Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please clearly explain how you arrived at each answer. Thanks! M10-21 (Supplement 10D) Preparing Journal Entries from an Installment Note Amortization Schedule [LO 10-14) Access

Please clearly explain how you arrived at each answer. Thanks!

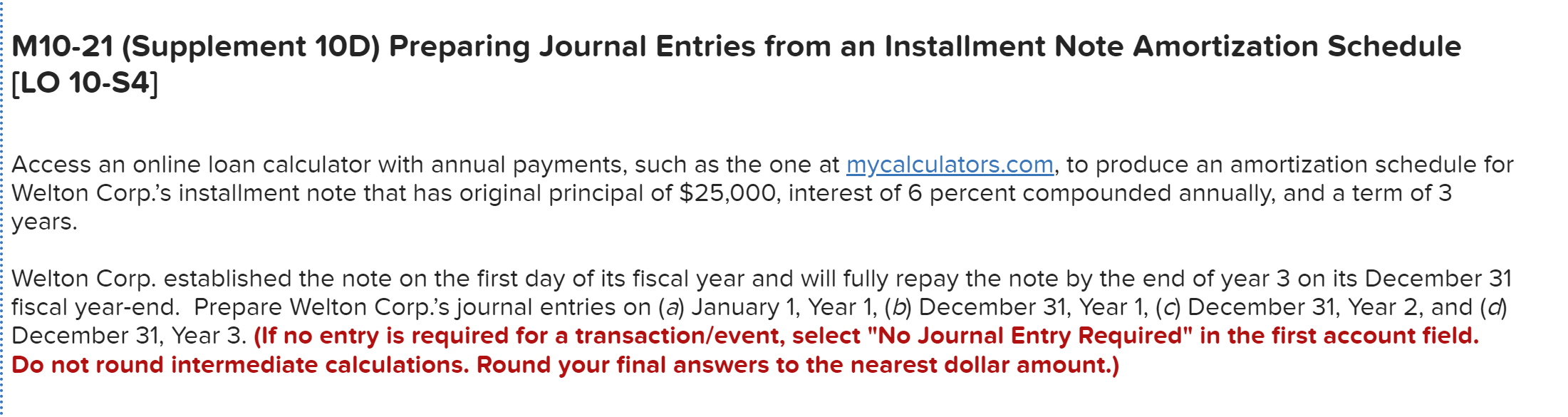

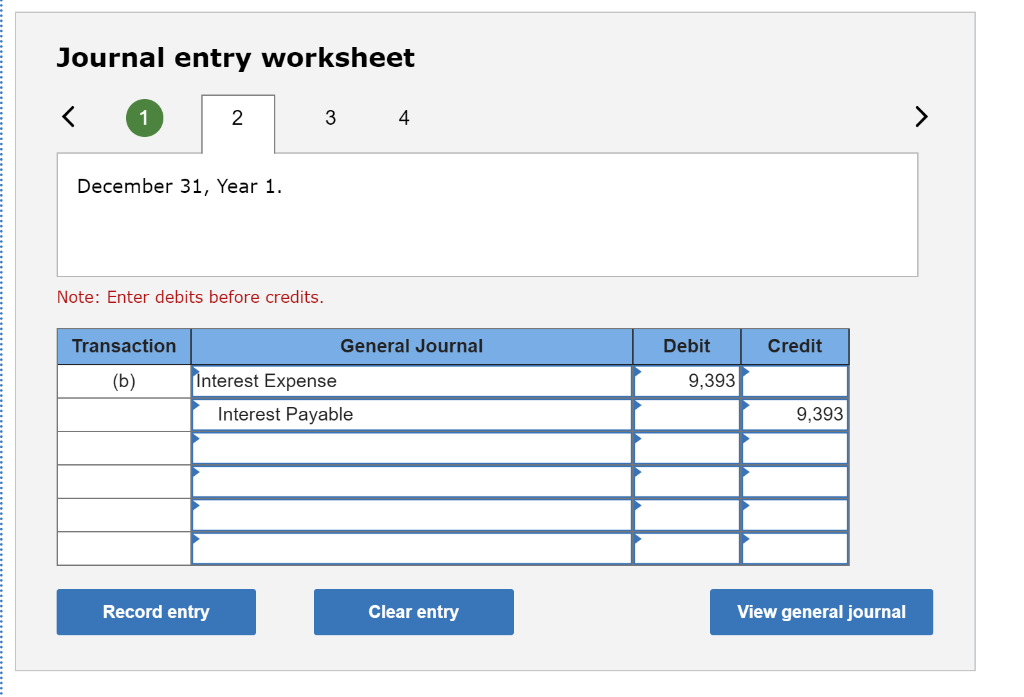

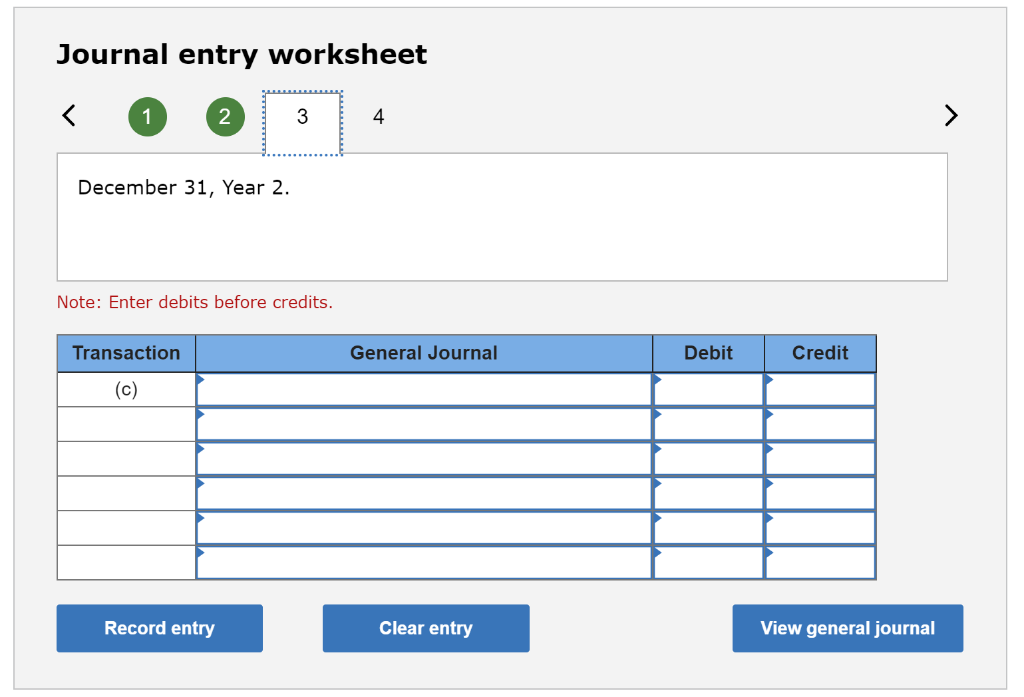

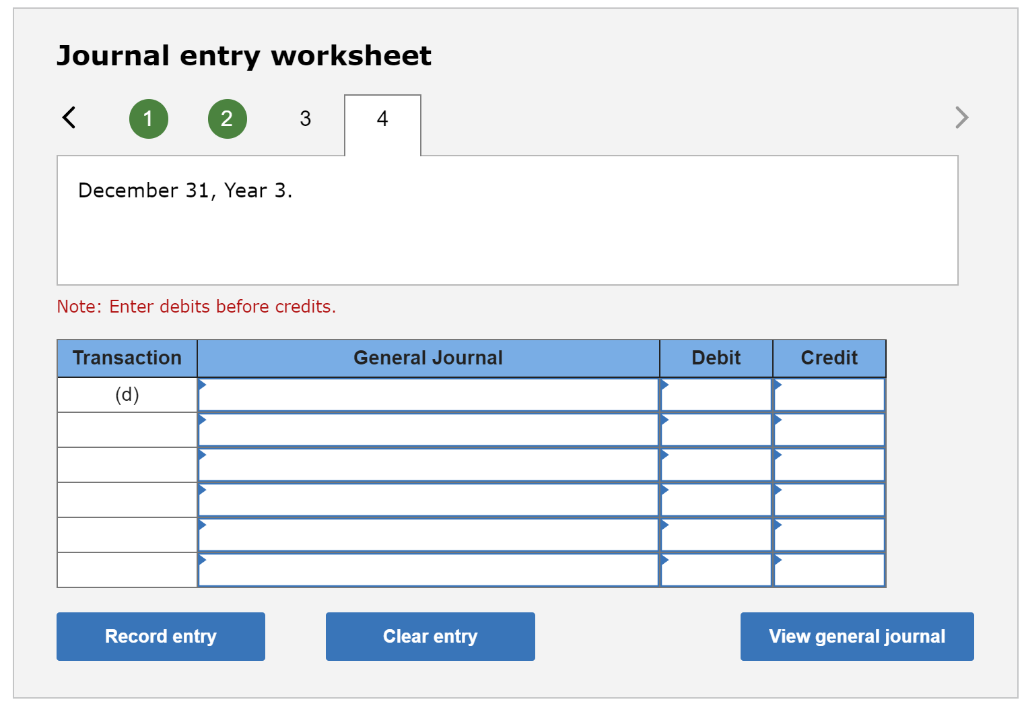

M10-21 (Supplement 10D) Preparing Journal Entries from an Installment Note Amortization Schedule [LO 10-14) Access an online loan calculator with annual payments, such as the one at mycalculators.com, to produce an amortization schedule for Welton Corp.s installment note that has original principal of $25,000, interest of 6 percent compounded annually, and a term of 3 years. Welton Corp. established the note on the first day of its fiscal year and will fully repay the note by the end of year 3 on its December 31 fiscal year-end. Prepare Welton Corp.s journal entries on (a) January 1, Year 1, (b) December 31, Year 1, (C) December 31, Year 2, and (d) December 31, Year 3. (If no entry is required for a transaction/event, select "No Journal Entry Required" the first account field. Do not round intermediate calculations. Round your final answers to the nearest dollar amount.) Journal entry worksheet 2. 3 4 > December 31, Year 1. Note: Enter debits before credits. Transaction General Journal Debit Credit (b) 9,393 Interest Expense Interest Payable 9,393 Record entry Clear entry View general journal Journal entry worksheet December 31, Year 2. Note: Enter debits before credits. Transaction General Journal Debit Credit (c) Record entry Clear entry View general journal Journal entry worksheetStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started