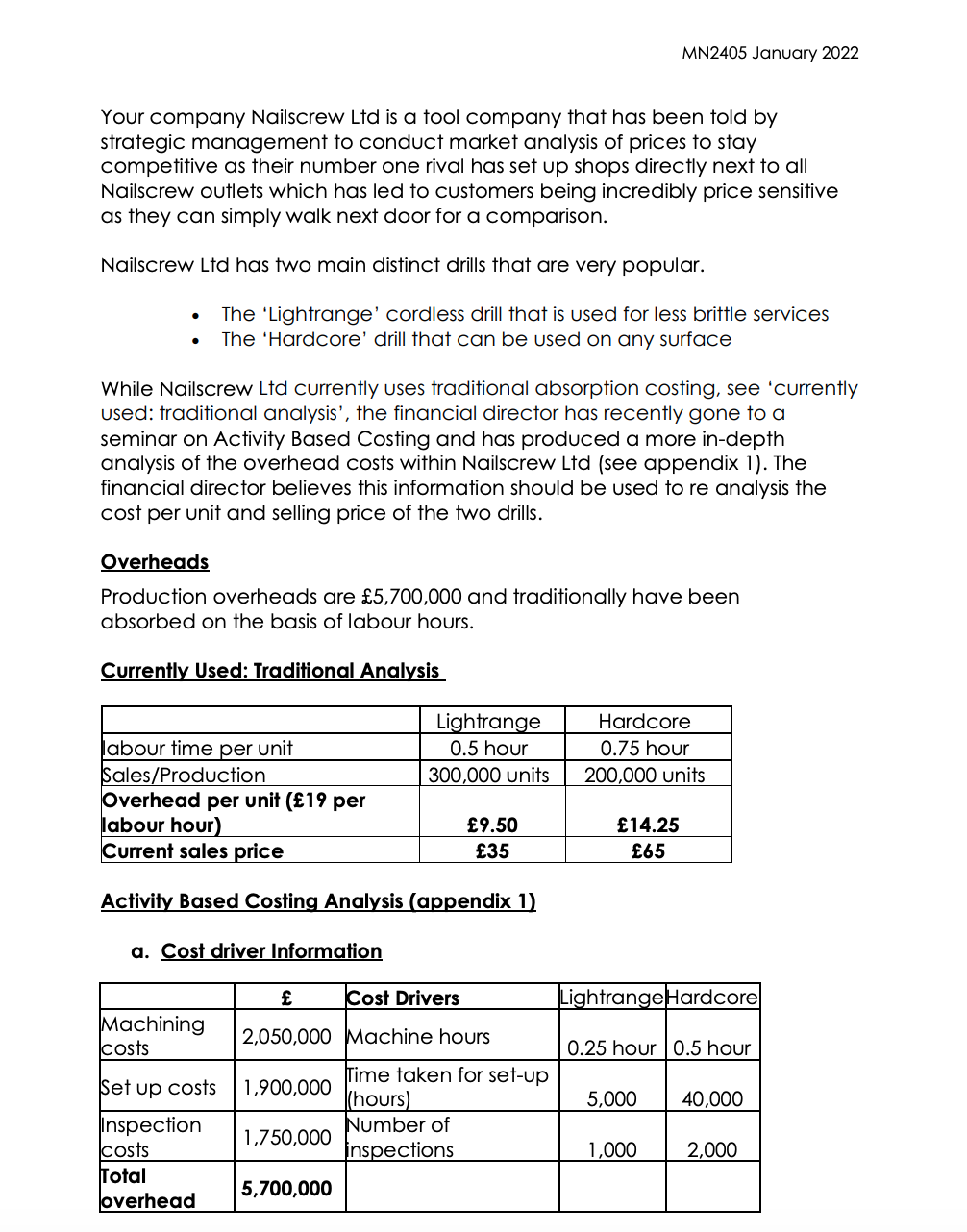

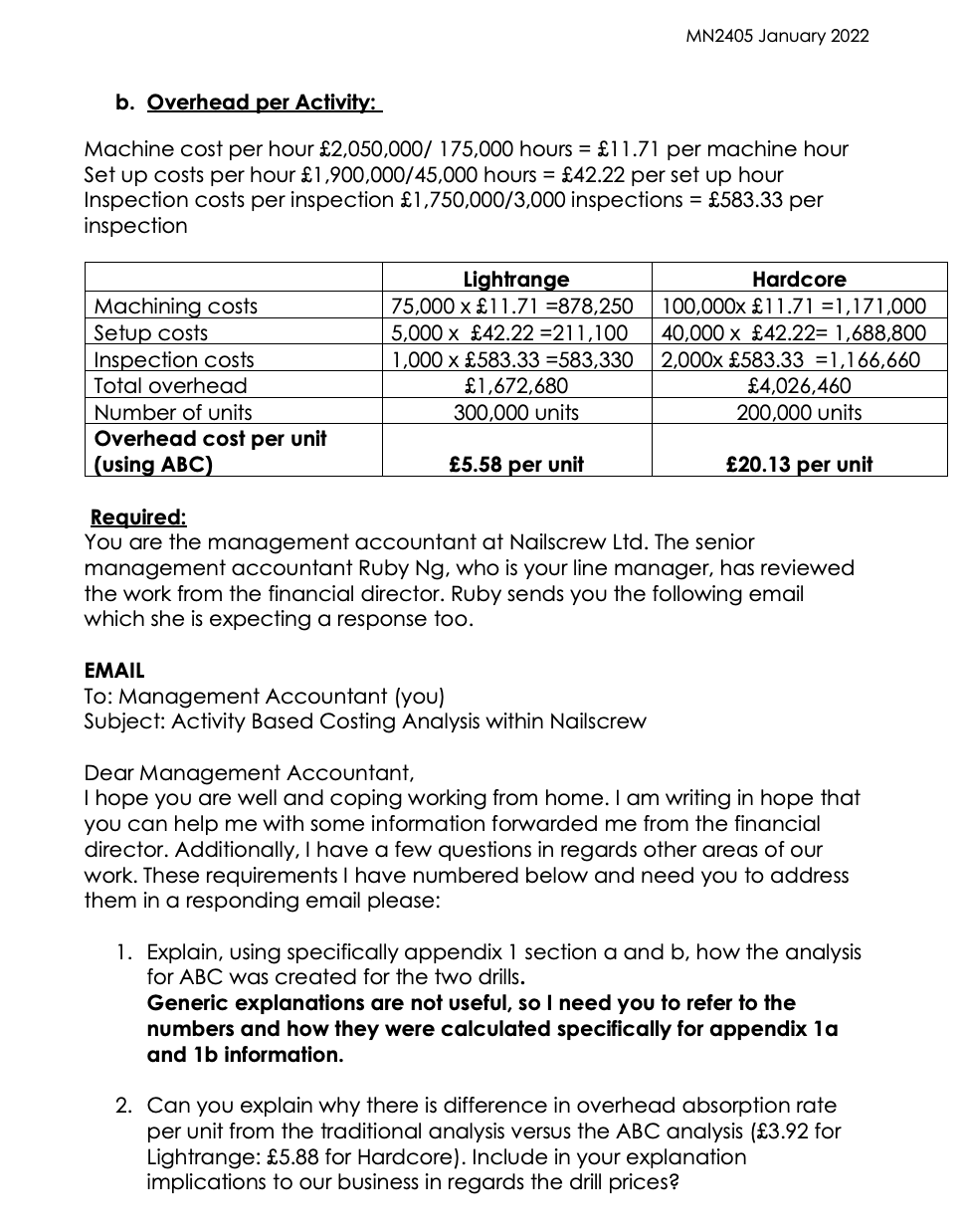

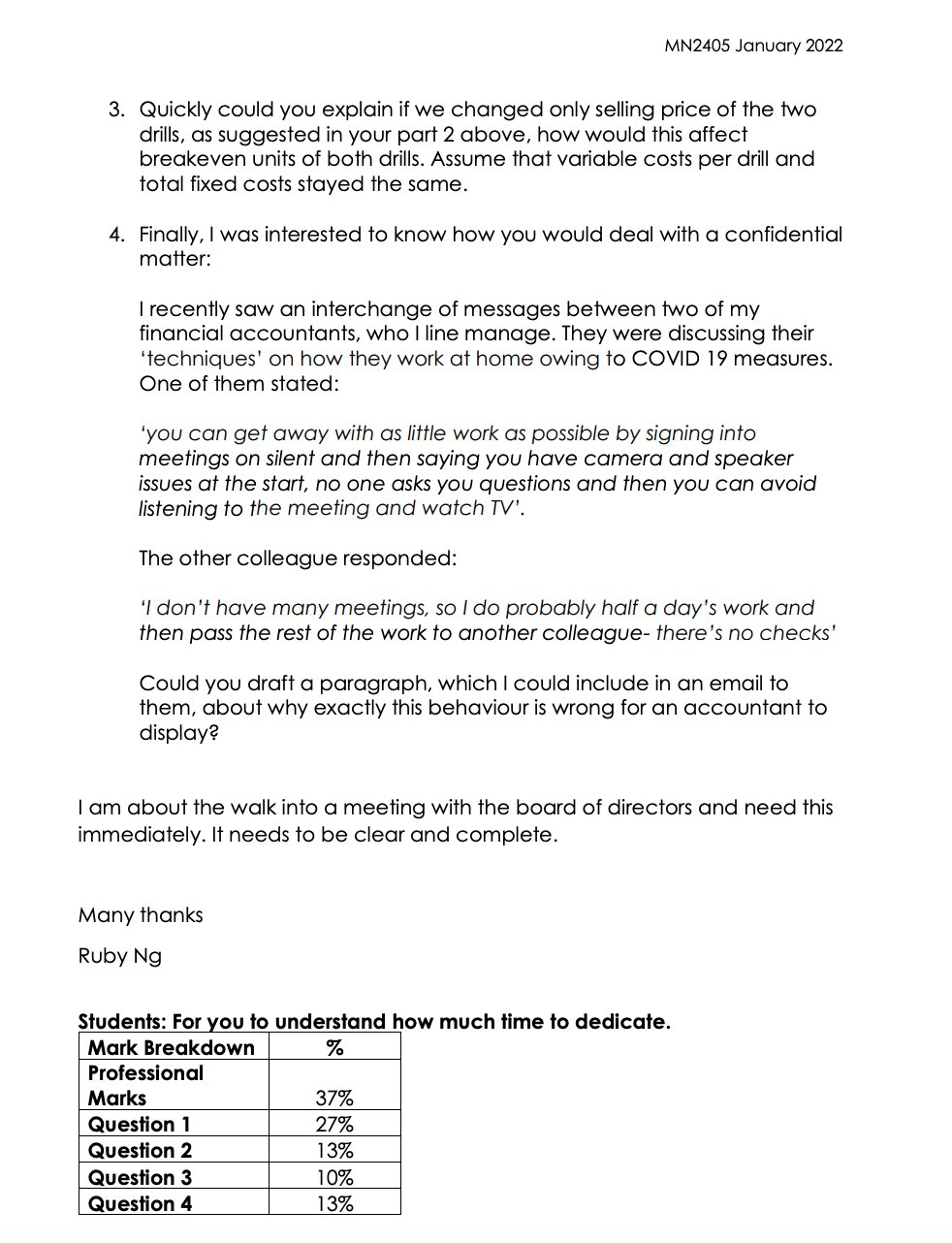

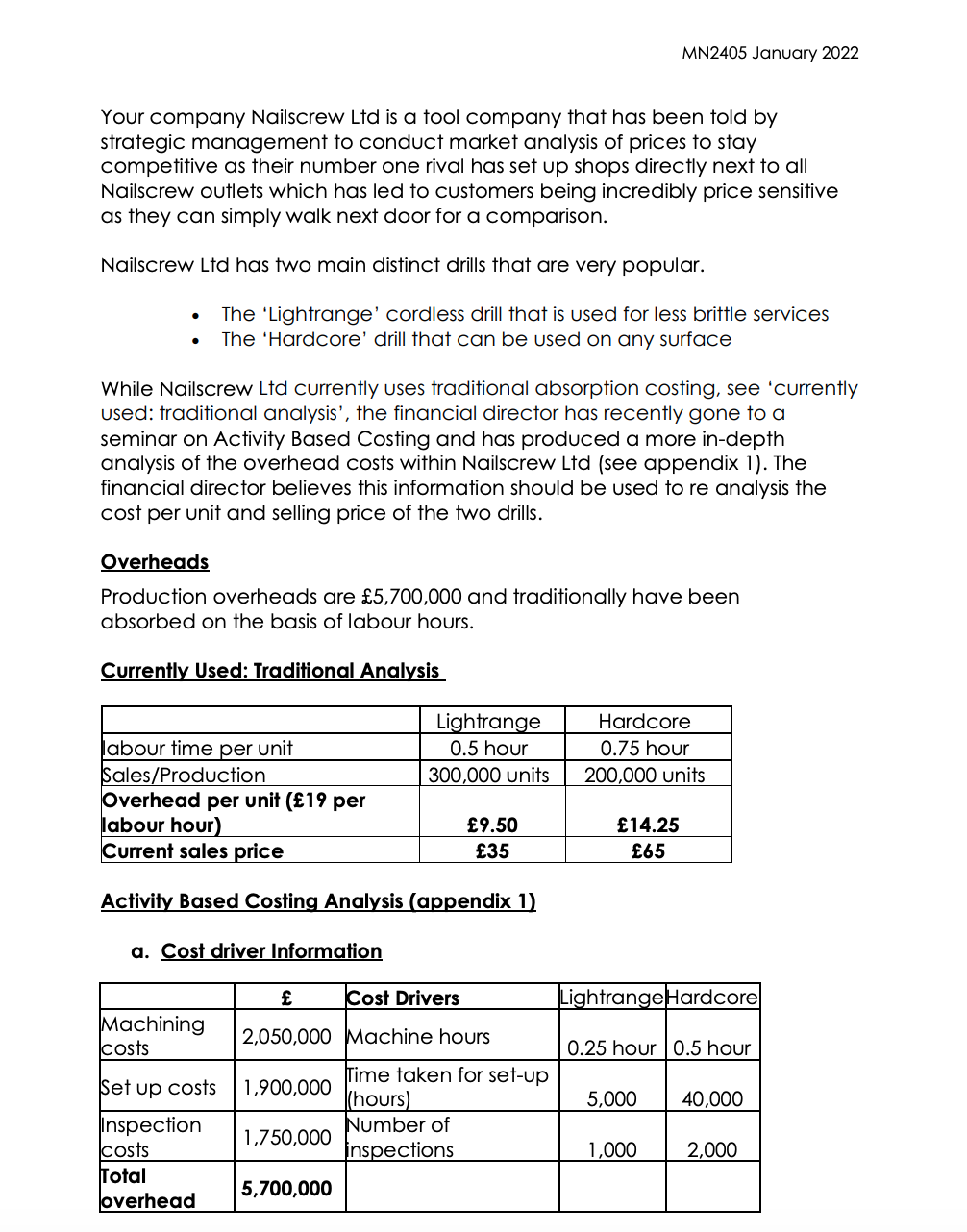

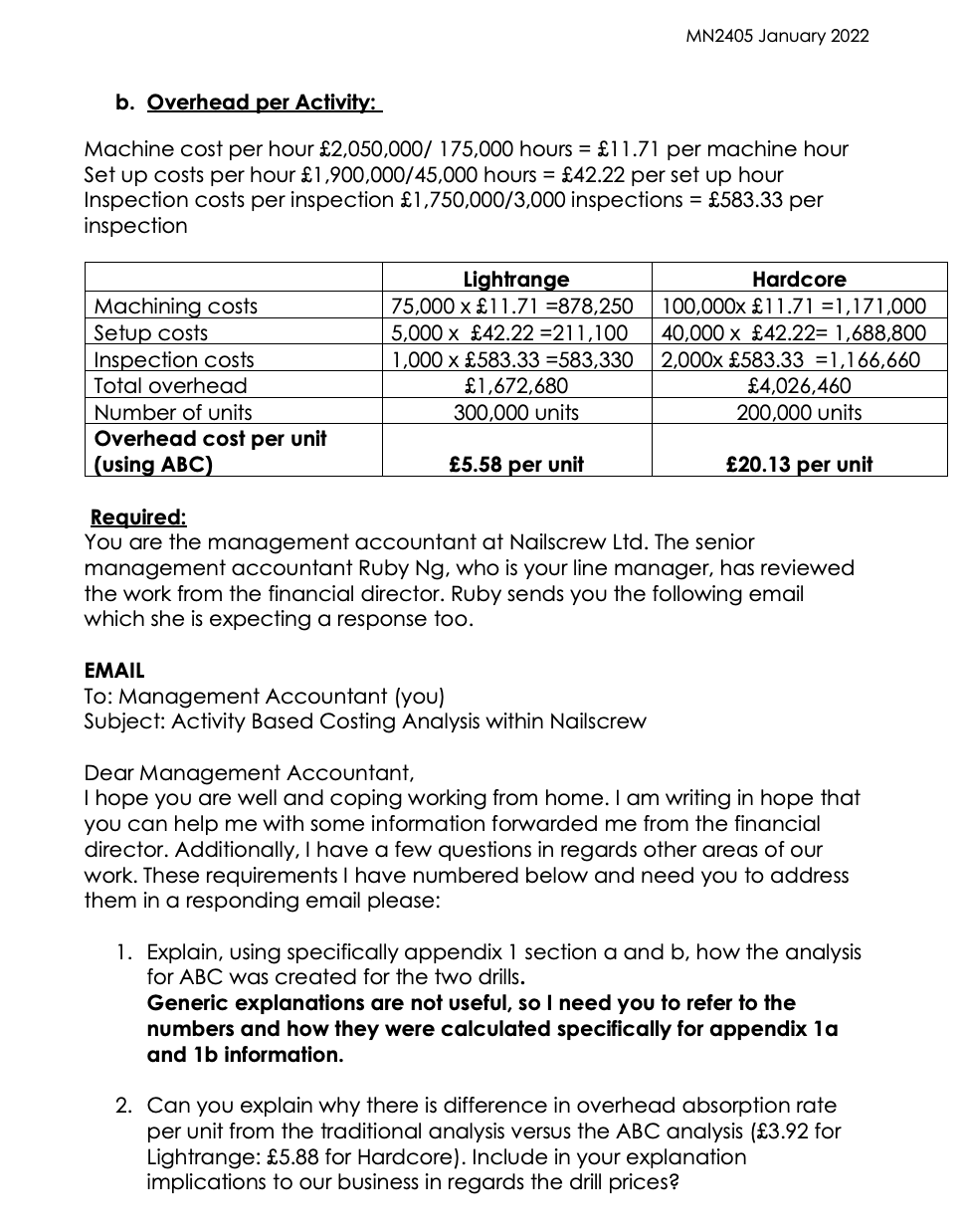

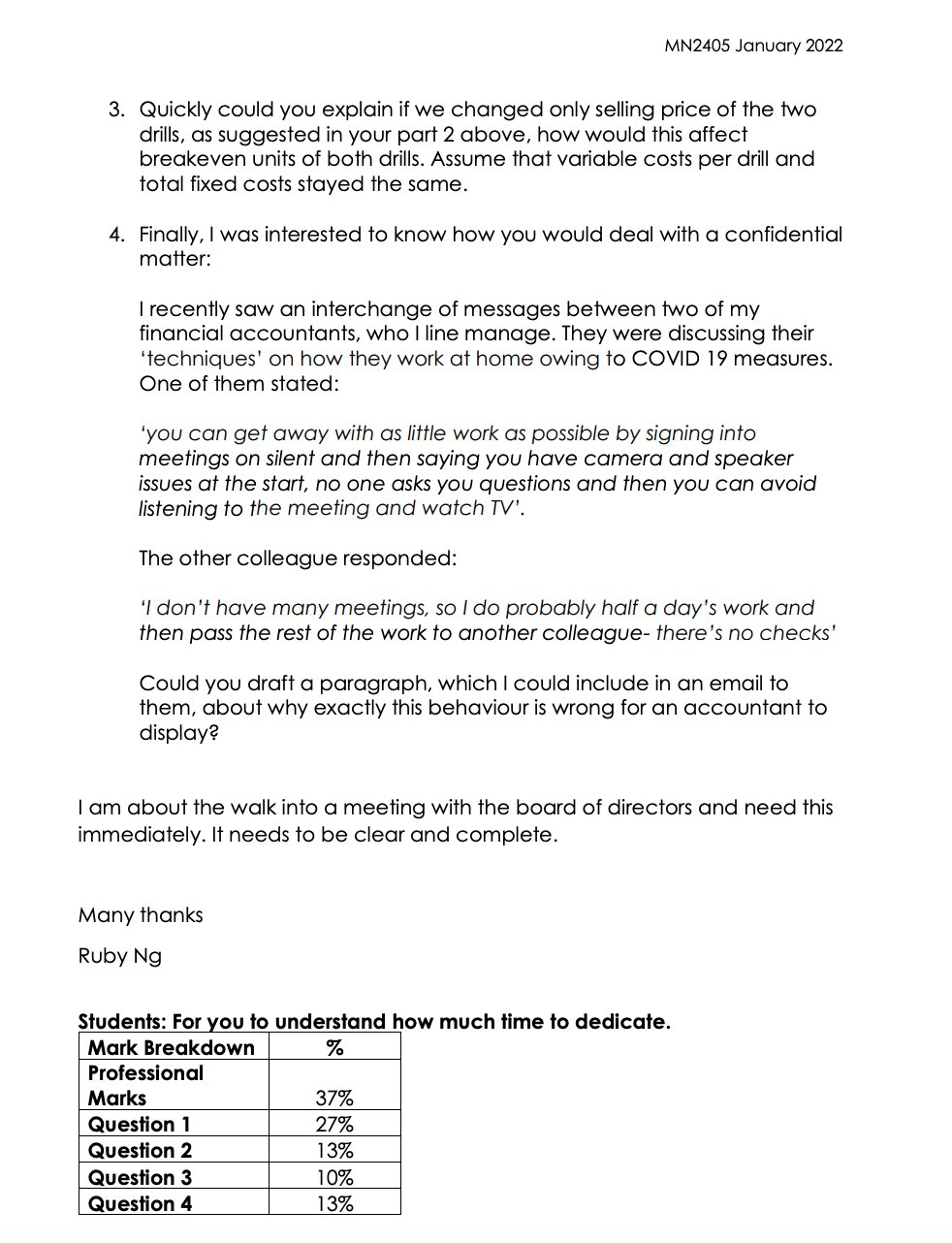

MN2405 January 2022 Your company Nailscrew Ltd is a tool company that has been told by strategic management to conduct market analysis of prices to stay competitive as their number one rival has set up shops directly next to all Nailscrew outlets which has led to customers being incredibly price sensitive as they can simply walk next door for a comparison. Nailscrew Ltd has two main distinct drills that are very popular. The 'Lightrange' cordless drill that is used for less brittle services The 'Hardcore' drill that can be used on any surface While Nailscrew Ltd currently uses traditional absorption costing, see 'currently used: traditional analysis', the financial director has recently gone to a seminar on Activity Based Costing and has produced a more in-depth analysis of the overhead costs within Nailscrew Ltd (see appendix 1). The financial director believes this information should be used to re analysis the cost per unit and selling price of the two drills. Overheads Production overheads