Please check all answers to confirm their correctness.

Dor the last question if Net Income before CCA is less than CCA, Net Income=CCA Claimed. If Net Income before CCA is equal to or greater than CCA, CCA=CCA Claimed.

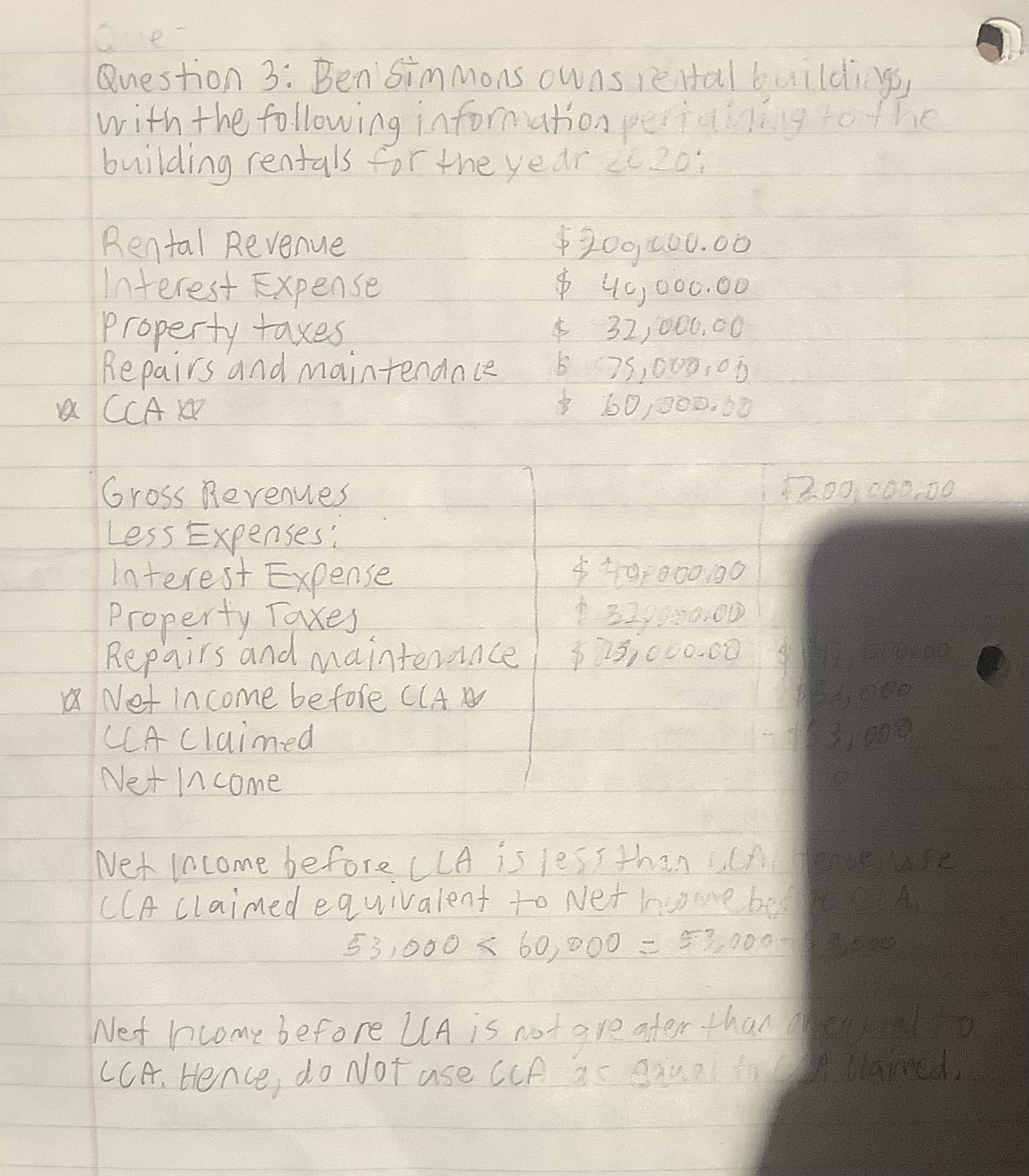

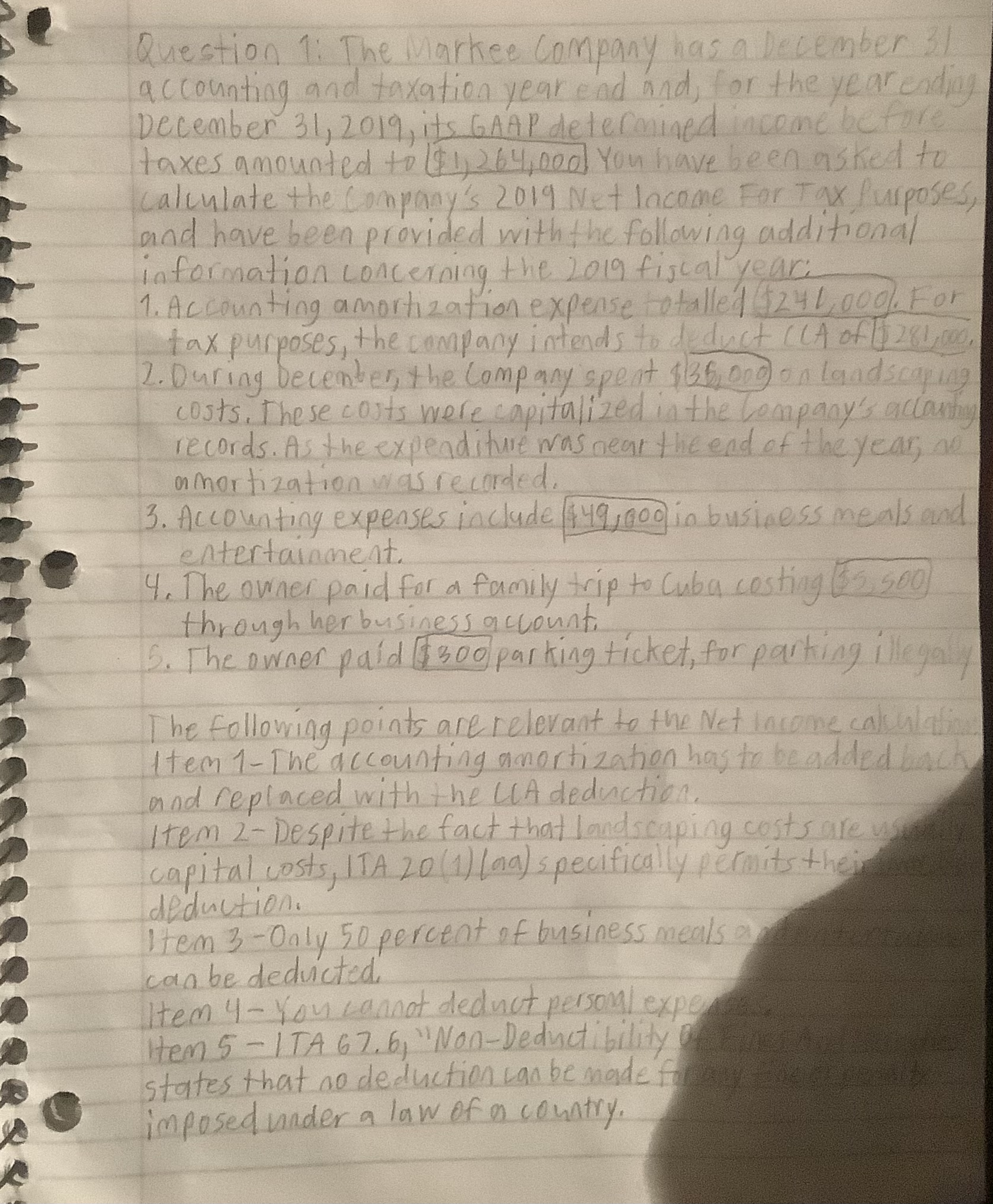

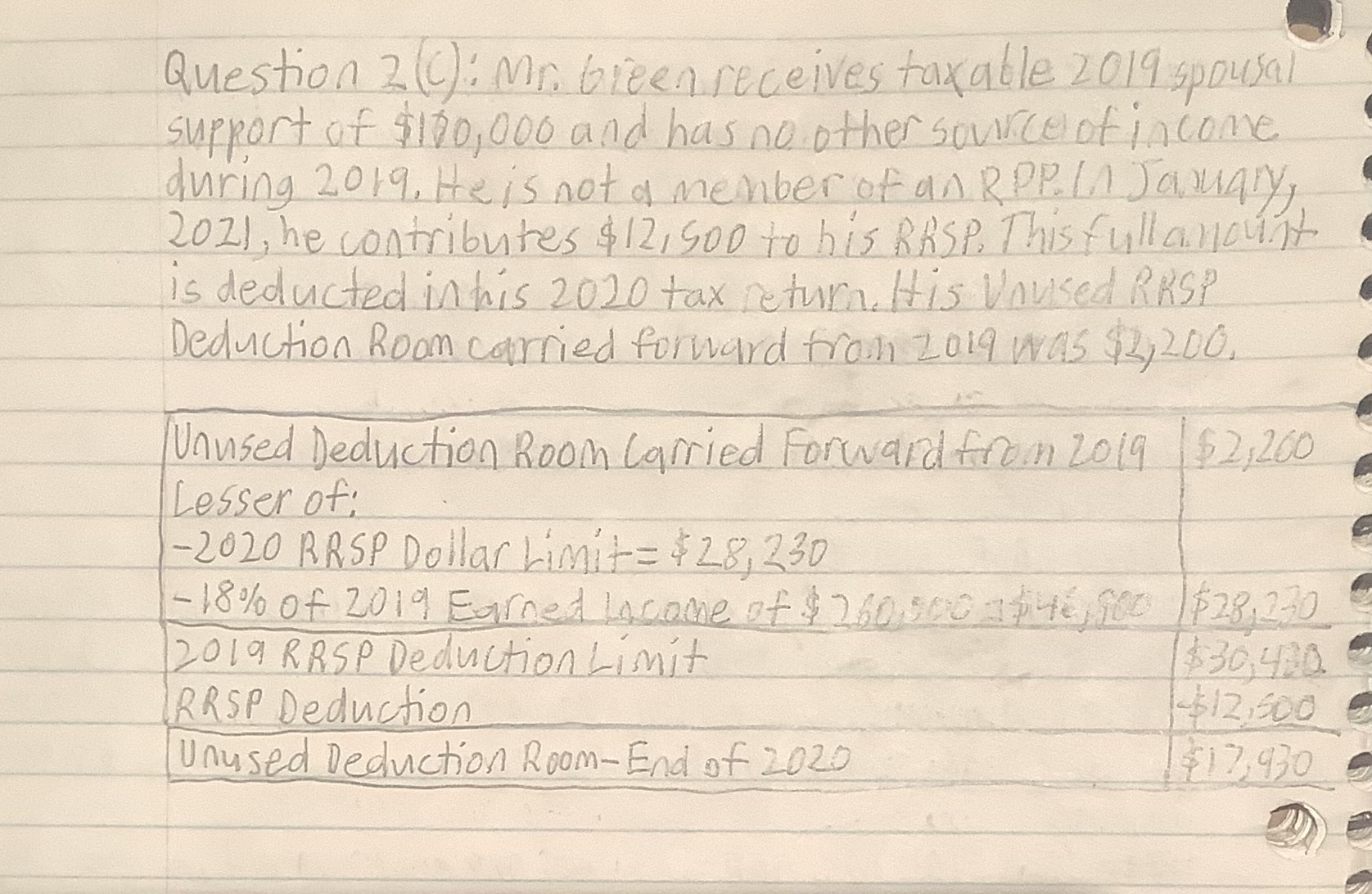

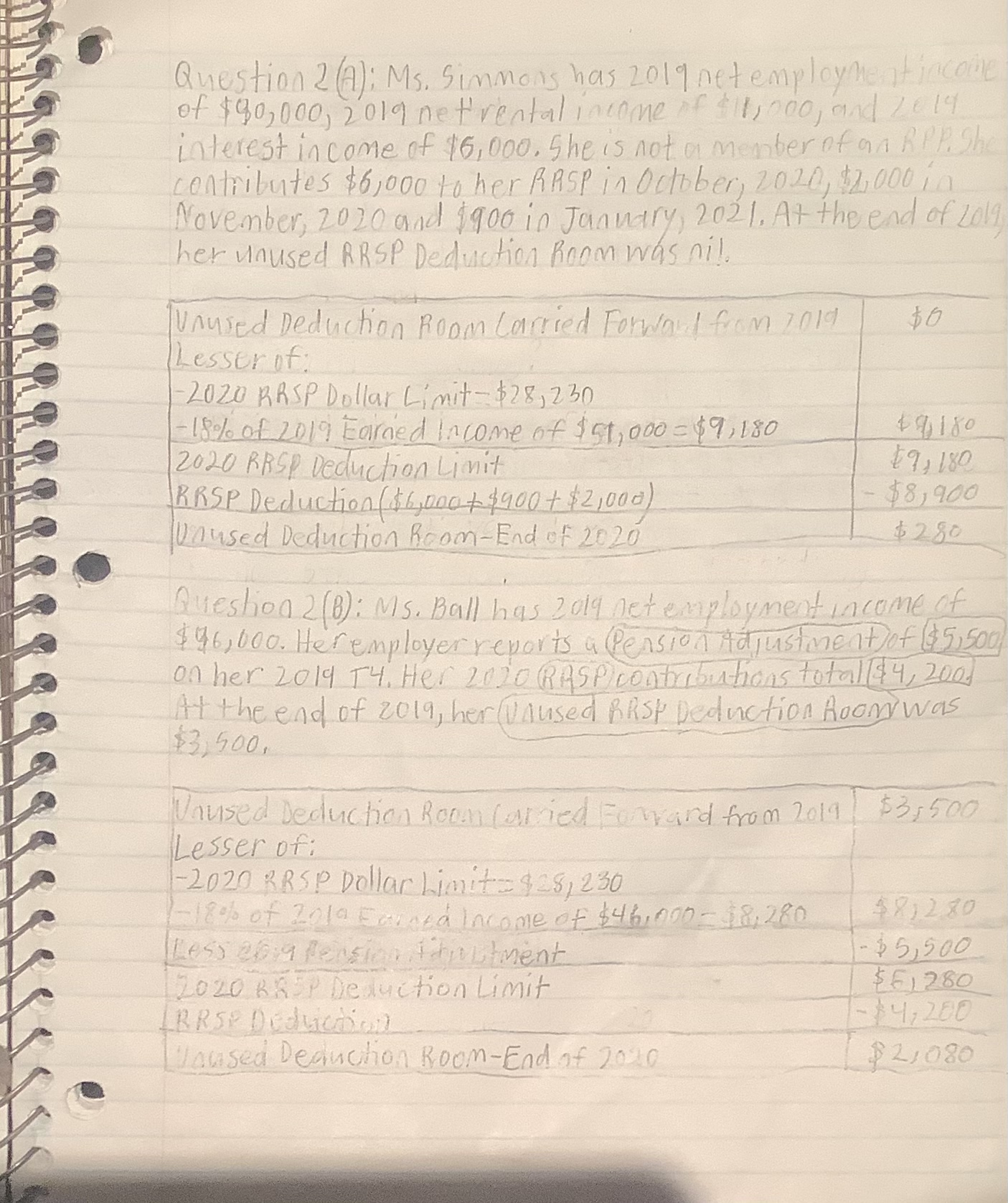

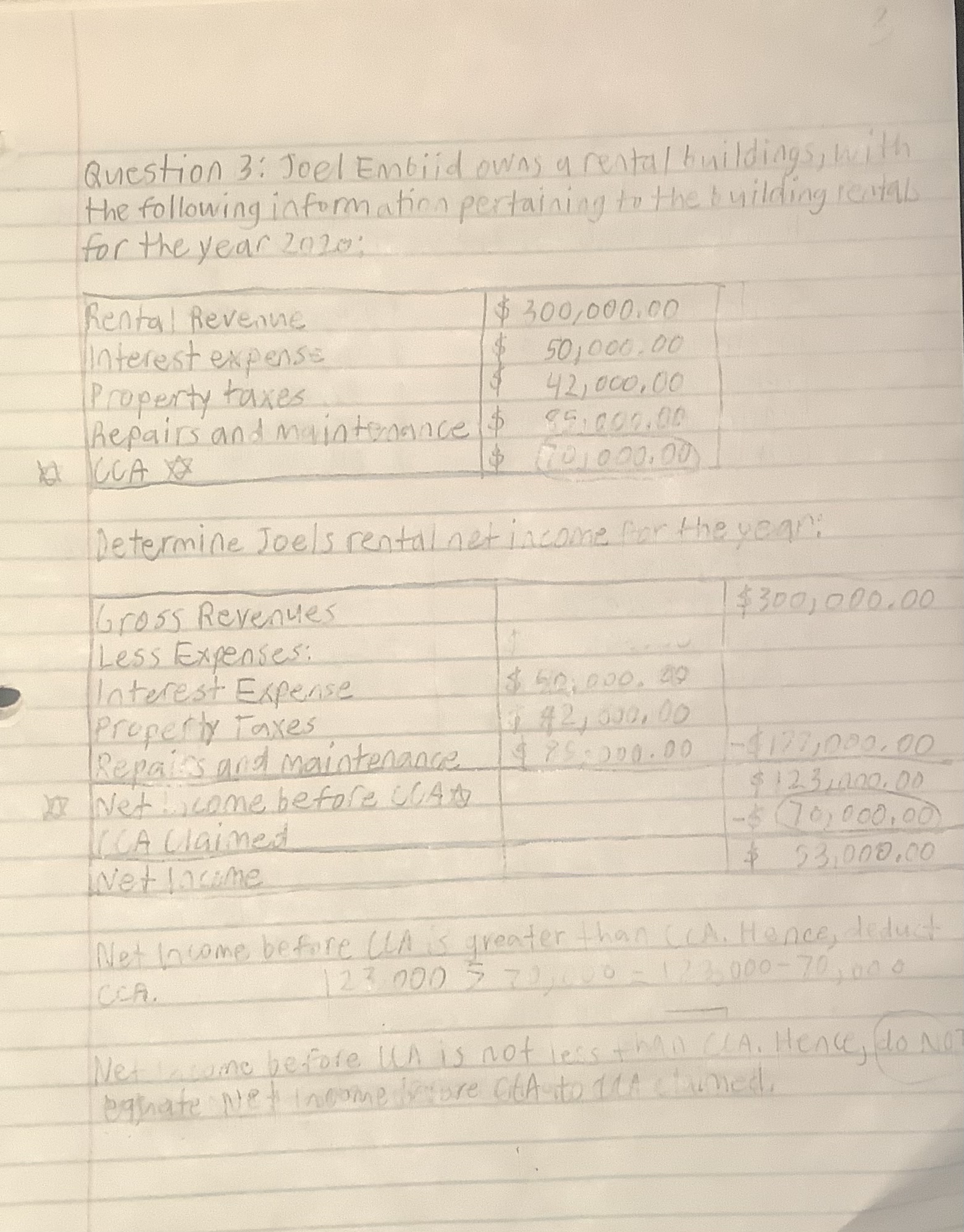

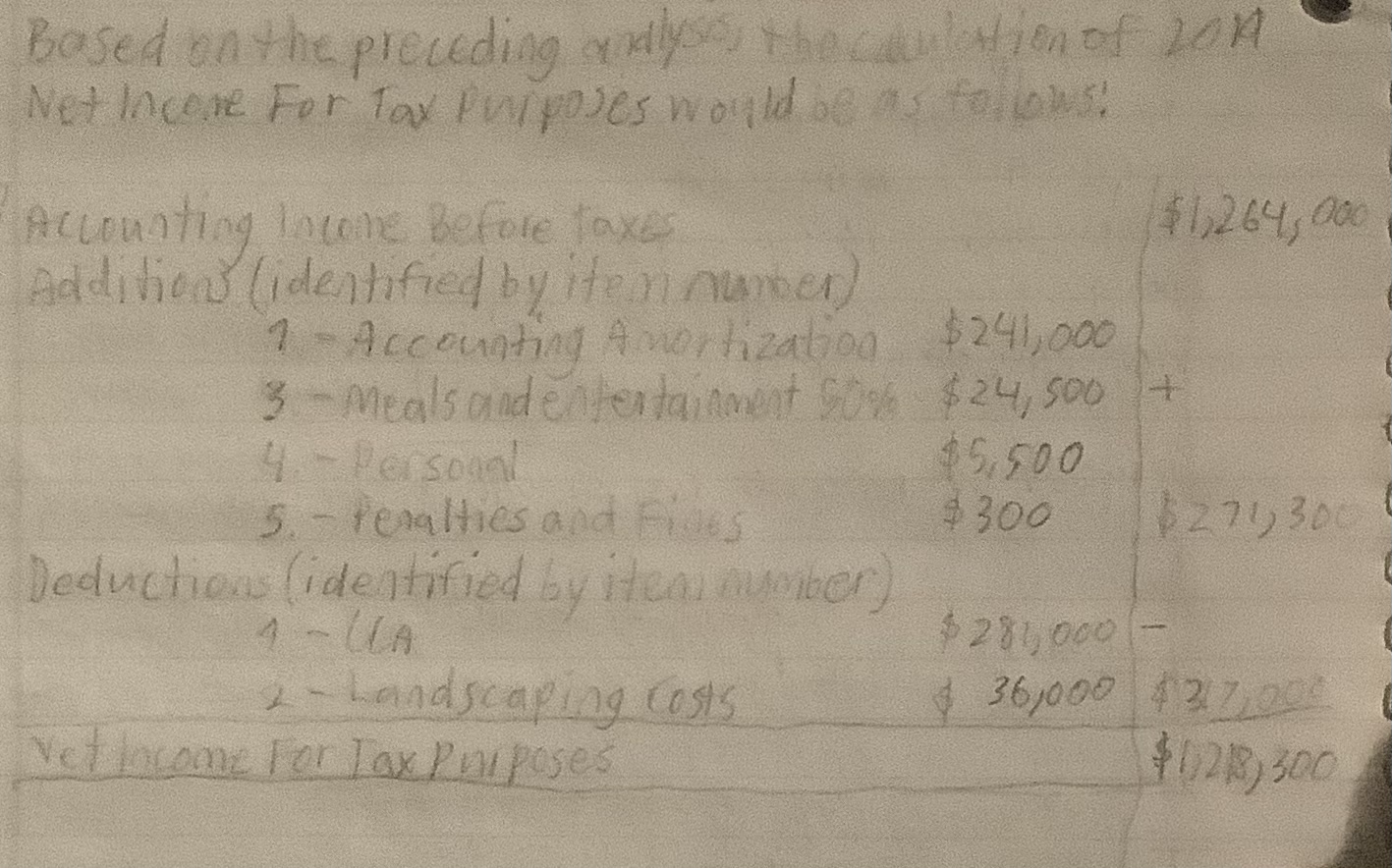

Question 3: Ben Simmons owns rental buildings, with the following information pertaining to the building rentals for the year 2620: Rental Revenue $ 200, 400.00 Interest Expense $ 40, 000.00 Property taxes $ 32, 000.00 Repairs and maintenance 6 75, 020sob A CCAX $ 60/ 900.30 Gross Revenues 200 080,00 Less Expenses : Interest Expense $ 40 000,20 Property Taxes Repairs and maintenance $75, 000.60 18 Net income before CLAN CLA claimed Net Income Net Income before LLA is less than beA device CCA claimed equivalent to Net home bed 53,000 5 60, 000 - 53,200- Net Income before LA is not are ater than a wowwatson LCA. Hence, do Not use Cef as Siualto IA Hamed,Question 1: The Markce Company has a December 31 accounting and taxation year end and, for the yearending December 31, 2019, its GAAP determined income before taxes amounted to ( $1) 264, De) You have been asked to calculate the company's 2019 Net Income For Tax Purposes, and have been provided with the following additional information concerning the 2019 fiscal year: 1. Accounting amortization expense totalled ( $ 241, 000. For tax purposes, the company intends to deduct (CA of 1 281,100 , 2. During December, the Company spent $86, 0ng on landscaping costs. These costs were capitalized in the Lempany's allany records. As the expenditure was near the end of the year, no amortization was recorded . 3. Accounting expenses include 149, 900 in business meals and entertainment . 4 . The owner paid for a family trip to Cuba costing (5 500) through her business account. 5 . The owner paid $ 300 parking ticket, for parking illegally The following points are relevant to the Net Income calculation Item 1 - The accounting amortization has to be added bach and replaced with the LLA deduction. Item 2 - Despite the fact that landscaping costs are us capital costs, ITA 20 ( 1 ) ( aa ) specifically permits their deduction . Item 3 - Only 50 percent of business meals a can be deducted Item 4 - You cannot deduct personal exper Hem 5 - 1 TA 67. 