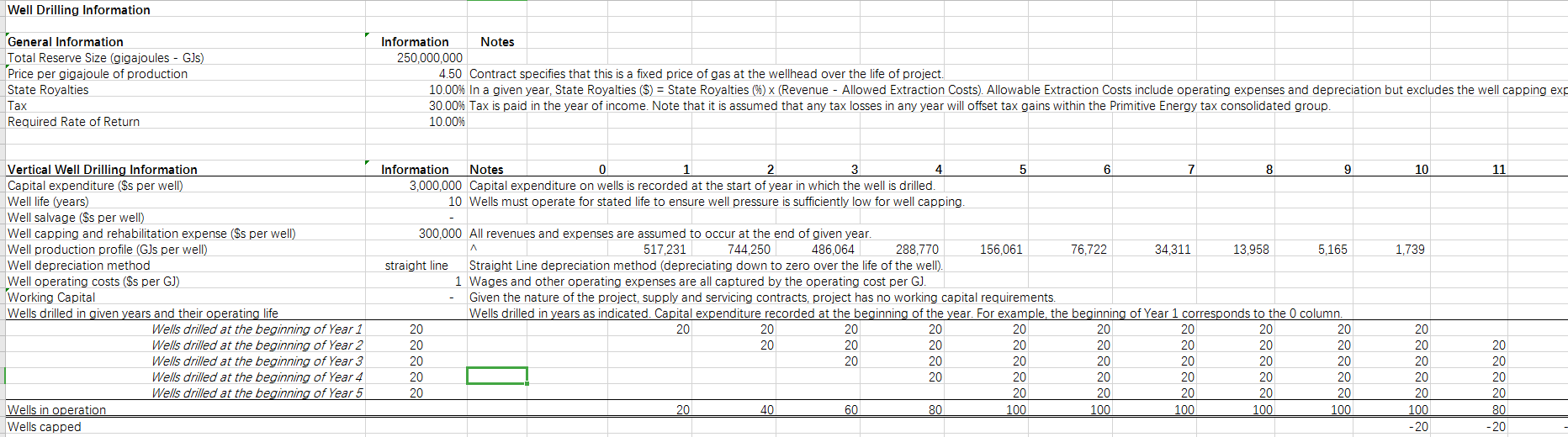

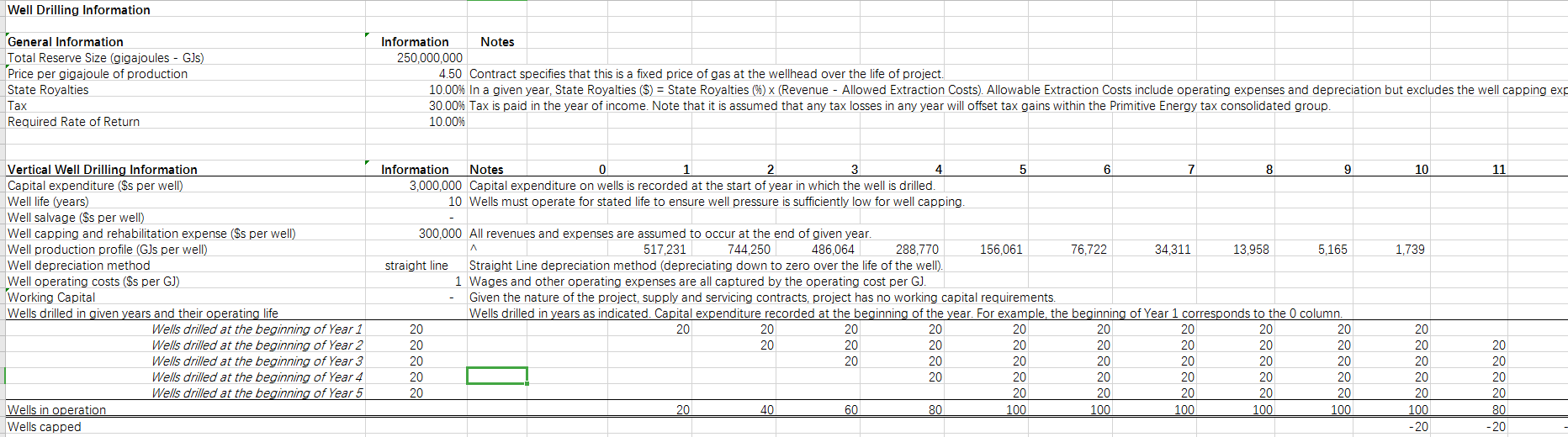

Please calculate each year's depreciation

Well Drilling Information General Information Total Reserve Size (gigajoules - GJs) Price per gigajoule of production State Royalties Tax Required Rate of Return Information Notes 250,000,000 4.50 Contract specifies that this is a fixed price of gas at the wellhead over the life of project. 10.00% In a given year, State Royalties ($) = State Royalties (%) x (Revenue - Allowed Extraction Costs). Allowable Extraction Costs include operating expenses and depreciation but excludes the well capping exp 30.00% Tax is paid in the year of income. Note that it is assumed that any tax losses in any year will offset tax gains within the Primitive Energy tax consolidated group. 10.00% 5 6 7 8 9 10 11 Information Notes 0 2 3 4 3,000,000 Capital expenditure on wells is recorded at the start of year in which the well is drilled. 10 Wells must operate for stated life to ensure well pressure is sufficiently low for well capping 1,739 Vertical Well Drilling Information Capital expenditure (Ss per well) Well life (years) Well salvage (Ss per well) Well capping and rehabilitation expense (Ss per well) Well production profile (Gls per well) Well depreciation method Well operating costs ($s per GJ) Working Capital Wells drilled in given years and their operating life Wells drilled at the beginning of Year 1 Wells drilled at the beginning of Year 2 Wells drilled at the beginning of Year 3 Wells drilled at the beginning of Year 4 Wells drilled at the beginning of Year 5 Wells in operation Wells capped 300,000 All revenues and expenses are assumed to occur at the end of given year. A 517,231 744,250 486,064 288,770 156,061 76,722 34,311 13,958 5,165 straight line Straight Line depreciation method (depreciating down to zero over the life of the well). 1 Wages and other operating expenses are all captured by the operating cost per G). Given the nature of the project, supply and servicing contracts, project has no working capital requirements Wells drilled in years as indicated. Capital expenditure recorded at the beginning of the year. For example, the beginning of Year 1 corresponds to the 0 column. 