are 5,700,000 and traditionally have been absorbed on the basis of labour hours. Currently Used: Traditional Analysis Lightrange 0.5 hour 300,000 units Hardcore 0.75 hour 200,000 units abour time per unit Sales/Production Overhead per unit (19 per labour hour) Current sales price 9.50 35 14.25 65 Activity Based Costing Analysis (appendix 1) a. Cost driver Information Cost Drivers Lightrange Hardcore Machining costs 2,050,000 Machine hours 0.25 hour 0.5 hour Set up costs 1,900,000 5,000 40,000 Time taken for set-up (hours) Number of inspections 1,750,000 1,000 2,000 Inspection costs Total overhead 5,700,000 MN2405 January 2022 b. Overhead per Activity: Machine cost per hour 2,050,000/ 175,000 hours = 11.71 per machine hour Set up costs per hour 1,900,000/45,000 hours = 42.22 per set up hour Inspection costs per inspection 1,750,000/3,000 inspections = 583.33 per inspection Machining costs Setup costs Inspection costs Total overhead Number of units Overhead cost per unit (using ABC) Lightrange 75,000 x 11.71 =878,250 5,000 x 42.22 =211,100 1,000 x 583.33 =583,330 1,672,680 300,000 units Hardcore 100,000x 11.71 =1,171,000 40,000 x 42.22= 1,688,800 2,000x 583.33 =1,166,660 4,026,460 200,000 units 5.58 per unit 20.13 per unit Required: You are