Question

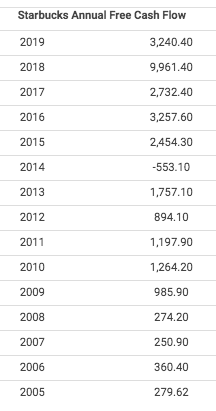

Please calculate the present value of Starbucks Corp. using it's free cash flow (FCF = cash flow from operating activities - cash flow from investment

Please calculate the present value of Starbucks Corp. using it's free cash flow (FCF = cash flow from operating activities - cash flow from investment activities).

Use it's cash flow statements from 2005 to 2019; Necessary Economic conditions are as follows: Discount rate 5%, Growth Rate 2%, Inflation Rate 2%.

Provide 3 limitations of this method you found while applying it to Starbucks (e.g. limited application, assumptions on future, regression analysis, etc.)

Be sure to provide rationales for why you think it's a limitation. Please also use Excel Spreadsheet.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started