-

Please compare and contrast between the 3 stocks and answer it the way it's being asked in the question

-

Would you invest in these stocks? Where we are currently in the business cycle? Where are we moving forward in the business cycle? Has the COVID-19 influenced these stocks negatively or positively and why? Find CAPM for all three stocks and risk free

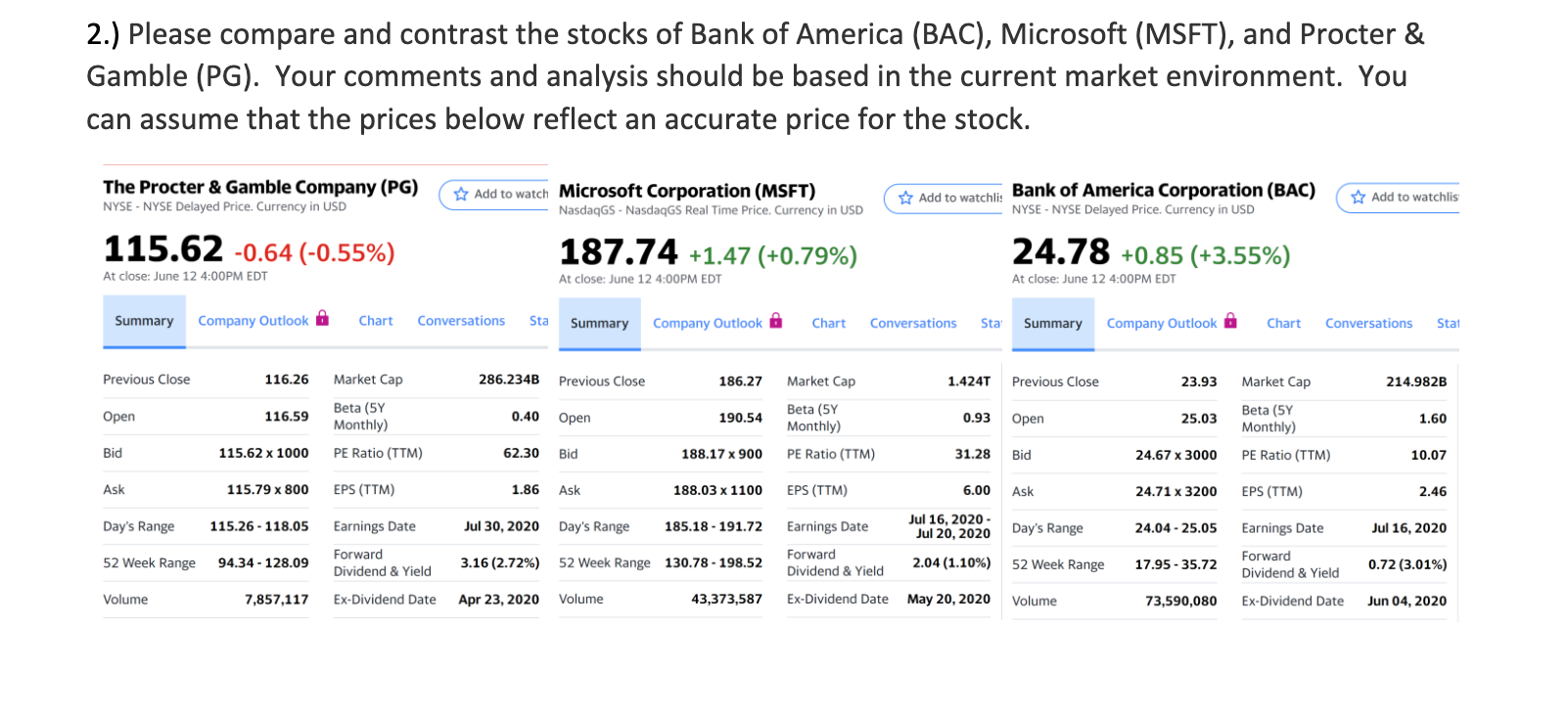

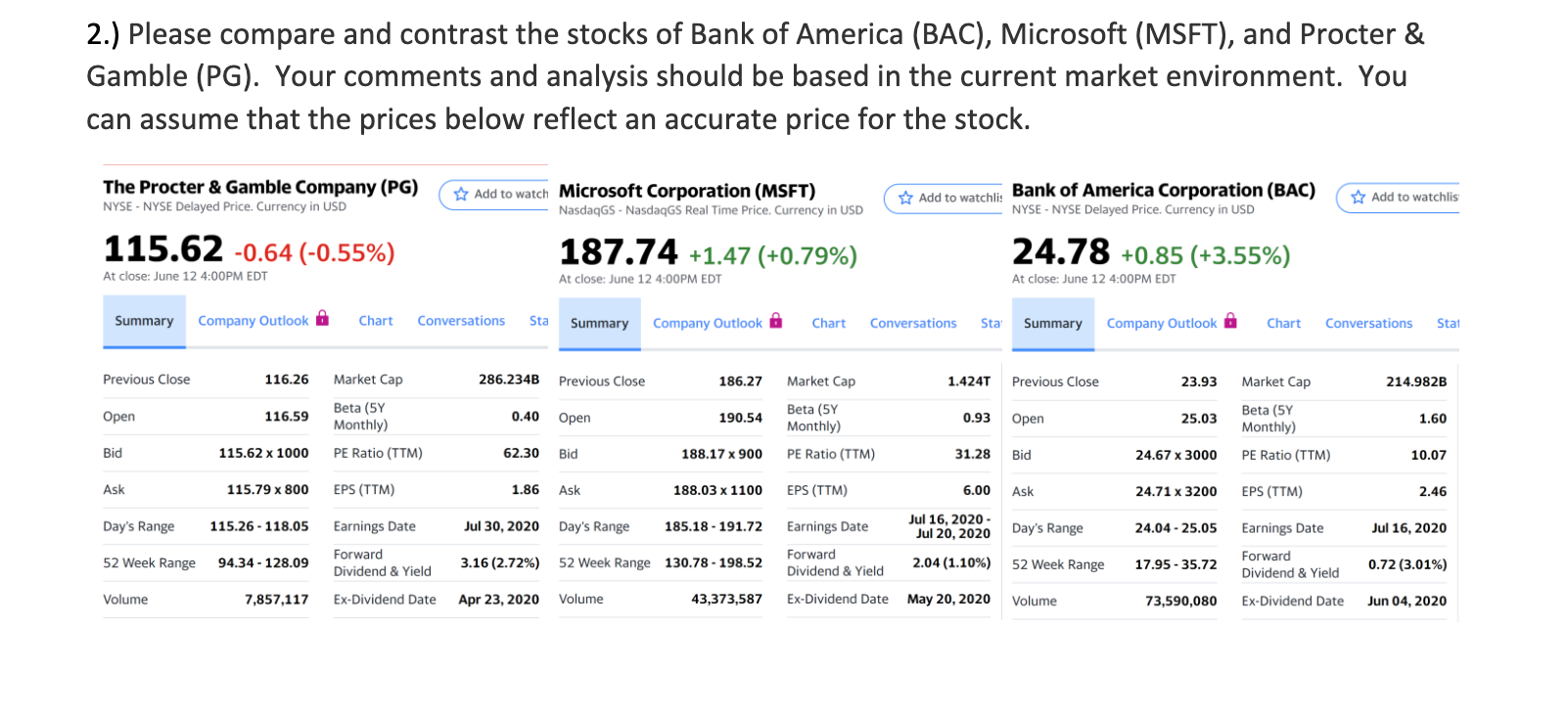

2.) Please compare and contrast the stocks of Bank of America (BAC), Microsoft (MSFT), and Procter & Gamble (PG). Your comments and analysis should be based in the current market environment. You can assume that the prices below reflect an accurate price for the stock. The Procter & Gamble Company (PG) NYSE - NYSE Delayed Price. Currency in USD Add to watch Microsoft Corporation (MSFT) Nasdaqgs - Nasdaq GS Real Time Price. Currency in USD Add to watchlis Bank of America Corporation (BAC) NYSE - NYSE Delayed Price. Currency in USD Add to watchlis 115.62 -0.64 (-0.55%) 187.74 +1.47 (+0.79%) 24.78 +0.85 (+3.55%) At close: June 12 4:00PM EDT At close: June 12 4:00PM EDT At close: June 12 4:00PM EDT Summary Company Outlook @ Chart Conversations Sta Summary Company Outlook Chart Conversations Sta Summary Company Outlook Chart Conversations Stat Previous Close 116.26 Market Cap 286.234B Previous Close 