Please can you answer question 1-3? Thank you!

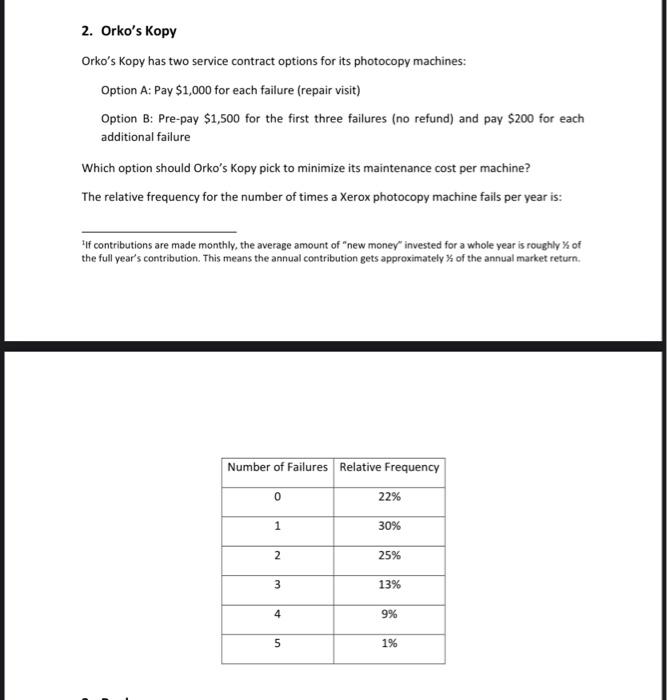

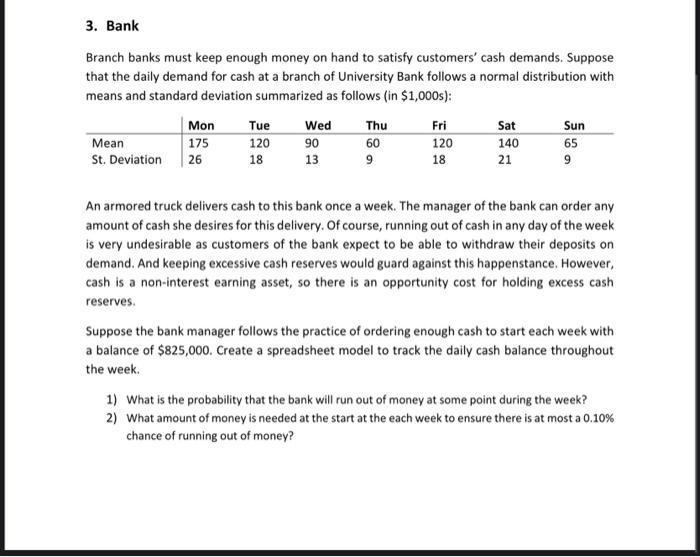

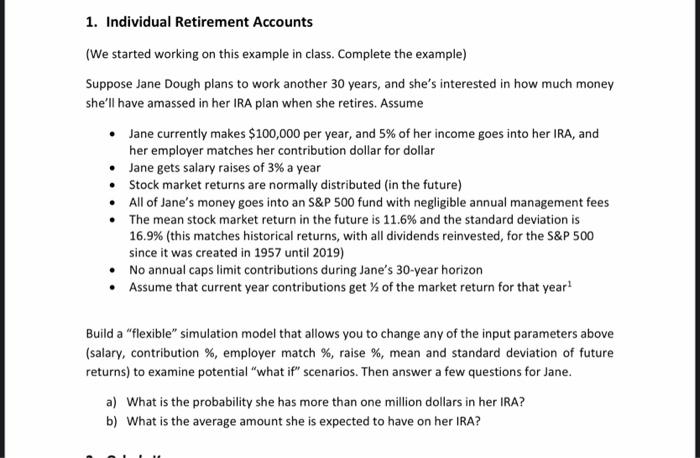

1. Individual Retirement Accounts (We started working on this example in class. Complete the example) Suppose Jane Dough plans to work another 30 years, and she's interested in how much money she'll have amassed in her IRA plan when she retires. Assume Jane currently makes $100,000 per year, and 5% of her income goes into her IRA, and her employer matches her contribution dollar for dollar Jane gets salary raises of 3% a year Stock market returns are normally distributed in the future) All of Jane's money goes into an S&P 500 fund with negligible annual management fees The mean stock market return in the future is 11.6% and the standard deviation is 16.9% (this matches historical returns, with all dividends reinvested, for the S&P 500 since it was created in 1957 until 2019) No annual caps limit contributions during Jane's 30-year horizon Assume that current year contributions get 1 of the market return for that year! Build a "flexible" simulation model that allows you to change any of the input parameters above (salary, contribution %, employer match %, raise %, mean and standard deviation of future returns) to examine potential "what if" scenarios. Then answer a few questions for Jane. a) What is the probability she has more than one million dollars in her IRA? b) What is the average amount she is expected to have on her IRA? 2. Orko's Kopy Orko's Kopy has two service contract options for its photocopy machines: Option A: Pay $1,000 for each failure (repair visit) Option B: Pre-pay $1,500 for the first three failures (no refund) and pay $200 for each additional failure Which option should Orko's Kopy pick to minimize its maintenance cost per machine? The relative frequency for the number of times a Xerox photocopy machine fails per year is: If contributions are made monthly, the average amount of "new money" invested for a whole year is roughly of the full year's contribution. This means the annual contribution gets approximately of the annual market return. Number of Failures Relative Frequency 0 22% 1 30% 2 25% 3 3 13% 4 9% 5 1% 3. Bank Branch banks must keep enough money on hand to satisfy customers' cash demands. Suppose that the daily demand for cash at a branch of University Bank follows a normal distribution with means and standard deviation summarized as follows (in $1,000s): Mon Tue Wed Thu Fri Sat Sun Mean 175 120 90 60 120 140 65 St. Deviation 18 13 9 18 21 9 26 An armored truck delivers cash to this bank once a week. The manager of the bank can order any amount of cash she desires for this delivery. Of course, running out of cash in any day of the week is very undesirable as customers of the bank expect to be able to withdraw their deposits on demand. And keeping excessive cash reserves would guard against this happenstance. However, cash is a non-interest earning asset, so there is an opportunity cost for holding excess cash reserves Suppose the bank manager follows the practice of ordering enough cash to start each week with a balance of $825,000. Create a spreadsheet model to track the daily cash balance throughout the week. 1) What is the probability that the bank will run out of money at some point during the week? 2) What amount of money is needed at the start at the each week to ensure there is at most a 0.10% chance of running out of money? 