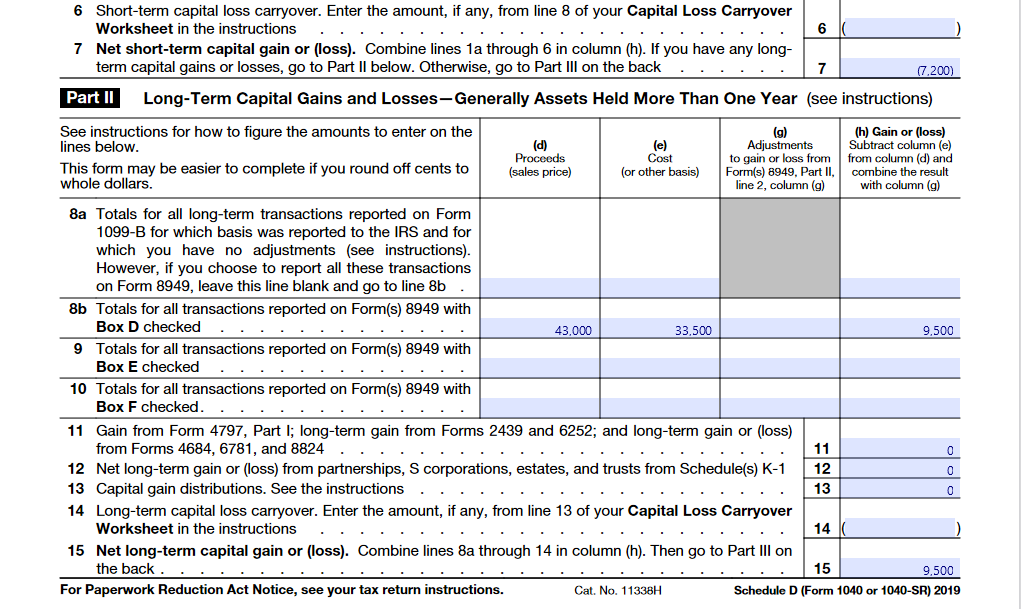

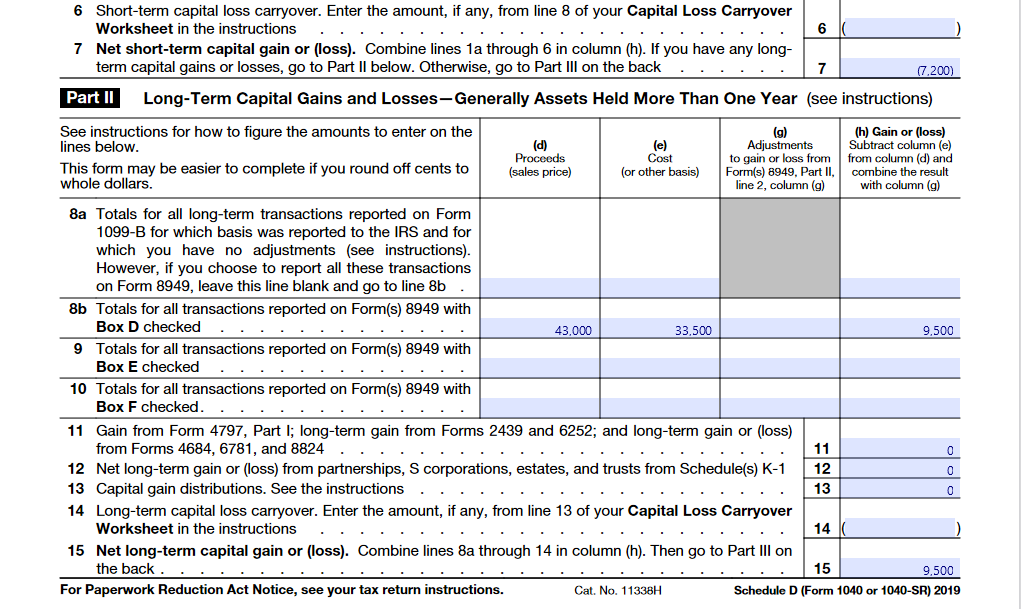

please can you explainme how you get 43,000 and 33,500 ?

please can you explainme how you get 43,000 and 33,500 ?