the management accountant at Nailscrew Ltd. The senior management accountant Ruby Ng, who is your line manager, has reviewed the work from the financial director. Ruby sends you the following email which she is expecting a response too. EMAIL To: Management Accountant (you) Subject: Activity Based Costing Analysis within Nailscrew Dear Management Accountant, I hope you are well and coping working from home. I am writing in hope that you can help me with some information forwarded me from the financial director. Additionally, I have a few questions in regards other areas of our work. These requirements I have numbered below and need you to address them in a responding email please: 1. Explain, using specifically appendix 1 section a and b, how the analysis for ABC was created for the two drills. Generic explanations are not useful, so I need you to refer to the numbers and how they were calculated specifically for appendix la and lb information. 2. Can you explain why there is difference in overhead absorption rate per unit from the traditional analysis versus the ABC analysis (3.92 for Lightrange: 5.88 for Hardcore). Include in your explanation implications to our business in regards the drill prices? MN2405 January 2022 3. Quickly could you explain if we changed only selling price of the two drills, as suggested in your part 2 above, how would this affect breakeven units of both drills. Assume that variable costs per drill and total fixed costs stayed the same. 4. Finally, I was interested to know how you would deal with a confidential matter: I recently saw an interchange of messages between two of my financial accountants, who I line manage. They were discussing their 'techniques' on how they work at home owing to COVID 19 measures. One of them stated: 'you can get away with as little work as possible by signing into meetings on silent and then saying you have camera and speaker issues at the start, no one asks you questions and then you can avoid listening to the meeting and watch TV'. The other colleague responded: 'I don't have many meetings, so I do probably half a day's work and then pass the rest of the work to another colleague- there's no checks' Could you draft a paragraph, which I could include in an email to them, about why exactly this behaviour is wrong for an accountant to display? I am about the walk into a meeting with the board of directors and need this immediately. It needs to be clear and complete. Many thanks Ruby Ng Students: For you to understand