Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please comment if there are any questions. B. Problems and Questions Sabino Company is considering the purchase of a new heavy-duty industrial waste-water pump. Suppliers

Please comment if there are any questions.

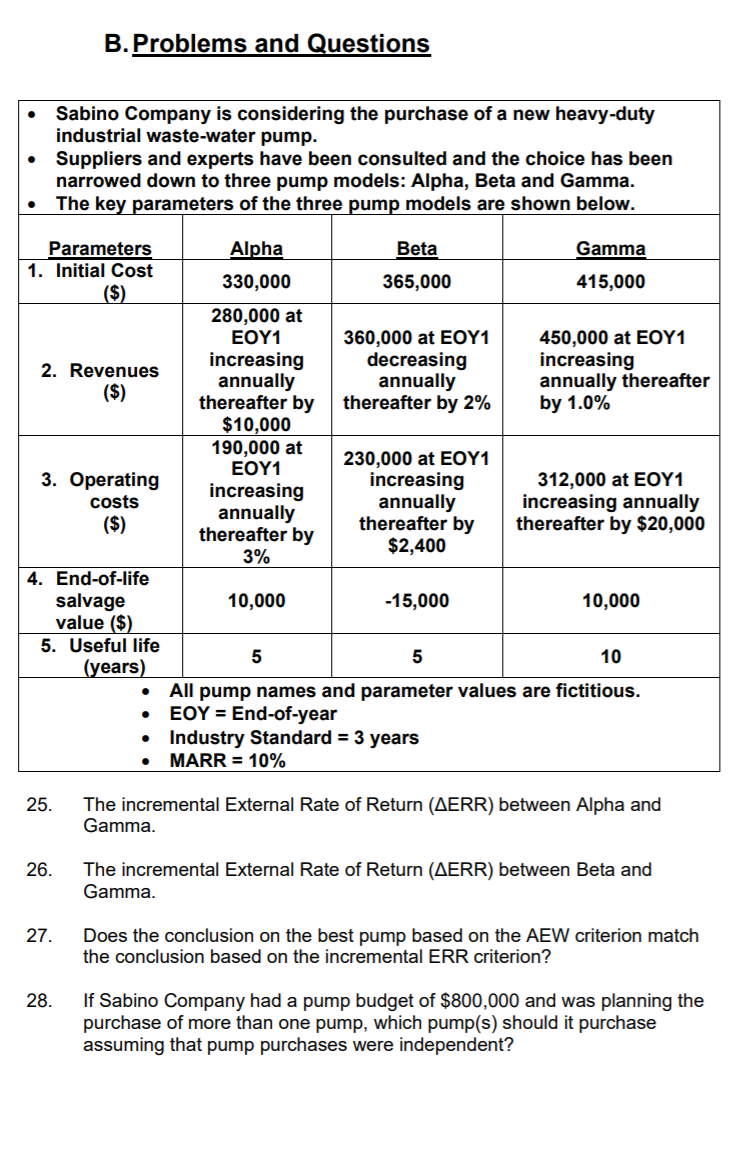

B. Problems and Questions Sabino Company is considering the purchase of a new heavy-duty industrial waste-water pump. Suppliers and experts have been consulted and the choice has been narrowed down to three pump models: Alpha, Beta and Gamma. The key parameters of the three pump models are shown below. Parameters Alpha Beta Gamma 1. Initial Cost 330,000 365,000 ($) 415,000 280,000 at EOY1 360,000 at EOY1 450,000 at EOY1 increasing decreasing increasing 2. Revenues annually ($) annually annually thereafter thereafter by thereafter by 2% by 1.0% $10,000 190,000 at EOY1 230,000 at EOY1 3. Operating increasing increasing 312,000 at EOY1 costs annually increasing annually ($) annually thereafter by thereafter by thereafter by $20,000 $2,400 3% 4. End-of-life salvage 10,000 -15,000 10,000 value ($) 5. Useful life 5 5 10 (years) All pump names and parameter values are fictitious. EOY = End-of-year Industry Standard = 3 years MARR = 10% . . 25. The incremental External Rate of Return (AERR) between Alpha and Gamma. 26. The incremental External Rate of Return (AERR) between Beta and Gamma. 27. Does the conclusion on the best pump based on the AEW criterion match the conclusion based on the incremental ERR criterion? 28. If Sabino Company had a pump budget of $800,000 and was planning the purchase of more than one pump, which pump(s) should it purchase assuming that pump purchases were independent? B. Problems and Questions Sabino Company is considering the purchase of a new heavy-duty industrial waste-water pump. Suppliers and experts have been consulted and the choice has been narrowed down to three pump models: Alpha, Beta and Gamma. The key parameters of the three pump models are shown below. Parameters Alpha Beta Gamma 1. Initial Cost 330,000 365,000 ($) 415,000 280,000 at EOY1 360,000 at EOY1 450,000 at EOY1 increasing decreasing increasing 2. Revenues annually ($) annually annually thereafter thereafter by thereafter by 2% by 1.0% $10,000 190,000 at EOY1 230,000 at EOY1 3. Operating increasing increasing 312,000 at EOY1 costs annually increasing annually ($) annually thereafter by thereafter by thereafter by $20,000 $2,400 3% 4. End-of-life salvage 10,000 -15,000 10,000 value ($) 5. Useful life 5 5 10 (years) All pump names and parameter values are fictitious. EOY = End-of-year Industry Standard = 3 years MARR = 10% . . 25. The incremental External Rate of Return (AERR) between Alpha and Gamma. 26. The incremental External Rate of Return (AERR) between Beta and Gamma. 27. Does the conclusion on the best pump based on the AEW criterion match the conclusion based on the incremental ERR criterion? 28. If Sabino Company had a pump budget of $800,000 and was planning the purchase of more than one pump, which pump(s) should it purchase assuming that pump purchases were independentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started