Please calculate the future cash flows for each company (kelly, volt, and olsten)

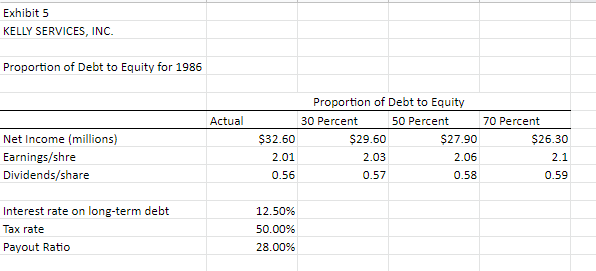

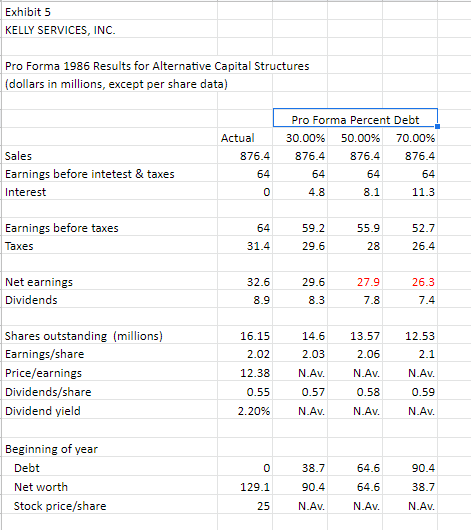

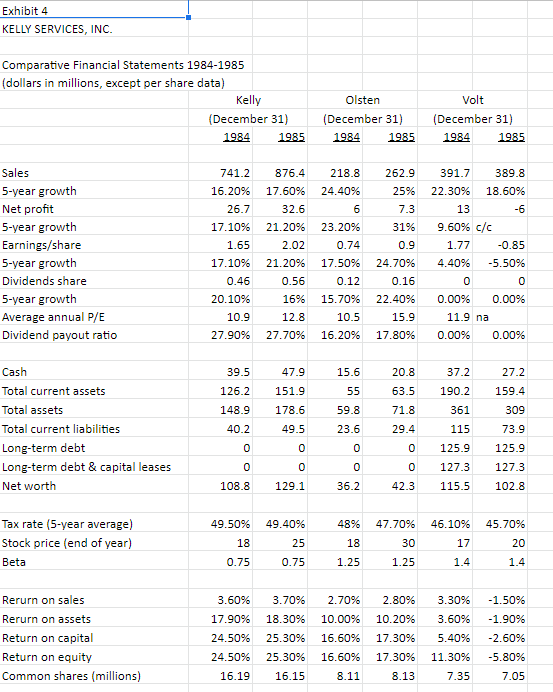

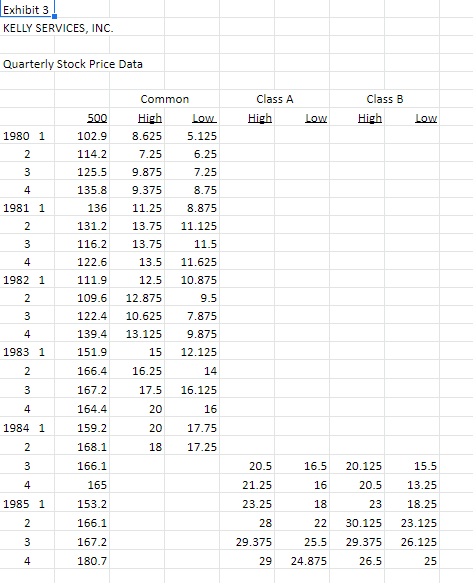

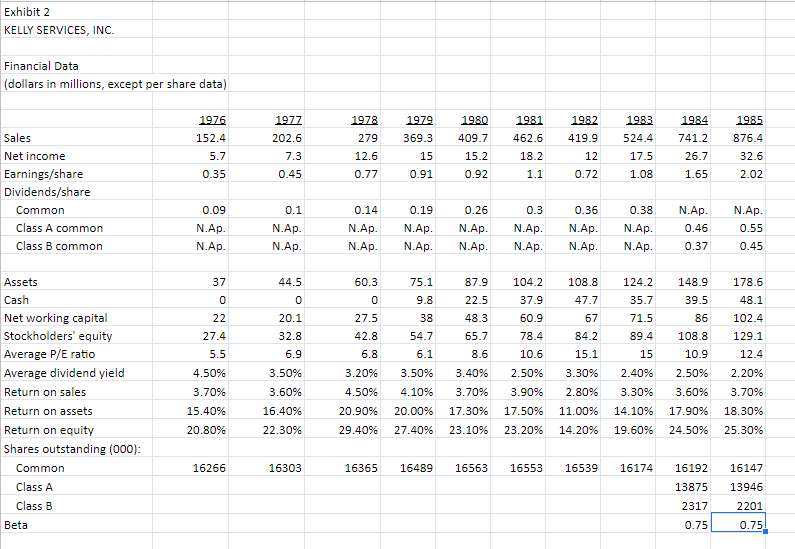

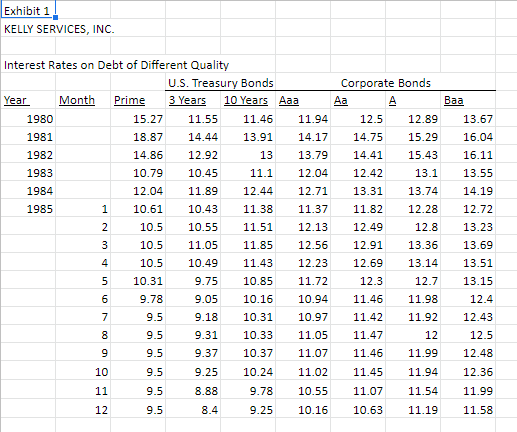

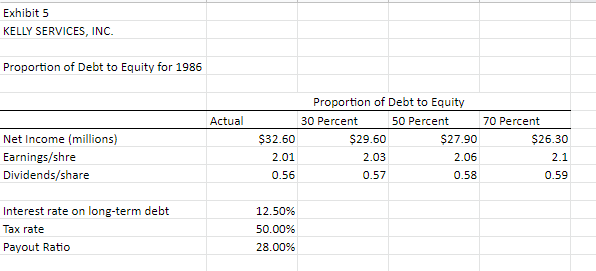

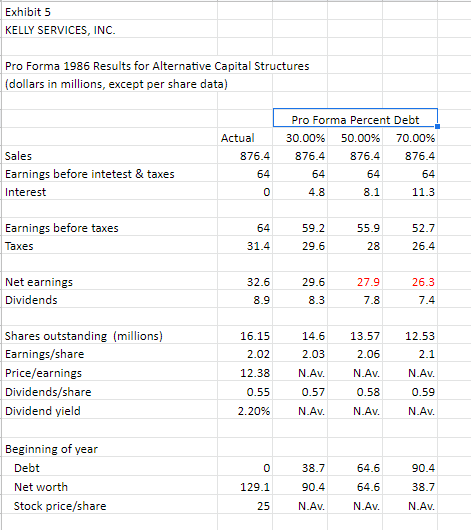

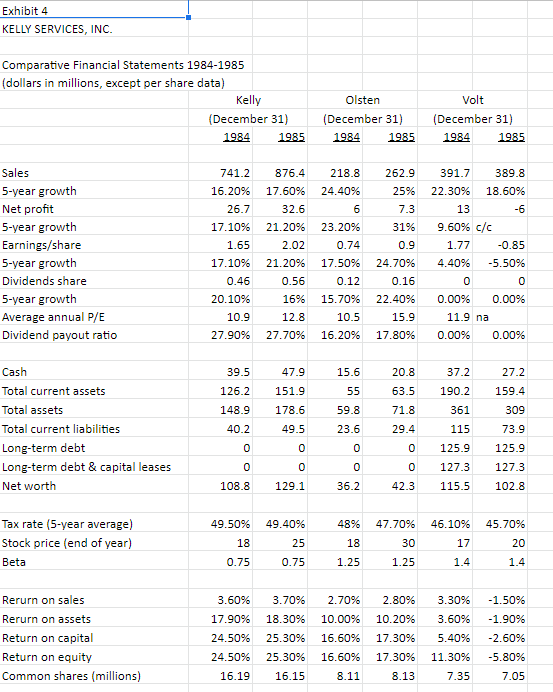

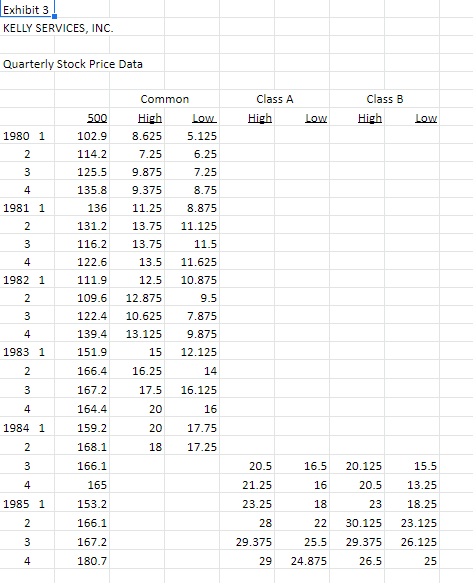

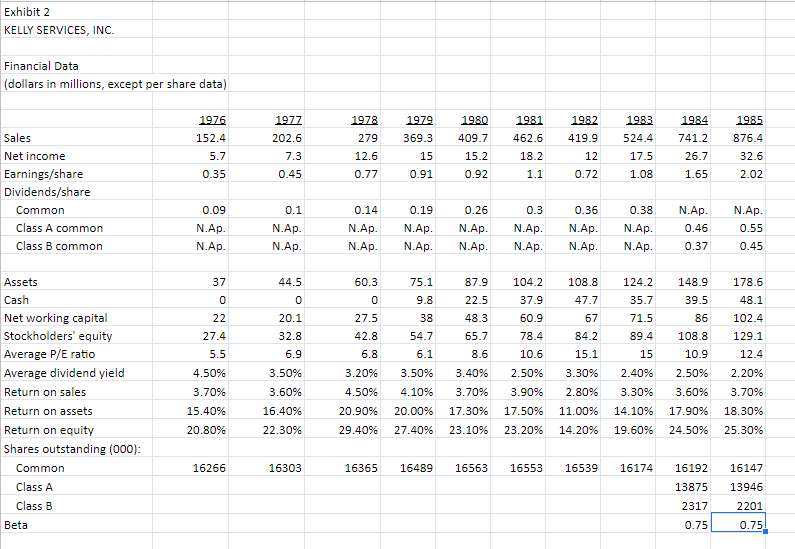

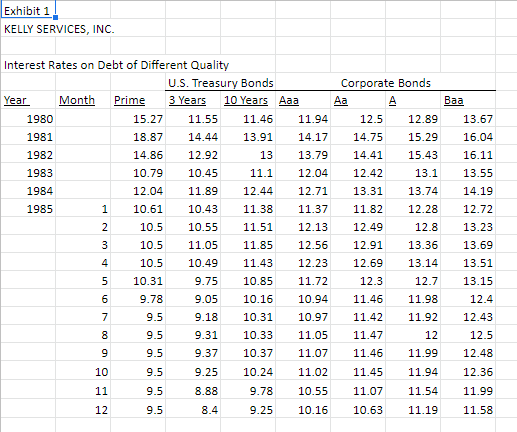

Exhibit 5 KELLY SERVICES, INC. Proportion of Debt to Equity for 1986 Net Income (millions) Earnings/shre Dividends/share Interest rate on long-term debt Tax rate Payout Ratio Actual $32.60 2.01 0.56 12.50% 50.00% 28.00% Proportion of Debt to Equity 30 Percent 50 Percent $29.60 $27.90 2.03 2.06 0.57 0.58 70 Percent $26.30 2.1 0.59 Exhibit 5 KELLY SERVICES, INC. Pro Forma 1986 Results for Alternative Capital Structures (dollars in millions, except per share data) Actual Sales Earnings before intetest & taxes Interest Earnings before taxes Taxes Net earnings Dividends Shares outstanding (millions) Earnings/share Price/earnings Dividends/share Dividend yield Beginning of year Debt Net worth Stock price/share 876.4 64 0 64 31.4 32.6 8.9 16.15 2.02 12.38 0.55 2.20% 0 129.1 25 Pro Forma Percent Debt 30.00% 50.00% 70.00% 876.4 876.4 876.4 64 64 64 4.8 8.1 11.3 59.2 55.9 52.7 29.6 28 26.4 29.6 27.9 26.3 8.3 7.8 7.4 14.6 13.57 12.53 2.03 2.06 2.1 N.Av. N.Av. N.Av. 0.57 0.58 0.59 N.Av. N.Av. N.Av. 38.7 64.6 90.4 90.4 64.6 