Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Rennie's Electronic Gadgets sells a variety of electronic devices including a variety of WIFI SMART camera bulbs. The business began the second quarter (April to

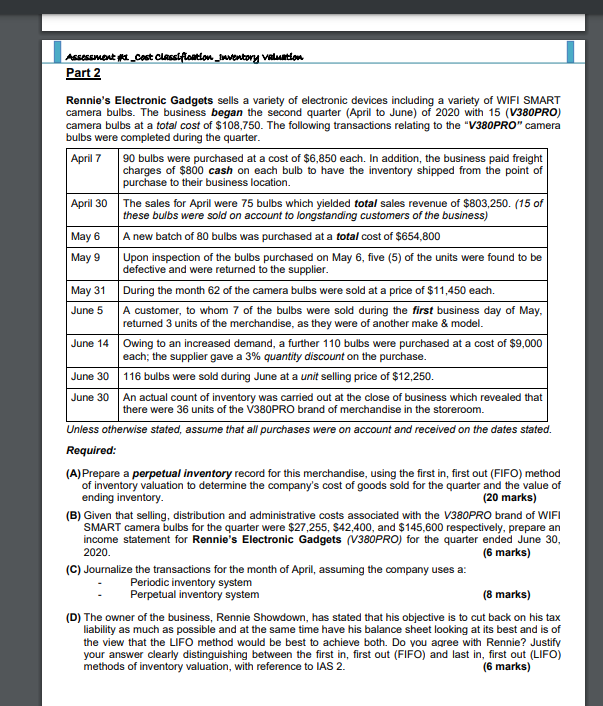

Rennie's Electronic Gadgets sells a variety of electronic devices including a variety of WIFI SMART camera bulbs. The business began the second quarter (April to June) of 2020 with 15 (V380PRO) camera bulbs at a total cost of $108,750. The following transactions relating to the "V380PRO" camera bulbs were completed during the quarter. Unless otherwise stated, assume that all purchases were on account and received on the dates stated. Required: (A)Prepare a perpetual inventory record for this merchandise, using the first in, first out (FIFO) method of inventory valuation to determine the company's cost of goods sold for the quarter and the value of ending inventory. (20 marks) (B) Given that selling, distribution and administrative costs associated with the V380PRO brand of WIFI SMART camera bulbs for the quarter were $27,255,$42,400, and $145,600 respectively, prepare an income statement for Rennie's Electronic Gadgets (V380PRO) for the quarter ended June 30, 2020. (6 marks) (C) Journalize the transactions for the month of April, assuming the company uses a: - Periodic inventory system - Perpetual inventory system (8 marks) (D) The owner of the business, Rennie Showdown, has stated that his objective is to cut back on his tax liability as much as possible and at the same time have his balance sheet looking at its best and is of the view that the LIFO method would be best to achieve both. Do you agree with Rennie? Justify your answer clearly distinguishing between the first in, first out (FIFO) and last in, first out (LIFO) methods of inventory valuation, with reference to IAS 2 . (6 marks)

Rennie's Electronic Gadgets sells a variety of electronic devices including a variety of WIFI SMART camera bulbs. The business began the second quarter (April to June) of 2020 with 15 (V380PRO) camera bulbs at a total cost of $108,750. The following transactions relating to the "V380PRO" camera bulbs were completed during the quarter. Unless otherwise stated, assume that all purchases were on account and received on the dates stated. Required: (A)Prepare a perpetual inventory record for this merchandise, using the first in, first out (FIFO) method of inventory valuation to determine the company's cost of goods sold for the quarter and the value of ending inventory. (20 marks) (B) Given that selling, distribution and administrative costs associated with the V380PRO brand of WIFI SMART camera bulbs for the quarter were $27,255,$42,400, and $145,600 respectively, prepare an income statement for Rennie's Electronic Gadgets (V380PRO) for the quarter ended June 30, 2020. (6 marks) (C) Journalize the transactions for the month of April, assuming the company uses a: - Periodic inventory system - Perpetual inventory system (8 marks) (D) The owner of the business, Rennie Showdown, has stated that his objective is to cut back on his tax liability as much as possible and at the same time have his balance sheet looking at its best and is of the view that the LIFO method would be best to achieve both. Do you agree with Rennie? Justify your answer clearly distinguishing between the first in, first out (FIFO) and last in, first out (LIFO) methods of inventory valuation, with reference to IAS 2 . (6 marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started