Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please check my work let me know if I made any mistake. can you not see the problems? they are in the images i provided

please check my work let me know if I made any mistake.

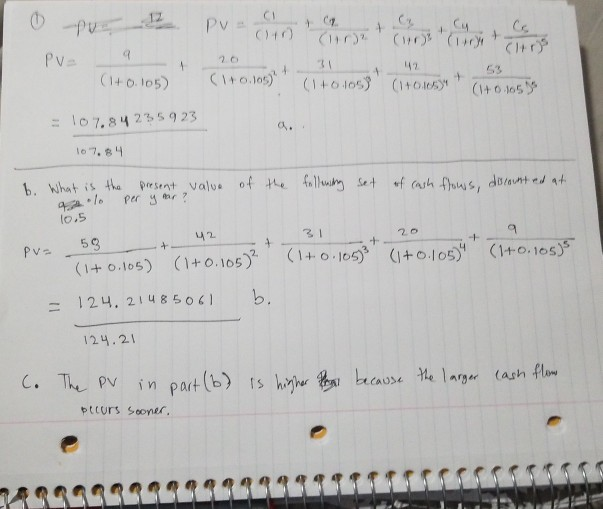

can you not see the problems? they are in the images i provided BELOW. ALSO, i've provided images to my solution to each problem in my notebook. PLEASE CHECK THEM AND LET ME KNOW IF THEY ARE CORRECT OR NOT. 1.