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 40 60 80 100 100 100 100 100 20 20 20 20 20 100 20 20 20 20 20 80 20 Well Drilling Information General Information Total Reserve Size (gigajoules - GJs) Price per gigajoule of production State Royalties Tax Required Rate of Return Information Notes 250,000,000 4.50 Contract specifies that this is a fixed price of gas at the wellhead over the life of project. 10.00% In a given year, State Royalties ($) = State Royalties (%) x (Revenue - Allowed Extraction Costs). Allowable Extraction Costs include operating expenses and depreciation but excludes the well capping exp 30.00% Tax is paid in the year of income. Note that it is assumed that any tax losses in any year will offset tax gains within the Primitive Energy tax consolidated group. 10.00% 5 6 7 8 9 10 11 Information Notes 0 2 3 4 3,000,000 Capital expenditure on wells is recorded at the start of year in which the well is drilled. 10 Wells must operate for stated life to ensure well pressure is sufficiently low for well capping 1,739 Vertical Well Drilling Information Capital expenditure (Ss per well) Well life (years) Well salvage (Ss per well) Well capping and rehabilitation expense (Ss per well) Well production profile (Gls per well) Well depreciation method Well operating costs ($s per GJ) Working Capital Wells drilled in given years and their operating life Wells drilled at the beginning of Year 1 Wells drilled at the beginning of Year 2 Wells drilled at the beginning of Year 3 Wells drilled at the beginning of Year 4 Wells drilled at the beginning of Year 5 Wells in operation Wells capped 300,000 All revenues and expenses are assumed to occur at the end of given year. A 517,231 744,250 486,064 288,770 156,061 76,722 34,311 13,958 5,165 straight line Straight Line depreciation method (depreciating down to zero over the life of the well). 1 Wages and other operating expenses are all captured by the operating cost per G). Given the nature of the project, supply and servicing contracts, project has no working capital requirements Wells drilled in years as indicated. Capital expenditure recorded at the beginning of the year. For example, the beginning of Year 1 corresponds to the 0 column. 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 40 60 80 100 100 100 100 100 20 20 20 20 20 100 20 20 20 20 20 80 20