Answered step by step

Verified Expert Solution

Question

1 Approved Answer

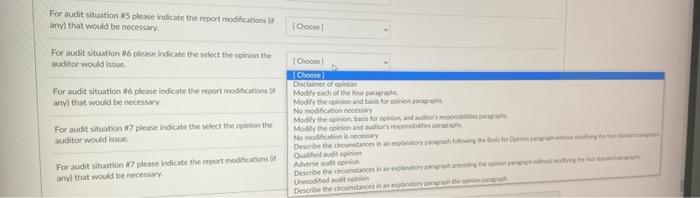

please choose the answer from the last picture The audit situations below present various independent factual situations in auditor might encounter in conducting an audit.

please choose the answer from the last picture

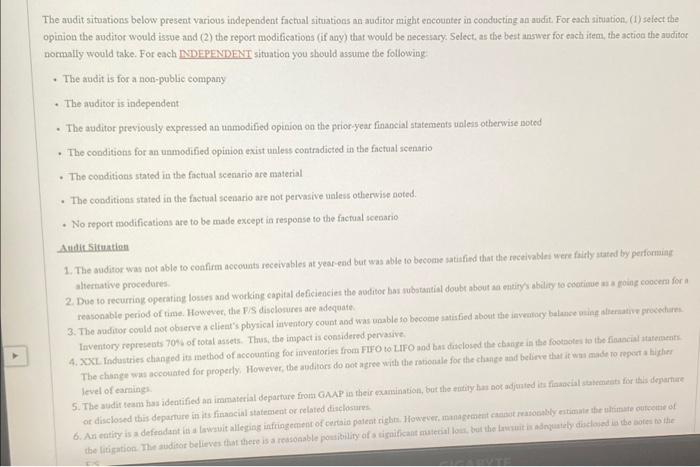

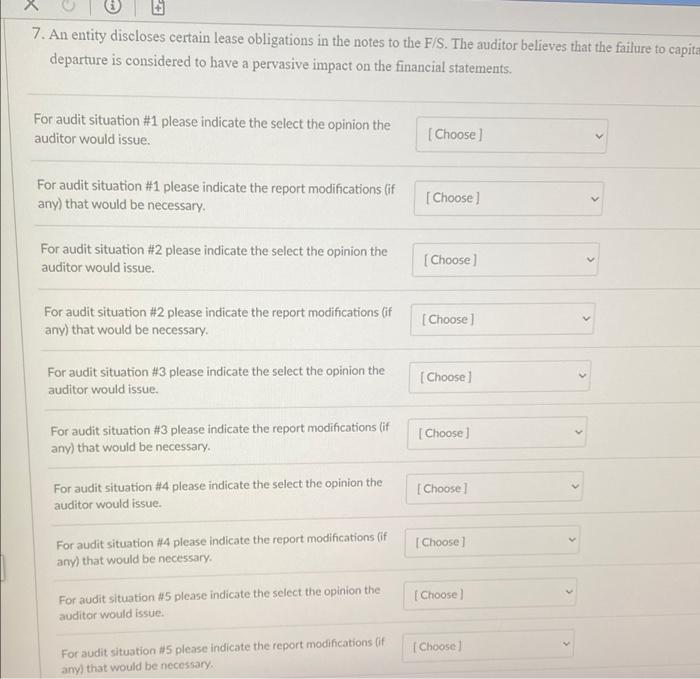

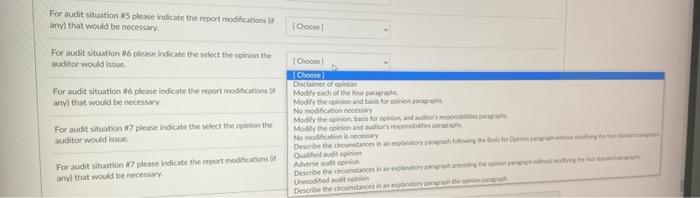

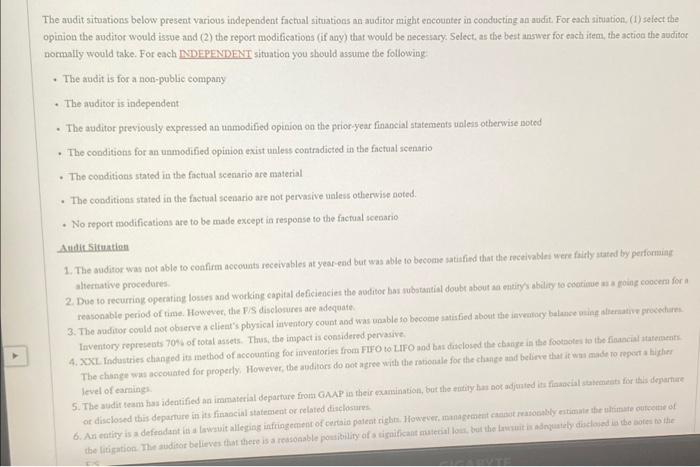

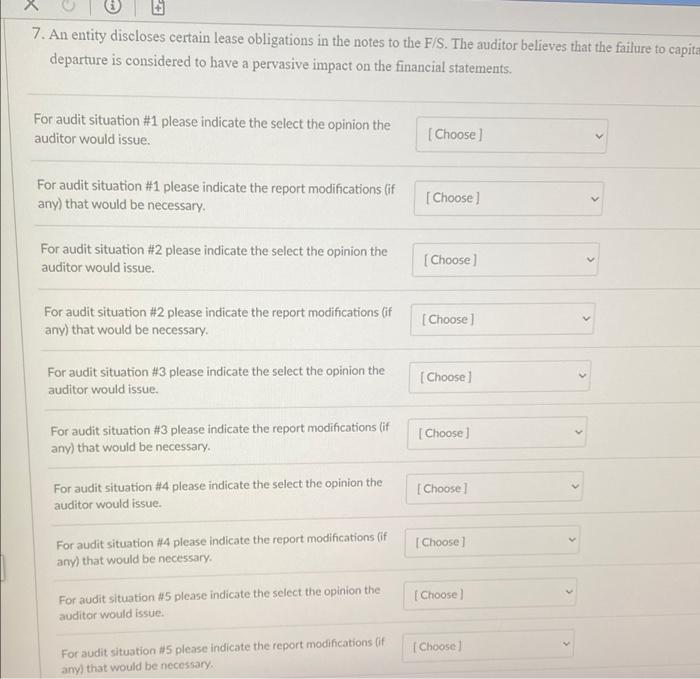

The audit situations below present various independent factual situations in auditor might encounter in conducting an audit. For each situation. (1) select the opinion the auditor would issue and (2) the report modifications (if any) that would be necessary. Select as the best answer for each item, the action the auditor normally would take. For ench INDEPENDENT situation you should assume the following The audit is for a non-public company The maditor is independent The auditor previously expressed an unmodified opinion on the prior year financial statements unless otherwise noted The conditions for an unmodified opinion exist unless contradicted in the factual scenario The conditions stated in the factual scenario are material The conditions stated in the factual scenario are not pervasive unless otherwise noted, No report modifications are to be made except in response to the factual scenario Andi Situation 1. The auditor was not able to confirm accounts receivables at year-end but was able to become satisfied that the receivables were fairly stated by performing sherative procedures 2. Due to recurring operating losses and working capital deficiencies the auditor has substantial doubt about an entiry's ability to continue as a poing concern for a reasonable period of time. However, the US discounts are adequate 3. The auditor could not observe a client's