5. An inspection revealed that merchandise with a purchase price of $1,000 from event No. 3 was defective. PSS returned this merchandise to its supplier for credit. 6. a. PSS recognizes the discount for $20,000 of the inventory purchased in event No. 3 . b. PSS paid this portion of accounts payable. 7. a. PSS sold inventory to various retail store customers on account. PSS offers customers payment terms of 1/15,n/30. The list price for the sales was $75,000. b. Recognized the cost of the inventory sold was $42,000. 8. a. Customers returned some goods PSS had sold in event No. 7. The goods had been sold for a list price of $2,000. The items are not defective and can be sold as is. b. These returned goods had a cost basis of $1,120. 9. PSS paid, in cash, transportation cost of $1,000 for goods delivered to customers FOB destination. 10. a. Receivables recorded at a gross price of $30,000 were paid within the 15 -day discount period. PSS recognized the sales discount. b. PSS collected cash from these customers. 11. PSS paid $9,950 in cash for other operating expenses. 12. PSS sold the land from transaction 2 for $10,000. 14. The delivery truck purchased in transaction 4 has an expected useful life of 5 years and an estimated salvage value of $5,000. PSS recorded the depreciation expense using the straight-line method. (for purposes of this exercise record the accumulated depreciation directly in the Equipment account and the Depreciation Expense directly in Operating Expenses). 15. a. PSS borrowed $5,000 by issuing a 12 -month, 6% note payable. The note was issued and cash collected from the bank on November 1. b. PSS recognized the interest expense as of December 31. (for purposes of this exercise, record the accrued interest payable directly in the Notes Payable account and the interest expense directly in Operating Expenses). Requirements are listed on the following page. Bonus Exercise Required a. Download the Excel Workbook (Bonus Exercise.xlsx) and record the events. - Enter the events listed above on the Transactions worksheet. Be sure to verify that the accounting equation remains in balance (A=L+SE) after each entry by examining the validation section of the worksheet. - Label each cash transaction (column R) as being operating, investing, or financing activity in column S. - The financial statements are automatically generated on the Financial Statements worksheet. Verify that the financial statement amounts agree with the transactions worksheet results. b. Save your solution and upload your completed Excel workbook to the assignment drop box in D2L