please assist.

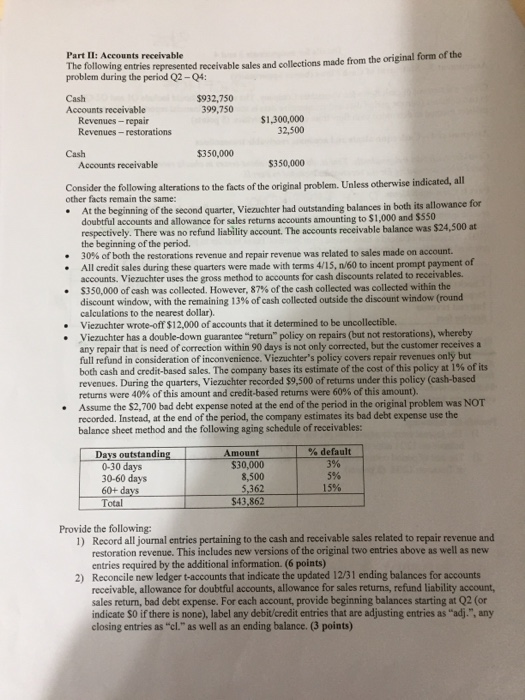

Part II: Accounts receivable The following entries represented reseable ledelstons made from the original form of the problem during the period Q2-04: Cash Accounts receivable Revenues-repair Revenues-restorations $932,750 399,750 $1,300,000 32,500 Cash Accounts receivable $350,000 $350,000 Consider the following alterations to the facts of the original problem. Unless otherwise indicated, all other facts remain the same: At the beginning of the second quarter. Vieruchter had outstanding balances in both its allowance for doubtful accounts and allowance for sales returns accounts amounting to $1,000 and $550 respectively. There was no refund liability account. The accounts receivable balance was $24.500 at the beginning of the period. 30% of both the restorations revenue and repair revenue was related to sales made on account. All credit sales during these quarters were made with terms 4/15, 1/60 to incent prompt payment of accounts. Viezuchter uses the gross method to accounts for cash discounts related to receivables. $350,000 of cash was collected. However, 87% of the cash collected was collected within the discount window, with the remaining 13% of cash collected outside the discount window (round calculations to the nearest dollar). Viezuchter wrote-off $12,000 of accounts that it determined to be uncollectible. Viezuchter has a double-down guarantee "return policy on repairs (but not restorations), whereby any repair that is need of correction within 90 days is not only corrected, but the customer receives a full refund in consideration of inconvenience. Viczuchter's policy covers repair revenues only but both cash and credit-based sales. The company bases its estimate of the cost of this policy at 1% of its revenues. During the quarters, Vieruchter recorded $9,500 of returns under this policy (cash-based returns were 40% of this amount and credit-based returns were 60% of this amount). Assume the $2,700 bad debt expense noted at the end of the period in the original problem was NOT recorded. Instead, at the end of the period, the company estimates its bad debt expense use the balance sheet method and the following aging schedule of receivables: Days outstanding 0-30 days 30-60 days 60+ days Total Amount $30,000 8,500 5,362 $43,862 % default 3% 5% 15% Provide the following: 1) Record all journal entries pertaining to the cash and receivable sales related to repair revenue and restoration revenue. This includes new versions of the original two entries above as well as new entries required by the additional information. (6 points) 2) Reconcile new ledger accounts that indicate the updated 12/31 ending balances for accounts receivable, allowance for doubtful accounts, allowance for sales returns, refund liability account sales return, bad debt expense. For each account, provide beginning balances starting at 02 (or indicate so if there is none), label any debit/credit entries that are adjusting entries as adj., any closing entries as "cl." as well as an ending balance. (3 points)