PLEASE COMMENT TO LET ME KNOW WHAT MORE INFO YOU NEED.

This is a capital gain tax question. The background story is so long that I have to put it into a picture. Thanks for your understanding and please solve this for me.

REQUIRED

- Explain how the disposal of the house will be dealt with under capital gains tax rules and what reliefs (if any) are available to Rina, stating whether she will be able to make such claims.

- Calculate the capital gains tax payable for Rina for 2019/20, assuming the home is subject to capital gains tax after all relevant reliefs have been claimed.

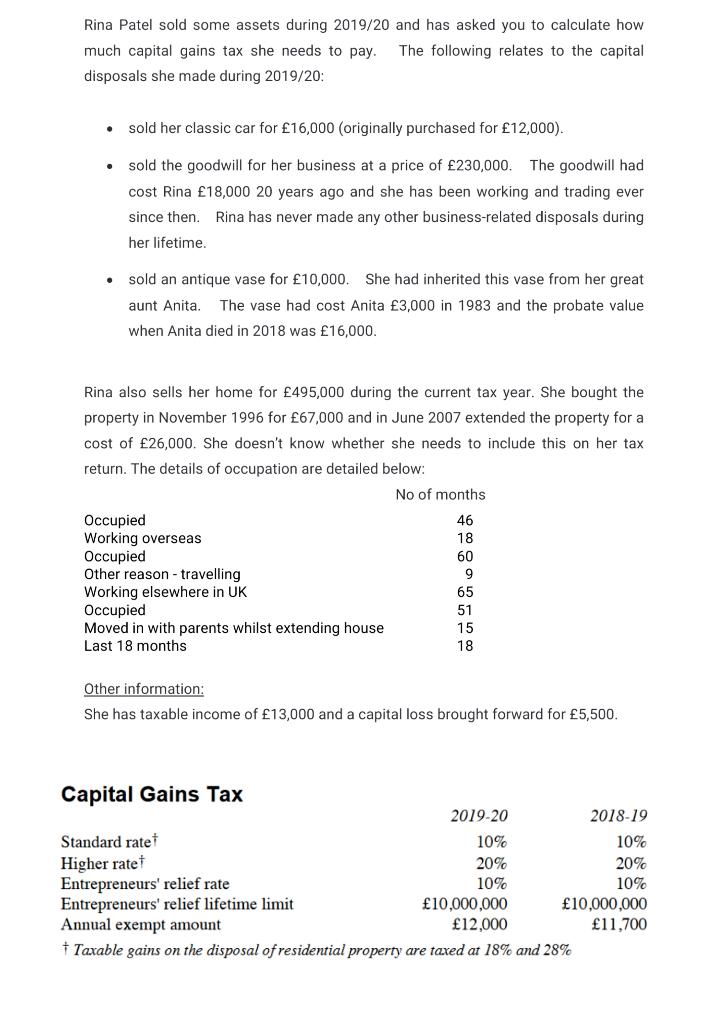

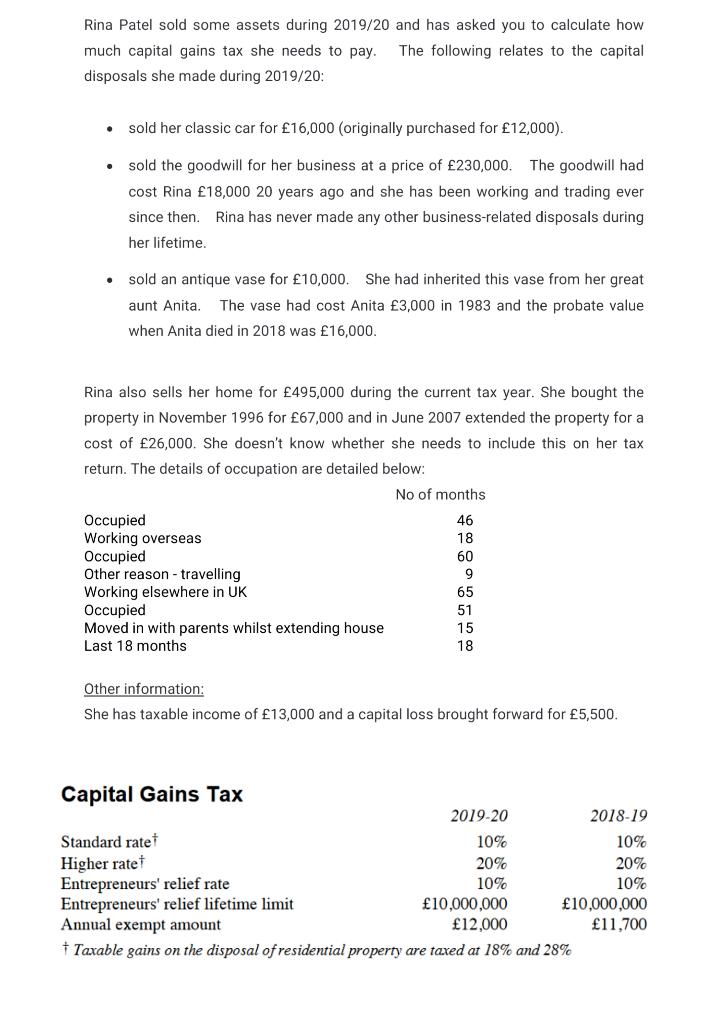

Rina Patel sold some assets during 2019/20 and has asked you to calculate how much capital gains tax she needs to pay. The following relates to the capital disposals she made during 2019/20: . sold her classic car for 16,000 (originally purchased for 12,000). . sold the goodwill for her business at a price of 230,000. The goodwill had cost Rina 18,000 20 years ago and she has been working and trading ever since then. Rina has never made any other business-related disposals during her lifetime. sold an antique vase for 10,000. She had inherited this vase from her great aunt Anita The vase had cost Anita 3,000 in 1983 and the probate value when Anita died in 2018 was 16,000. Rina also sells her home for 495,000 during the current tax year. She bought the property in November 1996 for 67,000 and in June 2007 extended the property for a cost of 26,000. She doesn't know whether she needs to include this on her tax return. The details of occupation are detailed below: No of months Occupied Working overseas Occupied 60 Other reason - travelling 9 Working elsewhere in UK 65 Occupied Moved in with parents whilst extending house 15 Last 18 months 46 18 51 18 Other information: She has taxable income of 13,000 