Answered step by step

Verified Expert Solution

Question

1 Approved Answer

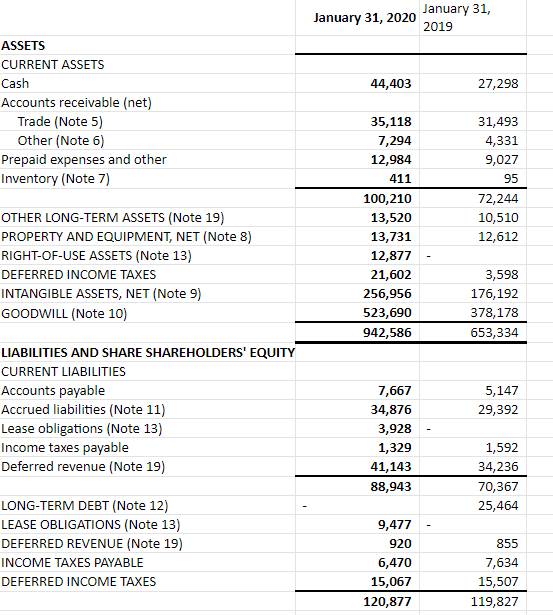

please calculate short and longterm ratios January 31, 2020 January 31, 2019 44,403 27,298 ASSETS CURRENT ASSETS Cash Accounts receivable (net) Trade (Note 5) Other

please calculate short and longterm ratios

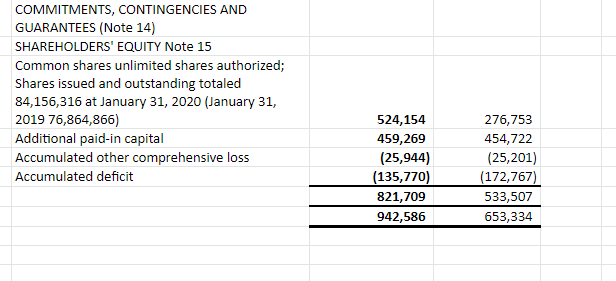

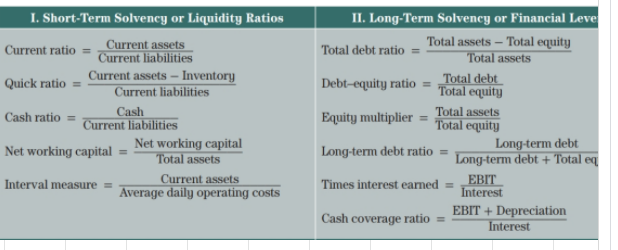

January 31, 2020 January 31, 2019 44,403 27,298 ASSETS CURRENT ASSETS Cash Accounts receivable (net) Trade (Note 5) Other (Note 6) Prepaid expenses and other Inventory (Note 7) 35,118 7,294 12,984 411 100,210 13,520 13,731 12,877 21,602 256,956 523,690 942,586 31,493 4,331 9,027 95 72,244 10,510 12,612 OTHER LONG-TERM ASSETS (Note 19) PROPERTY AND EQUIPMENT, NET (Note 8) RIGHT-OF-USE ASSETS (Note 13) DEFERRED INCOME TAXES INTANGIBLE ASSETS, NET (Note 9) GOODWILL (Note 10) 3,598 176,192 378,178 653,334 LIABILITIES AND SHARE SHAREHOLDERS' EQUITY CURRENT LIABILITIES Accounts payable Accrued liabilities (Note 11) Lease obligations (Note 13) Income taxes payable Deferred revenue (Note 19) 5,147 29,392 7,667 34,876 3,928 1,329 41,143 88,943 1,592 34,236 70,367 25,464 LONG-TERM DEBT (Note 12) LEASE OBLIGATIONS (Note 13) DEFERRED REVENUE (Note 19) INCOME TAXES PAYABLE DEFERRED INCOME TAXES 9,477 920 6,470 15,067 120,877 855 7,634 15,507 119,827 COMMITMENTS, CONTINGENCIES AND GUARANTEES (Note 14) SHAREHOLDERS' EQUITY Note 15 Common shares unlimited shares authorized; Shares issued and outstanding totaled 84,156,316 at January 31, 2020 (January 31, 2019 76,864,866) Additional paid-in capital Accumulated other comprehensive loss Accumulated deficit 524,154 459,269 (25,944) (135,770) 821,709 942,586 276,753 454,722 (25,201) (172,767) 533,507 653,334 1. Short-Term Solvency or Liquidity Ratios Current ratio = Current assets Current liabilities Quick ratio = Current assets Inventory Current liabilities Cash ratio = Cash Current liabilities Net working capital Net working capital Total assets Interval measure = Current assets Average daily operating costs II. Long-Term Solvency or Financial Leve Total assets Total equity Total debt ratio = Total assets Debt-equity ratio Total debt Total equity Equity multiplier = Total assets Total equity Long-term debt Long-term debt ratio = Long-term debt + Total eq Times interest earned = EBIT Interest EBIT + Depreciation Cash coverage ratio = InterestStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started