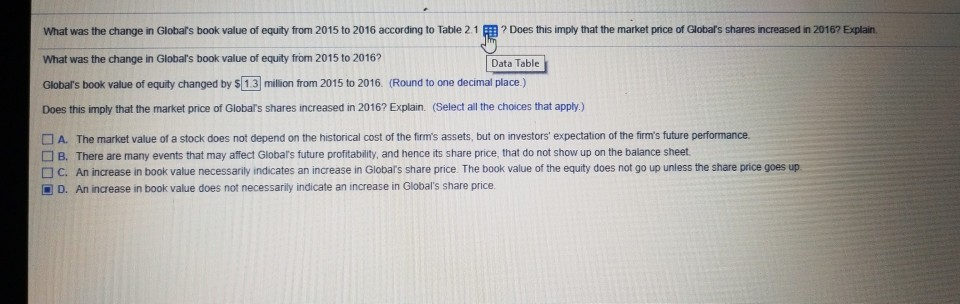

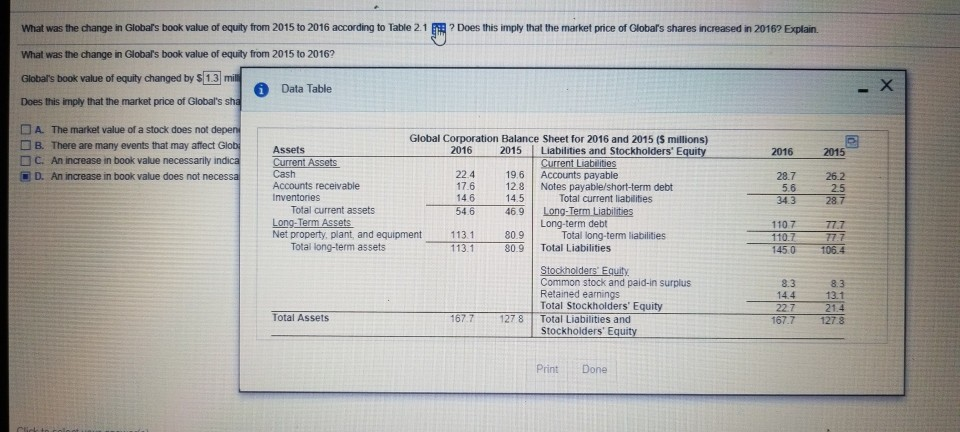

my work is done here

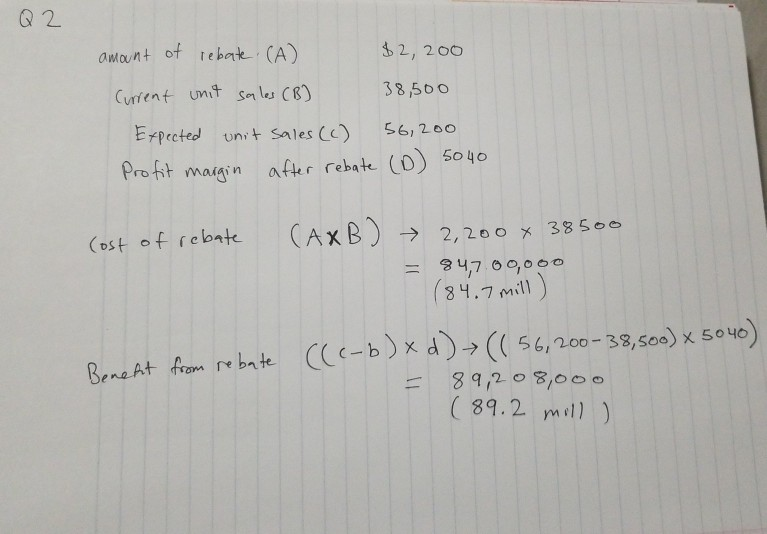

2.

my work is down here

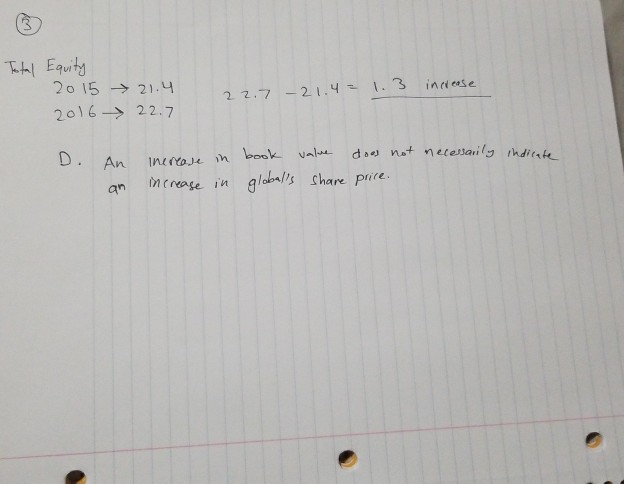

3.

