Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please assist two part question Suppose you own a small company that is contemplating construction of a suburbari office block. The cost of buying the

please assist two part question

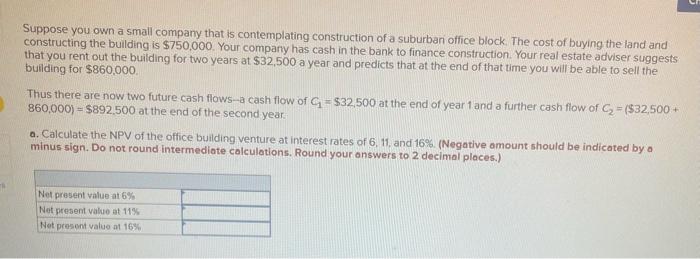

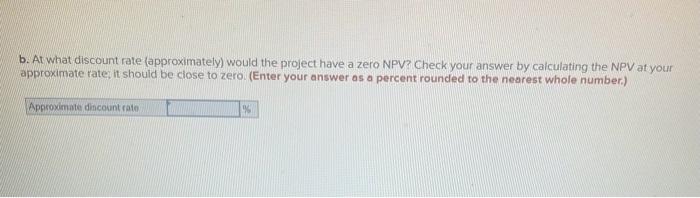

Suppose you own a small company that is contemplating construction of a suburbari office block. The cost of buying the land and constructing the building is $750,000. Your company has cash in the bank to finance construction. Your real estate adviser suggests that you rent out the building for two years at $32,500 a year and predicts that at the end of that time you will be able to sell the bulling for $860,000 Thus there are now two future cash flows - a cash flow of C1=$32,500 at the end of year 1 and a further cash flow of C2=($32,500 + 860,000)=$892,500 at the end of the second year. a. Calculate the NPV of the office building venture at interest rates of 6,11 , and 16%. (Negative amount should be indicated by a minus sign. Do not round intermediate colculations. Round your onswers to 2 decimal places.) b. At what discount rate (approximately) would the project have a zero NPV? Check your answer by calculating the NPV at your approximate rate; it should be ciose to zero. (Enter your answer as a percent rounded to the nearest whole number.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started