Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please bold Answers thank you so much There are six types of standard homeowner's policies, commonly referred to as HO-1 through HO-4, HO-6, and HO-8.

Please bold Answers thank you so much

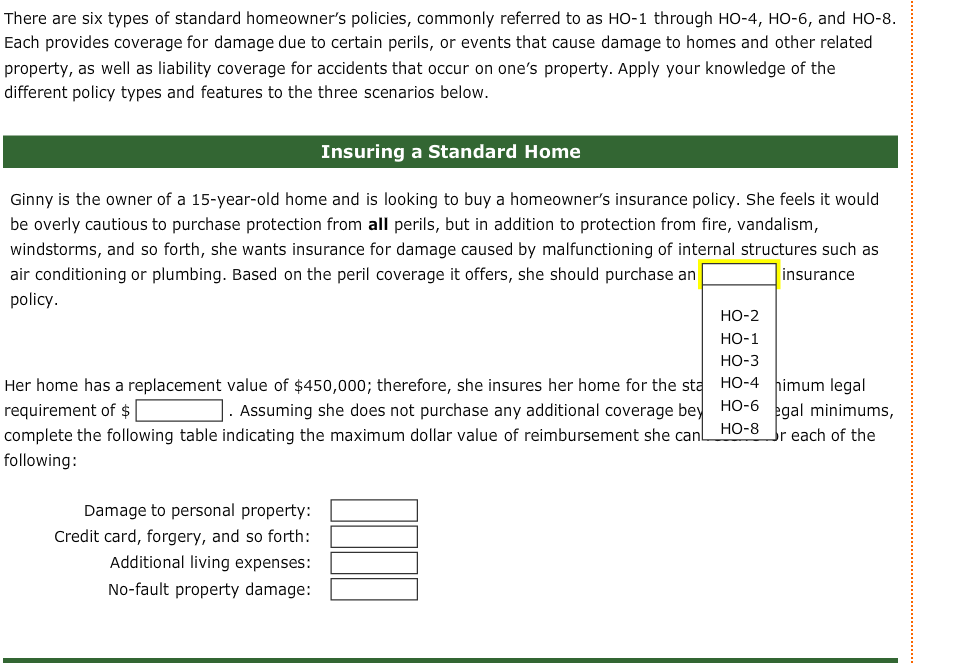

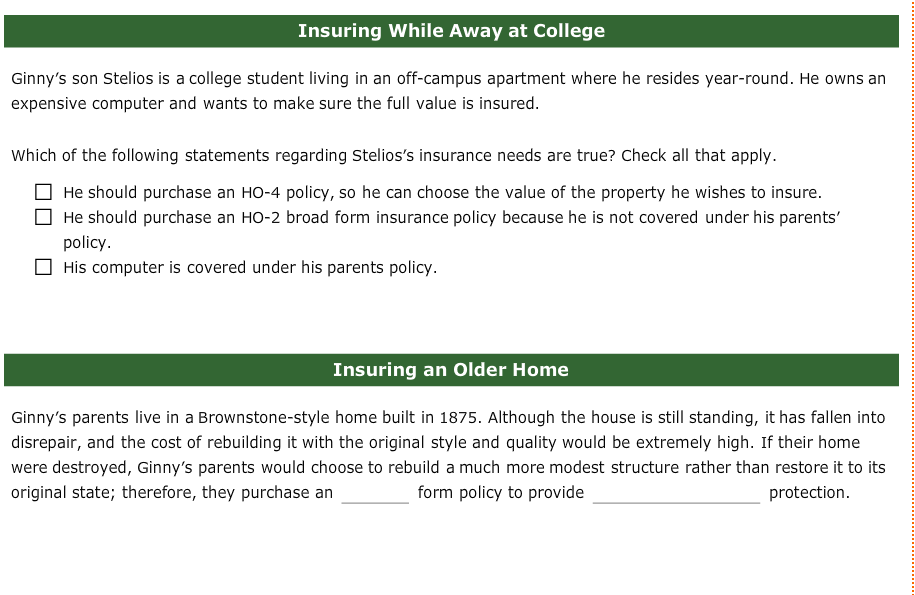

There are six types of standard homeowner's policies, commonly referred to as HO-1 through HO-4, HO-6, and HO-8. Each provides coverage for damage due to certain perils, or events that cause damage to homes and other related property, as well as liability coverage for accidents that occur on one's property. Apply your knowledge of the different policy types and features to the three scenarios below. Insuring a Standard Home Ginny is the owner of a 15-year-old home and is looking to buy a homeowner's insurance policy. She feels it would be overly cautious to purchase protection from all perils, but in addition to protection from fire, vandalism, windstorms, and so forth, she wants insurance for damage caused by malfunctioning of internal structures such as air conditioning or plumbing. Based on the peril coverage it offers, she should purchase an insurance policy. HO-2 HO-1 HO-3 Her home has a replacement value of $450,000; therefore, she insures her home for the sta HO-4 himum legal requirement of $ Assuming she does not purchase any additional coverage bey HO-6 Egal minimums, complete the following table indicating the maximum dollar value of reimbursement she canLHO-8 each of the following: Damage to personal property: Credit card, forgery, and so forth: Additional living expenses: No-fault property damage: Insuring While Away at College Ginny's son Stelios is a college student living in an off-campus apartment where he resides year-round. He owns an expensive computer and wants to make sure the full value is insured. Which of the following statements regarding Stelios's insurance needs are true? Check all that apply. He should purchase an HO-4 policy, so he can choose the value of the property he wishes to insure. He should purchase an HO-2 broad form insurance policy because he is not covered under his parents' policy. His computer is covered under his parents policy. Insuring an Older Home Ginny's parents live in a Brownstone-style home built in 1875. Although the house is still standing, it has fallen into disrepair, and the cost of rebuilding it with the original style and quality would be extremely high. If their home were destroyed, Ginny's parents would choose to rebuild a