physical inventory count and was unable so become satisfied about the inventory balance in alternative procedures Inventory represents 70% of total assets. This the impact is considered pervasive 4. XXL Industries changed its method of accounting for inventories from FIFO 10 LIFO od bat disclosed the change in the footnotes to the financial statements The change was accounted for properly. However, the auditors do not agree with the rationale for the chance and believe that it was made to report a higher level of earnings 5. The audit team has identified an immaterial departure from GAAP in their existination, but the entity has not adjusted its timial statements for this dorture or disclosed this departure in its financial statement or related disclosures 6. Ars entity is a defendant la nuit alleging infringement of certain patent right. However, management contracbly estimate the ultimate outcome of the litigation. The stor believes that there is a reasonable posibility of a significant muteciallout, but the lawsuitinguely disclosed in the notes to the 7. An entity discloses certain lease obligations in the notes to the F/S. The auditor believes that the failure to capita departure is considered to have a pervasive impact on the financial statements. For audit situation #1 please indicate the select the opinion the auditor would issue. [Choose For audit situation #1 please indicate the report modifications (if any) that would be necessary. [Choose For audit situation #2 please indicate the select the opinion the auditor would issue. [Choose > For audit situation #2 please indicate the report modifications (if any) that would be necessary. [Choose > For audit situation #3 please indicate the select the opinion the auditor would issue. [Choose For audit situation #3 please indicate the report modifications (if any) that would be necessary. [Choose)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started