Answered step by step

Verified Expert Solution

Question

1 Approved Answer

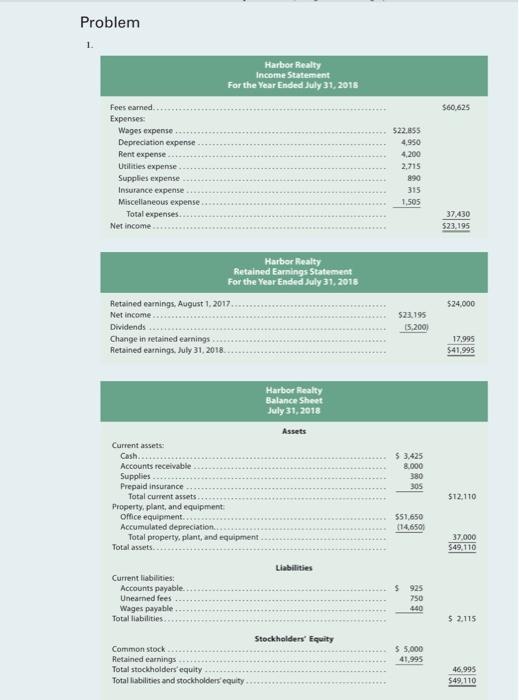

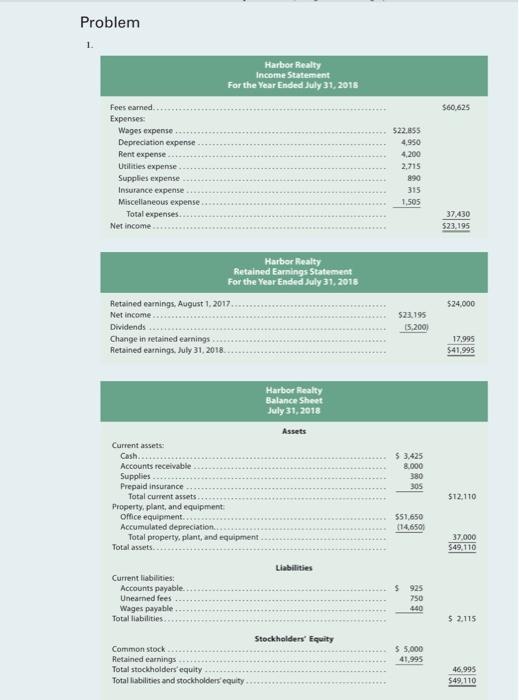

Please complete 1,4,6, 7 and 8. Problem Harbor Realty Income Statement For the Year Ended July 31, 2018 $60,625 Fees earned Expenses Wages expense Depreciation

Please complete 1,4,6, 7 and 8.