186.27 Market Cap 1.424T Previous Close 23.93 Market Cap 214.982B Open 116.59 Beta (5Y Monthly) 0.40 Open 190.54 Beta (5Y Monthly) 0.93 Open 25.03 Beta (5Y Monthly) 1.60 Bid 115.62 x 1000 PE Ratio (TTM) 62.30 Bid 188.17 x 900 PE Ratio (TTM) 31.28 Bid 24.67 x 3000 PE Ratio (TTM) 10.07 Ask 115.79 x 800 EPS (TTM) 1.86 Ask 188.03 x 1100 EPS (TTM) 6.00 Ask 24.71 x 3200 EPS (TTM) 2.46 Day's Range 115.26 - 118.05 Earnings Date Jul 30, 2020 Day's Range 185.18 - 191.72 Earnings Date Jul 16, 2020- Jul 20, 2020 Day's Range 24.04 - 25.05 Earnings Date Jul 16, 2020 52 Week Range 94.34 - 128.09 Forward Dividend & Yield 3.16 (2.72%) 52 Week Range 130.78 - 198.52 Forward Dividend & Yield 2.04 (1.10%) 52 Week Range 17.95- 35.72 Forward Dividend & Yield 0.72 (3.01%) Volume 7,857,117 Ex-Dividend Date Apr 23, 2020 Volume 43,373,587 Ex-Dividend Date May 20, 2020 Volume 73,590,080 Ex-Dividend Date Jun 04, 2020 2.) Please compare and contrast the stocks of Bank of America (BAC), Microsoft (MSFT), and Procter & Gamble (PG). Your comments and analysis should be based in the current market environment. You can assume that the prices below reflect an accurate price for the stock. The Procter & Gamble Company (PG) NYSE - NYSE Delayed Price. Currency in USD Add to watch Microsoft Corporation (MSFT) Nasdaqgs - Nasdaq GS Real Time Price. Currency in USD Add to