Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please assists this question, detail explanation would be needed as this exercise doesn't have answer for me to check. Much appreciate. Question One: Gaelar Ltd

Please assists this question, detail explanation would be needed as this exercise doesn't have answer for me to check. Much appreciate.

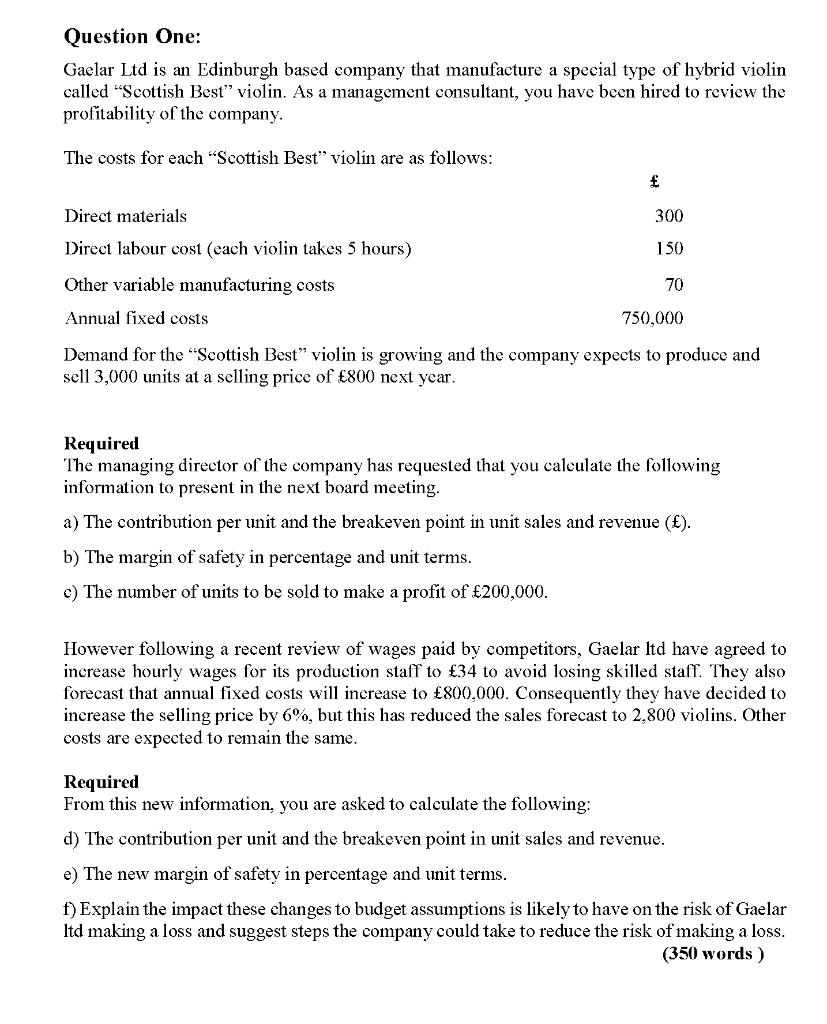

Question One: Gaelar Ltd is an Edinburgh based company that manufacture a special type of hybrid violin called "Scottish Best" violin. As a management consultant, you have been hired to review the profitability of the company. The costs for each "Scottish Best" violin are as follows: Direct materials 300 Direct labour cost (each violin takes 5 hours) 150 Other variable manufacturing costs 70 Annual fixed costs 750,000 Demand for the "Scottish Best" violin is growing and the company expects to produce and sell 3,000 units at a selling price of 800 next year. Required The managing director of the company has requested that you calculate the following information to present in the next board meeting. a) The contribution per unit and the breakeven point in unit sales and revenue (). b) The margin of safety in percentage and unit terms. c) The number of units to be sold to make a profit of 200,000. However following a recent review of wages paid by competitors, Gaelar ltd have agreed to increase hourly wages for its production staff to 34 to avoid losing skilled staff. They also forecast that annual fixed costs will increase to 800,000. Consequently they have decided to increase the selling price by 6%, but this has reduced the sales forecast to 2,800 violins. Other costs are expected to remain the same. Required From this new information, you are asked to calculate the following: d) The contribution per unit and the breakeven point in unit sales and revenue. e) The new margin of safety in percentage and unit terms. f) Explain the impact these changes to budget assumptions is likely to have on the risk of Gaelar Itd making a loss and suggest steps the company could take to reduce the risk of making a loss. (350 words )Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started