please assist

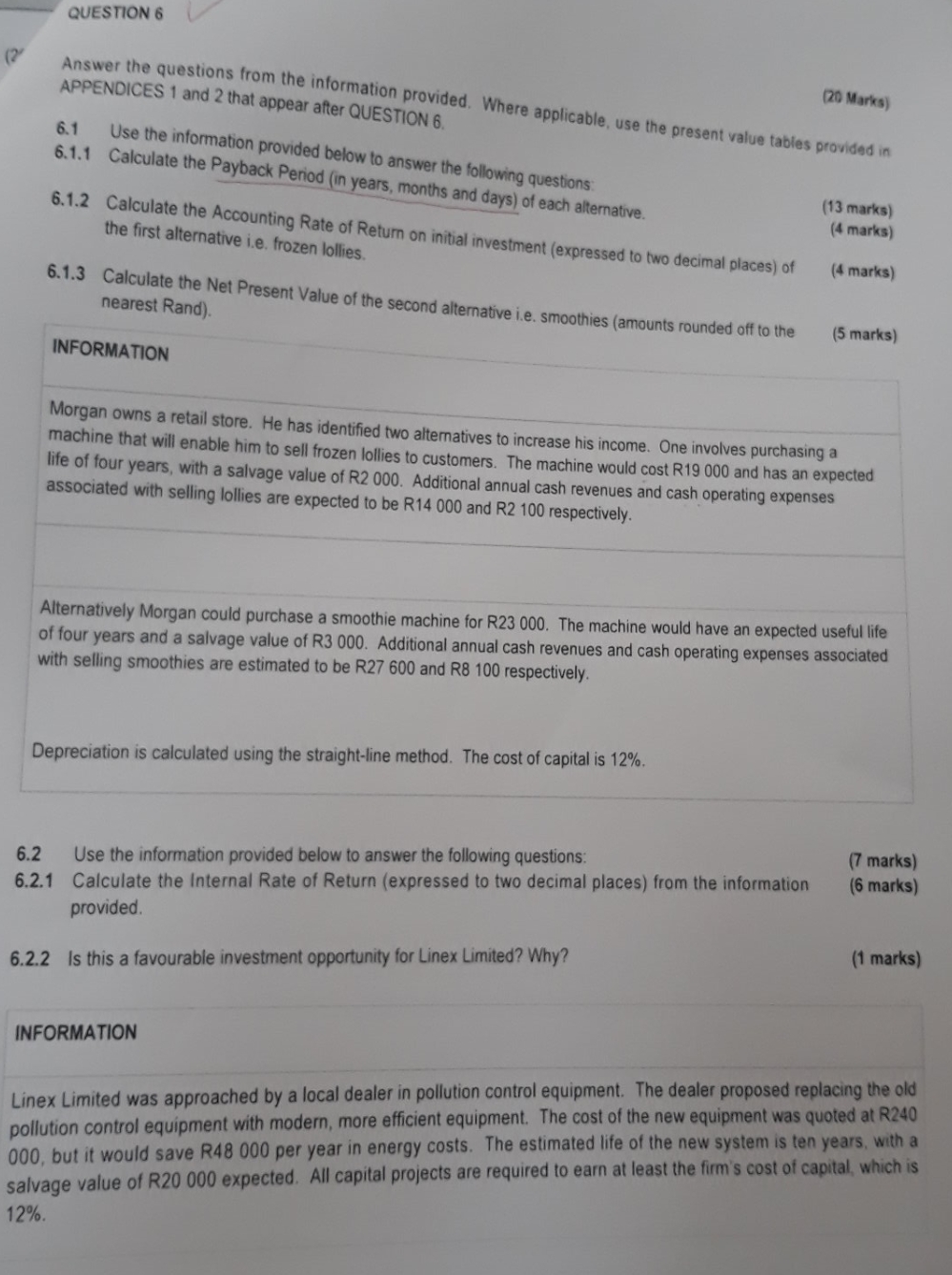

QUESTION 6 (2 (20 Marks) Answer the questions from the information provided. Where applicable, use the present value tables provided in APPENDICES 1 and 2 that appear after QUESTION 6. 6.1 Use the information provided below to answer the following questions: 6.1.1 Calculate the Payback Period (in years, months and days) of each alternative. (13 marks) (4 marks) 6.1.2 Calculate the Accounting Rate of Return on initial investment (expressed to two decimal places) of the first alternative i.e. frozen lollies. (4 marks) nearest Rand). 6.1.3 Calculate the Net Present Value of the second alternative i.e. smoothies (amounts rounded off to the (5 marks) INFORMATION Morgan owns a retail store. He has identified two alternatives to increase his income. One involves purchasing a machine that will enable him to sell frozen lollies to customers. The machine would cost R19 000 and has an expected life of four years, with a salvage value of R2 000. Additional annual cash revenues and cash operating expenses associated with selling lollies are expected to be R14 000 and R2 100 respectively. Alternatively Morgan could purchase a smoothie machine for R23 000. The machine would have an expected useful life of four years and a salvage value of R3 000. Additional annual cash revenues and cash operating expenses associated with selling smoothies are estimated to be R27 600 and R8 100 respectively. Depreciation is calculated using the straight-line method. The cost of capital is 12%. 6.2 Use the information provided below to answer the following questions: (7 marks) 6.2.1 Calculate the Internal Rate of Return (expressed to two decimal places) from the information (6 marks) provided. 6.2.2 Is this a favourable investment opportunity for Linex Limited? Why? (1 marks) INFORMATION Linex Limited was approached by a local dealer in pollution control equipment. The dealer proposed replacing the old pollution control equipment with modern, more efficient equipment. The cost of the new equipment was quoted at R240 000, but it would save R48 000 per year in energy costs. The estimated life of the new system is ten years, with a salvage value of R20 000 expected. All capital projects are required to earn at least the firm's cost of capital, which is 12%