Answered step by step

Verified Expert Solution

Question

1 Approved Answer

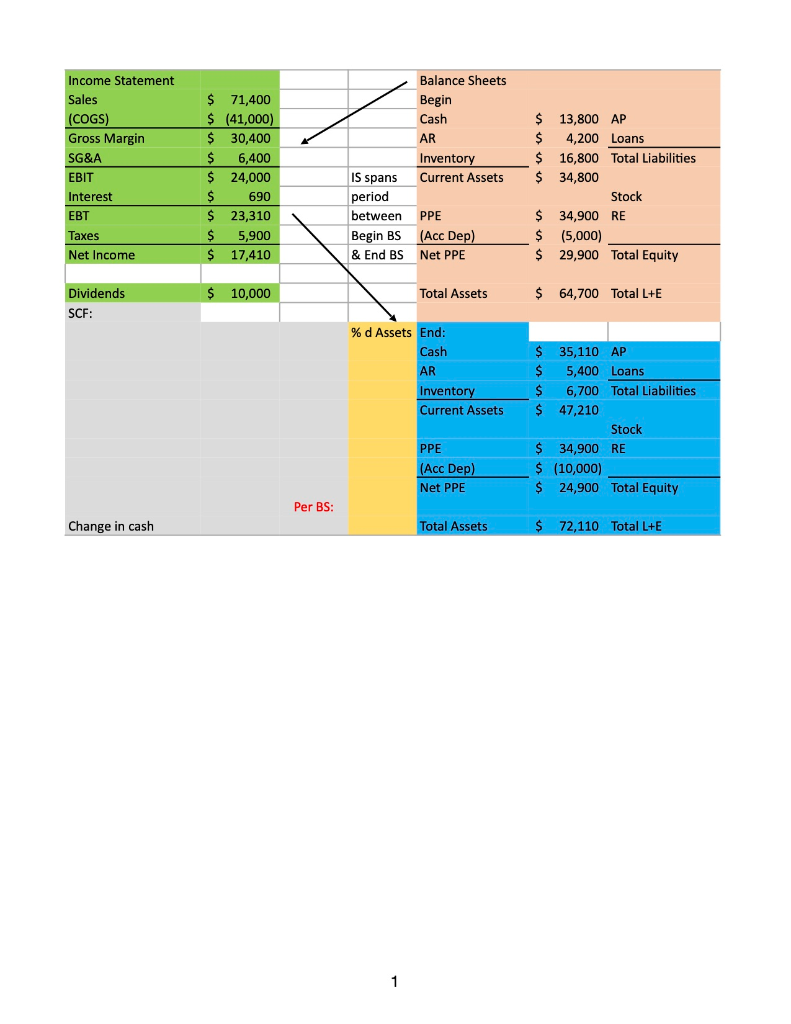

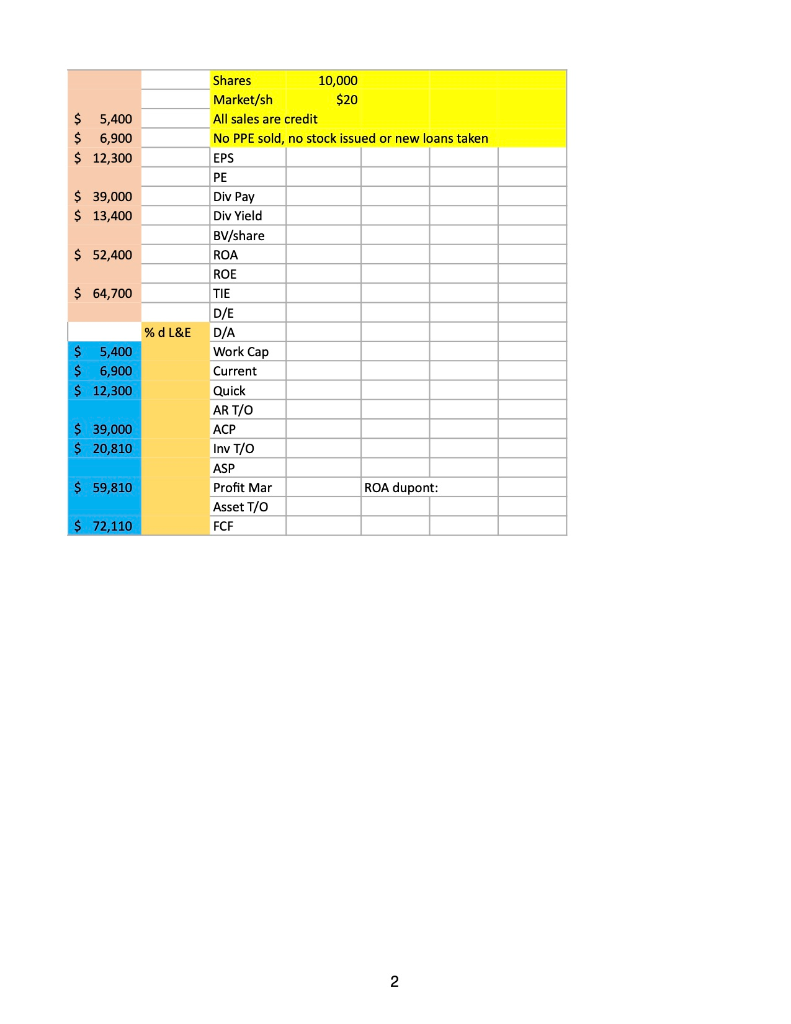

Please complete a financial statement analysis for the Paula assignment (see attached). The input columns are hidden and there is some additional information in yellow.

Please complete a financial statement analysis for the Paula assignment (see attached). The input columns are hidden and there is some additional information in yellow. Please common size and perform some simple trend analysis by calculating the percent change across the balance sheet (% d columns). Then create a Statement of Cash Flows in the space provided and calculate the listed ratios. Submit the Excel workbook here with clear formatting and using Excel formulas and references

Balance Sheets Begin Cash AR Income Statement Sales (COGS) Gross Margin SG&A EBIT Interest EBT Taxes Net Income $ 71,400 $ (41,000) $ 30,400 $ 6,400 $ 24,000 $ 690 $ 23,310 $ 5,900 $ 17,410 IS spans Inventory Current Assets period between PPE Begin BS (Acc Dep) & End BS Net PPE $ 13,800 AP $ 4,200 Loans $ 16,800 Total Liabilities $ 34,800 Stock $ 34,900 RE $ (5,000) $ 29,900 Total Equity $ 10,000 Total Assets Dividends SCF: $ 64,700 Total L+E % d Assets End: Cash AR Inventory Current Assets $ 35,110 AP $ 5,400 Loans $ 6,700 Total Liabilities $ 47,210 Stock $ 34,900 RE $ (10,000) $ 24,900 Total Equity PPE (Acc Dep) Net PPE Per BS: Change in cash Total Assets $ 72,110 Total L+E 1 $ 5,400 $ 6,900 $ 12,300 $ 39,000 $ 13,400 $ 52,400 $ 64,700 Shares 10,000 Market/sh $20 All sales are credit No PPE sold, no stock issued or new loans taken EPS PE Div Pay Div Yield BV/share ROA ROE TIE D/E D/A Work Cap Current Quick AR T/O ACP Inv T/O ASP Profit Mar ROA dupont: Asset To FCF % d L&E $ 5,400 $ 6,900 $ 12,300 $ 39,000 $ 20,810 $ 59,810 $ 72,110 2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started