Please calculate the Solvency ratio for Mar 31, 2019 and Dec 31,2018. Pleases show your work and the formula.

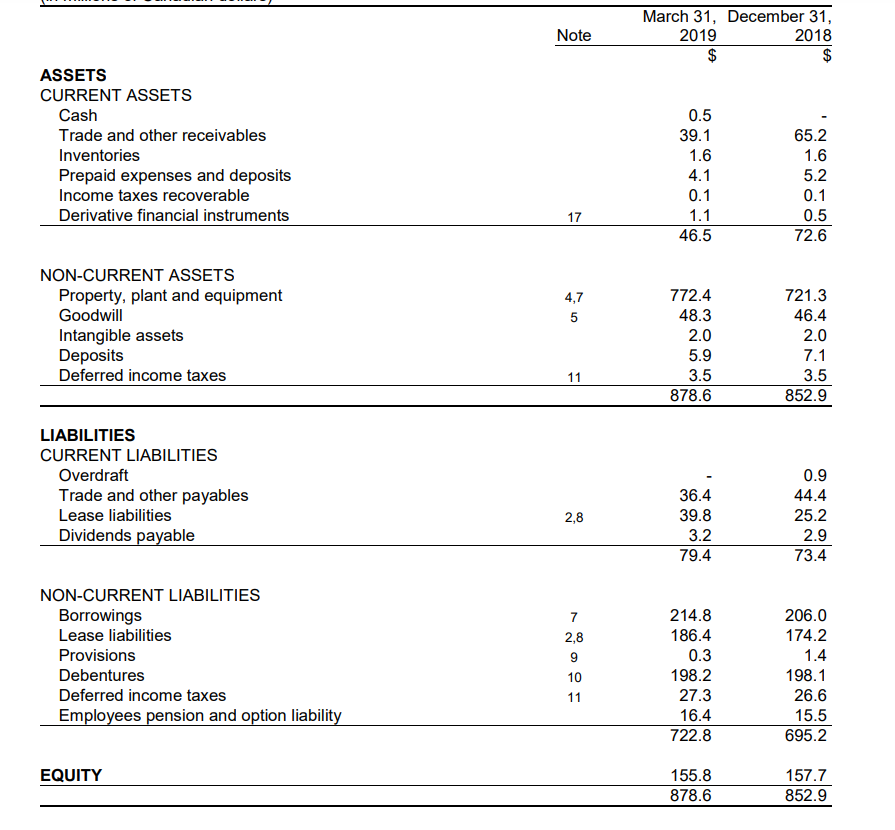

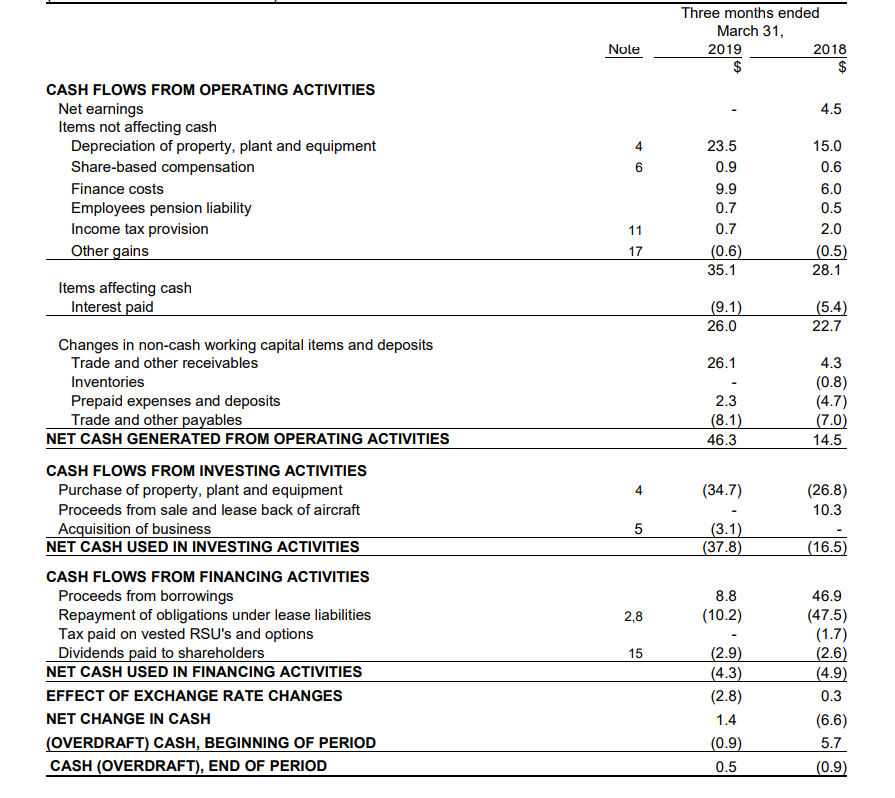

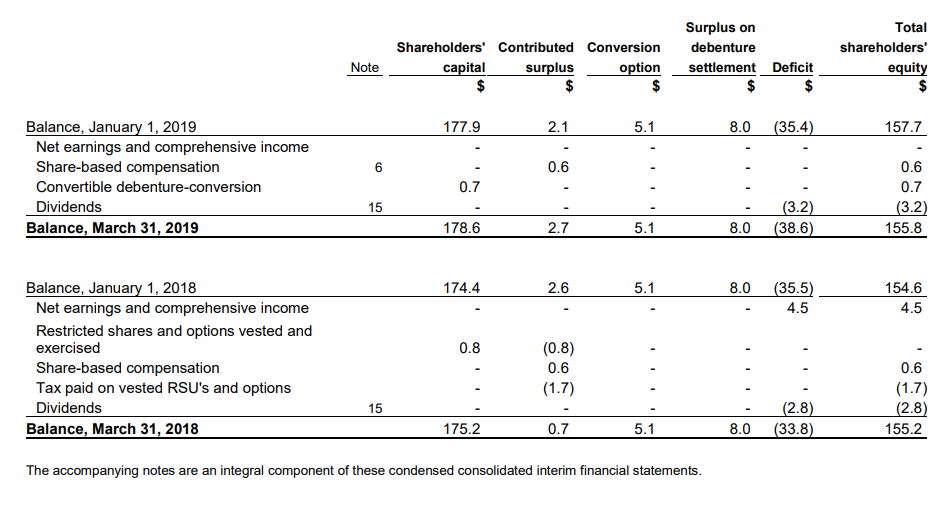

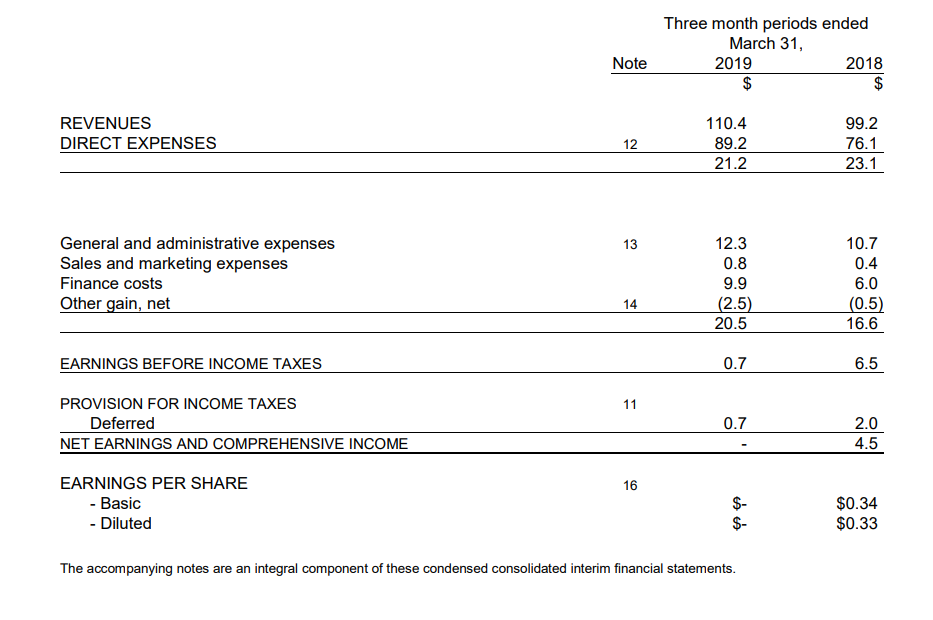

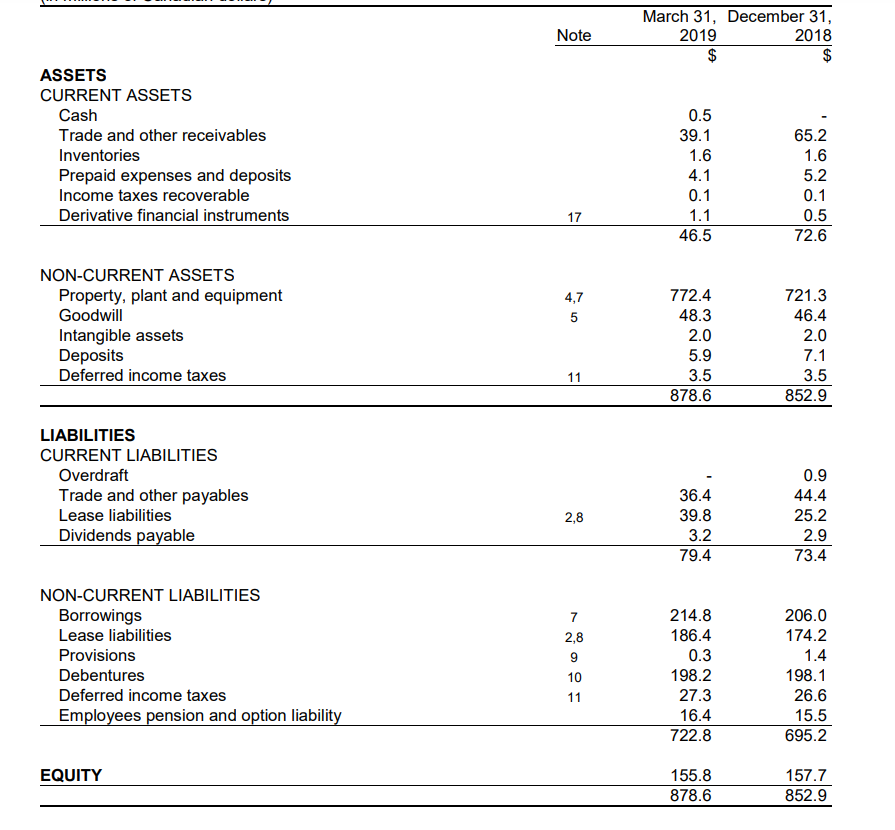

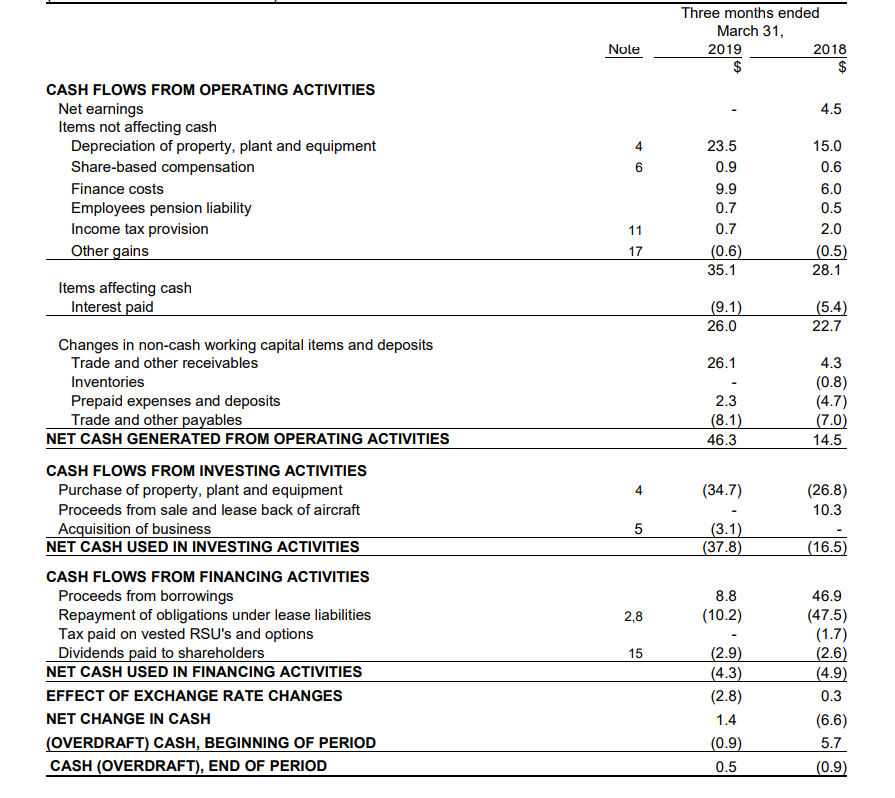

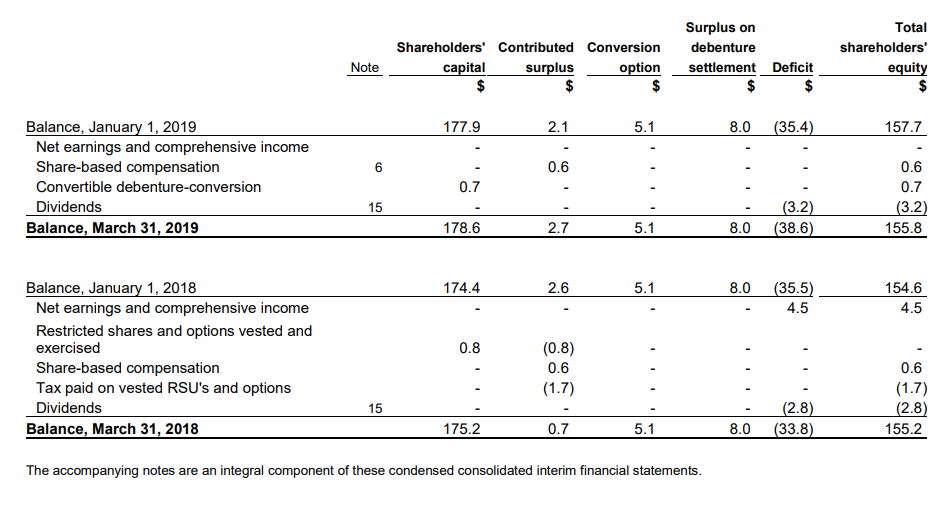

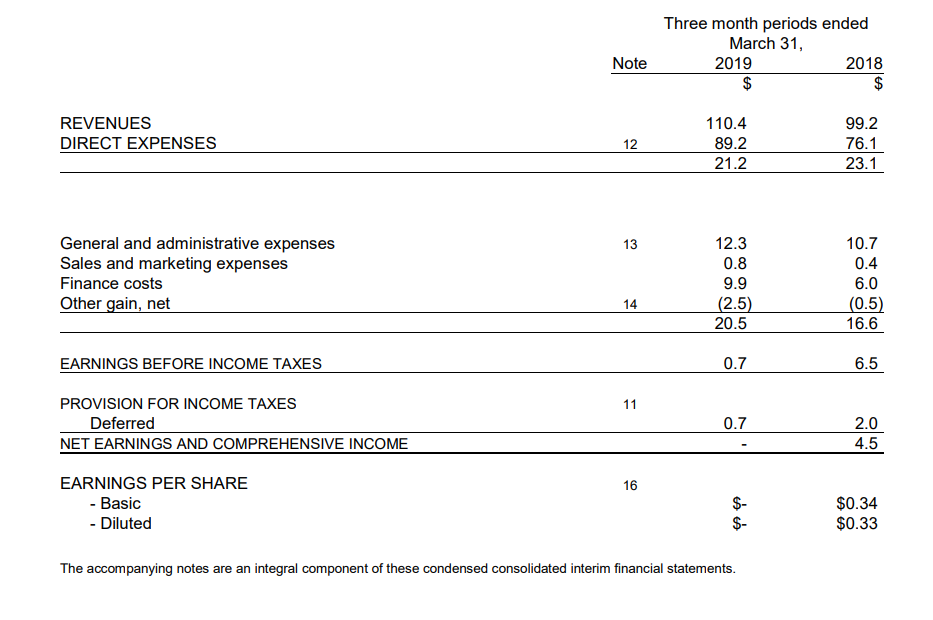

ASSETS CURRENT ASSETS Cash Trade and other receivables Inventories Prepaid expenses and deposits Income taxes recoverable Derivative financial instruments NON-CURRENT ASSETS Property, plant and equipment Goodwill Intangible assets Deposits Deferred income taxes LIABILITIES CURRENT LIABILITIES Overdraft Trade and other payables Lease liabilities