38.7 N.Av. N.Av. N.Av. 603 Exhibit 4 KELLY SERVICES, INC. Comparative Financial Statements 1984-1985 (dollars in millions, except per share data) Kelly Olsten Volt (December 31) (December 31) (December 31) 1984 1985 1984 1985 1984 1985 Sales 741.2 876.4 218.8 262.9 391.7 389.8 5-year growth 16.20% 17.60% 24.40% 25% 22.30% 18.60% Net profit 26.7 32.6 6 7.3 13 -6 5-year growth 17.10% 21.20% 23.20% 31% 9.60% c/c Earnings/share 1.65 2.02 0.74 0.9 1.77 -0.85 5-year growth 17.10% 21.20% 17.50% 24.70% 4.40% -5.50% Dividends share 0.46 0.56 0.12 0.16 0 0 5-year growth 20.10% 16% 15.70% 22.40% 0.00% 0.00% Average annual P/E 10.9 12.8 10.5 15.9 Dividend payout ratio 27.90% 27.70% 16.20% 17.80% 0.00% 0.00% Cash 39.5 47.9 15.6 20.8 37.2 27.2 Total current assets 126.2 151.9 55 63.5 190.2 159.4 Total assets 148.9 178.6 59.8 71.8 361 309 Total current liabilities 40.2 49.5 23.6 29.4 115 73.9 Long-term debt 0 0 0 0 125.9 125.9 Long-term debt & capital leases 0 0 0 127.3 127.3 Net worth 108.8 129.1 36.2 42.3 115.5 102.8 Tax rate (5-year average) 49.50% 49.40% 48% 47.70% 46.10% 45.70% 18 25 18 30 17 20 Stock price (end of year) Beta 0.75 0.75 1.25 1.25 1.4 1.4 Rerurn on sales 3.70% 2.70% 2.80% 3.30% -1.50% 3.60% 17.90% 18.30% 10.00% 10.20% Rerurn on assets 3.60% -1.90% Return on capital 5.40% -2.60% 24.50% 25.30% 16.60% 17.30% 24.50% 25.30% 16.60% 17.30% 11.30% Return on equity -5.80% Common shares (millions) 16.19 16.15 8.11 8.13 7.35 7.05 O 00 0 11.9 na Exhibit 3 KELLY SERVICES, INC. Quarterly Stock Price Data 500 1980 1 102.9 2 114.2 3 125.5 135.8 136 131.2 116.2 122.6 111.9 109.6 122.4 139.4 151.9 166.4 