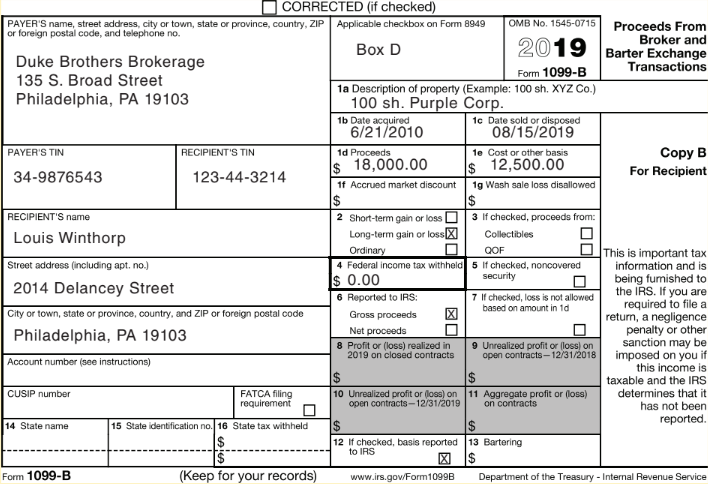

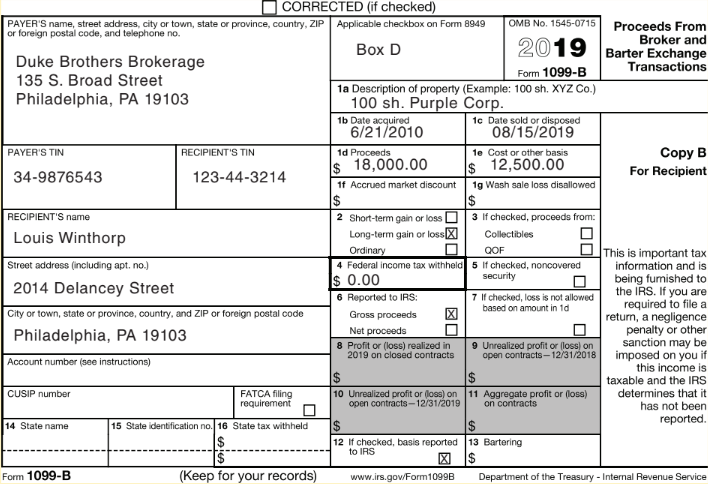

6 6 Short-term capital loss carryover. Enter the amount, if any, from line 8 of your Capital Loss Carryover Worksheet in the instructions 7 Net short-term capital gain or loss). Combine lines 1a through 6 in column (h). If you have any long- term capital gains or losses, go to Part II below. Otherwise, go to Part III on the back 7 (7.200) Part II Long-Term Capital Gains and Losses-Generally Assets Held More Than One Year (see instructions) See instructions for how to figure the amounts to enter on the lines below. This form may be easier to complete if you round off cents to whole dollars. (d) Proceeds (sales price) (e) Cost (or other basis) (g) Adjustments to gain or loss from Form(s) 8949, Part II line 2, column (g) (h) Gain or (loss) Subtract column (e) from column (d) and combine the result with column (g) 8a Totals for all long-term transactions reported on Form 1099-B for which basis was reported to the IRS and for which you have no adjustments (see instructions). However, if you choose to report all these transactions on Form 8949, leave this line blank and go to line 8b 8b Totals for all transactions reported on Form(s) 8949 with Box D checked 43,000 33.500 9,500 9 Totals for all transactions reported on Form(s) 8949 with Box E checked 10 Totals for all transactions reported on Form(s) 8949 with Box F checked. 11 Gain from Form 4797, Part 1; long-term gain from Forms 2439 and 6252; and long-term gain or loss) from Forms 4684, 6781, and 8824 .. 11 12 Net long-term gain or loss) from partnerships, S corporations, estates, and trusts from Schedule(s) K-1 12 13 Capital gain distributions. See the instructions 13 14 Long-term capital loss carryover. Enter the amount, if any, from line 13 of your Capital Loss Carryover Worksheet in the instructions 14 15 Net long-term capital gain or (loss). Combine lines 8a through 14 in column (h). Then go to Part III on the back 15 9.500 For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 11338H Schedule D (Form 1040 or 1040-SR) 2019 0 0 0 CORRECTED (if checked) PAYER'S name, street address, city or town, state or province, country, ZIP Applicable checkbox on Form 8949 OMB No. 1545-0715 or foreign postal code, and telephone no. Proceeds From Box D Broker and 2019 Duke Brothers Brokerage Barter Exchange Transactions 135 S. Broad Street Form 1099-B 1a Description of property (Example: 100 sh. XYZ Co.) Philadelphia, PA 19103 100 sh. Purple Corp. 1b Date acquired 1c Date sold or disposed 6/21/2010 08/15/2019 PAYER'S TIN RECIPIENT'S TIN 1d Proceeds 1e Cost or other basis Copy B $ 18,000.00 $ 12,500.00 34-9876543 123-44-3214 For Recipient 1f Accrued market discount 1g Wash sale loss disallowed $ $ RECIPIENT'S name 2 Short-term gain or loss D3 if checked, proceeds from: Louis Winthorp Long-term gain or loss Collectibles Ordinary QOF This is important tax Street address (including apt. no.) 4 Federal income tax withheld 5 If checked, noncovered information and is $ 0.00 Security 2014 Delancey Street being furnished to 6 Reported to IRS the IRS. If you are 7 If checked, loss is not allowed based on amount in 1d required to file a City or town, state or province, country, and ZIP or foreign postal code Gross proceeds return, a negligence Philadelphia, PA 19103 Net proceeds penalty or other 8 Profit or (loss) realized in 9 Unrealized profit or loss) on sanction may be 2019 on closed contracts open contracts-12/31/2018 imposed on you if Account number (see instructions) this income is $ $ taxable and the IRS CUSIP number FATCA filing 10 Unrealized profit or loss) on 11 Aggregate profit or (oss) determines that it requirement open contracts-12/31/2019 on contracts has not been 14 State name 15 State identification no. 16 State tax withheld $ reported. $ 12 If checked, basis reported 13 Bartering to IRS $ $ Form 1099-B (Keep for your records) www.irs.gov/Form 1099B Department of the Treasury - Internal Revenue Service 6 6 Short-term