how much time to dedicate. Mark Breakdown % Professional Marks 37% Question 1 27% Question 2 13% Question 3 10% Question 4 13% MN2405 January 2022 Your company Nailscrew Ltd is a tool company that has been told by strategic management to conduct market analysis of prices to stay competitive as their number one rival has set up shops directly next to all Nailscrew outlets which has led to customers being incredibly price sensitive as they can simply walk next door for a comparison. Nailscrew Ltd has two main distinct drills that are very popular. The 'Lightrange' cordless drill that is used for less brittle services The 'Hardcore' drill that can be used on any surface While Nailscrew Ltd currently uses traditional absorption costing, see 'currently used: traditional analysis', the financial director has recently gone to a seminar on Activity Based Costing and has produced a more in-depth analysis of the overhead costs within Nailscrew Ltd (see appendix 1). The financial director believes this information should be used to re analysis the cost per unit and selling price of the two drills. Overheads Production overheads are 5,700,000 and traditionally have been absorbed on the basis of labour hours. Currently Used: Traditional Analysis Lightrange 0.5 hour 300,000 units Hardcore 0.75 hour 200,000 units abour time per unit Sales/Production Overhead per unit (19 per labour hour) Current sales price 9.50 35 14.25 65 Activity Based Costing Analysis (appendix 1) a. Cost driver Information Cost Drivers Lightrange Hardcore Machining costs 2,050,000 Machine hours 0.25 hour 0.5 hour Set up costs 1,900,000 5,000 40,000 Time taken for set-up (hours) Number of inspections 1,750,000 1,000 2,000 Inspection costs Total overhead 5,700,000 MN2405 January 2022 b. Overhead per Activity: Machine cost per hour 2,050,000/ 175,000 hours = 11.71 per machine hour Set up costs per hour 1,900,000/45,000 hours = 42.22 per set up hour Inspection costs per inspection 1,750,000/3,000 inspections = 583.33 per inspection Machining costs Setup costs Inspection costs Total overhead Number of units Overhead cost per unit (using ABC) Lightrange 75,000 x 11.71 =878,250 5,000 x 42.22 =211,100 1,000 x 583.33 =583,330 1,672,680 300,000 units Hardcore 100,000x 11.71 =1,171,000 40,000 x 42.22= 1,688,800 2,000x 583.33 =1,166,660 4,026,460 200,000 units 5.58 per unit 20.13 per unit Required: You are the management accountant at Nailscrew Ltd. The senior management accountant Ruby Ng, who is your line manager, has reviewed