my work is done here

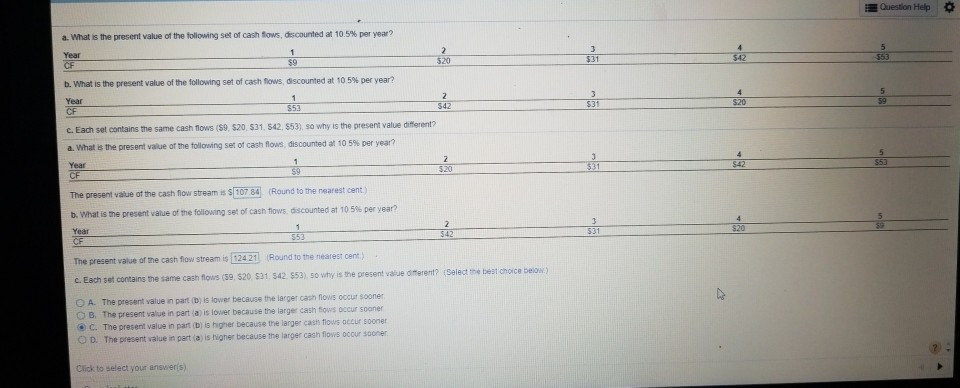

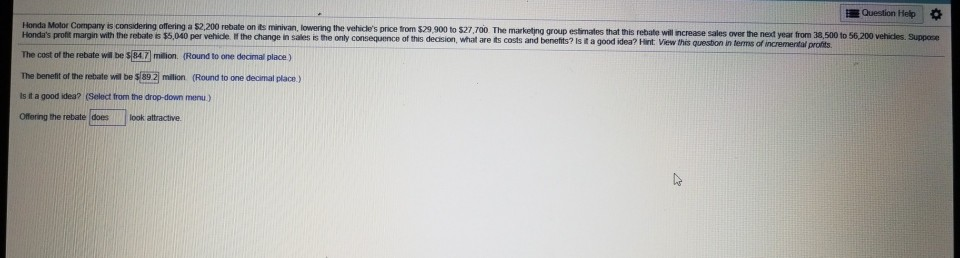

Question Help aWhat is the present value of the following set of cash tows, dscounted at 10 5% per year, Year $9 $31 what is the present value of the following set of cash tows dscounted at 10 5% per year? Year $31 $20 59 853 $42 c. Each set contains the same cash flows (S9, $20, 531. 542, $53), so why is the present value different? a. what the present value of the following set of cash flows discounted at 10 5% per year? Year 342 353 The present value ot the cash flow stream is $ 107 84 Round to the nearest cent) b. what is te present value of the following set of cash tows discounted at 10 5% per year Year 531 The present value of the cash fow stream is 124 21 Round to the nearest cent c. Each set contains the same cash flows (59. 520 $31, 542 $53) so why is the present valiue oferent? (Select the A. The present value in part 0b) is lower because te ierger cash flows occur sooner The present value in panaus iower because the large cash tous occur sooner e C. The present value in part (b) is higher because the larger cash tlows accur soonen B, D. The present value in part la is higher because the larger cash fiows occur Click to select your answers) Question ep Horda Mol r pay r ing a 200 et te onts min an, weng the ve en g o s p ce ton se son to S27700 The marketin po estm tes a t s rebate will cea e sae oame ned Honda's pront margin with the rebate $5,040 per vel ide lf te The cost of the rebate wil be sB4 milion. (Round to one decimal place ) The benefit of the rebate will be $ 892 milion (Round to one deoimal place) Is it a good idea? (Select from the drop-down menu) Offering the rebate does look attractive. change in sales is the only consecuence of this decision, whal are ts costs and benefts? ls t a good idea? Hint Vew thes queson irms of ncrementar s te What was the change in Globars book value of equity from 2015 to 2016 according to Table 2.1B? Does this imply that the market price of Globar's shares increased in 2016? Explain What was the change in Global's book value of equity from 2015 to 2016? Globa's book value of equity changed by $1.3 million from 2015 to 2016. (Round to one decimal place) Does this imply that the market price of Globar's shares increased in 2016? Explain. (Select all the choices that apply.) Data Table A. The market value of a stock does not depend on the historical cost of the firms assets, but on investors' expectation of the firm's future performance. B There are many events that may affect Globars future profitability, and hence s share price that to not snow on h e balance sheet C. An increase in book value necessarily indicates an increase in Globars share price. The book value of the equity does not go up unless the share price goes up D D. An increase in book value does not necessarily indicate an increase in Global's share price. What was the change in Globals book value of equity tom 2015 2016 according to Table 2 What was the change in Globals book value of equity from 2015 to 2016? Global's book value of equity changed by $ 1.3 Does this inply that the market price of Giobal's sha A. The market value ofa stock does not depen Does this imply that he market price of Obars shares ncreased r 2 pbpan mil Data Table Global Corporation Balance Sheet for 2016 and 2015 (S millions) 2016 2015 Liabilities and Stockholders' Equity B. There are many events that may affect C. An increase in book value necessarily D. An increase in book value does not 2016 2015 Cash Accounts receivable 224 19.6 Accounts payable 17.6 146 14.5 54.6 46.9 Long-Term Liabilities 28.7 26.2 2.5 28 7 neces 128 Notes payable/short-term debt 5.6 34.3 Total current liabilities Total current assets Long-Term Assets Net property plant, and equent 1131 09 Total long-term liabilities Long-term debt 1107 77.7 110.7 Total long-term assets 113.1 809 Total Liabilities 1450 106.4 Common stock and paid-in surplus Retained earnings Total Stockholders Equity 8.3 14.4 22.7 8.3 13.1 Total Assets 167 1278 Total Liabilities and 67.7127.8 Print Done 2 o 1521.4 20622.7 2 2.721. 