Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please calculate WACC for an French company operating in Healthcare Products sector assuming (please provide links o webpages used in the estimations): a. application of

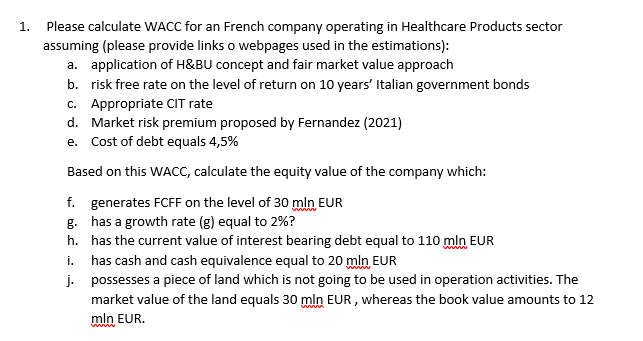

Please calculate WACC for an French company operating in Healthcare Products sector assuming (please provide links o webpages used in the estimations): a. application of H&BU concept and fair market value approach b. risk free rate on the level of return on 10 years' Italian government bonds c. Appropriate CIT rate d. Market risk premium proposed by Fernandez (2021) e. Cost of debt equals 4,5% Based on this WACC, calculate the equity value of the company which: f. generates FCFF on the level of 30mln EUR g. has a growth rate (g) equal to 2% ? h. has the current value of interest bearing debt equal to 110mln EUR i. has cash and cash equivalence equal to 20mln EUR j. possesses a piece of land which is not going to be used in operation activities. The market value of the land equals 30mln EUR, whereas the book value amounts to 12 mln EUR

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started