Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please assist in answering all questions below Suppose a company, Scalar Limited (Ltd) paid a dividend of R2 on the current market price and its

Please assist in answering all questions below

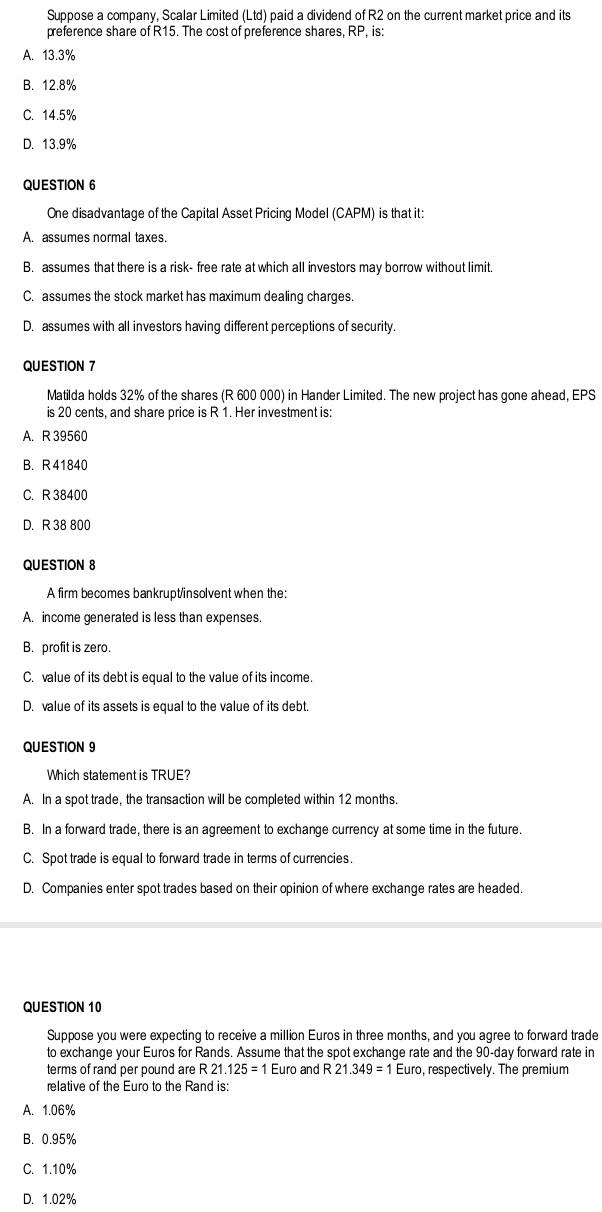

Suppose a company, Scalar Limited (Ltd) paid a dividend of R2 on the current market price and its preference share of R15. The cost of preference shares, RP, is: A. 13.3% B. 12.8% C. 14.5% D. 13.9% QUESTION 6 One disadvantage of the Capital Asset Pricing Model (CAPM) is that it: A. assumes normal taxes. B. assumes that there is a risk- free rate at which all investors may borrow without limit. C. assumes the stock market has maximum dealing charges. D. assumes with all investors having different perceptions of security. QUESTION 7 Matilda holds 32% of the shares (R 600000 ) in Hander Limited. The new project has gone ahead, EPS is 20 cents, and share price is R1. Her investment is: A. R 39560 B. R41840 C. R 38400 D. R38 800 QUESTION 8 A firm becomes bankrupt/insolvent when the: A. income generated is less than expenses. B. profit is zero. C. value of its debt is equal to the value of its income. D. value of its assets is equal to the value of its debt. QUESTION 9 Which statement is TRUE? A. In a spot trade, the transaction will be completed within 12 months. B. In a forward trade, there is an agreement to exchange currency at some time in the future. C. Spot trade is equal to forward trade in terms of currencies. D. Companies enter spot trades based on their opinion of where exchange rates are headed. QUESTION 10 Suppose you were expecting to receive a million Euros in three months, and you agree to forward trade to exchange your Euros for Rands. Assume that the spot exchange rate and the 90 -day forward rate in terms of rand per pound are R 21.125=1 Euro and R21.349=1 Euro, respectively. The premium relative of the Euro to the Rand is: A. 1.06% B. 0.95% C. 1.10% D. 1.02%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started