Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please assist Accounting rules require a company to disclose error corrections in its annual report for the year in which it made the corrections. The

please assist

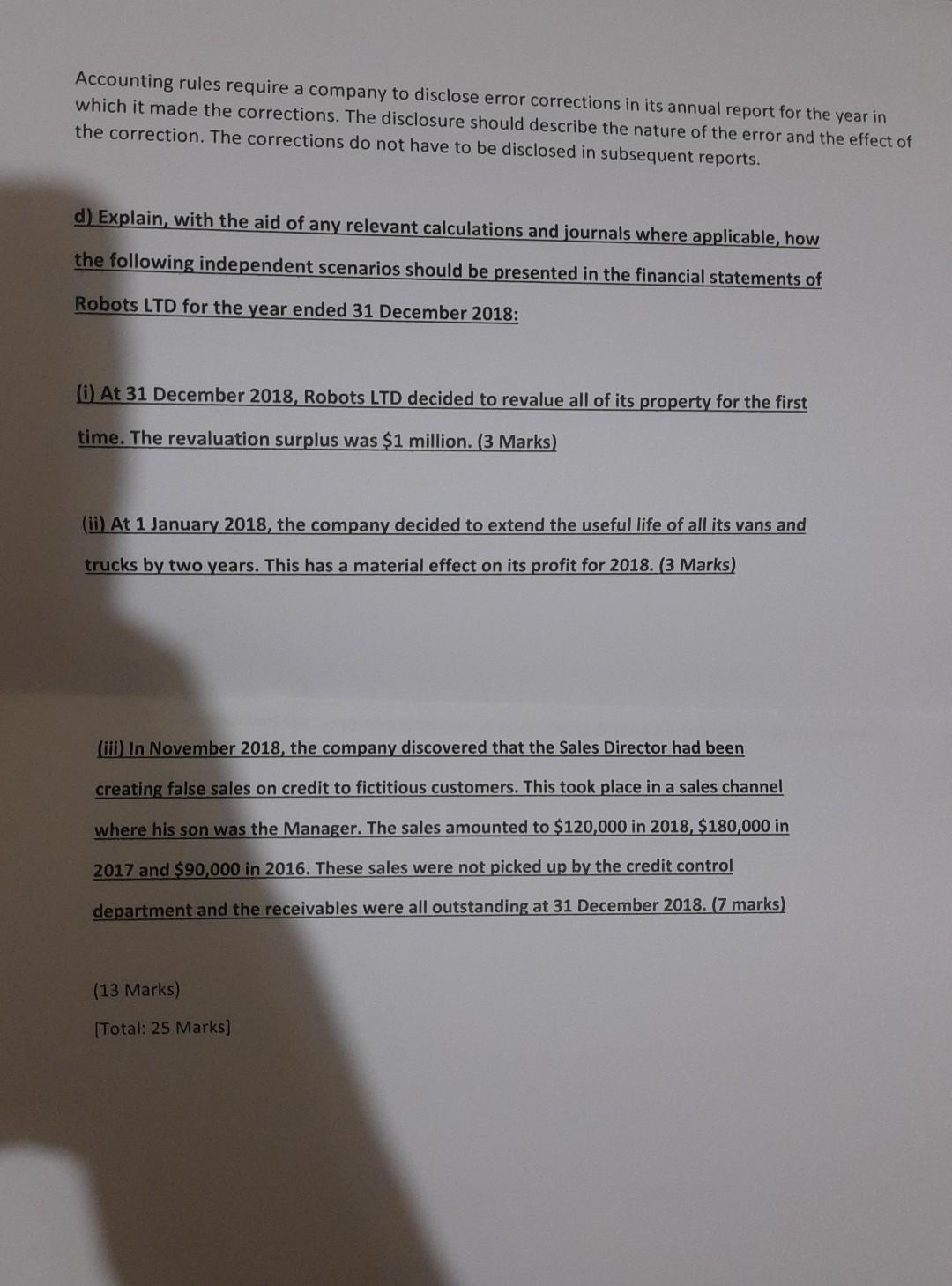

Accounting rules require a company to disclose error corrections in its annual report for the year in which it made the corrections. The disclosure should describe the nature of the error and the effect of the correction. The corrections do not have to be disclosed in subsequent reports. d) Explain, with the aid of any relevant calculations and journals where applicable, how the following independent scenarios should be presented in the financial statements of Robots LTD for the year ended 31 December 2018: (i) At 31 December 2018, Robots LTD decided to revalue all of its property for the first time. The revaluation surplus was $1 million. ( 3 Marks) (ii) At 1 January 2018, the company decided to extend the useful life of all its vans and trucks by two years. This has a material effect on its profit for 2018. (3 Marks) (iii) In November 2018, the company discovered that the Sales Director had been creating false sales on credit to fictitious customers. This took place in a sales channel where his son was the Manager. The sales amounted to $120,000 in 2018,$180,000 in 2017 and $90,000 in 2016 . These sales were not picked up by the credit control department and the receivables were all outstanding at 31 December 2018. (7 marks) (13 Marks) [Total: 25 Marks]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started