167.2 164.4 159.2 168.1 166.1 165 153.2 166.1 167.2 180.7 4 1981 1 23 4 1982 1 2 3 4 1983 1 2 3 4 1984 1 2 3 4 1985 1 2 3 4 Common High Low 8.625 5.125 7.25 6.25 9.875 7.25 9.375 8.75 11.25 8.875 13.75 11.125 13.75 11.5 13.5 11.625 12.5 10.875 12.875 9.5 10.625 7.875 13.125 9.875 15 12.125 16.25 14 17.5 16.125 20 16 20 17.75 18 17.25 Class A High 20.5 21.25 23.25 28 29.375 Low Class B Low 16.5 20.125 15.5 16 20.5 13.25 18 23 18.25 22 30.125 23.125 25.5 29.375 26.125 26.5 25 29 24.875 High Exhibit 2 KELLY SERVICES, INC. Financial Data (dollars in millions, except per share data) 1976 Sales 152.4 Net income 5.7 Earnings/share 0.35 Dividends/share Common 0.09 Class A common N.Ap. Class B common N.Ap. Assets 37 Cash 0 Net working capital 22 Stockholders' equity 27.4 Average P/E ratio 5.5 Average dividend yield 4.50% Return on sales 3.70% Return on assets 15.40% Return on equity 20.80% Shares outstanding (000): Common 16266 Class A Class B Beta 1977 202.6 7.3 0.45 0.1 N.Ap. N.Ap. 44.5 0 20.1 32.8 6.9 3.50% 3.60% 16.40% 22.30% 16303 1978 1979 1980 1981 279 369.3 409.7 462.6 12.6 15 15.2 18.2 0.77 0.91 0.92 1.1 0.14 0.19 0.26 0.3 N.Ap. N.Ap. N.Ap. N.Ap. N.Ap. N.Ap. N.Ap. N.Ap. 60.3 75.1 87.9 104.2 0 9.8 22.5 37.9 27.5 38 48.3 60.9 42.8 54.7 65.7 78.4 6.8 6.1 8.6 10.6 3.50% 3.40% 2.50% 4.10% 3.70% 3.90% 3.20% 4.50% 20.90% 20.00% 29.40% 27.40% 16365 16489 16563 16553 1982 1983 1985 419.9 524.4 741.2 876.4 12 17.5 26.7 32.6 0.72 1.08 1.65 2.02 0.36 0.38 N.Ap. N.Ap. N.Ap. N.Ap. 0.46 0.55 N.Ap. N.Ap. 0.37 0.45 108.8 124.2 148.9 178.6 47.7 35.7 39.5 48.1 67 71.5 86 102.4 84.2 89.4 108.8 129.1 15.1 