6 , " Non - Deductibility states that no deduction can be made film imposed under a law of an countryQuestion 2 (C): Mr. breen receives taxable 2019 spousal support of $170, 000 and has no other source of income during 2019 , He is not a member of an RPP. I January, 2021, he contributes $ 12, soo to his RRSP. This full a mount is deducted in his 2020 tax return. His Unused RRSP Deduction Room carried forward train 2019 was $2, 200, Unused Deduction Room Carried Forward From 2019 | $2, 200 Lesser of: - 2020 RRSP Dollar Limit = $28, 230 - 18% of 2019 Earned Income of $ 260 500 -1946 10 $28, 230 2019 RRSP Deduction Limit $30,420. RRSP Deduction -$12, 500 Unused Deduction Room - End of 2020 $17,930Question 2 ( A); MS. Simmons has 2019 net employmentincome of $90, 000, 2019 net rental income of $11, 200, and Ze 19 interest income of $6, 000. She is not a member of an R PP. She contributes $6, 000 to her RASP in October, 2020, $2,000 in November, 2020 and $900 in January, 2021, At the end of 2019 her unused RRSP Deduction Room was nil. Unused Deduction Room Carried Forward from 2019 $6 Lesser of : - 2020 RRSP Dollar Limit = $28, 230 - 18/0 of 2019 Earned Income of $51, 000 = $9, 180 4 4 180 2020 RRSP Deduction Limit 19, 180 RRSP Deduction ( $ 1, ona + $900 + $2,000) - $8, 900 unused Deduction Room - End of 2020 $280 Question 2 (B): MS. Ball has 2019 net employment income of $96, 100. Heremployer reports a Pension Adjustment of ($5,500 on her 2019 14. Her 2020 