Answered step by step

Verified Expert Solution

Question

1 Approved Answer

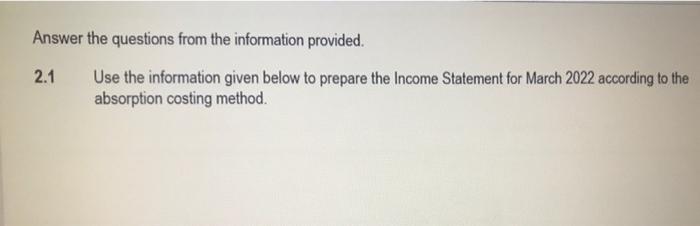

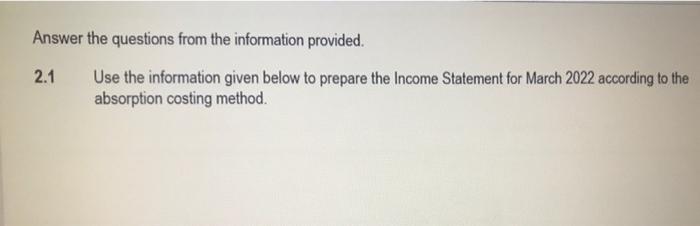

Please assist with the below Answer the questions from the information provided. 2.1 Use the information given below to prepare the Income Statement for March