15 10.9 12.4 3.30% 2.40% 2.50% 2.20% 3.70% 2.80% 3.30% 3.60% 17.30% 17.50% 11.00% 14.10% 17.90% 18.30% 23.10% 23.20% 14.20% 19.60% 24.50% 25.30% 16539 16174 16192 16147 13875 13946 2317 2201 0.75 0.75 1984 Exhibit 1 KELLY SERVICES, INC. Interest Rates on Debt of Different Quality Year Month Prime 1980 1981 1982 1983 1984 1985 1 2 3 4 5 6 7 8 9 10 11 12 U.S. Treasury Bonds Corporate Bonds Aa A 3 Years 10 Years Aaa 11.55 11.46 11.94 15.27 12.5 12.89 18.87 14.44 13.91 14.17 14.75 15.29 14.86 12.92 13 13.79 14.41 15.43 10.79 10.45 11.1 12.04 12.42 13.1 12.04 11.89 12.44 12.71 13.31 13.74 10.61 10.43 11.38 11.37 11.82 12.28 10.5 10.55 11.51 12.13 12.49 12.8 10.5 11.05 11.85 12.56 12.91 13.36 10.5 10.49 11.43 12.23 12.69 13.14 10.31 9.75 10.85 11.72 12.3 12.7 9.78 9.05 10.16 10.94 11.46 11.98 9.5 9.18 10.31 10.97 11.42 11.92 9.5 9.31 10.33 11.05 11.47 12 9.5 9.37 10.37 11.07 11.46 11.99 9.5 9.25 10.24 11.02 11.45 11.94 9.5 8.88 9.78 10.55 11.07 11.54 9.5 8.4 9.25 10.16 10.63 11.19 in in Il Baa 13.67 16.04 16.11 13.55 14.19 12.72 13.23 13.69 13.51 13.15 12.4 12.43 12.5 12.48 12.36 11.99 11.58 Exhibit 5 KELLY SERVICES, INC. Proportion of Debt to Equity for 1986 Net Income (millions) Earnings/shre Dividends/share Interest rate on long-term debt Tax rate Payout Ratio Actual $32.60 2.01 0.56 12.50% 50.00% 28.00% Proportion of Debt to Equity 30 Percent 50 Percent $29.60 $27.90 2.03 2.06 0.57 0.58 70 Percent $26.30 2.1 0.59 Exhibit 5 KELLY SERVICES, INC. Pro Forma 1986 Results for Alternative Capital Structures (dollars in millions, except per share data) Actual Sales Earnings before intetest & taxes