and a capital loss brought forward for 5,500. Capital Gains Tax 2019-20 2018-19 Standard ratet 10% 10% Higher ratet 20% 20% Entrepreneurs' relief rate 10% 10% Entrepreneurs' relief lifetime limit 10,000,000 10,000,000 Annual exempt amount 12,000 11,700 # Taxable gains on the disposal of residential property are taxed at 18% and 28% Rina Patel sold some assets during 2019/20 and has asked you to calculate how much capital gains tax she needs to pay. The following relates to the capital disposals she made during 2019/20: . sold her classic car for 16,000 (originally purchased for 12,000). . sold the goodwill for her business at a price of 230,000. The goodwill had cost Rina 18,000 20 years ago and she has been working and trading ever since then. Rina has never made any other business-related disposals during her lifetime. sold an antique vase for 10,000. She had inherited this vase from her great aunt Anita The vase had cost Anita 3,000 in 1983 and the probate value when Anita died in 2018 was 16,000. Rina also sells her home for 495,000 during the current tax year. She bought the property in November 1996 for 67,000 and in June 2007 extended the property for a cost of 26,000. She doesn't know whether she needs to include this on her tax return. The details of occupation are detailed below: No of months Occupied Working overseas Occupied 60 Other reason - travelling 9 Working elsewhere in UK 65 Occupied Moved in with parents whilst extending house 15 Last 18 months 46 18 51 18 Other information: She has taxable income of 13,000 and a capital loss brought forward for 5,500. Capital Gains Tax 2019-20 2018-19 Standard ratet 10% 10% Higher ratet 20% 20% Entrepreneurs' relief rate 10% 10% Entrepreneurs' relief lifetime limit 10,000,000 10,000,000 Annual exempt amount 12,000 11,700 # Taxable gains on the disposal of residential property are taxed at 18% and 28%