Please assist in correcting errors.

Please assist in correcting errors.

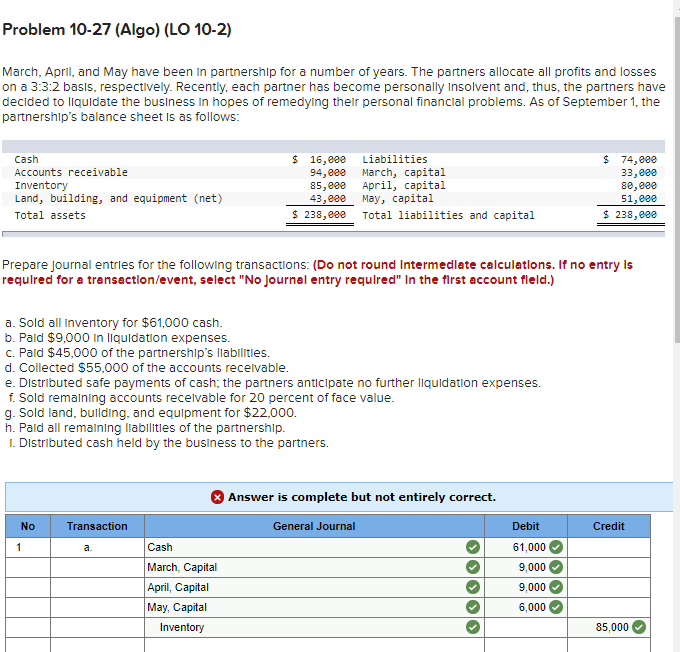

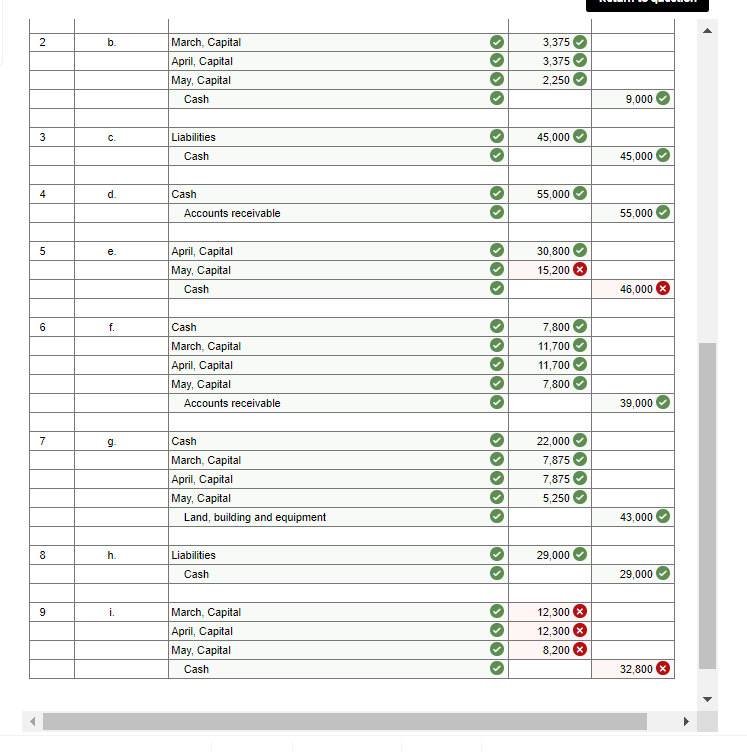

Problem 10-27 (Algo) (LO 10-2) March, April, and may have been in partnership for a number of years. The partners allocate all profits and losses on a 3:3:2 basis, respectively. Recently, each partner has become personally Insolvent and, thus, the partners have decided to liquidate the business in hopes of remedying their personal financial problems. As of September 1, the partnership's balance sheet is as follows: Cash Accounts receivable Inventory Land, building, and equipment (net) Total assets $ 16, eee 94, eee 85, eee 43, eee $ 238, eee Liabilities March, capital April, capital May, capital Total liabilities and capital $ 74, eee 33, eee 80, eee 51, eee $ 238, eee Prepare Journal entries for the following transactions: (Do not round Intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required" In the first account field.) a. Sold all Inventory for $61,000 cash. b. Pald $9,000 in liquidation expenses. c. Pald $45,000 of the partnership's liabilities. d. Collected $55,000 of the accounts recevable. e. Distributed safe payments of cash; the partners anticipate no further liquidation expenses. f. Sold remaining accounts receivable for 20 percent of face value. g. Sold land, building, and equipment for $22,000. h. Pald all remaining liabilities of the partnership. 1. Distributed cash held by the business to the partners. Answer is complete but not entirely correct. No Transaction General Journal Debit Credit 1 a 61,000 9.000 Cash March, Capital April, Capital May, Capital Inventory 9,000 6,000 85,000 2 b March, Capital April, Capital May, Capital Cash 3,375 3,375 2.250 9,000 3 C Liabilities 45,000 Cash 45,000 4 Cash 55,000 Accounts receivable 55,000 5 e April, Capital May, Capital Cash 30,800 15,200 46,000 6 f. Cash March, Capital April, Capital May, Capital Accounts receivable 7,800 11,700 11,700 O 7,800 39,000 7 g Cash March, Capital April, Capital May, Capital Land, building and equipment 22,000 7,875 7,875 5.250 43,000 8 h. Liabilities >> 29,000 Cash 29,000 9 i. March, Capital April, Capital May, Capital Cash 12,300 12,300 8,200 32.800 X

Please assist in correcting errors.

Please assist in correcting errors.