RASP contributions total( $ 4, 20.0) At the end of 2019, her Unused RRSP Deduction Room was $3, 500 , Unused Deduction Room Carried Forward from 2019) $3 500 Lesser of : - 2020 RRSP Dollar Limit = $28, 230 - 180 of 2019 Earned Income of $46, 090 - 18, 280 $8, 280 Less 2019 Pension thatment - $ 5, 500 2020 RRSP Deduction Limit $61 280 RRSP Deduction -$4,280 Jaused Deauction Room - End of 2010 $21080Question 3: Joel Embiid owns a rental buildings, with the following information pertaining to the building rentals for the year 2020: Rental Revenue $ 300 000.00 Interest expense 501000.00 Property taxes 42, 000,00 Repairs and maintenance $ (5, 090.06 CCA XX 701020,00 Determine Joels rental net income for the year Gross Revenues $ 3001 020.00 Less Expenses : Interest Expense $ 50, 020. 20 Property Taxes 1 42 630, 00 Repairs and maintenance $79-200. 00 -$127,020,00 18 Net ! come before CAN $1231 100.00 CCA claimed - (70) 000,20 Net Income $ 53 008,00 Net Income before (LA is greater than CCA. Hence, deduct CCA . 23 200 5 70 100 - 12 2 000-70 010 Met some before LA is not less than CLA. Hence, do NO equate Net income in fore atA to the Inmed.Based on the preceding only thecutie of 201 Not lacene For Tax Purposes would Accounting Income Before taxes $1, 264, 000 Additions (identified by item numer) 7 - Accounting Amortization $ 241,000 3 - Mealsandentertainment took $ 24, 500 4. - Personal $5,500 5. - Penalties and Rides $ 300 $271 300 Deductions ( identified by Heal number) 4 - (LA $ 280 060- 2 - Landscaping costs 36/000 427,20 Vet income For Tax Purposes $1213) 300