Interest Earnings before taxes Taxes Net earnings Dividends Shares outstanding (millions) Earnings/share Price/earnings Dividends/share Dividend yield Beginning of year Debt Net worth Stock price/share 876.4 64 0 64 31.4 32.6 8.9 16.15 2.02 12.38 0.55 2.20% 0 129.1 25 Pro Forma Percent Debt 30.00% 50.00% 70.00% 876.4 876.4 876.4 64 64 64 4.8 8.1 11.3 59.2 55.9 52.7 29.6 28 26.4 29.6 27.9 26.3 8.3 7.8 7.4 14.6 13.57 12.53 2.03 2.06 2.1 N.Av. N.Av. N.Av. 0.57 0.58 0.59 N.Av. N.Av. N.Av. 38.7 64.6 90.4 90.4 64.6 38.7 N.Av. N.Av. N.Av. 603 Exhibit 4 KELLY SERVICES, INC. Comparative Financial Statements 1984-1985 (dollars in millions, except per share data) Kelly Olsten Volt (December 31) (December 31) (December 31) 1984 1985 1984 1985 1984 1985 Sales 741.2 876.4 218.8 262.9 391.7 389.8 5-year growth 16.20% 17.60% 24.40% 25% 22.30% 18.60% Net profit 26.7 32.6 6 7.3 13 -6 5-year growth 17.10% 21.20% 23.20% 31% 9.60% c/c Earnings/share 1.65 2.02 0.74 0.9 1.77 -0.85 5-year growth 17.10% 21.20% 17.50% 24.70% 4.40% -5.50% Dividends share 0.46 0.56 0.12 0.16 0 0 5-year growth 20.10% 16% 15.70% 22.40% 0.00% 0.00% Average annual P/E 10.9 12.8 10.5 15.9 Dividend payout ratio 27.90% 27.70% 16.20% 17.80% 0.00% 0.00% Cash 39.5 47.9 15.6 20.8 37.2 27.2 Total current assets 126.2 151.9 55 63.5 190.2 159.4 Total assets 148.9 178.6 59.8 71.8 361 309 Total current liabilities 40.2 49.5 23.6 29.4 115 73.9 Long-term debt 0 0 0 0 125.9 125.9 Long-term debt & capital leases 0 0 0 127.3 127.3 Net worth 108.8 129.1 36.2 42.3 115.5 102.8 Tax rate (5-year average) 49.50% 49.40% 48% 47.70% 46.10% 45.70% 18 25 18 30 17 20 