capital loss carryover. Enter the amount, if any, from line 8 of your Capital Loss Carryover Worksheet in the instructions 7 Net short-term capital gain or loss). Combine lines 1a through 6 in column (h). If you have any long- term capital gains or losses, go to Part II below. Otherwise, go to Part III on the back 7 (7.200) Part II Long-Term Capital Gains and Losses-Generally Assets Held More Than One Year (see instructions) See instructions for how to figure the amounts to enter on the lines below. This form may be easier to complete if you round off cents to whole dollars. (d) Proceeds (sales price) (e) Cost (or other basis) (g) Adjustments to gain or loss from Form(s) 8949, Part II line 2, column (g) (h) Gain or (loss) Subtract column (e) from column (d) and combine the result with column (g) 8a Totals for all long-term transactions reported on Form 1099-B for which basis was reported to the IRS and for which you have no adjustments (see instructions). However, if you choose to report all these transactions on Form 8949, leave this line blank and go to line 8b 8b Totals for all transactions reported on Form(s) 8949 with Box D checked 43,000 33.500 9,500 9 Totals for all transactions reported on Form(s) 8949 with Box E checked 10 Totals for all transactions reported on Form(s) 8949 with Box F checked. 11 Gain from Form 4797, Part 1; long-term gain from Forms 2439 and 6252; and long-term gain or loss) from Forms 4684, 6781, and 8824 .. 11 12 Net long-term gain or loss) from partnerships, S corporations, estates, and trusts from Schedule(s) K-1 12 13 Capital gain distributions. See the instructions 13 14 Long-term capital loss carryover. Enter the amount, if any, from line 13 of your Capital Loss Carryover Worksheet in the instructions 14 15 Net long-term capital gain or (loss). Combine lines 8a through 14 in column (h). Then go to Part III on the back 15 9.500 For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 11338H Schedule D (Form 1040 or 1040-SR) 2019 0 0 0 CORRECTED (if checked) PAYER'S name, street address, city or town, state or province, country, ZIP Applicable checkbox on Form 8949 OMB No. 1545-0715 or foreign postal code, and telephone no. Proceeds From Box D Broker and 2019 Duke Brothers Brokerage Barter Exchange Transactions 135 S. Broad Street Form 1099-B 1a Description of property (Example: 100 sh. XYZ Co.) Philadelphia, PA 19103 100 sh. Purple Corp. 1b Date acquired 1c Date sold or disposed 6/21/2010 08/15/2019 PAYER'S TIN RECIPIENT'S TIN 1d Proceeds 1e Cost or other basis Copy B $ 18,000.00 $ 12,500.00 34-9876543 123-44-3214 For Recipient 1f Accrued market discount 1g Wash sale loss disallowed $ $ RECIPIENT'S name 2 Short-term gain or loss D3 if checked, proceeds from: Louis Winthorp Long-term gain or loss Collectibles Ordinary QOF This is important tax Street address (including apt. no.) 4 Federal income tax withheld 5 If checked, noncovered information and is $ 0.00 Security 2014 Delancey Street being furnished to 6 Reported to IRS the IRS. If you are 7 If checked, loss is not allowed based on amount in 1d required to file a City or town, state or province, country, and ZIP or foreign postal code Gross proceeds return, a negligence Philadelphia, PA 19103 Net proceeds penalty or other 8 Profit or (loss) realized in 9 Unrealized profit or loss) on sanction may be 2019 on closed contracts open contracts-12/31/2018 imposed on you if Account number (see instructions) this income is $ $ taxable and the IRS CUSIP number FATCA filing 10 Unrealized profit or loss) on 11 Aggregate profit or (oss) determines that it requirement open contracts-12/31/2019 on contracts has not been 14 State name 15 State identification no. 16 State tax withheld $ reported. $ 12 If checked, basis reported 13 Bartering to IRS $ $ Form 1099-B (Keep for your records) www.irs.gov/Form 1099B Department of the Treasury - Internal Revenue Service

please can you explainme how you get 43,000 and 33,500 ?

please can you explainme how you get 43,000 and 33,500 ?