watchlis Bank of America Corporation (BAC) NYSE - NYSE Delayed Price. Currency in USD Add to watchlis 115.62 -0.64 (-0.55%) 187.74 +1.47 (+0.79%) 24.78 +0.85 (+3.55%) At close: June 12 4:00PM EDT At close: June 12 4:00PM EDT At close: June 12 4:00PM EDT Summary Company Outlook @ Chart Conversations Sta Summary Company Outlook Chart Conversations Sta Summary Company Outlook Chart Conversations Stat Previous Close 116.26 Market Cap 286.234B Previous Close 186.27 Market Cap 1.424T Previous Close 23.93 Market Cap 214.982B Open 116.59 Beta (5Y Monthly) 0.40 Open 190.54 Beta (5Y Monthly) 0.93 Open 25.03 Beta (5Y Monthly) 1.60 Bid 115.62 x 1000 PE Ratio (TTM) 62.30 Bid 188.17 x 900 PE Ratio (TTM) 31.28 Bid 24.67 x 3000 PE Ratio (TTM) 10.07 Ask 115.79 x 800 EPS (TTM) 1.86 Ask 188.03 x 1100 EPS (TTM) 6.00 Ask 24.71 x 3200 EPS (TTM) 2.46 Day's Range 115.26 - 118.05 Earnings Date Jul 30, 2020 Day's Range 185.18 - 191.72 Earnings Date Jul 16, 2020- Jul 20, 2020 Day's Range 24.04 - 25.05 Earnings Date Jul 16, 2020 52 Week Range 94.34 - 128.09 Forward Dividend & Yield 3.16 (2.72%) 52 Week Range 130.78 - 198.52 Forward Dividend & Yield 2.04 (1.10%) 52 Week Range 17.95- 35.72 Forward Dividend & Yield 0.72 (3.01%) Volume 7,857,117 Ex-Dividend Date Apr 23, 2020 Volume 43,373,587 Ex-Dividend Date May 20, 2020 Volume 73,590,080 Ex-Dividend Date Jun 04, 2020