Stock price (end of year) Beta 0.75 0.75 1.25 1.25 1.4 1.4 Rerurn on sales 3.70% 2.70% 2.80% 3.30% -1.50% 3.60% 17.90% 18.30% 10.00% 10.20% Rerurn on assets 3.60% -1.90% Return on capital 5.40% -2.60% 24.50% 25.30% 16.60% 17.30% 24.50% 25.30% 16.60% 17.30% 11.30% Return on equity -5.80% Common shares (millions) 16.19 16.15 8.11 8.13 7.35 7.05 O 00 0 11.9 na Exhibit 3 KELLY SERVICES, INC. Quarterly Stock Price Data 500 1980 1 102.9 2 114.2 3 125.5 135.8 136 131.2 116.2 122.6 111.9 109.6 122.4 139.4 151.9 166.4 167.2 164.4 159.2 168.1 166.1 165 153.2 166.1 167.2 180.7 4 1981 1 23 4 1982 1 2 3 4 1983 1 2 3 4 1984 1 2 3 4 1985 1 2 3 4 Common High Low 8.625 5.125 7.25 6.25 9.875 7.25 9.375 8.75 11.25 8.875 13.75 11.125 13.75 11.5 13.5 11.625 12.5 10.875 12.875 9.5 10.625 7.875 13.125 9.875 15 12.125 16.25 14 17.5 16.125 20 16 20 17.75 18 17.25 Class A High 20.5 21.25 23.25 28 29.375 Low Class B Low 16.5 20.125 15.5 16 20.5 13.25 18 23 18.25 22 30.125 23.125 25.5 29.375 26.125 26.5 25 29 24.875 High Exhibit 2 KELLY SERVICES, INC. Financial Data (dollars in millions, except per share data) 1976 Sales 152.4 Net income 5.7 Earnings/share 0.35 Dividends/share Common 0.09 Class A common N.Ap. Class B common N.Ap. Assets 37 Cash 0 Net working capital 22 Stockholders' equity 27.4 Average P/E ratio 5.5 Average dividend yield 4.50% Return on sales 3.70% Return on assets 15.40% Return on equity 20.80% Shares outstanding (000): Common 16266 Class A Class B Beta 1977 202.6 7.3 0.45 0.1 N.Ap. N.Ap. 44.5 0 20.1 32.8 6.9 3.50% 3.60% 16.40% 22.30% 16303 1978 1979 1980 1981 279 369.3 409.7 462.6 12.6 15 15.2 