3 inease An InetoJe in book an intease in globrl's are pire Question Help aWhat is the present value of the following set of cash tows, dscounted at 10 5% per year, Year $9 $31 what is the present value of the following set of cash tows dscounted at 10 5% per year? Year $31 $20 59 853 $42 c. Each set contains the same cash flows (S9, $20, 531. 542, $53), so why is the present value different? a. what the present value of the following set of cash flows discounted at 10 5% per year? Year 342 353 The present value ot the cash flow stream is $ 107 84 Round to the nearest cent) b. what is te present value of the following set of cash tows discounted at 10 5% per year Year 531 The present value of the cash fow stream is 124 21 Round to the nearest cent c. Each set contains the same cash flows (59. 520 $31, 542 $53) so why is the present valiue oferent? (Select the A. The present value in part 0b) is lower because te ierger cash flows occur sooner The present value in panaus iower because the large cash tous occur sooner e C. The present value in part (b) is higher because the larger cash tlows accur soonen B, D. The present value in part la is higher because the larger cash fiows occur Click to select your answers) Question ep Horda Mol r pay r ing a 200 et te onts min an, weng the ve en g o s p ce ton se son to S27700 The marketin po estm tes a t s rebate will cea e sae oame ned Honda's pront margin with the rebate $5,040 per vel ide lf te The cost of the rebate wil be sB4 milion. (Round to one decimal place ) The benefit of the rebate will be $ 892 milion (Round to one deoimal place) Is it a good idea? (Select from the drop-down menu) Offering the rebate does look attractive. change in sales is the only consecuence of this decision, whal are ts costs and benefts? ls t a good idea? Hint Vew thes queson irms of ncrementar s te What was the change in Globars book value of equity from 2015 to 2016 according to Table 2.1B? Does this imply that the market price of Globar's shares increased in 2016? Explain What was the change in Global's book value of equity from 2015 to 2016? Globa's book value of equity changed by $1.3 million from 2015 to 2016. (Round to one decimal place) Does this imply that the market price of Globar's shares increased in 2016? Explain. (Select all the choices that apply.) Data Table A. The market value of a stock does not depend on the historical cost of the firms assets, but on investors' expectation of the firm's future performance. B There are many events that may affect Globars future profitability, and hence s share price that to not snow on h e balance sheet C. An increase in book value necessarily indicates an increase in Globars share price. The book value of the equity does not go up unless the share price goes up D D. An increase in book value does not necessarily indicate an increase in Global's share price. What was the change in Globals book value of equity tom 2015 2016 according to Table 2 What was the change in Globals book value of equity from 2015 to 2016? Global's book value of equity changed by $ 1.3 Does this inply that the market price of Giobal's sha A. The market value ofa stock does not depen Does this imply that he market price of Obars shares ncreased r 2 pbpan mil Data Table Global Corporation Balance Sheet for 2016 and 2015 (S millions) 2016 2015 Liabilities and Stockholders' Equity B. There are many events that may affect C. An increase in book value necessarily D. An increase in book value does not 2016 2015 Cash Accounts receivable 224 19.6 Accounts payable 17.6 146 14.5 54.6 46.9 Long-Term Liabilities 28.7 26.2 2.5 28 7 neces 128 Notes payable/short-term debt 5.6 34.3 Total current liabilities Total current assets Long-Term Assets Net property plant, and equent 1131 09 Total long-term liabilities Long-term debt 1107 77.7 110.7 Total long-term assets 113.1 809 Total Liabilities 1450 106.4 Common stock and paid-in surplus Retained earnings Total Stockholders Equity 8.3 14.4 22.7 8.3 13.1 Total Assets 167 1278 Total Liabilities and 67.7127.8 Print Done 2 o 1521.4 20622.7 2 2.721. 3 inease An InetoJe in book an intease in globrl's are pire

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started