Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please assist using the spreadsheet attached. Maskaraid Manufacturing is an international compamy the manufactures Purple Mask Machines. The company is facing a transfer pricing issue.

please assist using the spreadsheet attached.

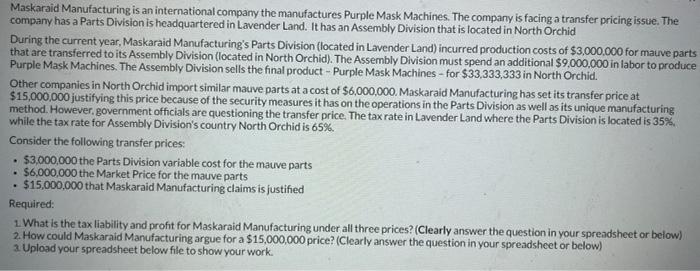

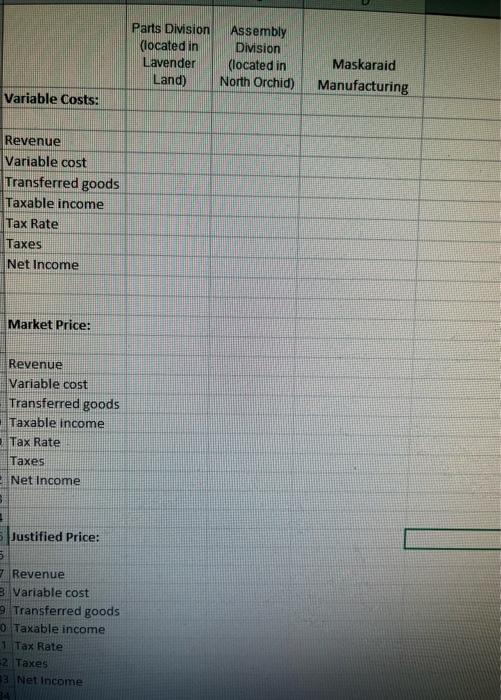

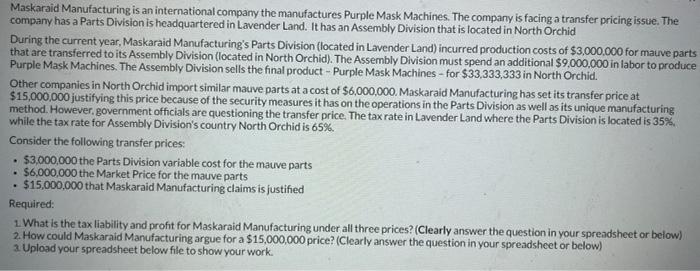

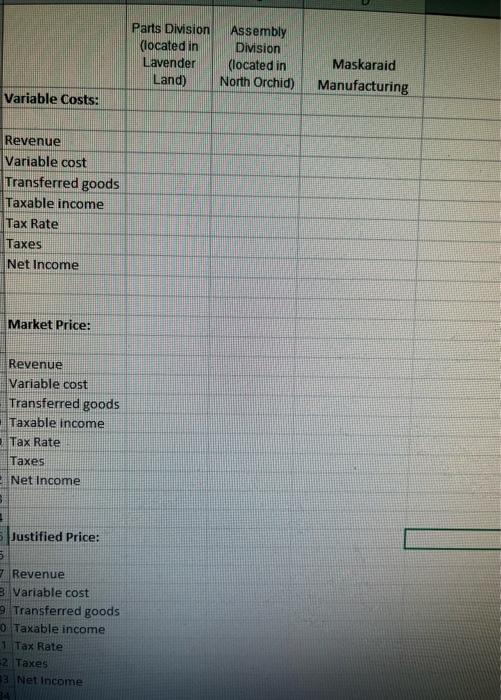

Maskaraid Manufacturing is an international compamy the manufactures Purple Mask Machines. The company is facing a transfer pricing issue. The company has a Parts Division is headquartered in Lavender Land. It has an Assembly Division that is located in North Orchid During the current year, Maskaraid Manufacturing's Parts Division (located in Lavender Land) incurred production costs of $3,000,000 for mative parts that are transferred to its Assembly Division (located in North Orchid). The Assembly Division must spend an additional $9,000,000 in labor to produce Purple Mask Machines. The Assembly Division sells the final product - Purple Mask Machines - for $33,333,333 in North Orchid. Other companies in North Orchid import similar mauve parts at a cost of $6,000,000. Maskaraid Manufacturing has set its transfer price at $15,000,000 justifying this price because of the security measures it has on the operations in the Parts Division as well as its unique manufacturing method. However, government officials are questioning the transfer price. The tax rate in Lavender Land where the Parts Division is located is 35%. while the tax rate for Assembly Division's country North Orchid is 65%. Consider the following transfer prices: - $3,000,000 the Parts Division variable cost for the mative parts - \$6,000,000 the Market Price for the mauve parts - \$15,000,000 that Maskaraid Manufacturing claims is justified Required: 1. What is the tax liability and profit for Maskaraid Manufacturing under all three prices? (Clearly answer the question in your spreadsheet or below) 2. How could Maskaraid Manufacturing argue for a $15,000,000 price? (Clearly answer the question in your spreadsheet or below) 3. Upload your spreadsheet below file to show your work. Variable Costs: Revenue Variable cost Transferred goods Taxable income TaxRate Taxes Net Income Market Price: Revenue Variable cost Transferred goods Taxable income Tax Rate Taxes Net income Justified Price: Revenue Variable cost Transferred goods Taxable income 1 Tax Rate 2. Taxes 3 Net income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started