18.2 0.77 0.91 0.92 1.1 0.14 0.19 0.26 0.3 N.Ap. N.Ap. N.Ap. N.Ap. N.Ap. N.Ap. N.Ap. N.Ap. 60.3 75.1 87.9 104.2 0 9.8 22.5 37.9 27.5 38 48.3 60.9 42.8 54.7 65.7 78.4 6.8 6.1 8.6 10.6 3.50% 3.40% 2.50% 4.10% 3.70% 3.90% 3.20% 4.50% 20.90% 20.00% 29.40% 27.40% 16365 16489 16563 16553 1982 1983 1985 419.9 524.4 741.2 876.4 12 17.5 26.7 32.6 0.72 1.08 1.65 2.02 0.36 0.38 N.Ap. N.Ap. N.Ap. N.Ap. 0.46 0.55 N.Ap. N.Ap. 0.37 0.45 108.8 124.2 148.9 178.6 47.7 35.7 39.5 48.1 67 71.5 86 102.4 84.2 89.4 108.8 129.1 15.1 15 10.9 12.4 3.30% 2.40% 2.50% 2.20% 3.70% 2.80% 3.30% 3.60% 17.30% 17.50% 11.00% 14.10% 17.90% 18.30% 23.10% 23.20% 14.20% 19.60% 24.50% 25.30% 16539 16174 16192 16147 13875 13946 2317 2201 0.75 0.75 1984 Exhibit 1 KELLY SERVICES, INC. Interest Rates on Debt of Different Quality Year Month Prime 1980 1981 1982 1983 1984 1985 1 2 3 4 5 6 7 8 9 10 11 12 U.S. Treasury Bonds Corporate Bonds Aa A 3 Years 10 Years Aaa 11.55 11.46 11.94 15.27 12.5 12.89 18.87 14.44 13.91 14.17 14.75 15.29 14.86 12.92 13 13.79 14.41 15.43 10.79 10.45 11.1 12.04 12.42 13.1 12.04 11.89 12.44 12.71 13.31 13.74 10.61 10.43 11.38 11.37 11.82 12.28 10.5 10.55 11.51 12.13 12.49 12.8 10.5 11.05 11.85 12.56 12.91 13.36 10.5 10.49 11.43 12.23 12.69 13.14 10.31 9.75 10.85 11.72 12.3 12.7 9.78 9.05 10.16 10.94 11.46 11.98 9.5 9.18 10.31 10.97 11.42 11.92 9.5 9.31 10.33 11.05 11.47 12 9.5 9.37 10.37 11.07 11.46 11.99 9.5 9.25 10.24 11.02 11.45 11.94 9.5 8.88 9.78 10.55 11.07 11.54 9.5 8.4 9.25 10.16 10.63 11.19 in in Il Baa 13.67 16.04 16.11 13.55 14.19 12.72 13.23 13.69 13.51 13.15 12.4 12.43 12.5 12.48 12.36 11.99 11.58