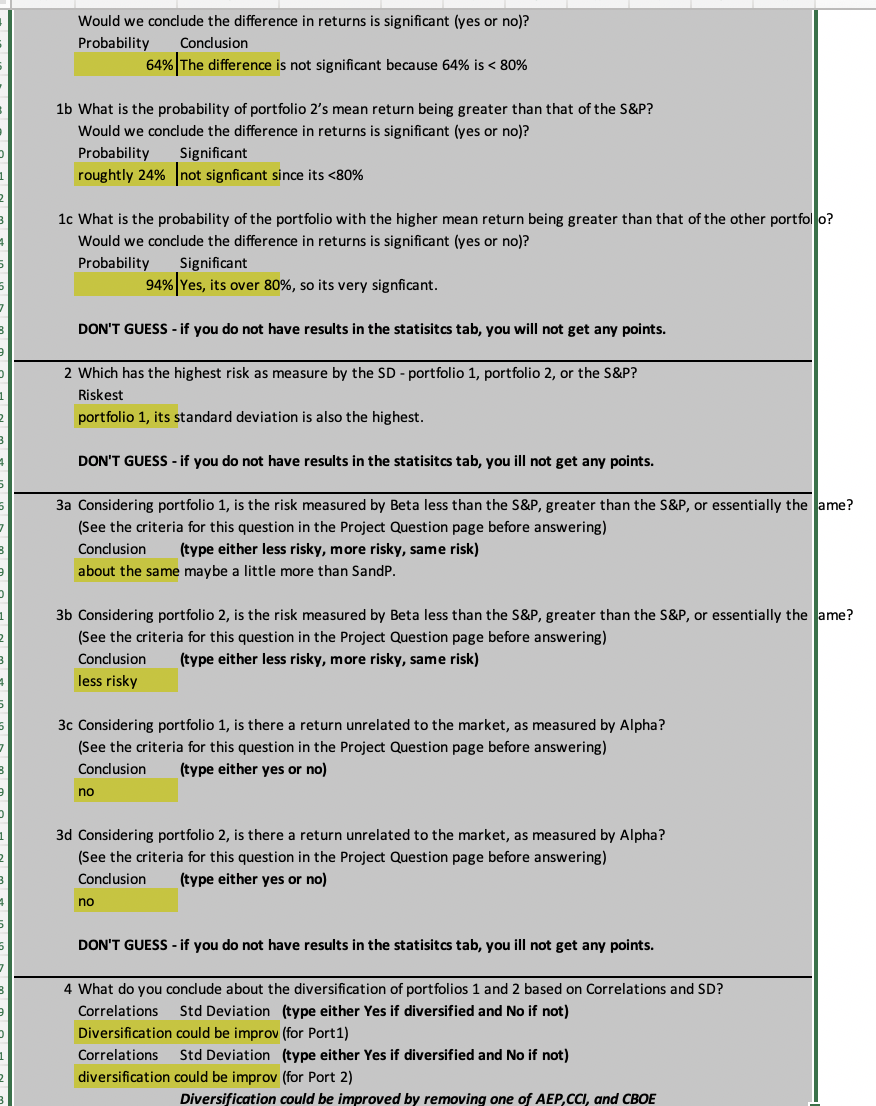

Please check my work

Also, need to know if Portfolio 1 or Portfolio 2 is better to invest in?