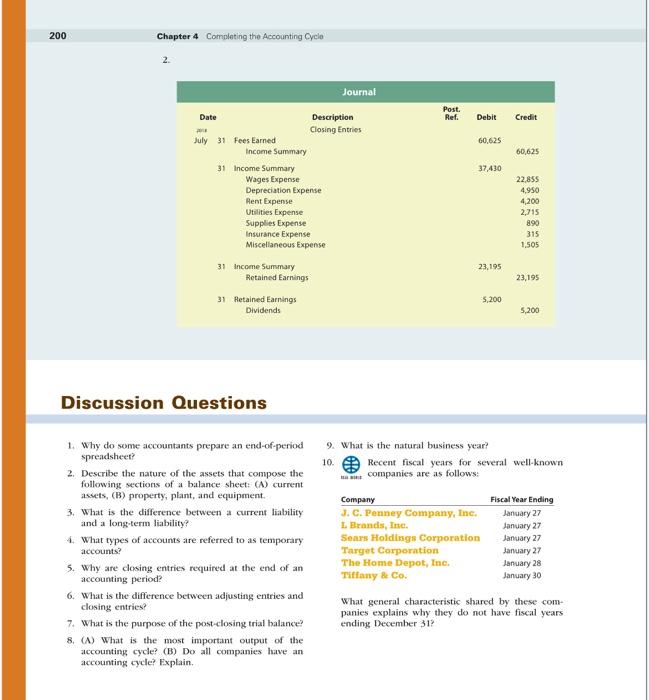

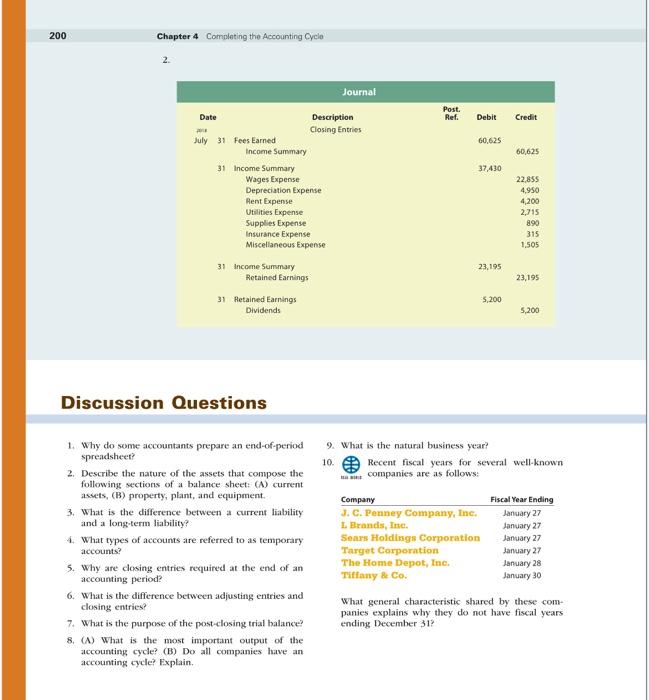

Problem Harbor Realty Income Statement For the Year Ended July 31, 2018 $60,625 Fees earned Expenses Wages expense Depreciation expense Rent expense Utilities expense Supplies expense Insurance expense Miscellaneous expense Total expenses Net income 522,855 4.950 4,200 2.715 890 315 1,505 37.430 523.195 Harbor Realty Retained Earnings Statement For the Year Ended July 31, 2018 Retained earnings, August 1, 2017... Net income.. Dividends Change in retained earnings Retained earnings, July 31, 2018 524,000 523,195 15,200) 17.995 $41,995 Harbor Realty Balance Sheet July 31, 2018 Assets $ 3.425 8.000 380 305 Current assets: Cash Accounts receivable Supplies Prepaid insurance Total current assets Property, plant, and equipment Office equipment Accumulated depreciation.... Total property, plant, and equipment Total assets.. $12.110 551,650 114,6501 37.000 $49, 110 Liabilities Current liabilities: Accounts payable Uneamed fees Wages payable Total liabilities $ 925 750 440 $ 2,115 Stockholders' Equity $ 5.000 41.995 Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 46.995 $49.110 200 Chapter 4 Completing the Accounting Cycle 2. Journal Post. Ref. Debit Credit 60,625 60,625 37,430 Date Description Closing Entries July 31 Fees Earned Income Summary 31 Income Summary Wages Expense Depreciation Expense Rent Expense Utilities Expense Supplies Expense Insurance Expense Miscellaneous Expense 22,855 4,950 4,200 2,715 890 315 1.505 23,195 31 Income Summary Retained Earnings 23,195 5.200 31 Retained Earnings Dividends 5,200 Discussion Questions 9. What is the natural business year? 10. Recent fiscal years for several well-known companies are as follows: 1. Why do some accountants prepare an end-of-period spreadsheet? 2. Describe the nature of the assets that compose the following sections of a balance sheet: (A) current assets, (B) property, plant, and equipment. 3. What is the difference between a current liability and a long-term liability 4 What types of accounts are referred to as temporary accounts? 5. Why are closing entries required at the end of an accounting period? 6. What is the difference between adjusting entries and closing entries 7. What is the purpose of the post-closing trial balance? 8. (A) What is the most important output of the accounting cycle? (B) Do all companies have an accounting cycle? Explain. Company J. C. Penney Company, Inc. L Brands, Ine. Sears Holdings Corporation Target Corporation The Home Depot, Inc. Tiffany & Co. Fiscal Year Ending January 27 January 27 January 27 January 27 January 28 January 30 What general characteristic shared by these com- panies explains why they do not have fiscal years ending December 31

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started