Please assist with the below

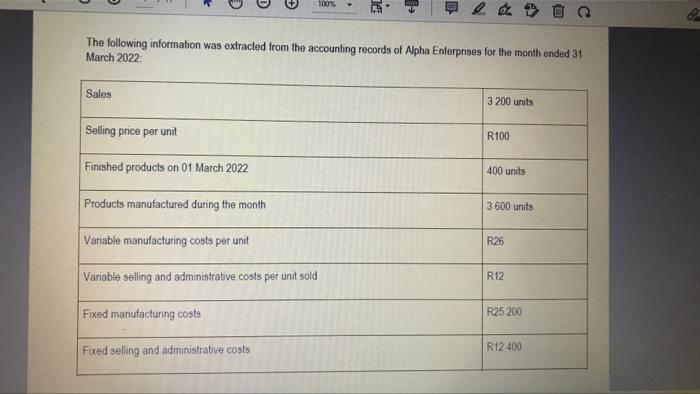

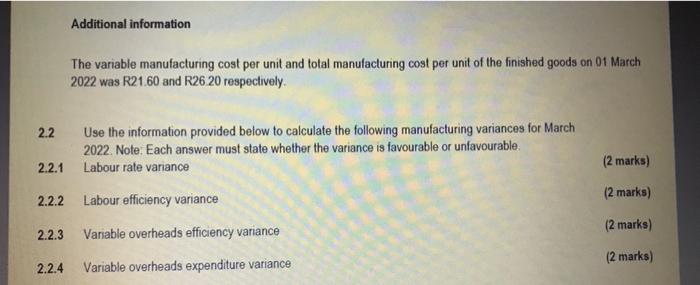

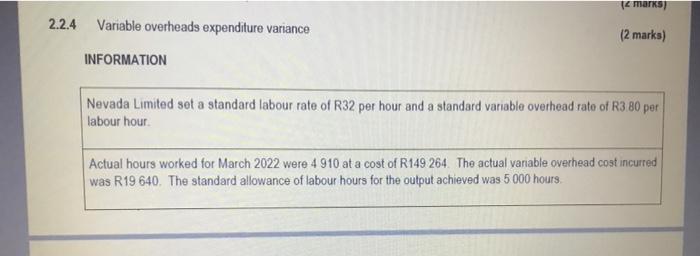

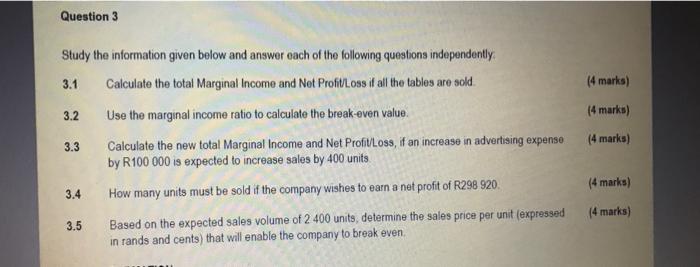

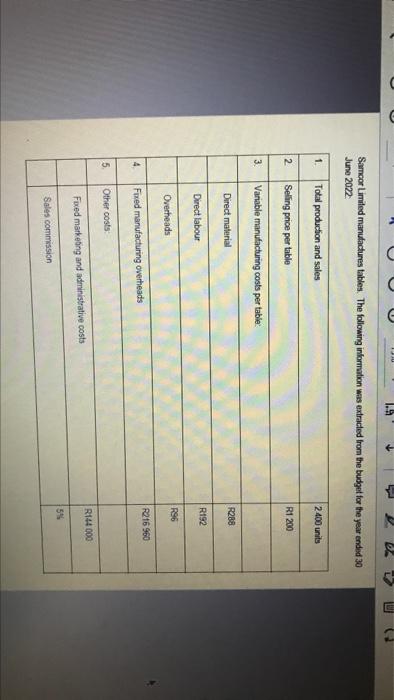

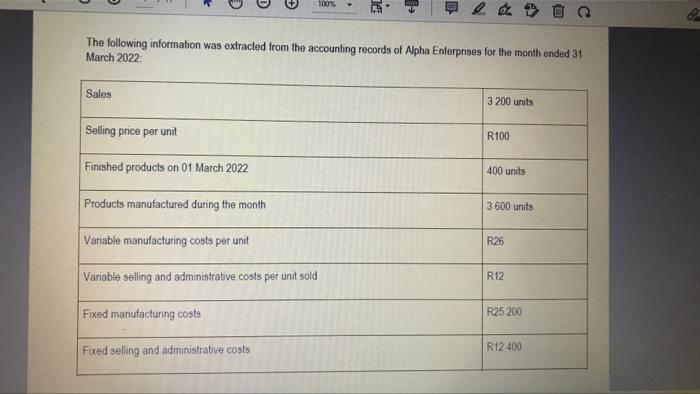

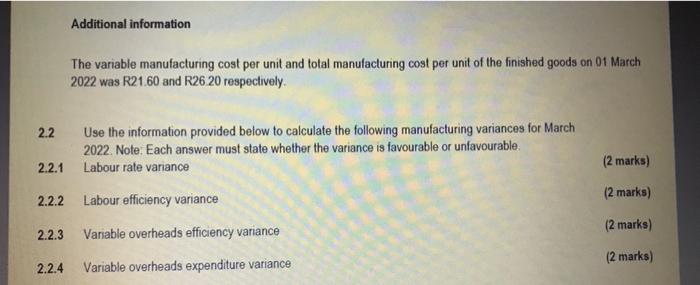

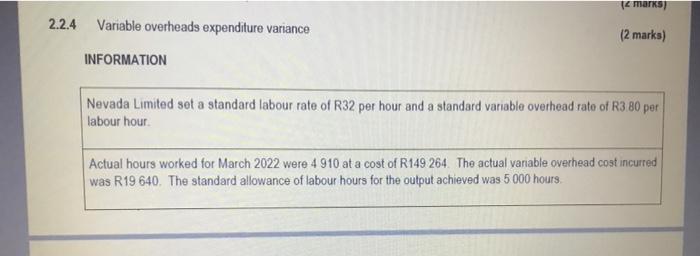

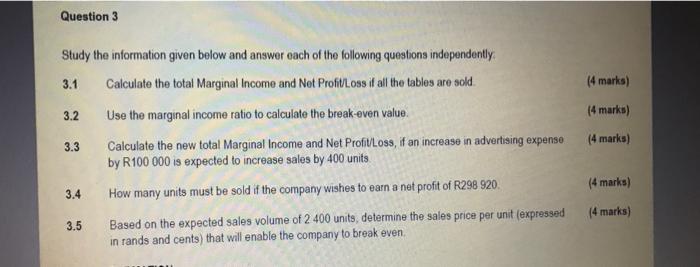

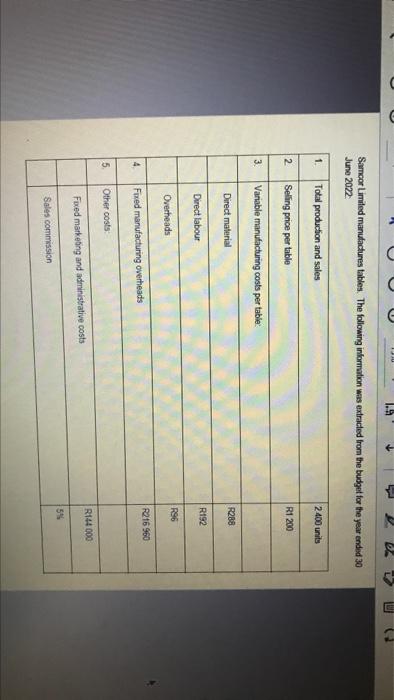

Answer the questions from the information provided. 2.1 Use the information given below to prepare the Income Statement for March 2022 according to the absorption costing method. Sales D D Selling price per unit The following information was extracted from the accounting records of Alpha Enterprises for the month ended 31 March 2022: Finished products on 01 March 2022 Products manufactured during the month Variable manufacturing costs per unit Variable selling and administrative costs per unit sold 100% Fixed manufacturing costs Fixed selling and administrative costs DL 3 200 units R100 400 units 3 600 units R26 R12 R25 200 C R12 400 8 2.2 Use the information provided below to calculate the following manufacturing variances for March 2022. Note: Each answer must state whether the variance is favourable or unfavourable. Labour rate variance Labour efficiency variance Variable overheads efficiency variance 2.2.4 Variable overheads expenditure variance 2.2.1 2.2.2 Additional information 2.2.3 The variable manufacturing cost per unit and total manufacturing cost per unit of the finished goods on 01 March 2022 was R21.60 and R26.20 respectively. (2 marks) (2 marks) (2 