please be clear with the answer! thank you!

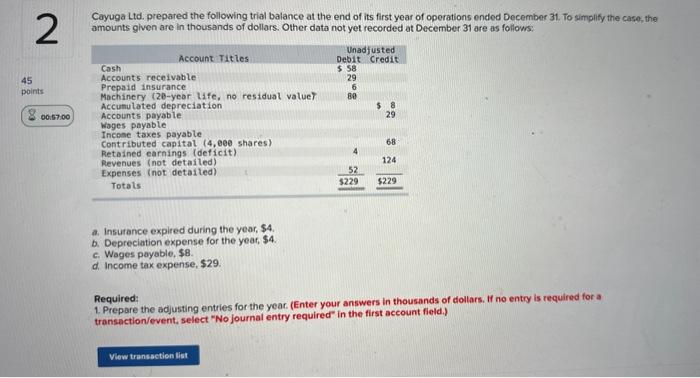

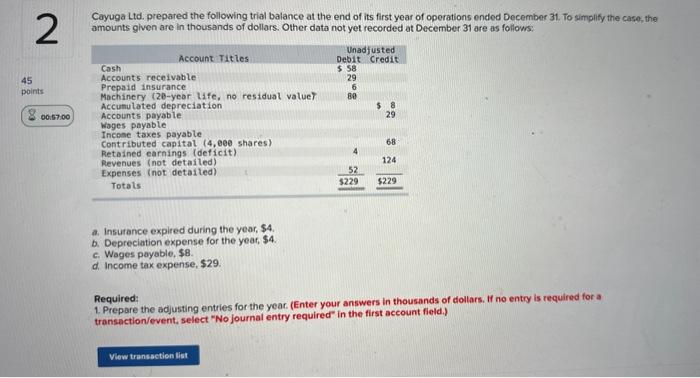

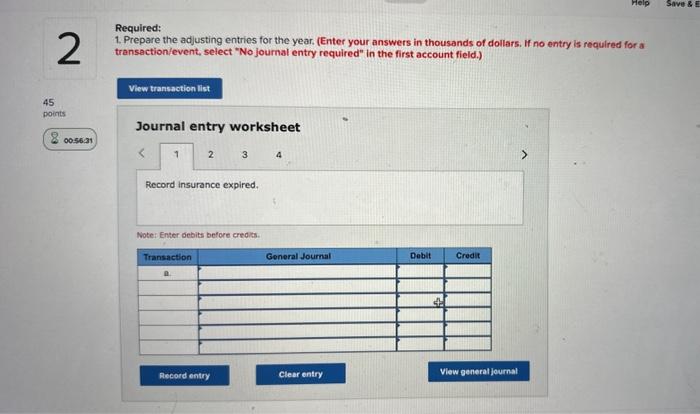

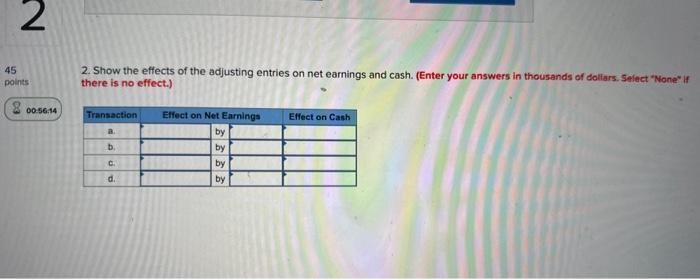

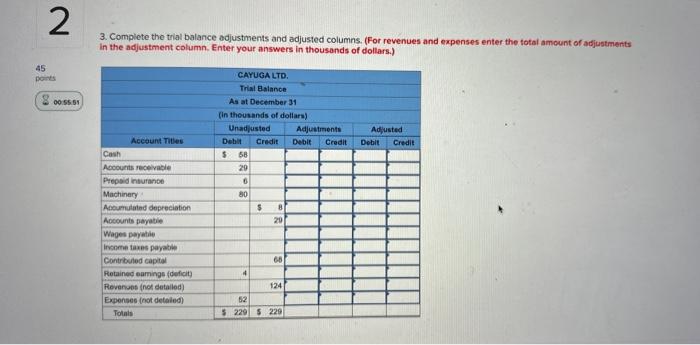

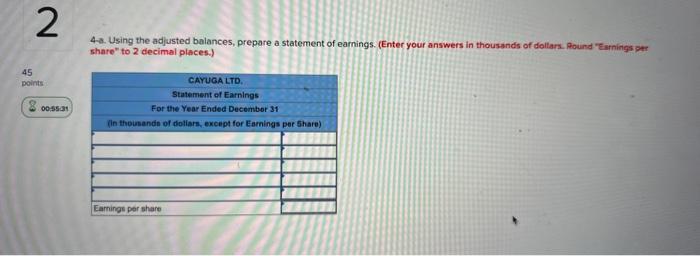

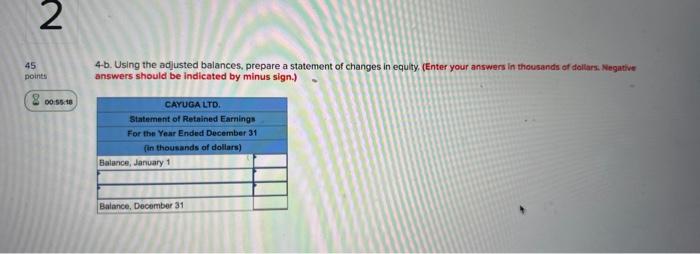

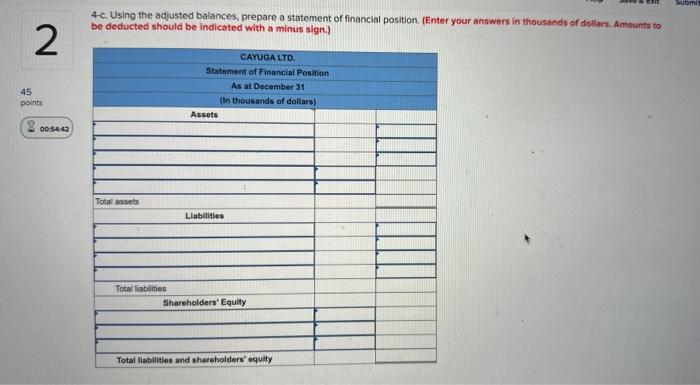

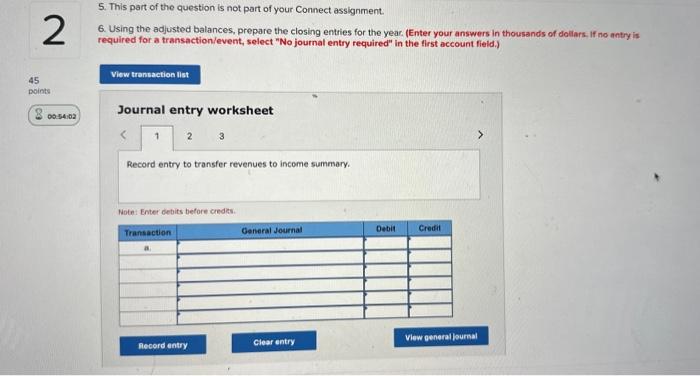

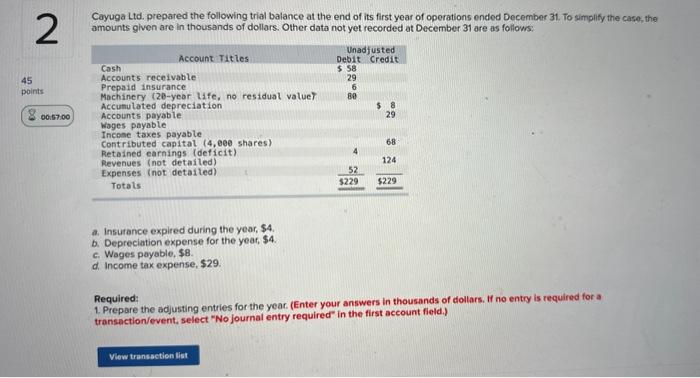

Cayuga Ltd. prepared the following trial balance at the end of its first year of operations ended December 31. To simplify the case, the amounts given are in thousands of dollars. Other data not yet recorded at December 31 are as follows: a. Insurance expired during the year, $4. b. Depreciation expense for the year, $4. c. Wages paysble, $8. d. Income tax expense, $29. Required: 1. Prepare the adjusting entries for the year. (Enter your answers in thousands of dollars. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Required: 1. Prepare the adjusting entries for the year. (Enter your answers in thousands of dollars. If no entry is required for a transaction/event, select "No journal entry required" In the first account field.) Journal entry worksheet 4 flecord insurance expired. Note: Enter debits before credits. 2. Show the effects of the adjusting entries on net earnings and cash. (Enter your answers in thousands of dallars. Select "None" if there is no effect.) 3. Complete the trial balance adjustments and adjusted columns. (For revenues and expenses enter the total amount of adjustments In the adjustment column. Enter your answers in thousands of dollars.) 4-a. Using the adjusted balances, prepare a statement of earnings. (Enter your answers in thousands of dollars. Round "Earnings per share" to 2 decimal places.) 4b. Using the adjusted balances, prepare a statement of changes in equity. (Enter your answers in thousands of dollars. Negative answers should be indicated by minus sign.) 4-c. Using the adjusted balances, prepare a statement of financial position. (Enter your answers in thousands of dollars. Amounts to be deducted should be indicated with a minus sign.) 5. This part of the question is not part of your Connect assignment. 6. Using the adjusted balances, prepare the closing entries for the year, (Enter your answers in thousands of doliars. If no antry is required for a transaction/event, select "No journal entry required" in the flirst account field.) Journal entry worksheet Record entry to transfer revenues to income summary. Notnt Enter Gebits before oredes