Please assist me with these questions. Thank you.

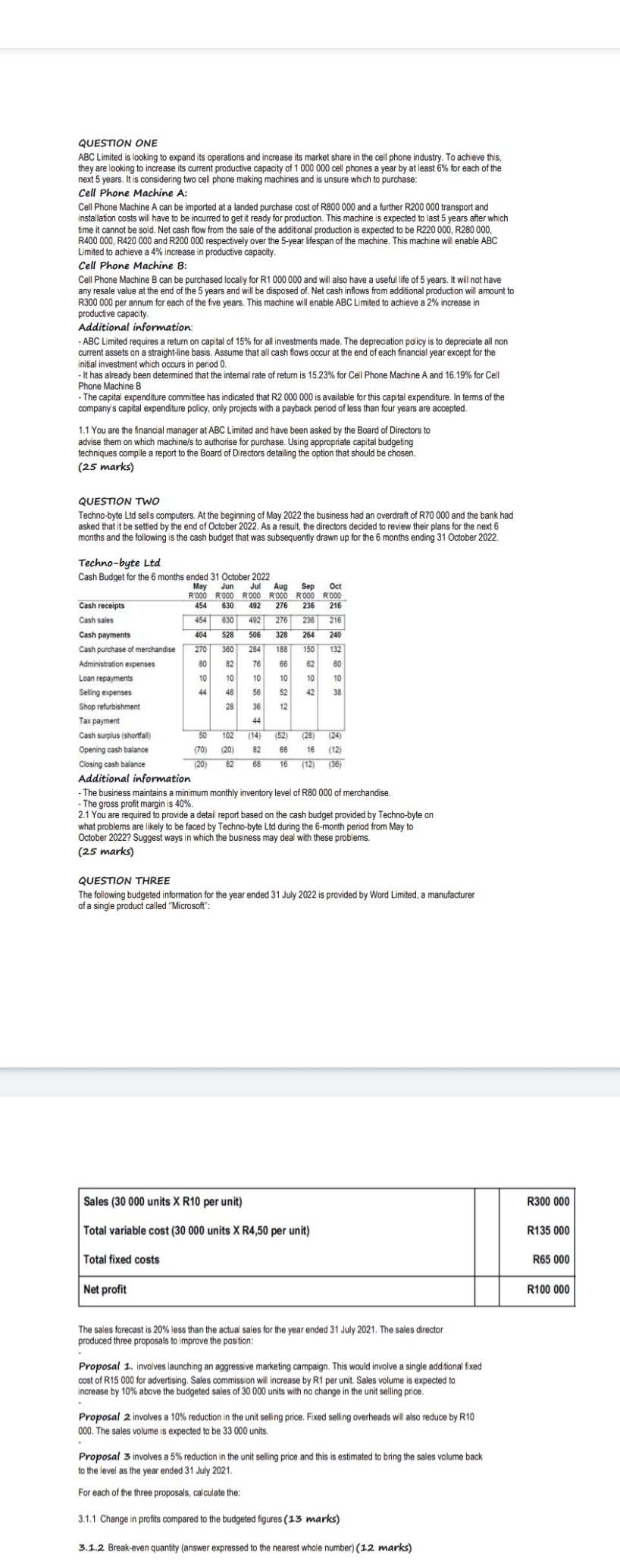

QUESTION ONE ABC Limited is looking to expand its operations and increase its market share in the cell phone industry. To achieve this, they are looking to increase its current productive capacity of 1 000 000 cell phones a year by at least 6% for each of the next 5 years. It is considering two cell phone making machines and is unsure which to purchase Cell Phone Machine A: Cell Phone Machine A can be imported at a landed purchase cost of R800 000 and a further R200 000 transport and installation costs will have to be incurred to get it ready for production. This machine is expected to last 5 years after which time it cannot be sold. Net cash flow from the sale of the additional production is expected to be R220 000, R280 000, R400 000, R420 000 and R200 000 respectively over the 5-year lifespan of the machine. This machine will enable ABC Limited to achieve a 4% increase in productive capacity. Cell Phone Machine B: Cell Phone Machine B can be purchased locally for R1 000 000 and will also have a useful life of 5 years. It will not have any resale value at the end of the 5 years and will be disposed of. Net cash inflows from additional production will amount to R300 000 per annum for each of the five years. This machine will enable ABC Limited to achieve a 2% increase in productive capacity. Additional information: - ABC Limited requires a return on capital of 15% for all investments made. The depreciation policy is to depreciate all non current assets on a straight-line basis. Assume that all cash flows occur at the end of each financial year except for the initial investment which occurs in period 0. - It has already been determined that the internal rate of return is 15.23% for Cell Phone Machine A and 16.19% for Cell Phone Machine B - The capital expenditure committee has indicated that R2 000 000 is available for this capital expenditure. In terms of the company's capital expenditure policy, only projects with a payback period of less than four years are accepted. 1.1 You are the financial manager at ABC Limited and have been asked by the Board of Directors to advise them on which machine/s to authorise for purchase. Using appropriate capital budgeting techniques compile a report to the Board of Directors detailing the option that should be chosen. (25 marks) QUESTION TWO Techno-byte Lid sells computers. At the beginning of May 2022 the business had an overdraft of R70 000 and the bank had asked that it be settled by the end of October 2022. As a result, the directors decided to review their plans for the next months and the following is the cash budget that was subsequently drawn up for the 6 months ending 31 October 2022. Techno-byte Ltd Cash Budget for the 6 months ended 31 October 2022 Aug Sep Oct '000 R'000 R'000 R'ODD R'000 R'000 Cash receipts 454 630 492 276 236 216 Cash sales 454 630 492 276 236 Cash payments 404 528 506 328 264 240 Cash purchase of merchandise 270 150 Administration expenses 80 Loan repayments 10 Selling expenses Shop refurbishment 28 Tax payment 44 Cash surplus (shortfall) 50 102 (14) (52) (28) (24) Opening cash balance (70) (20) 82 68 16 (12) Closing cash balance (20) 82 68 16 (12) (36) Additional information -The business maintains a minimum monthly inventory level of R80 000 of merchandise. - The gross profit margin is 40%. 2.1 You are required to provide a detail report based on the cash budget provided by Techno-byte on what problems are likely to be faced by Techno-byte Lid during the 6-month period from May to October 2022? Suggest ways in which the business may deal with these problems. (25 marks) QUESTION THREE The following budgeted information for the year ended 31 July 2022 is provided by Word Limited, a manufacturer of a single product called "Microsoft": Sales (30 000 units X R10 per unit) R300 000 Total variable cost (30 000 units X R4,50 per unit) R135 000 Total fixed costs R65 000 Net profit R100 000 The sales forecast is 20% less than the actual sales for the year ended 31 July 2021. The sales director produced three proposals to improve the position: Proposal 1. involves launching an aggressive marketing campaign. This would involve a single additional fixed cost of R15 000 for advertising. Sales commission will increase by R1 per unit. Sales volume is expected to increase by 10% above the budgeted sales of 30 000 units with no change in the unit selling price. Proposal 2 involves a 10% reduction in the unit selling price. Fixed selling overheads will also reduce by R10 000. The sales volume is expected to be 33 000 units. Proposal 3 involves a 5% reduction in the unit selling price and this is estimated to bring the sales volume back to the level as the year ended 31 July 2021. For each of the three proposals, calculate the: 3.1.1 Change in profits compared to the budgeted figures (13 marks) 3.1.2 Break-even quantity (answer expressed to the nearest whole number) (12 marks)