Dividends payable NON-CURRENT LIABILITIES Borrowings Lease liabilities Provisions Debentures Deferred income taxes Employees pension and option liability EQUITY Note 17 4,7 5 11 2,8 7 2,8 9 10 11 March 31, December 31, 2019 2018 $ $ 0.5 39.1 1.6 4.1 0.1 1.1 46.5 772.4 48.3 2.0 5.9 3.5 878.6 36.4 39.8 3.2 79.4 214.8 186.4 0.3 198.2 27.3 16.4 722.8 155.8 878.6 65.2 1.6 5.2 0.1 0.5 72.6 721.3 46.4 2.0 7.1 3.5 852.9 0.9 44.4 25.2 2.9 73.4 206.0 174.2 1.4 198.1 26.6 15.5 695.2 157.7 852.9 CASH FLOWS FROM OPERATING ACTIVITIES Net earnings Items not affecting cash Depreciation of property, plant and equipment Share-based compensation Finance costs Employees pension liability Income tax provision Other gains Items affecting cash Interest paid Changes in non-cash working capital items and deposits Trade and other receivables Inventories Prepaid expenses and deposits Trade and other payables NET CASH GENERATED FROM OPERATING ACTIVITIES CASH FLOWS FROM INVESTING ACTIVITIES Purchase of property, plant and equipment Proceeds from sale and lease back of aircraft Acquisition of business NET CASH USED IN INVESTING ACTIVITIES CASH FLOWS FROM FINANCING ACTIVITIES Proceeds from borrowings Repayment of obligations under lease liabilities Tax paid on vested RSU's and options Dividends paid to shareholders NET CASH USED IN FINANCING ACTIVITIES EFFECT OF EXCHANGE RATE CHANGES NET CHANGE IN CASH (OVERDRAFT) CASH, BEGINNING OF PERIOD CASH (OVERDRAFT), END OF PERIOD Note 4 6 11 17 4 5 2,8 15 Three months ended March 31, 2019 $ 23.5 0.9 9.9 0.7 0.7 (0.6) 35.1 (9.1) 26.0 26.1 2.3 (8.1) 46.3 (34.7) (3.1) (37.8) 8.8 (10.2) (2.9) (4.3) (2.8) 1.4 (0.9) 0.5 2018 4.5 15.0 0.6 6.0 0.5 2.0 (0.5) 28.1 (5.4) 22.7 4.3 (0.8) (4.7) (7.0) 14.5 (26.8) 10.3 (16.5) 46.9 (47.5) (1.7) (2.6) (4.9) 0.3 (6.6) 5.7 (0.9) Note Shareholders' Contributed Conversion option capital surplus $ $ $ Balance, January 1, 2019 177.9 2.1 5.1 Net earnings and comprehensive income Share-based compensation 0.6 Convertible debenture-conversion 0.7 Dividends Balance, March 31, 2019 178.6 2.7 5.1 Balance, January 1, 2018 174.4 2.6 5.1 Net earnings and comprehensive income Restricted shares and options vested and exercised 0.8 (0.8) Share-based compensation 0.6 (1.7) Tax paid on vested RSU's and options Dividends 15 Balance, March 31, 2018 175.2 0.7 5.1 The accompanying notes are an integral component of these condensed consolidated interim financial statements. Surplus on debenture settlement Deficit $ $ 8.0 (35.4) (3.2) 8.0 (38.6) 8.0 (35.5) 4.5 (2.8) 8.0 (33.8) 6 15 Total shareholders' equity $ 157.7 0.6 0.7 (3.2) 155.8 154.6 4.5 0.6 (1.7) (2.8) 155.2 Three month periods ended March 31, 2019 2018 $ $ 99.2 76.1 23.1 10.7 0.4 6.0 (0.5) 16.6 6.5 2.0 4.5 $0.34 $0.33 Note REVENUES DIRECT EXPENSES 12 13 General and administrative expenses Sales and marketing expenses Finance costs Other gain, net 14 EARNINGS BEFORE INCOME TAXES PROVISION FOR INCOME TAXES 11 Deferred NET EARNINGS AND COMPREHENSIVE INCOME EARNINGS PER SHARE 16 - Basic - Diluted The accompanying notes are an integral component of these condensed consolidated interim financial statements. 110.4 89.2 21.2 12.3 0.8 9.9 (2.5) 20.5 0.7 0.7