much more modest structure rather than restore it to its original state; therefore, they purchase an form policy to provide protection. There are six types of standard homeowner's policies, commonly referred to as HO-1 through HO-4, HO-6, and HO-8. Each provides coverage for damage due to certain perils, or events that cause damage to homes and other related property, as well as liability coverage for accidents that occur on one's property. Apply your knowledge of the different policy types and features to the three scenarios below. Insuring a Standard Home Ginny is the owner of a 15-year-old home and is looking to buy a homeowner's insurance policy. She feels it would be overly cautious to purchase protection from all perils, but in addition to protection from fire, vandalism, windstorms, and so forth, she wants insurance for damage caused by malfunctioning of internal structures such as air conditioning or plumbing. Based on the peril coverage it offers, she should purchase an insurance policy. HO-2 HO-1 HO-3 Her home has a replacement value of $450,000; therefore, she insures her home for the sta HO-4 himum legal requirement of $ Assuming she does not purchase any additional coverage bey HO-6 Egal minimums, complete the following table indicating the maximum dollar value of reimbursement she canLHO-8 each of the following: Damage to personal property: Credit card, forgery, and so forth: Additional living expenses: No-fault property damage: Insuring While Away at College Ginny's son Stelios is a college student living in an off-campus apartment where he resides year-round. He owns an expensive computer and wants to make sure the full value is insured. Which of the following statements regarding Stelios's insurance needs are true? Check all that apply. He should purchase an HO-4 policy, so he can choose the value of the property he wishes to insure. He should purchase an HO-2 broad form insurance policy because he is not covered under his parents' policy. His computer is covered under his parents policy. Insuring an Older Home Ginny's parents live in a Brownstone-style home built in 1875. Although the house is still standing, it has fallen into disrepair, and the cost of rebuilding it with the original style and quality would be extremely high. If their home were destroyed, Ginny's parents would choose to rebuild a much more modest structure rather than restore it to its original state; therefore, they purchase an form policy to provide protectionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started