the work from the financial director. Ruby sends you the following email which she is expecting a response too. EMAIL To: Management Accountant (you) Subject: Activity Based Costing Analysis within Nailscrew Dear Management Accountant, I hope you are well and coping working from home. I am writing in hope that you can help me with some information forwarded me from the financial director. Additionally, I have a few questions in regards other areas of our work. These requirements I have numbered below and need you to address them in a responding email please: 1. Explain, using specifically appendix 1 section a and b, how the analysis for ABC was created for the two drills. Generic explanations are not useful, so I need you to refer to the numbers and how they were calculated specifically for appendix la and lb information. 2. Can you explain why there is difference in overhead absorption rate per unit from the traditional analysis versus the ABC analysis (3.92 for Lightrange: 5.88 for Hardcore). Include in your explanation implications to our business in regards the drill prices? MN2405 January 2022 3. Quickly could you explain if we changed only selling price of the two drills, as suggested in your part 2 above, how would this affect breakeven units of both drills. Assume that variable costs per drill and total fixed costs stayed the same. 4. Finally, I was interested to know how you would deal with a confidential matter: I recently saw an interchange of messages between two of my financial accountants, who I line manage. They were discussing their 'techniques' on how they work at home owing to COVID 19 measures. One of them stated: 'you can get away with as little work as possible by signing into meetings on silent and then saying you have camera and speaker issues at the start, no one asks you questions and then you can avoid listening to the meeting and watch TV'. The other colleague responded: 'I don't have many meetings, so I do probably half a day's work and then pass the rest of the work to another colleague- there's no checks' Could you draft a paragraph, which I could include in an email to them, about why exactly this behaviour is wrong for an accountant to display? I am about the walk into a meeting with the board of directors and need this immediately. It needs to be clear and complete. Many thanks Ruby Ng Students: For you to understand how much time to dedicate. Mark Breakdown % Professional Marks 37% Question 1 27% Question 2 13% Question 3 10% Question 4 13%