marks) (2 marks) 2.2.4 Variable overheads expenditure variance INFORMATION (2 marks] (2 marks) per Nevada Limited set a standard labour rate of R32 per hour and a standard variable overhead rate of R3.80 labour hour. Actual hours worked for March 2022 were 4 910 at a cost of R149 264. The actual variable overhead cost incurred was R19 640. The standard allowance of labour hours for the output achieved was 5 000 hours. Question 3 Study the information given below and answer each of the following questions independently. Calculate the total Marginal Income and Net Profit/Loss if all the tables are sold 3.1 Use the marginal income ratio to calculate the break-even value. Calculate the new total Marginal Income and Net Profit/Loss, if an increase in advertising expense by R100 000 is expected to increase sales by 400 units. 3.4 How many units must be sold if the company wishes to earn a net profit of R298 920. 3.5 Based on the expected sales volume of 2 400 units, determine the sales price per unit (expressed in rands and cents) that will enable the company to break even. 3.2 3.3 (4 marks) (4 marks) (4 marks) (4 marks) (4 marks) C Samcor Limited manufactures tables. The following information was extracted from the budget for the year ended 30 June 2022: Total production and sales Selling price per table Variable manufacturing costs per table: 1. 2 3. 4. 5. Direct material Direct labour Overheads Fixed manufacturing overheads Other costs Fixed marketing and administrative costs 1.9 Sales commission 2400 units R1 200 R288 R192 R96 R216 960 R144 000 5% S E C

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started