Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(please assume an annual timing convention for this question; bonds in this question are assumed to pay coupons annually) Borrowing and lending occurs at the

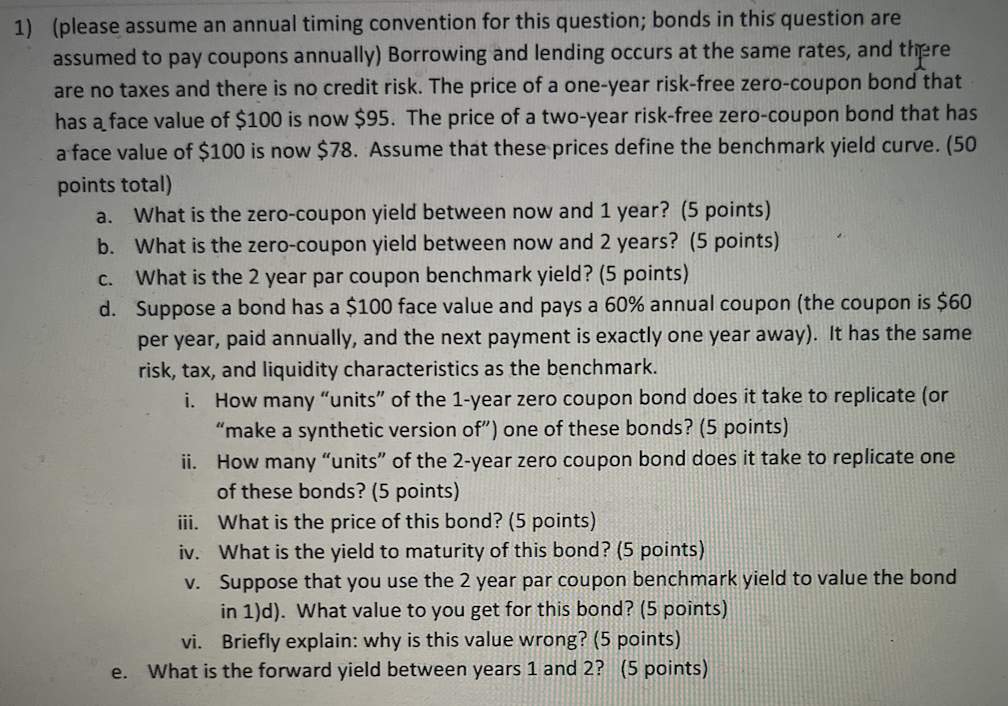

(please assume an annual timing convention for this question; bonds in this question are assumed to pay coupons annually) Borrowing and lending occurs at the same rates, and thirere are no taxes and there is no credit risk. The price of a one-year risk-free zero-coupon bond that has a face value of $100 is now $95. The price of a two-year risk-free zero-coupon bond that has a face value of $100 is now $78. Assume that these prices define the benchmark yield curve. ( 50 points total) a. What is the zero-coupon yield between now and 1 year? ( 5 points) b. What is the zero-coupon yield between now and 2 years? ( 5 points) c. What is the 2 year par coupon benchmark yield? ( 5 points) d. Suppose a bond has a $100 face value and pays a 60% annual coupon (the coupon is $60 per year, paid annually, and the next payment is exactly one year away). It has the same risk, tax, and liquidity characteristics as the benchmark. i. How many "units" of the 1-year zero coupon bond does it take to replicate (or "make a synthetic version of") one of these bonds? (5 points) ii. How many "units" of the 2-year zero coupon bond does it take to replicate one of these bonds? (5 points) iii. What is the price of this bond? ( 5 points) iv. What is the yield to maturity of this bond? ( 5 points) v. Suppose that you use the 2 year par coupon benchmark yield to value the bond in 1)d). What value to you get for this bond? (5 points) vi. Briefly explain: why is this value wrong? ( 5 points) e. What is the forward yield between years 1 and 2 ? ( 5 points)

(please assume an annual timing convention for this question; bonds in this question are assumed to pay coupons annually) Borrowing and lending occurs at the same rates, and thirere are no taxes and there is no credit risk. The price of a one-year risk-free zero-coupon bond that has a face value of $100 is now $95. The price of a two-year risk-free zero-coupon bond that has a face value of $100 is now $78. Assume that these prices define the benchmark yield curve. ( 50 points total) a. What is the zero-coupon yield between now and 1 year? ( 5 points) b. What is the zero-coupon yield between now and 2 years? ( 5 points) c. What is the 2 year par coupon benchmark yield? ( 5 points) d. Suppose a bond has a $100 face value and pays a 60% annual coupon (the coupon is $60 per year, paid annually, and the next payment is exactly one year away). It has the same risk, tax, and liquidity characteristics as the benchmark. i. How many "units" of the 1-year zero coupon bond does it take to replicate (or "make a synthetic version of") one of these bonds? (5 points) ii. How many "units" of the 2-year zero coupon bond does it take to replicate one of these bonds? (5 points) iii. What is the price of this bond? ( 5 points) iv. What is the yield to maturity of this bond? ( 5 points) v. Suppose that you use the 2 year par coupon benchmark yield to value the bond in 1)d). What value to you get for this bond? (5 points) vi. Briefly explain: why is this value wrong? ( 5 points) e. What is the forward yield between years 1 and 2 ? ( 5 points) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started