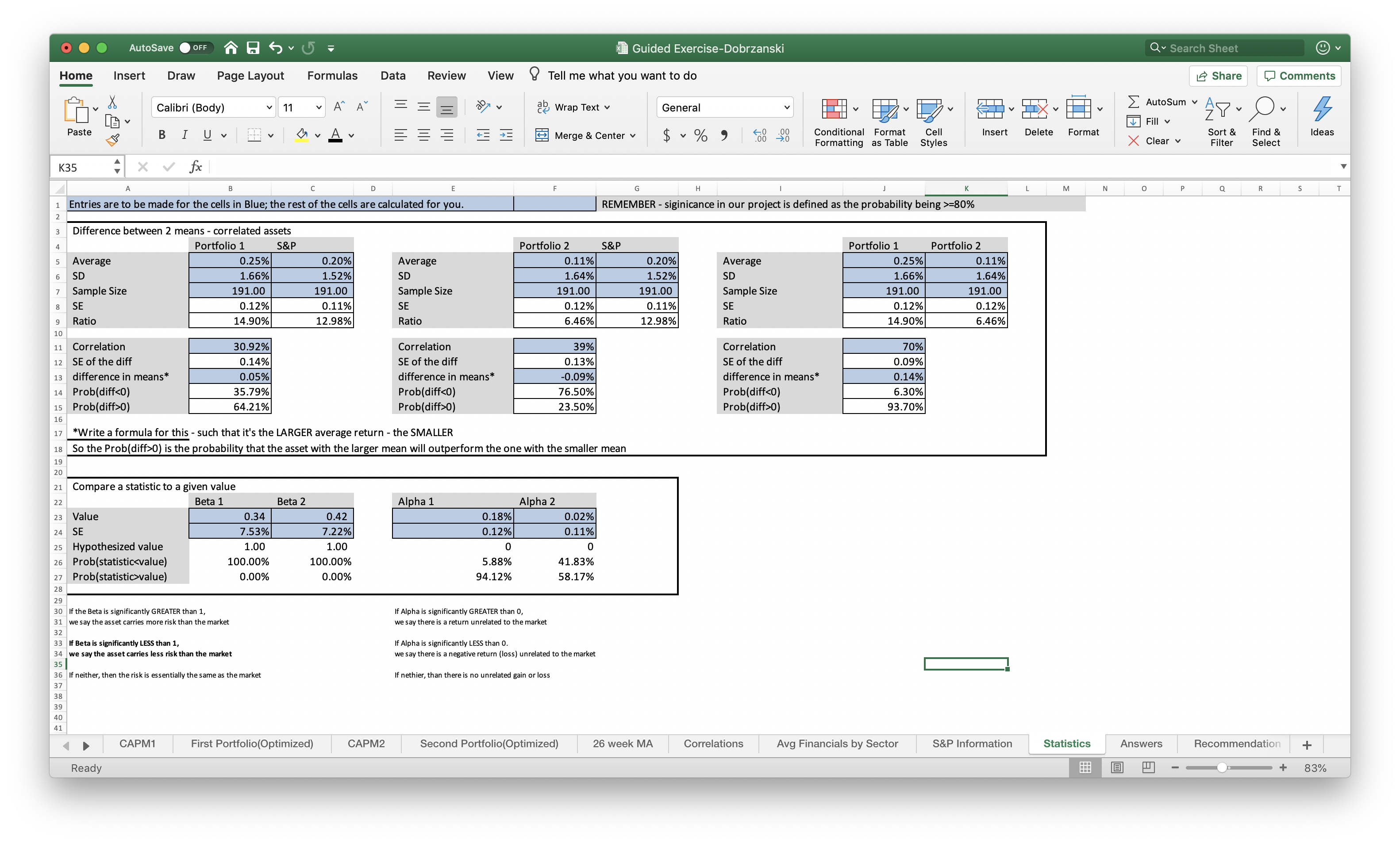

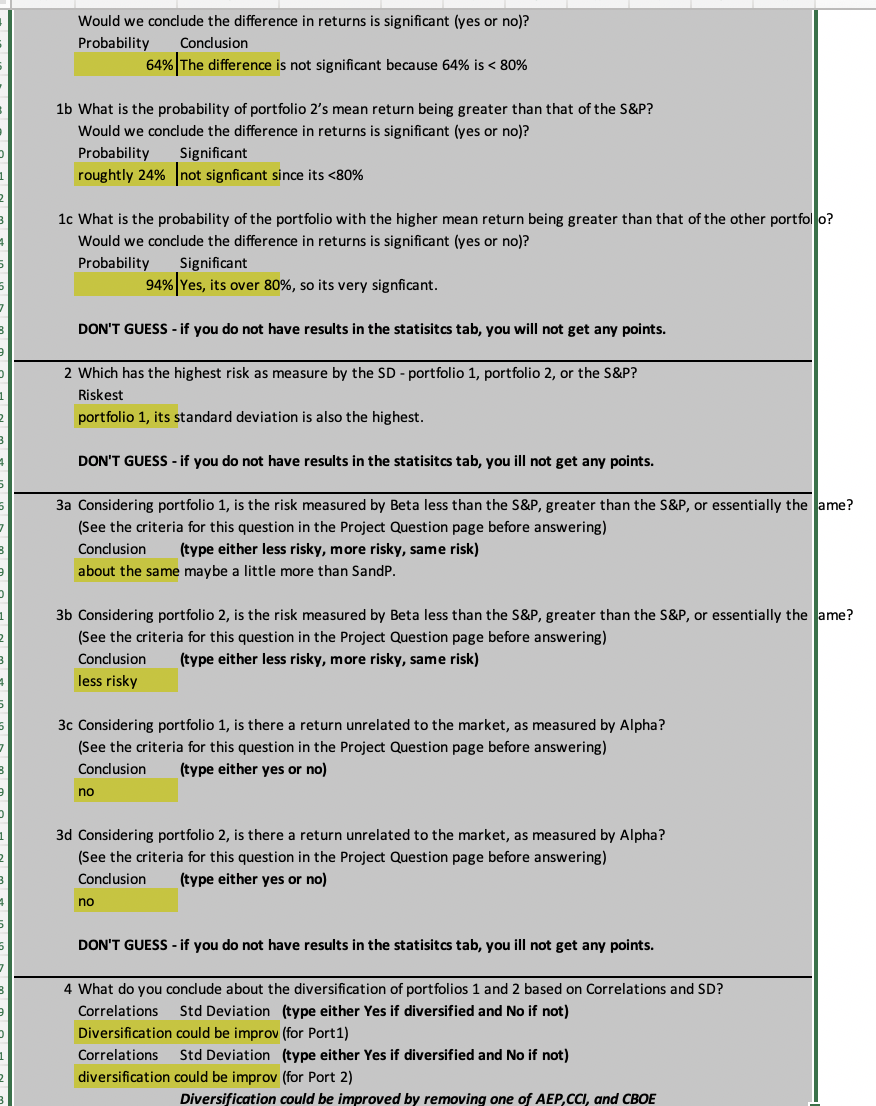

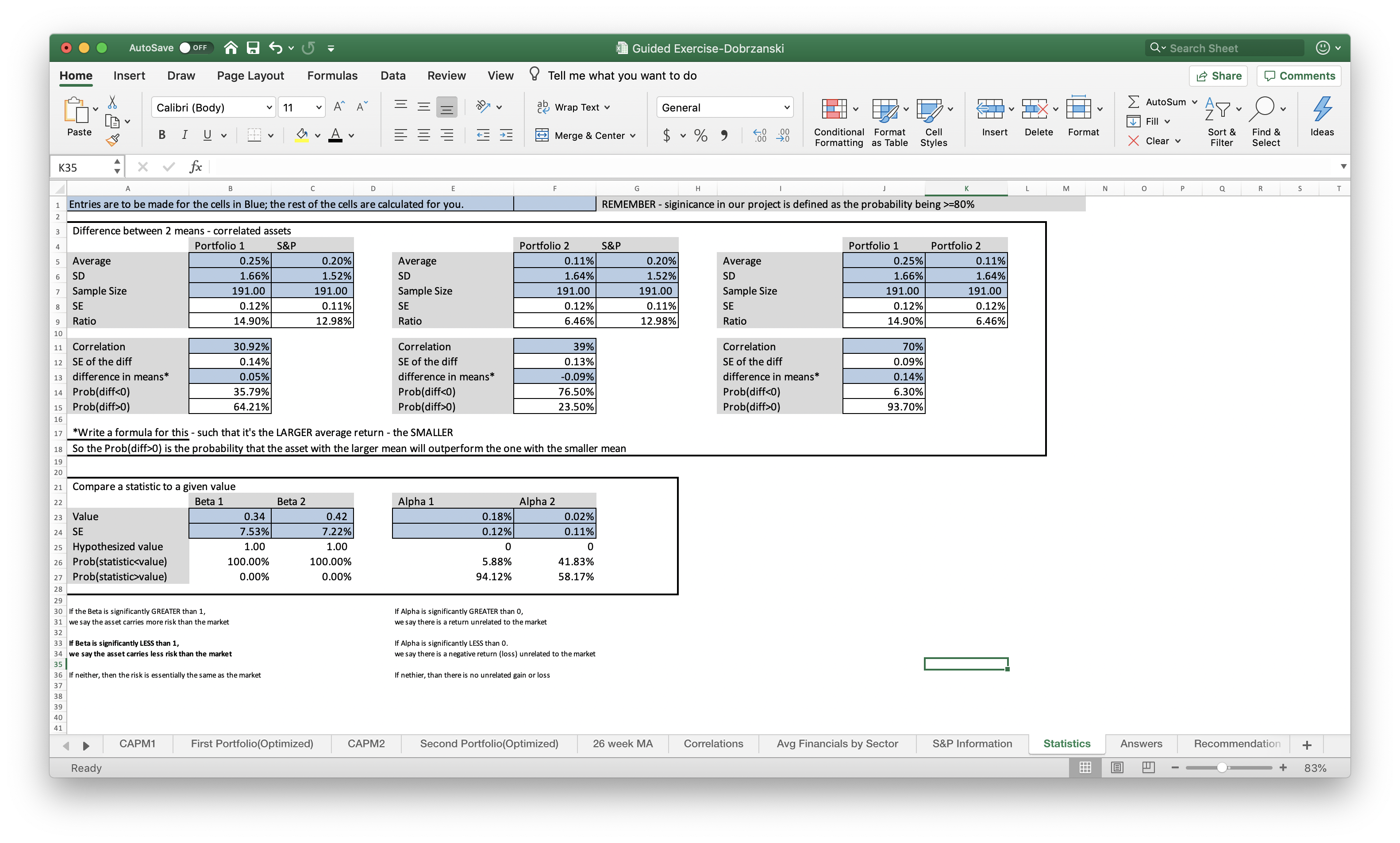

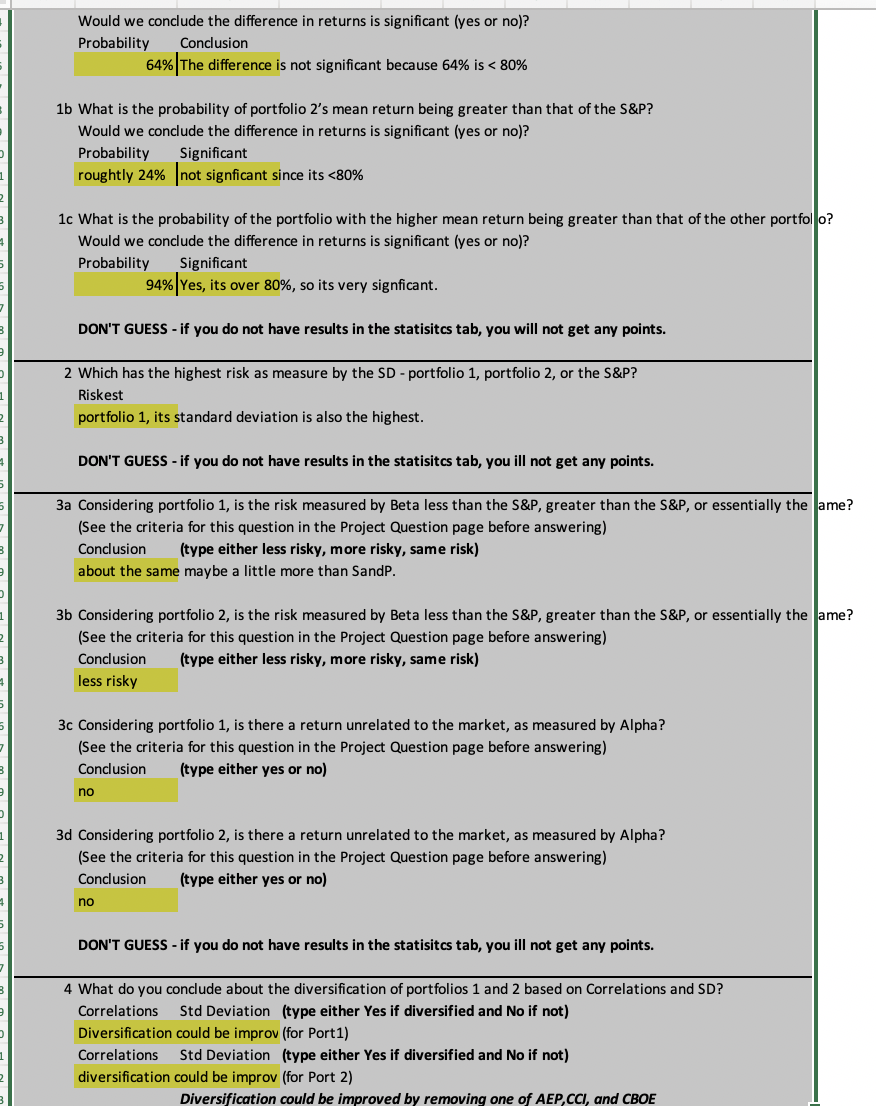

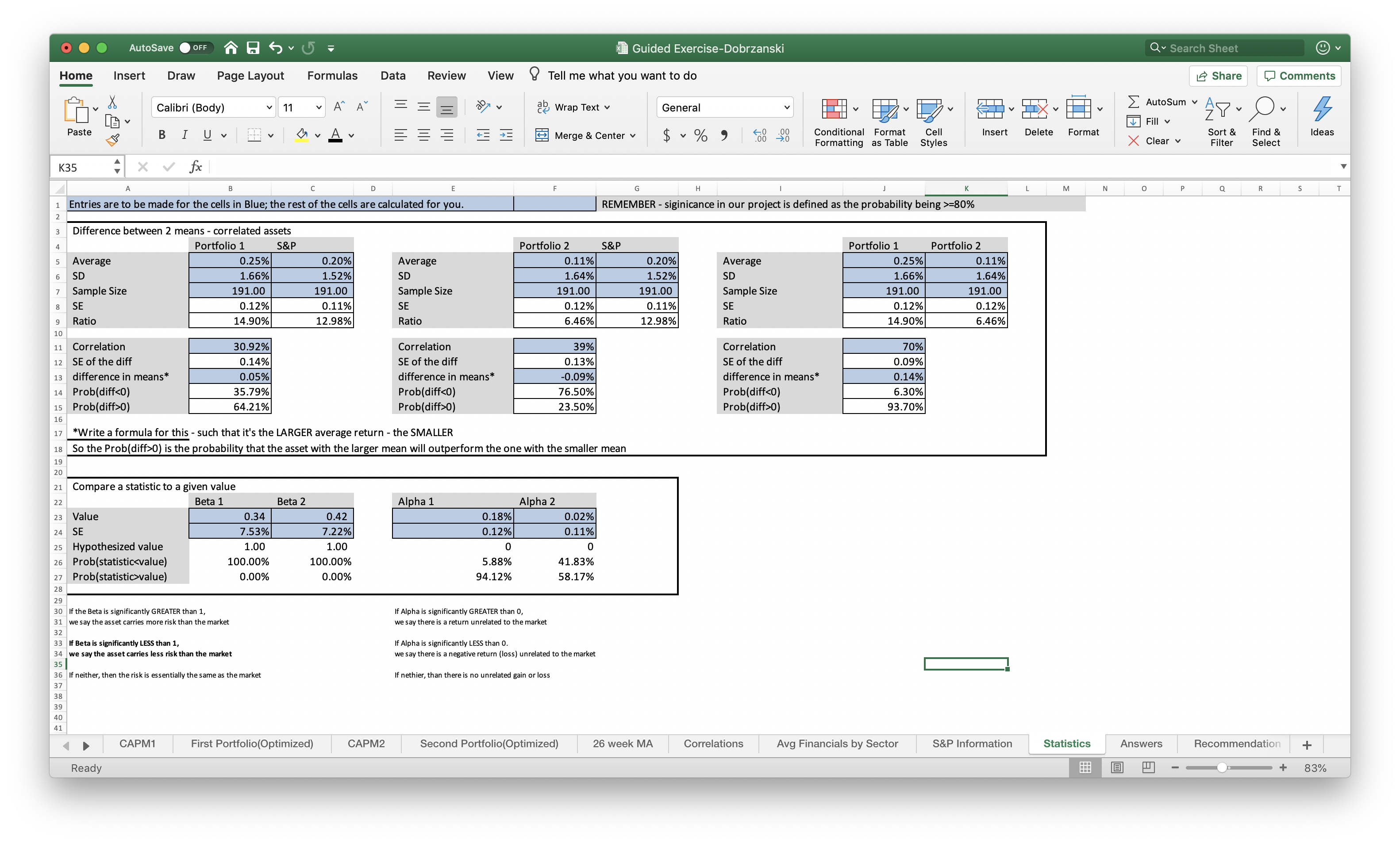

AutoSave OFF Guided Exercise-Dobrzanski Q Search Sheet Home Insert Draw Page Layout Formulas Data Review View Tell me what you want to do Share Comments Calibri (Body) v 11 A AY 207 v ap Wrap Text v General TIX Autosum ~ A~ Fill Paste BIUV MvAv = Merge & Center $ % Conditional Format Cell Insert Delete Format X Clear v Sort & Find & Ideas Formatting as Table Styles Filter Select K35 X V M o P Q R S 1 Entries are to be made for the cells in Blue; the rest of the cells are calculated for you. REMEMBER - siginicance in our project is defined as the probability being >=80% A w Difference between 2 means - correlated assets Portfolio 1 S&P Portfolio 2 S&P Portfolio 1 Portfolio 2 5 Average 0.25% 0.20% Average 0.11% 0.20% Average 0.25% 0.11% 6 SD ..66% 1.52% SD 1.64% 1.52% SD 1.66% 1.64% Sample Size 191.00 191.00 Sample Size 91.00 191.00 Sample Size 191.00 191.00 8 SE .12% 0.11% SE 0.12% 0.11% SE .12% 0.12% Ratio 4.90% 12.98% Ratio 6.46% 12.98% Ratio 14.90% 5.46% 10 11 Correlation 30.92% Correlation 39% Correlation 70% 12 SE of the diff .14% SE of the diff 0.13% SE of the diff 0.09% 13 difference in means* 0.05% difference in means* 0.09% difference in means* 0.14% 14 Prob(diff0) 64.21% Prob(diff>0 3.50% Prob(diff>0 93.70% 16 *Write a formula for this - such that it's the LARGER average return - the SMALLER So the Prob(diff>0) is the probability that the asset with the larger mean will outperform the one with the smaller mean 21 Compare a statistic to a given value 22 Beta 1 Beta 2 Alpha 1 Alpha 2 23 0.34 0.42 0.18% 0.02% 24 7.53% 7.22% 0.12% 0.11% Hypothesized value 1.0 1.00 0 0 26 Prob(statistic

value) 0.00% 0.00% 94.12% 58.17% 28 29 30 If the Beta is significantly GREATER than 1, If Alpha is significantly GREATER than 0, 31 we say the asset carries more risk than the market we say there is a return unrelated to the market 32 33 If Beta is significantly LESS than 1, 34 we say the asset carries less risk than the market If Alpha is significantly LESS than 0. we say there is a negative return (loss) unrelated to the market 35 36 If neither, then the risk is essentially the same as the market If nethier, than there is no unrelated gain or loss 37 38 39 CAPM1 First Portfolio(Optimized) CAPM2 Second Portfolio(Optimized) 26 week MA Correlations Avg Financials by Sector S&P Information Statistics Answers Recommendation + Ready + 83%Would we conclude the difference in returns is significant (yes or no)? Probability Conclusion 64% The difference is not significant because 64% is