1. Individual Retirement Accounts (We started working on this example in class. Complete the example) Suppose Jane Dough plans to work another 30 years, and she's interested in how much money she'll have amassed in her IRA plan when she retires. Assume Jane currently makes $100,000 per year, and 5% of her income goes into her IRA, and her employer matches her contribution dollar for dollar Jane gets salary raises of 3% a year Stock market returns are normally distributed in the future) All of Jane's money goes into an S&P 500 fund with negligible annual management fees The mean stock market return in the future is 11.6% and the standard deviation is 16.9% (this matches historical returns, with all dividends reinvested, for the S&P 500 since it was created in 1957 until 2019) No annual caps limit contributions during Jane's 30-year horizon Assume that current year contributions get 1 of the market return for that year! Build a "flexible" simulation model that allows you to change any of the input parameters above (salary, contribution %, employer match %, raise %, mean and standard deviation of future returns) to examine potential "what if" scenarios. Then answer a few questions for Jane. a) What is the probability she has more than one million dollars in her IRA? b) What is the average amount she is expected to have on her IRA? 2. Orko's Kopy Orko's Kopy has two service contract options for its photocopy machines: Option A: Pay $1,000 for each failure (repair visit) Option B: Pre-pay $1,500 for the first three failures (no refund) and pay $200 for each additional failure Which option should Orko's Kopy pick to minimize its maintenance cost per machine? The relative frequency for the number of times a Xerox photocopy machine fails per year is: If contributions are made monthly, the average amount of "new money" invested for a whole year is roughly of the full year's contribution. This means the annual contribution gets approximately of the annual market return. Number of Failures Relative Frequency 0 22% 1 30% 2 25% 3 3 13% 4 9% 5 1% 3. Bank Branch banks must keep enough money on hand to satisfy customers' cash demands. Suppose that the daily demand for cash at a branch of University Bank follows a normal distribution with means and standard deviation summarized as follows (in $1,000s): Mon Tue Wed Thu Fri Sat Sun Mean 175 120 90 60 120 140 65 St. Deviation 18 13 9 18 21 9 26 An armored truck delivers cash to this bank once a week. The manager of the bank can order any amount of cash she desires for this delivery. Of course, running out of cash in any day of the week is very undesirable as customers of the bank expect to be able to withdraw their deposits on demand. And keeping excessive cash reserves would guard against this happenstance. However, cash is a non-interest earning asset, so there is an opportunity cost for holding excess cash reserves Suppose the bank manager follows the practice of ordering enough cash to start each week with a balance of $825,000. Create a spreadsheet model to track the daily cash balance throughout the week. 1) What is the probability that the bank will run out of money at some point during the week? 2) What amount of money is needed at the start at the each week to ensure there is at most a 0.10% chance of running out of money